Hello, and Happy Thanksgiving!

If, hypothetically, one were a data geek, this time of year would bring anticipation for not just the holidays, but also the release of two indispensable economic data sets. Both look at every American county, allowing for comparisons between Teton County and the rest of the country.

In a few weeks, the Internal Revenue Service (IRS) will release information based on 2021’s tax returns. Last week, the Bureau of Economic Analysis (BEA) released its own set of income- and jobs-related data. These data reflect actual information from 2021, and the BEA’s estimates for 2022.

Here’s the punchline.

According to November 16’s BEA data:

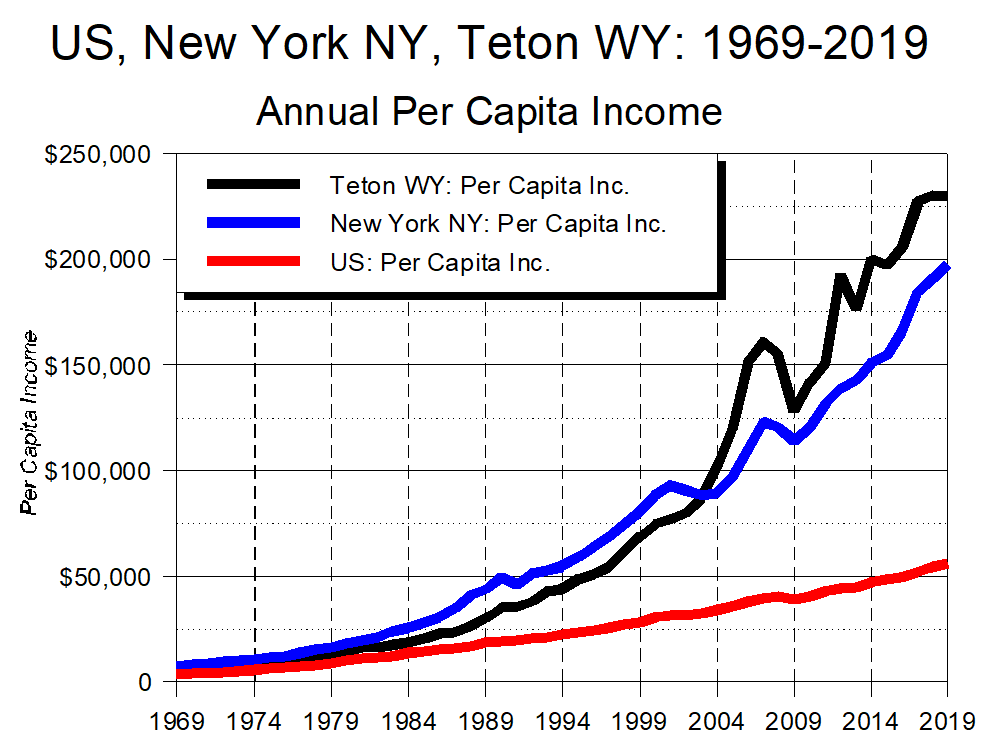

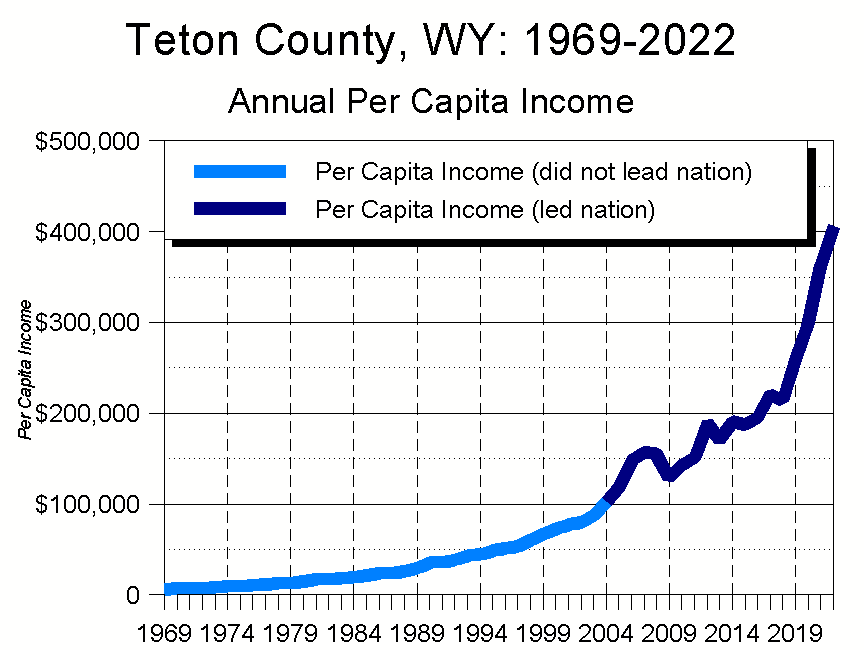

- In 2017, Teton County, WY became the first county in the nation’s history to record a per capita income of more than $200,000 – to be precise, $220,415

- That year, the US figure was $51,004, 23% of Teton’s

- In 2020, Teton County, WY became the first county in the nation’s history to record a per capita income of more than $300,000 – $300,665

- The US figure was $59,153, 20% of Teton’s

- In 2022, the BEA estimates that Teton County WY became the first county in the nation’s history to record a per capita income of more than $400,000 – $406,054

- The US figure was $65,470, 16% of Teton’s

Ponder that for a moment. Last year, every one of Teton County’s 23,287 residents had a mean income of $406,054, more than six times that of the typical American. To an even greater degree than has been true in the past, on a per capita basis Teton County, Wyoming is the wealthiest county in the wealthiest country in the history of the world.

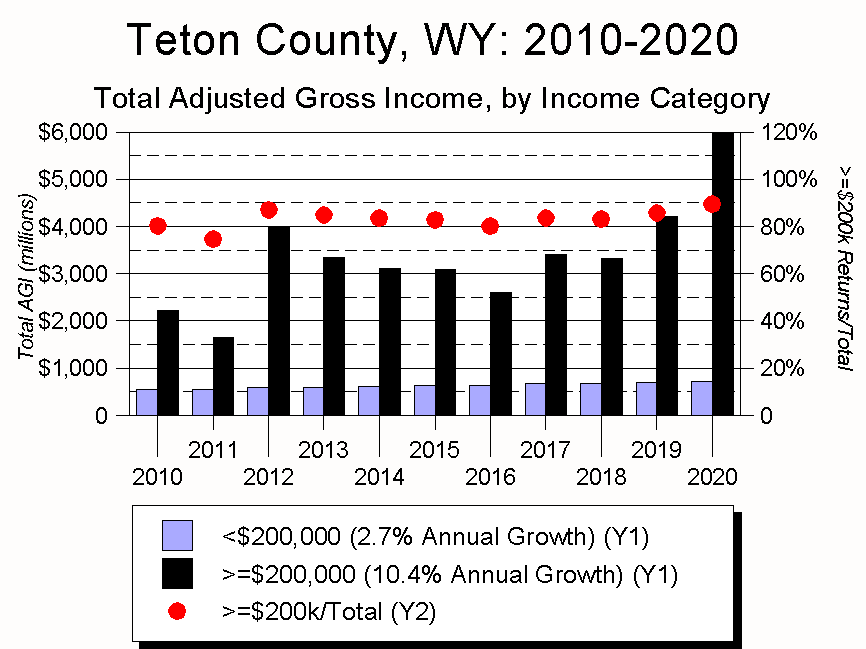

Making things even more surreal is the pace at which change has occurred. In 2016, Teton County’s population was 23,157 and its residents’ total income was $4.53 billion. Six years later, the population was essentially the same – 23,287 – but residents’ total income had doubled, to $9.46 billion. In comparison, for the nation as a whole, income increased by one-third.

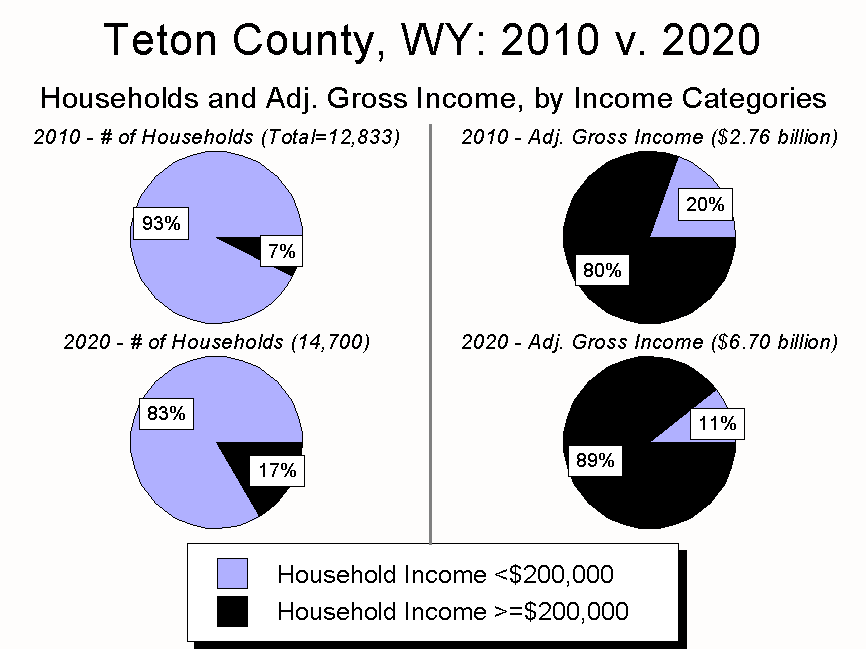

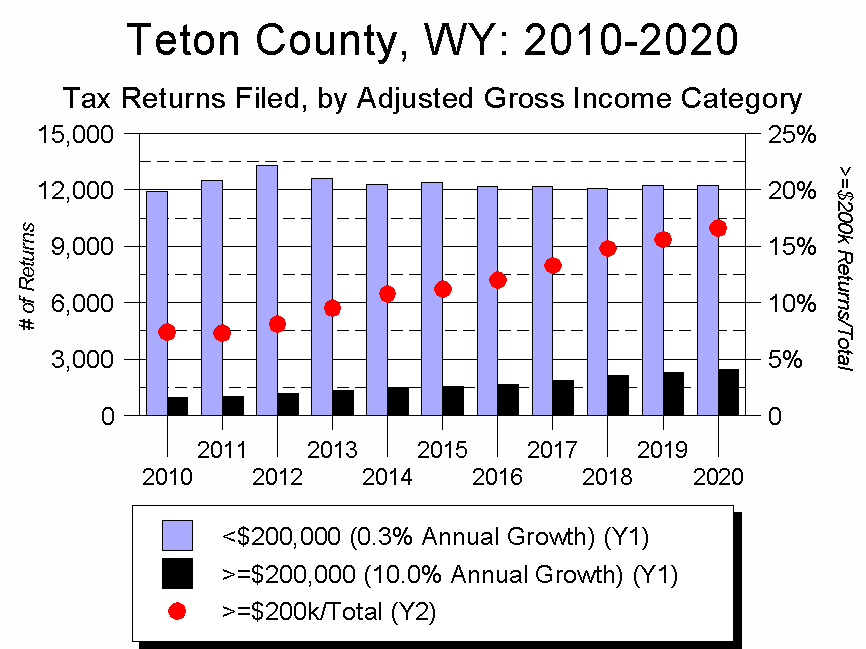

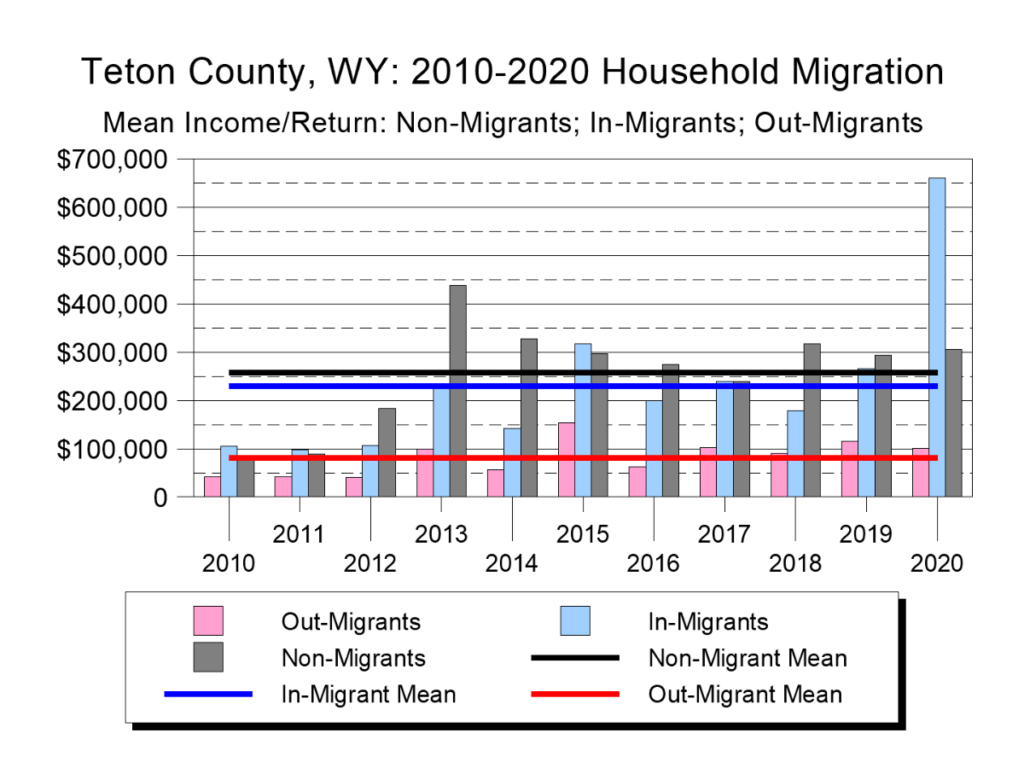

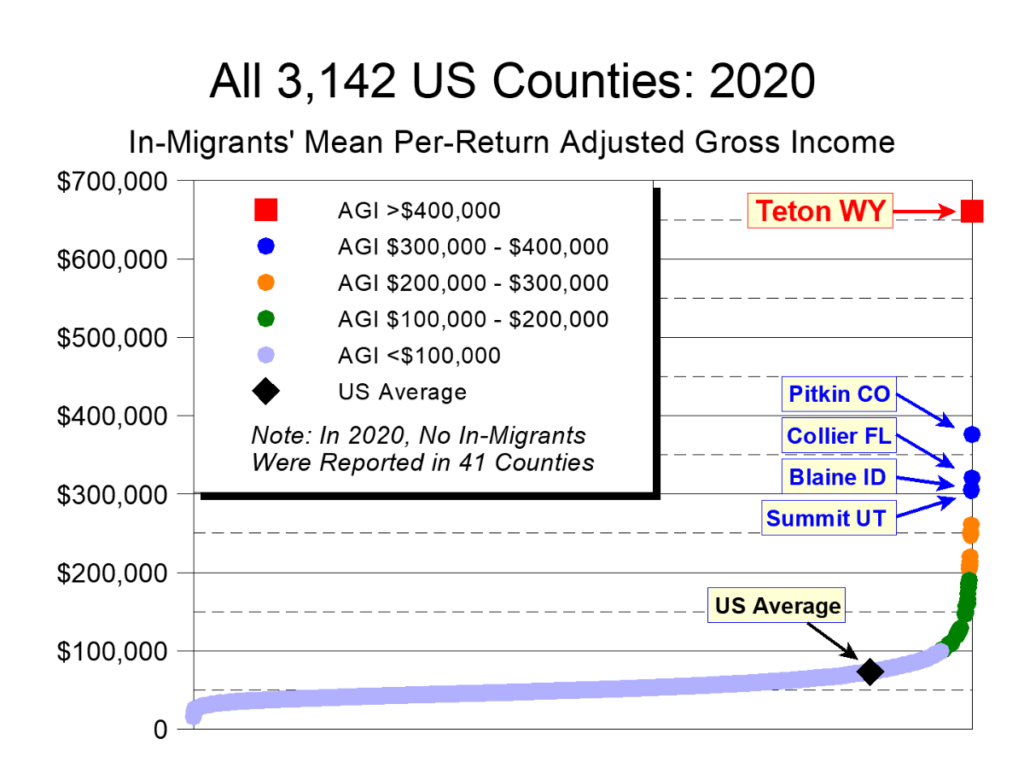

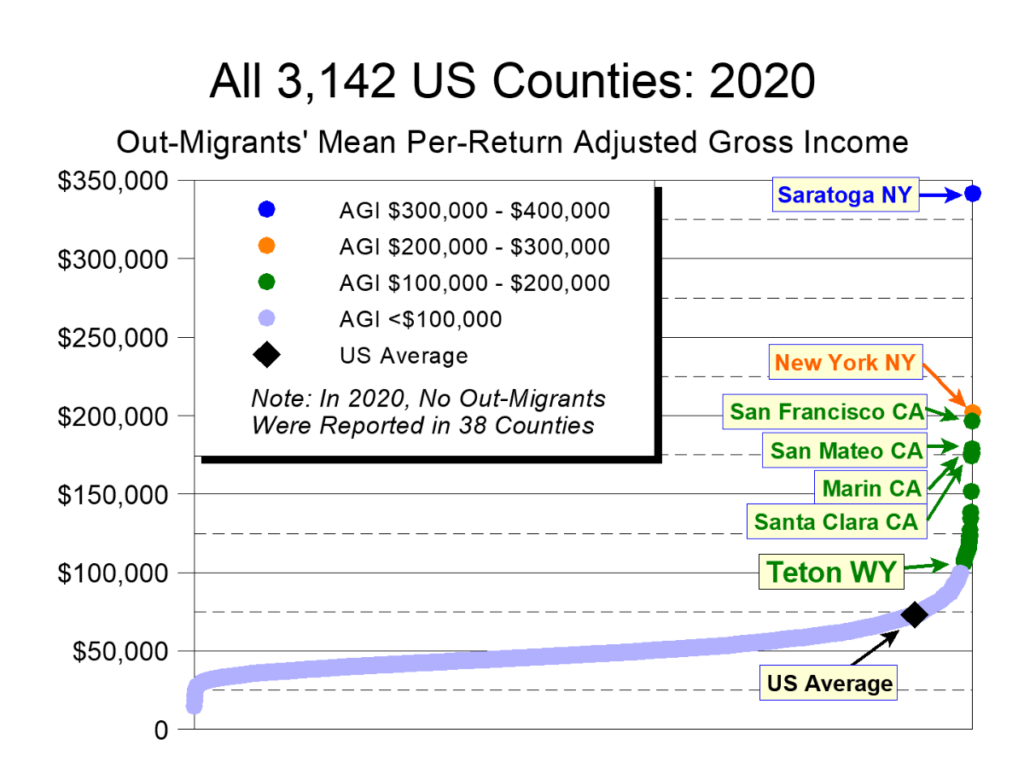

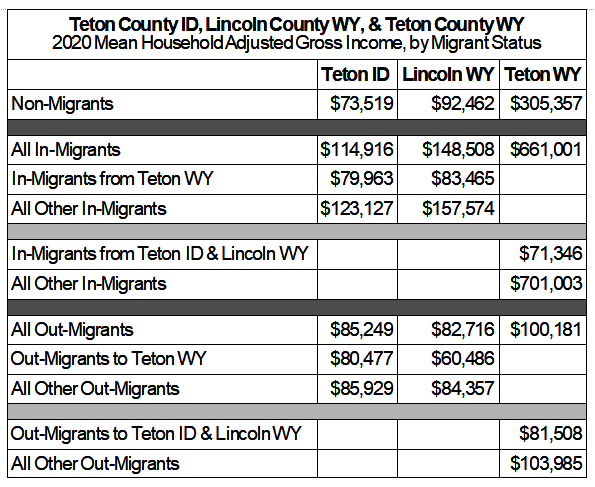

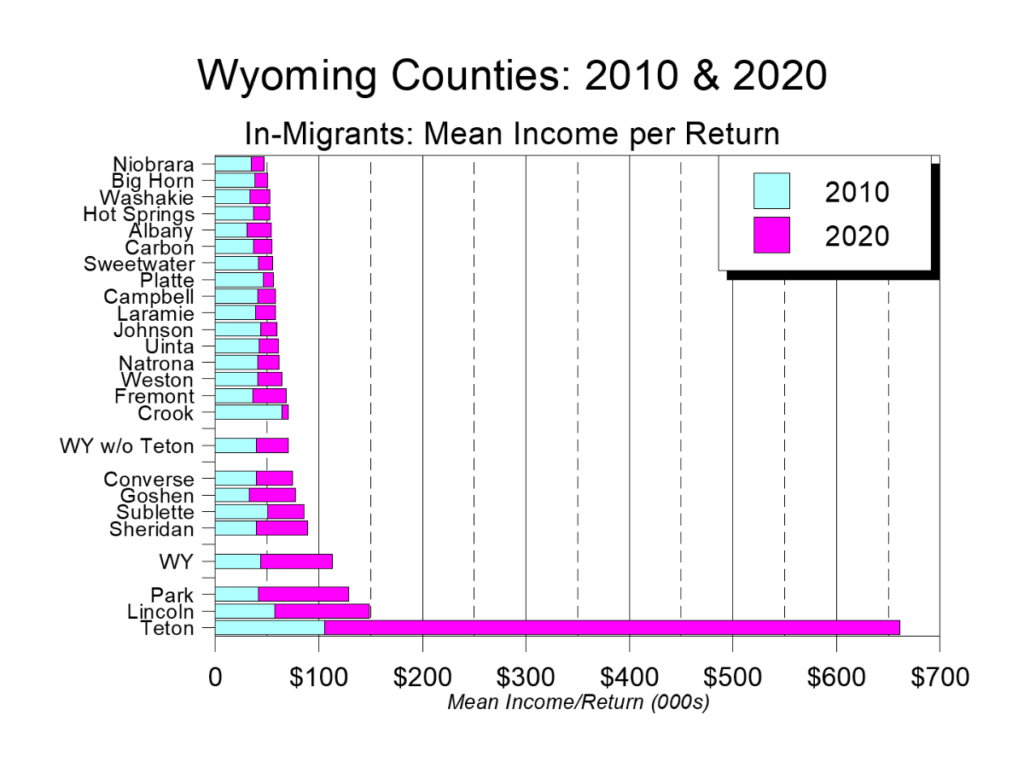

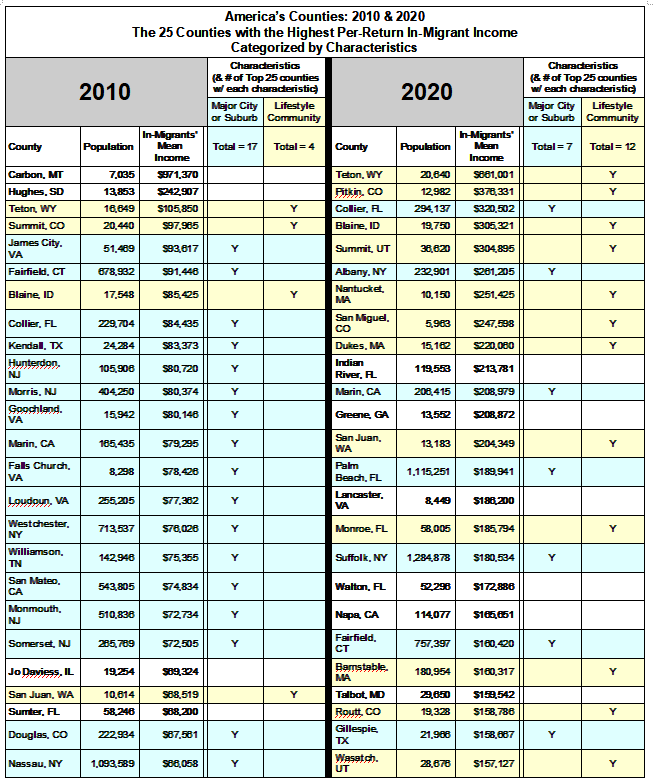

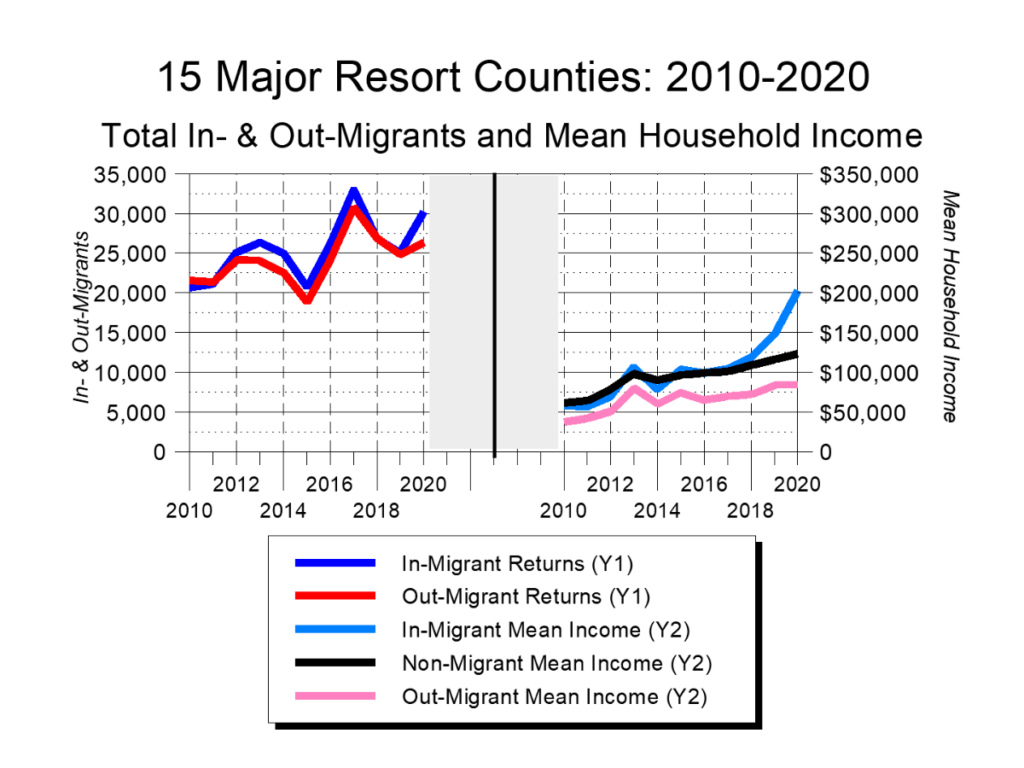

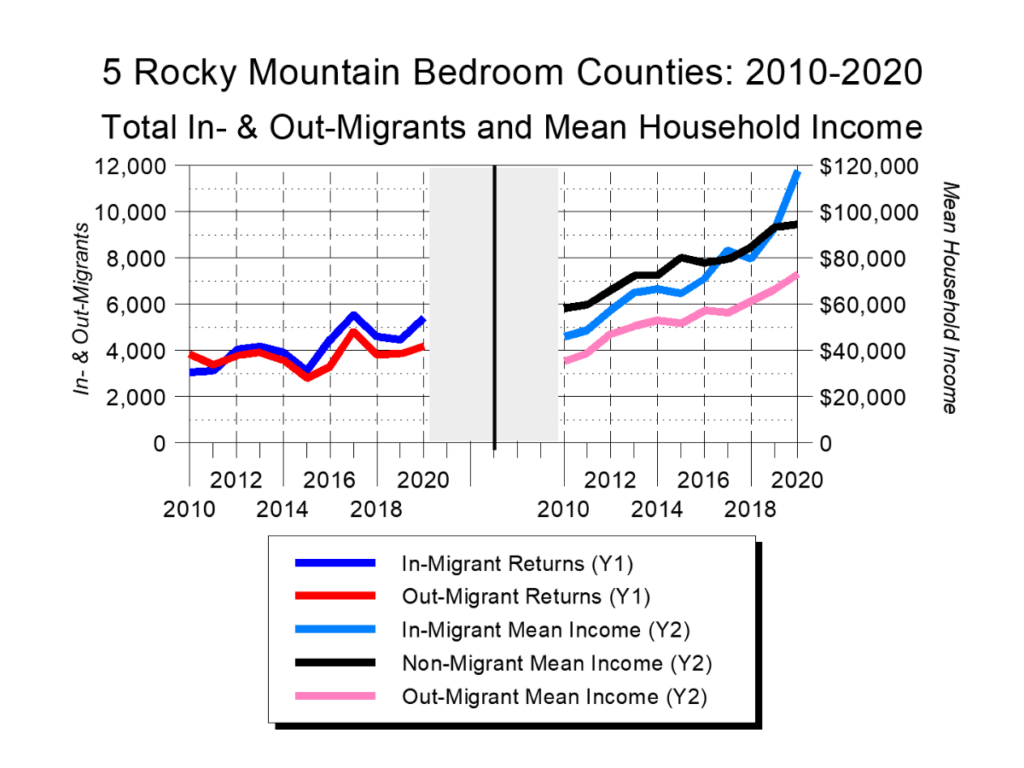

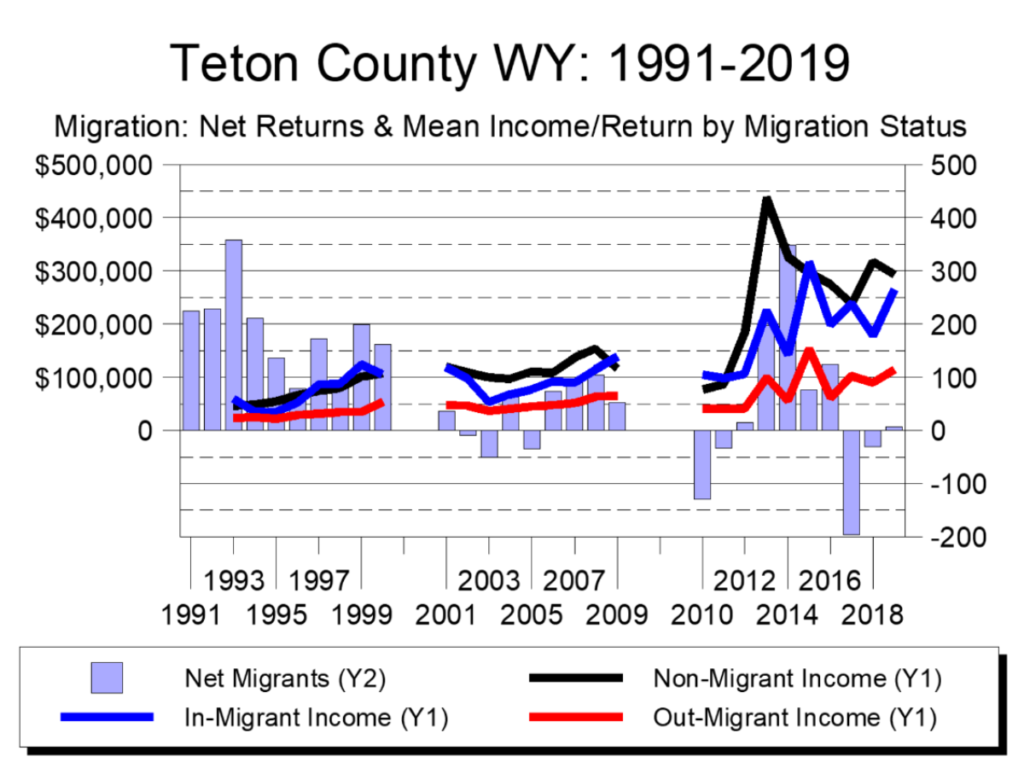

To say such growth and change is whiplash-inducing dramatically understates the case. Especially because it’s almost certain the growth has not been equally distributed. Equally likely is that while the overall population hasn’t changed much during that time, its composition has, with new, higher-income residents displacing longer-term lower-income folks.

The fact that COVID occurred in the middle of this transformation hints at how the forces unleashed by the pandemic are shaping Teton County’s present and future. What really interests me, though, is that the same forces changing Jackson Hole are also unmooring every desirable place to live worldwide. The same phenomena are occurring all over the place; they’re just easier to see in the Tetons.

- Income: The Mind Boggles

- Jobs: The Rise of Finance & Professional Services

- Growth and Change

- Conclusion

The essay below dissects the BEA’s numbers. I’ll do another, similar analysis when the IRS figures are released, for they will allow me to examine how widely distributed Teton County’s income growth has been.

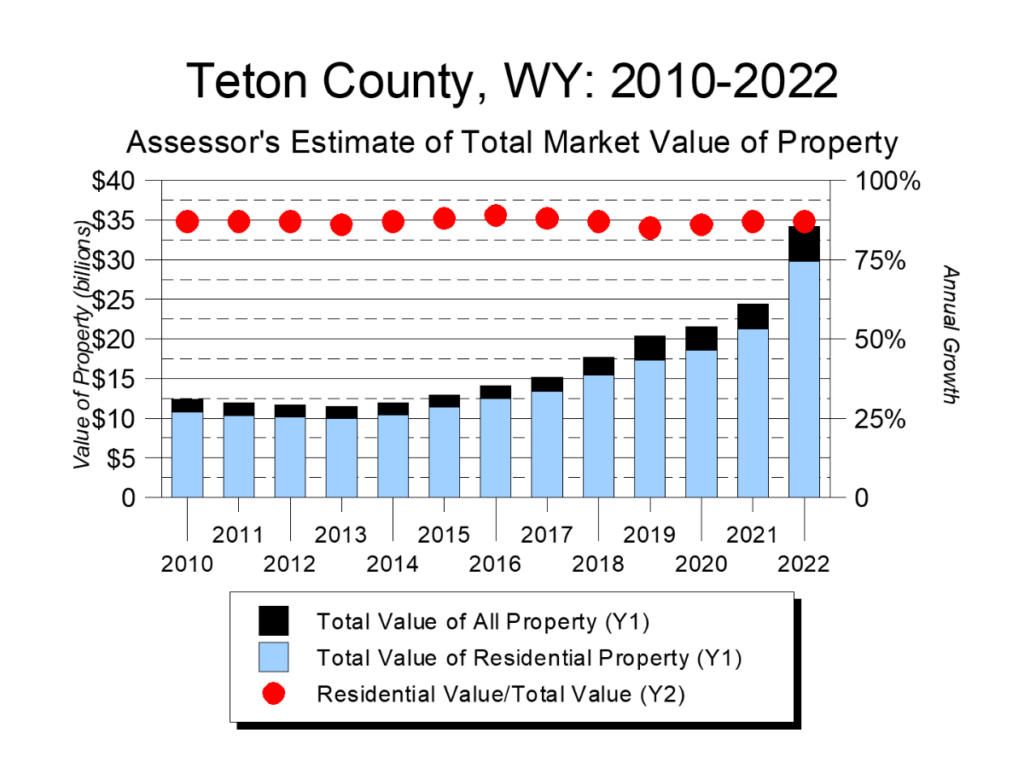

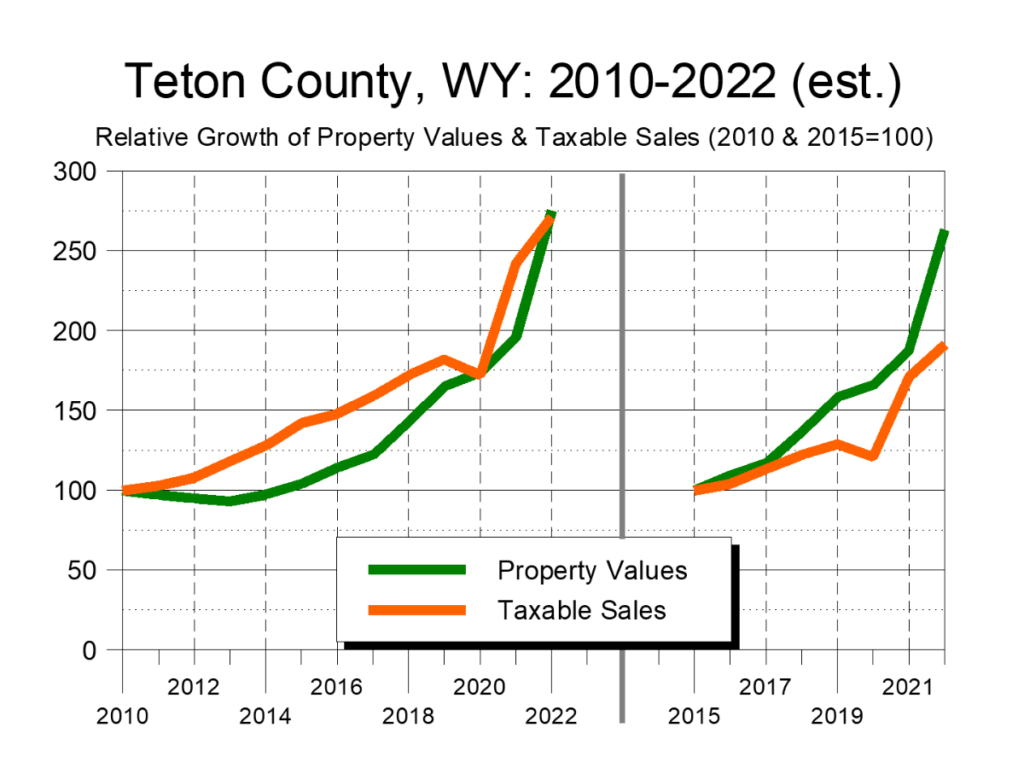

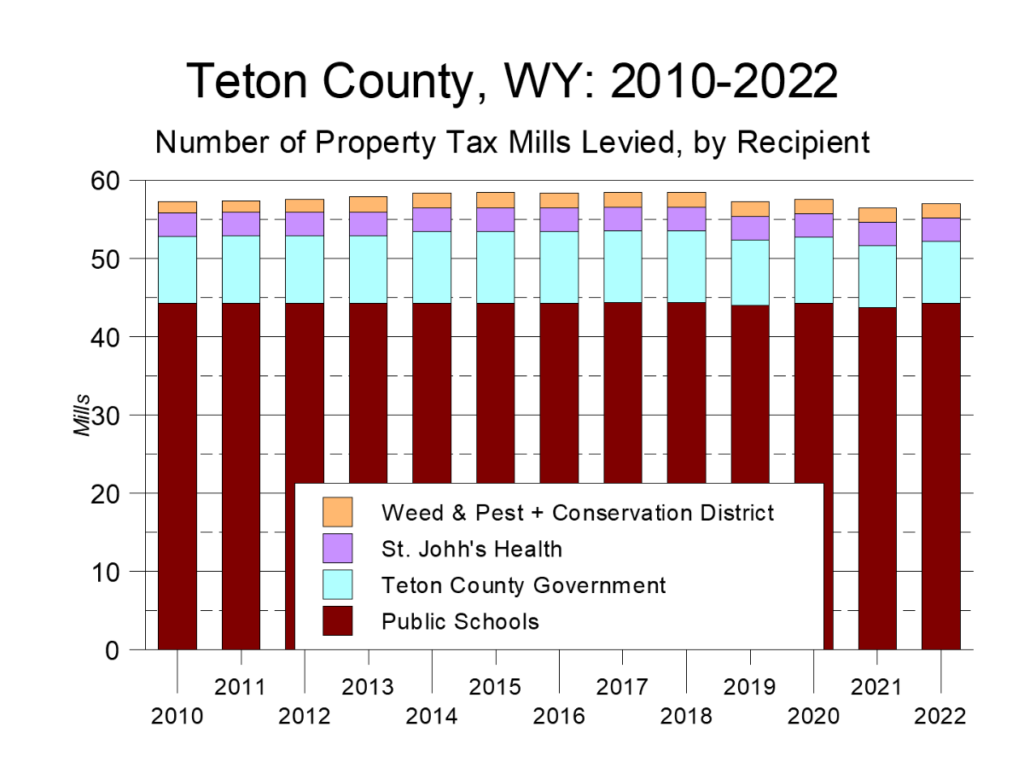

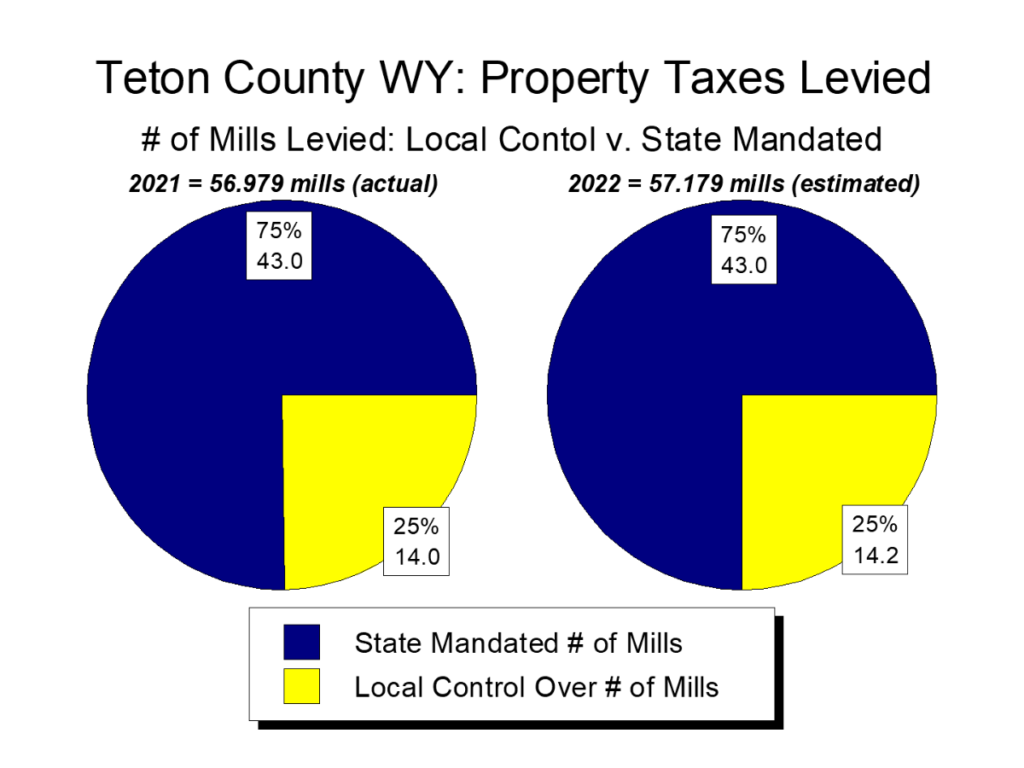

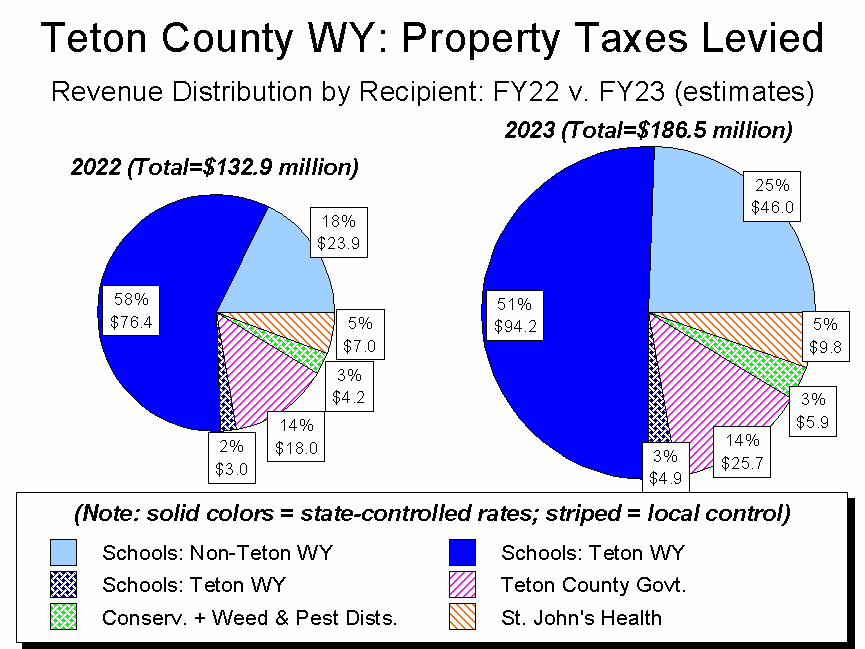

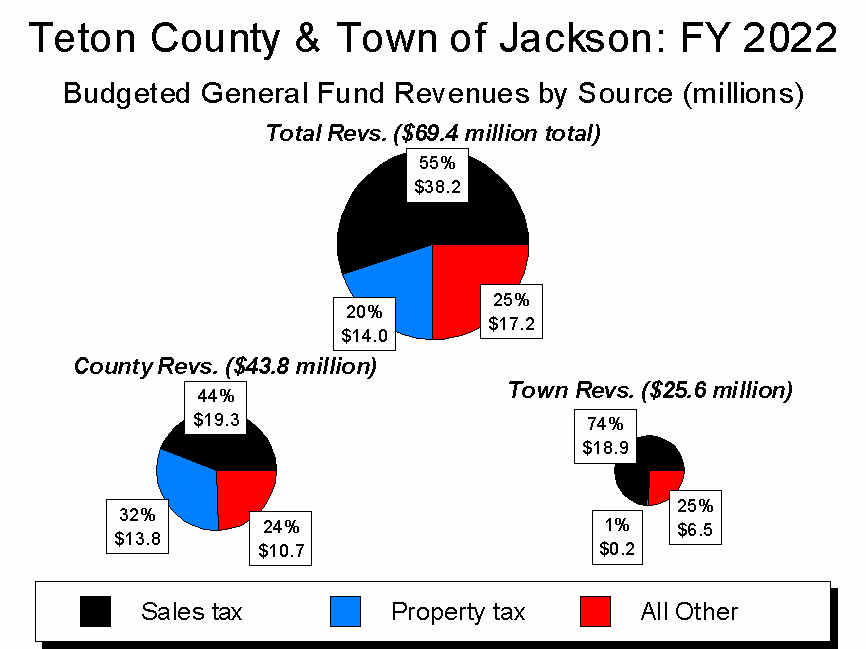

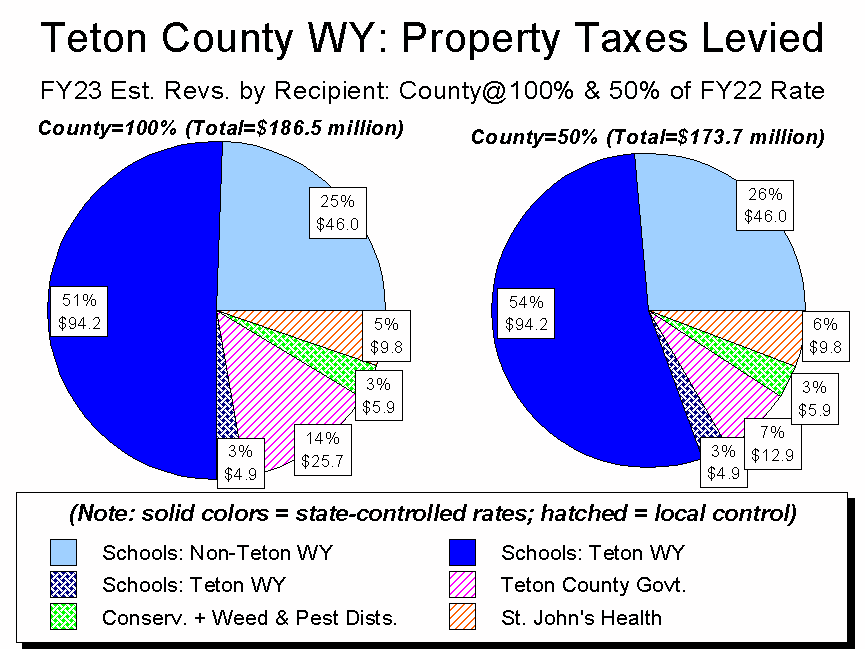

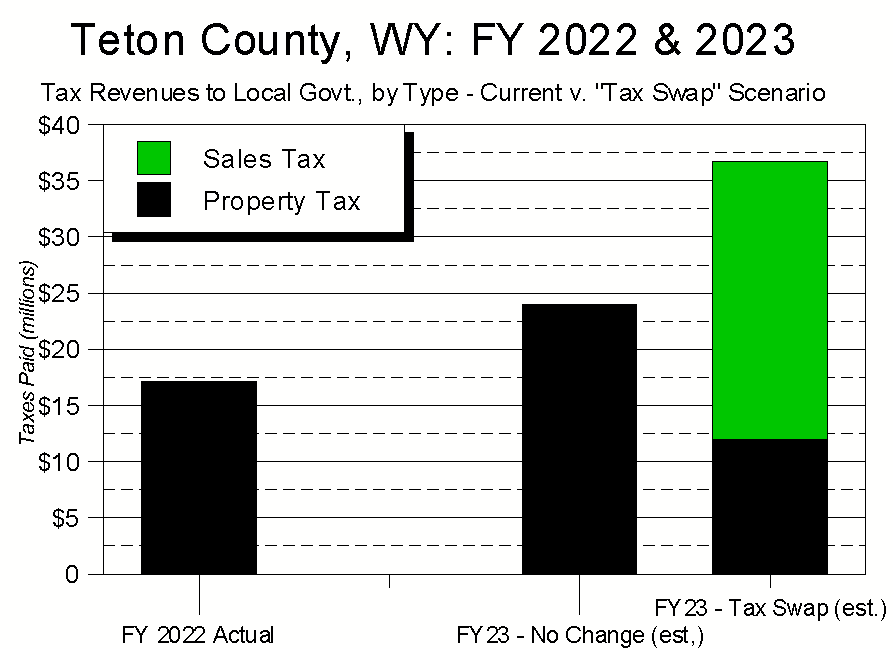

To further telegraph my punches, I’ve also been looking into Teton County’s dramatic rise in property taxes. Look for a newsletter on that subject post-Thanksgiving.

During this season of gratitude, please accept my deepest thanks for your interest and support. May you and all those you love enjoy the most wonderful and bountiful Thanksgiving and transition into winter.

Cheers!

Jonathan Schechter

Executive Director

Income: The Mind Boggles

It’s hard to write a compelling narrative about a treasure-trove of data. Rather than subject either you or me to such a fraught exercise, below I offer a smorgasbord of figures I found compelling. Following this homage to Harper’s Index are some thoughts about the data’s implications.

Income

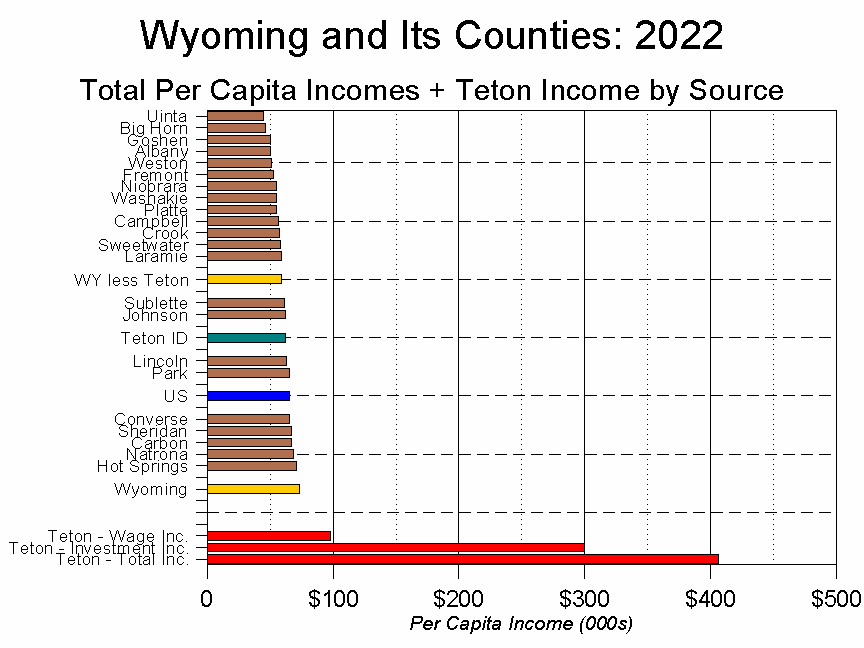

- For 2022, the US Bureau of Economic Analysis estimated Teton County residents’ total personal income was $9.456 billion. With a population of 23,287, this meant that Teton County’s per capita income – the average income for every resident, regardless of age, work status, or any other consideration – was $406,054.

- Teton County’s per capita income of $406,054 led the nation, and marked the 19th consecutive year in which Teton County had the nation’s highest per capita income.

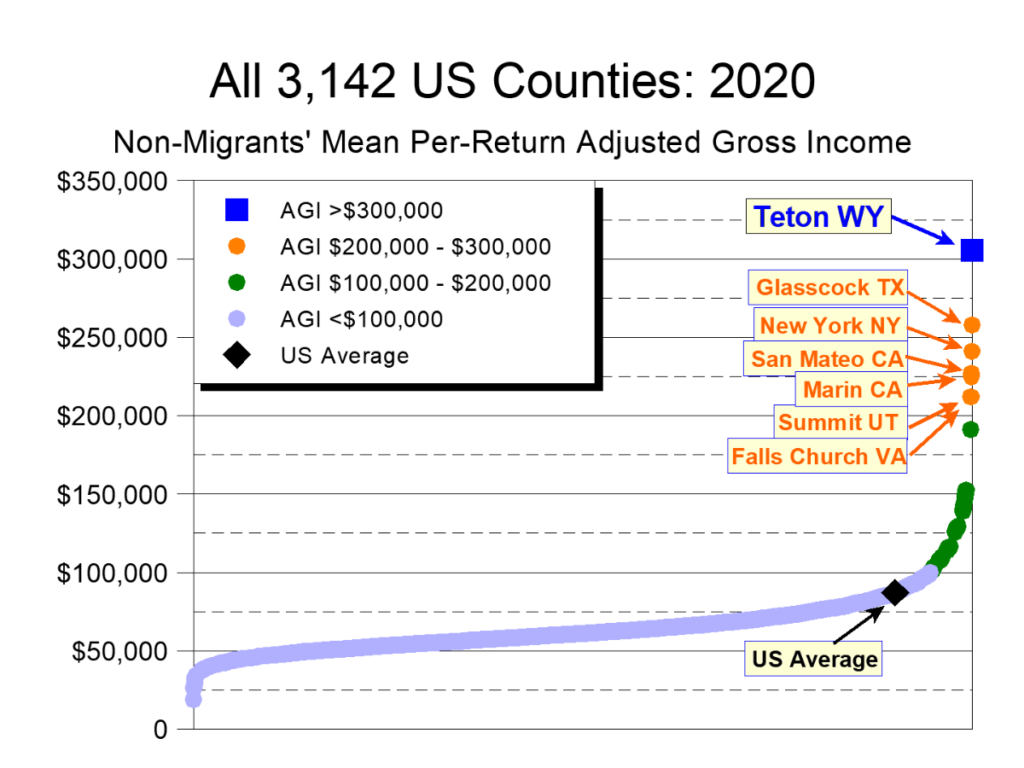

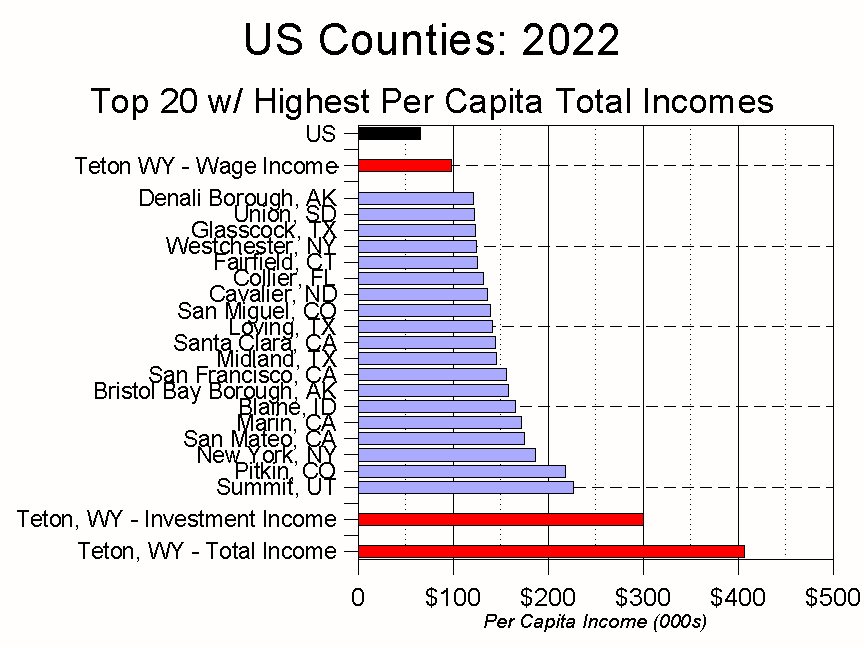

- There are 3,114 counties in America. Teton County’s per capita income is ridiculously higher than any other county’s.

- In 2022, Teton County’s per capita income of $406,054 was $340,584 higher – 6.2 times higher – than the nation’s overall per capita income of $65,470.

- In 2022, Teton County’s per capita income of $406,054 was $180,058 higher – 80% higher – than that of second-place Summit County, Utah’s $225,996 (Summit County is the location of Park City).

- The gap of $180,058 between nation-leading Teton WY and second-place Summit UT was essentially the same as the gap between second-place Summit UT and 2,189th place Perry County, Ohio (per capita income of $45,943).

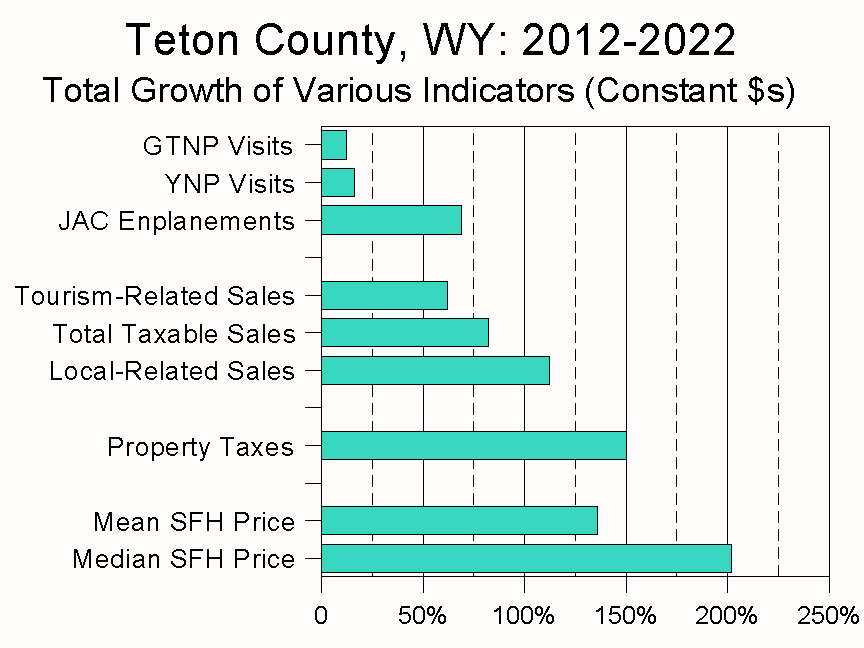

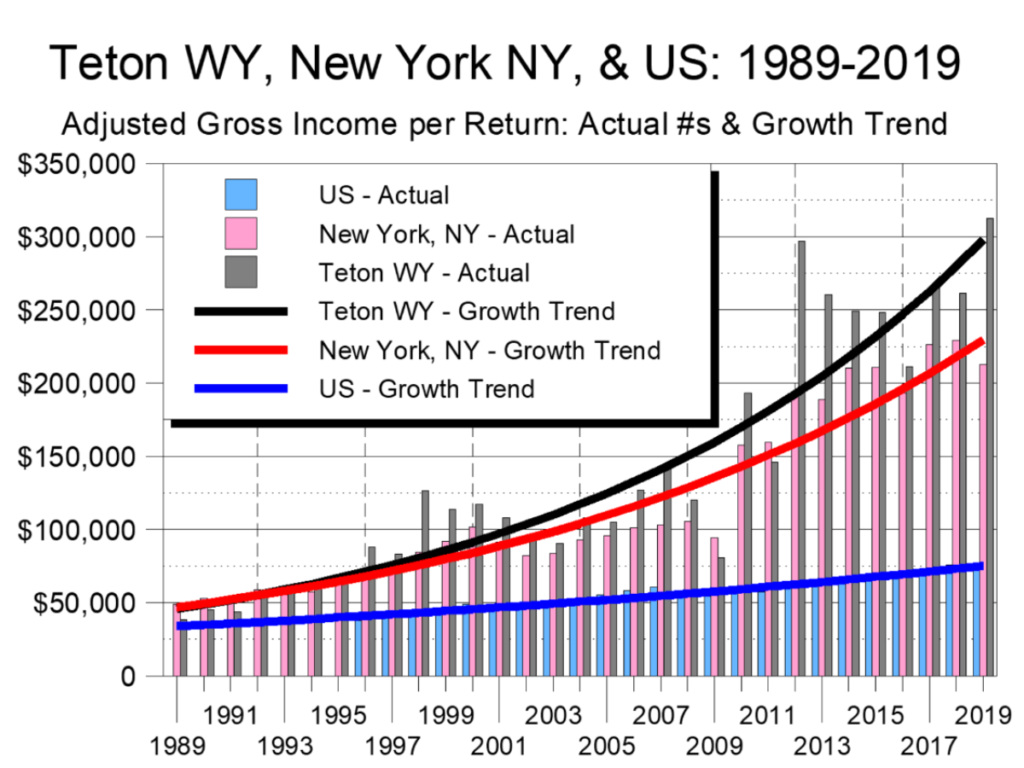

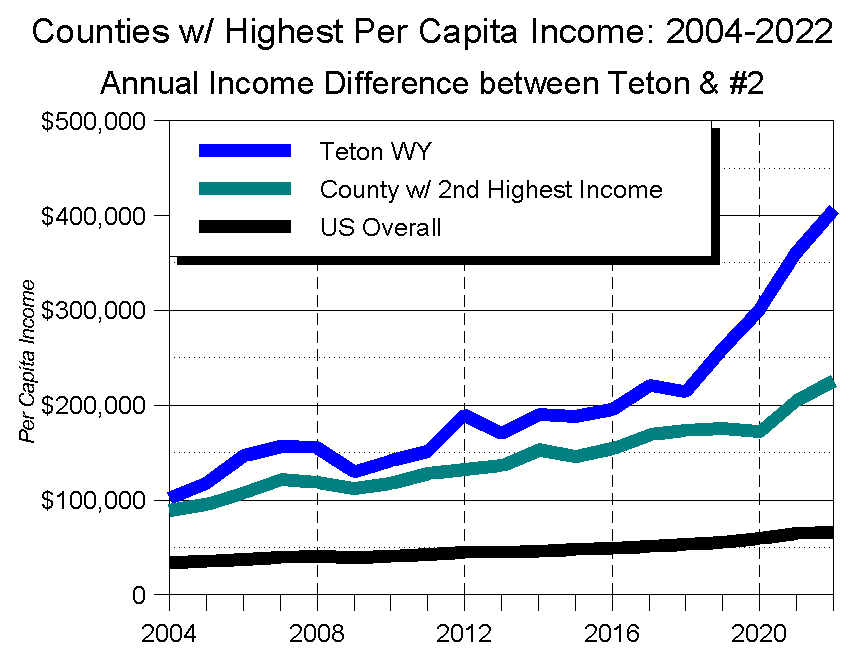

- The gap between Teton County and the rest of the nation is growing.

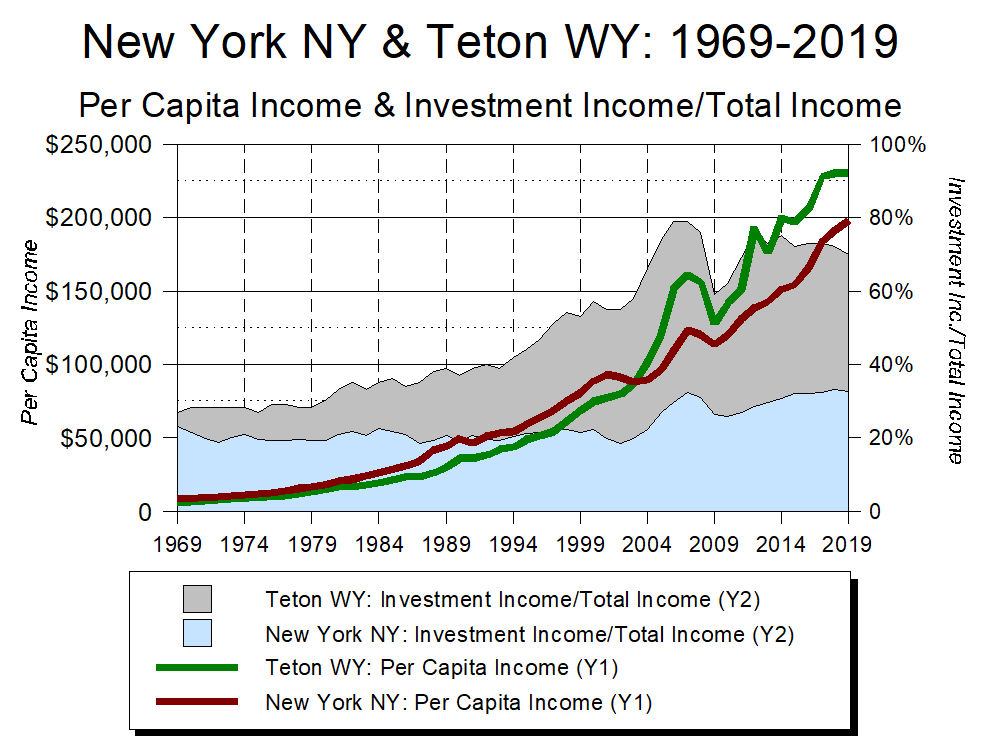

- In 2004, when Teton County first led the nation in per capita income, the gap between Teton County and second place New York County (the island of Manhattan) was 20%. In 2022, the gap between Teton County and second place Summit County was 80%.

- In 2004, Teton County’s per capita income figure was 3.0 times greater than the nation’s overall per capita income. In 2022, it was 6.2 times greater.

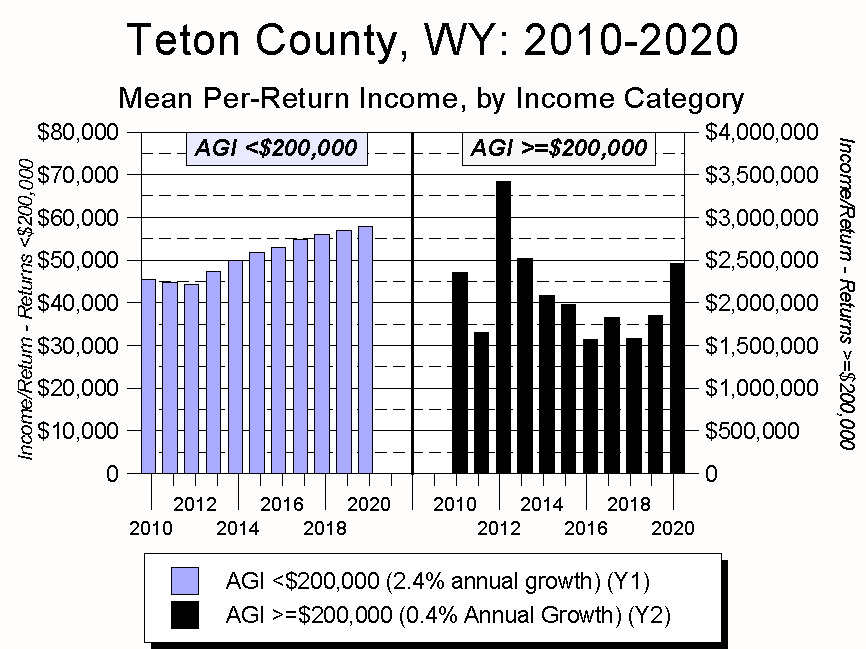

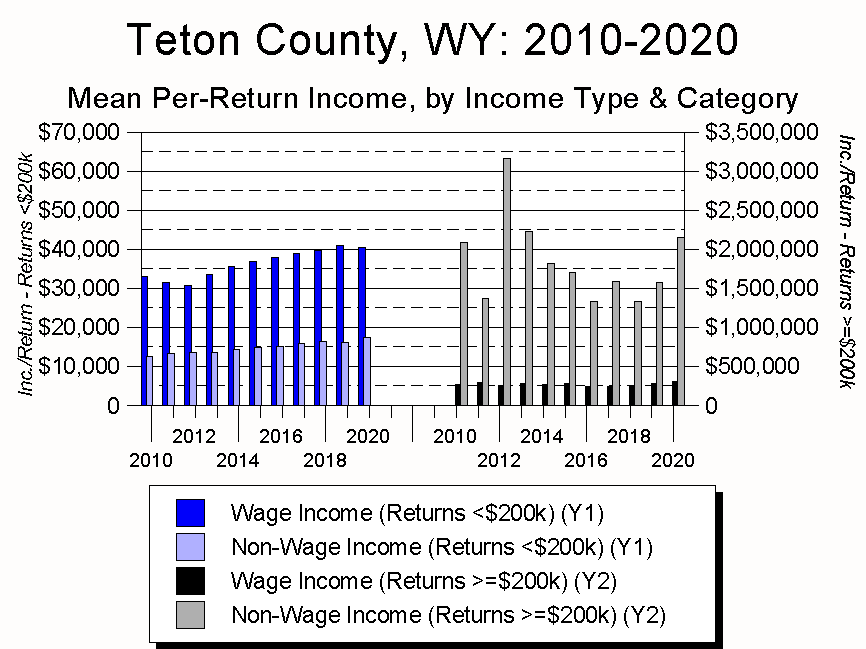

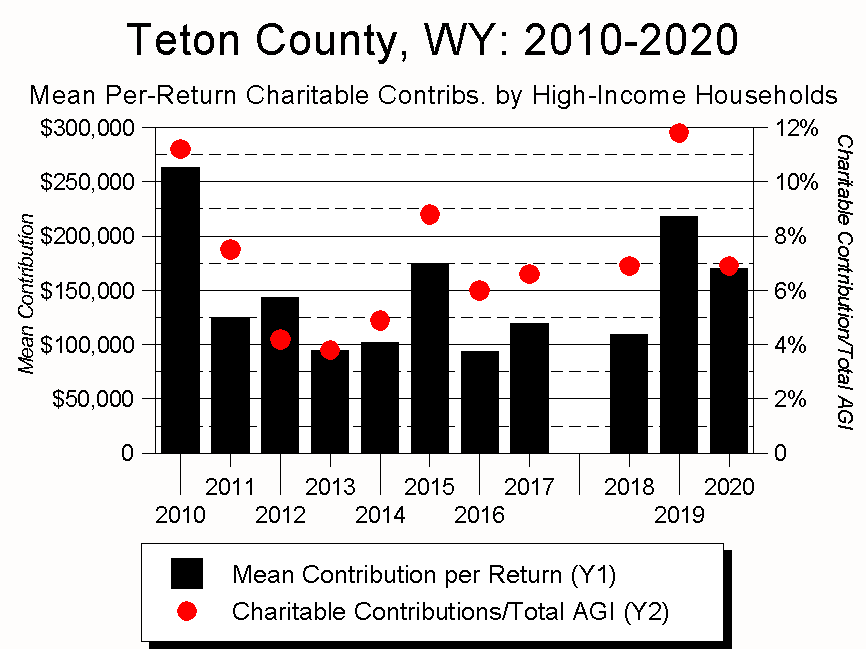

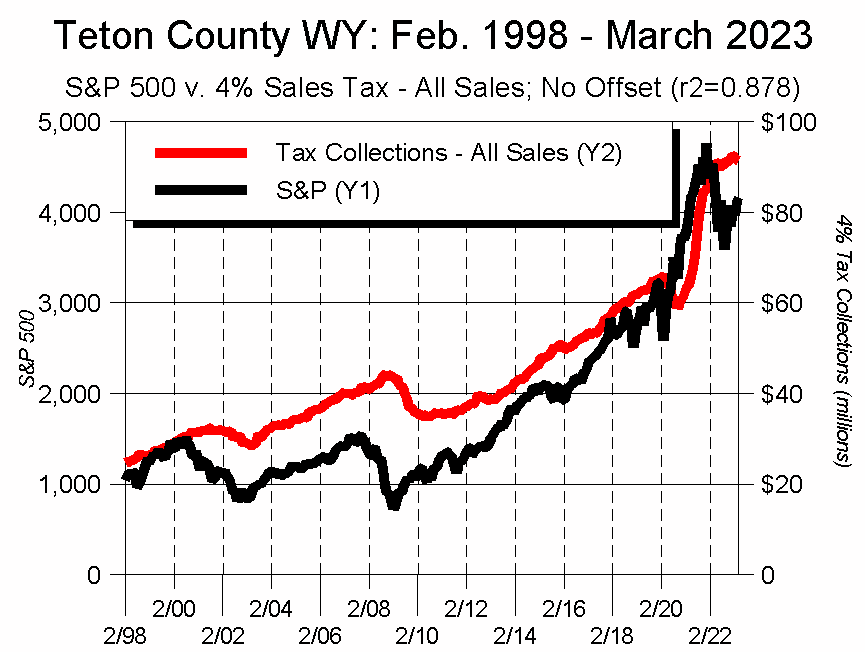

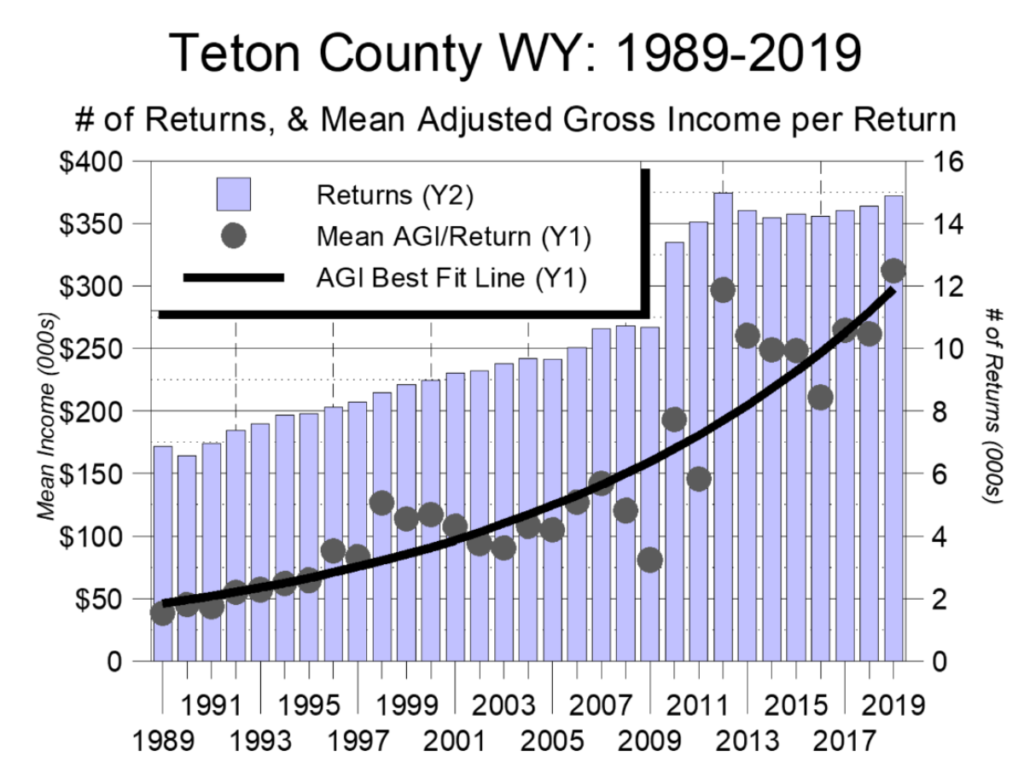

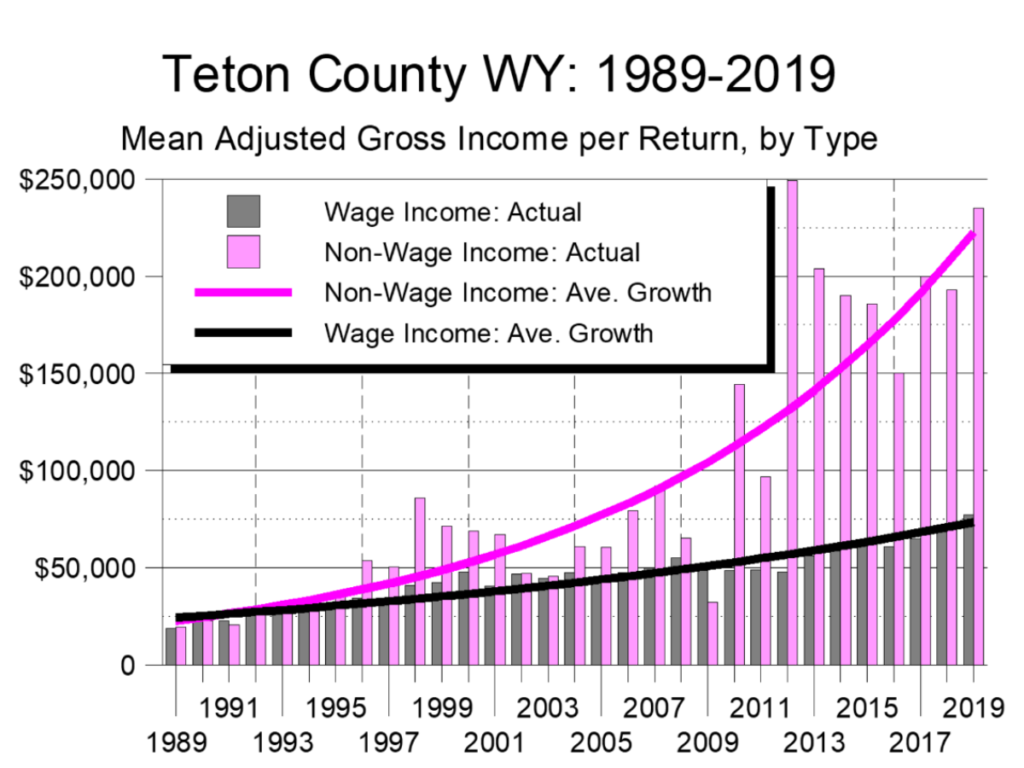

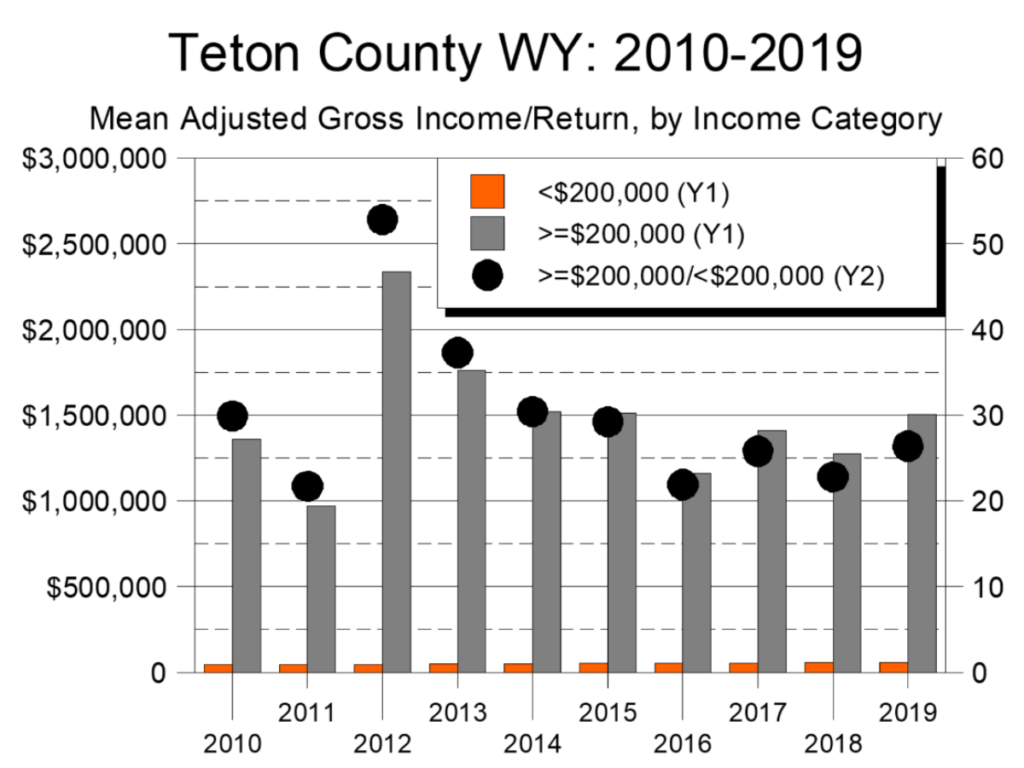

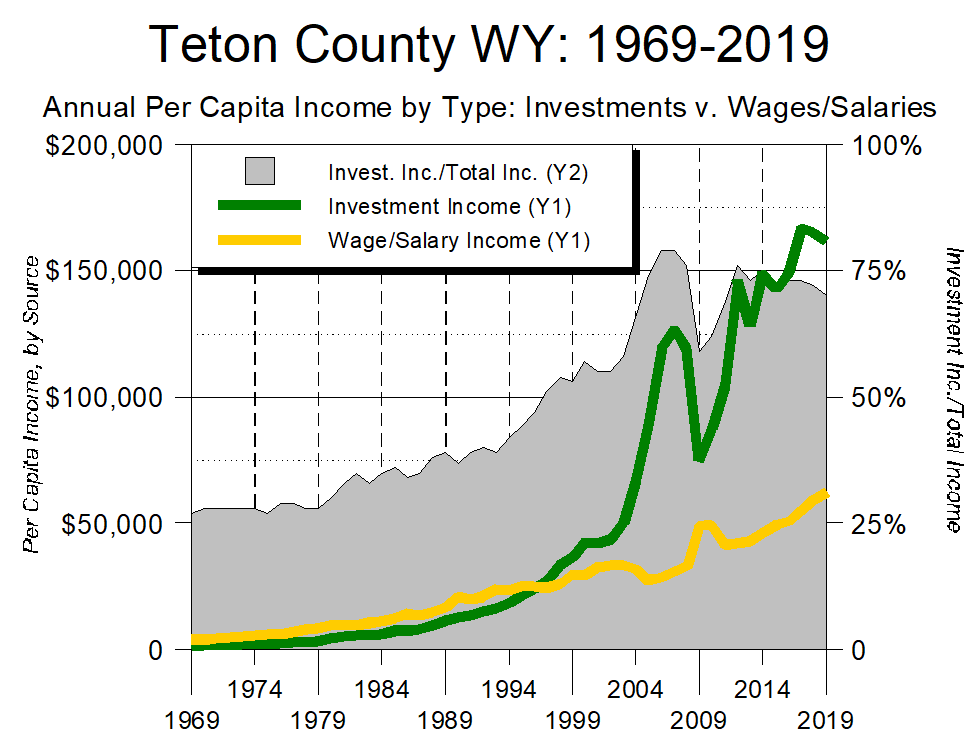

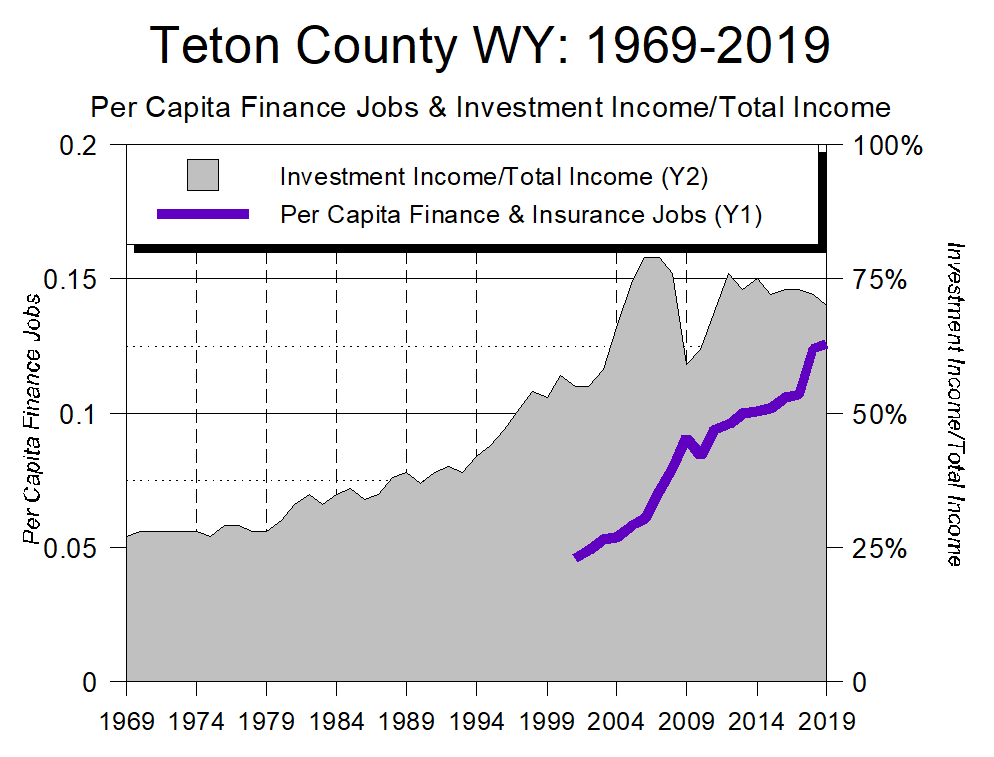

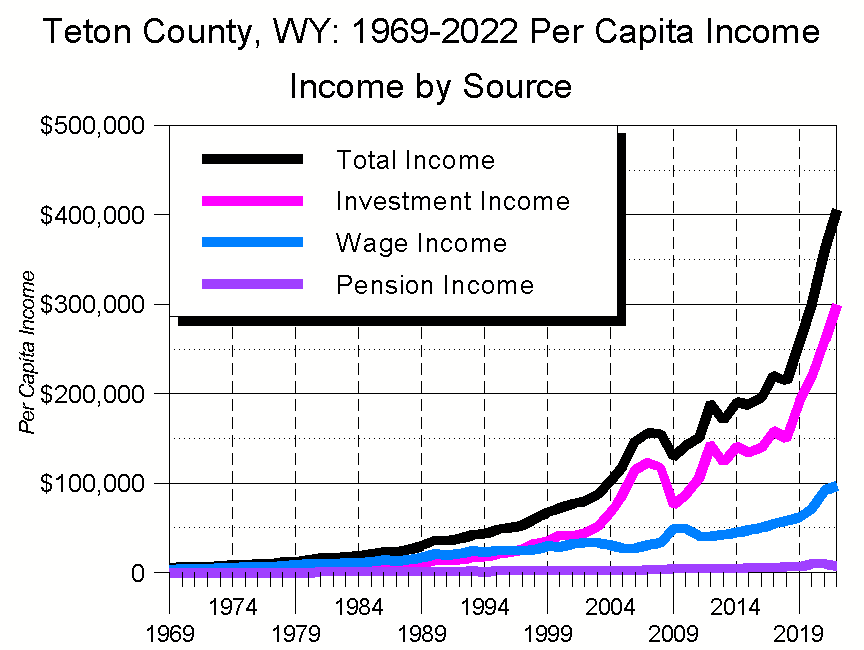

- Investments account for the vast majority of Teton County’s income.

- In 2022, 74% of Teton County’s income came from investments, 24% from wages, and 2% from pensions and government assistance programs.

- In 2022, Teton WY’s per capita investment income of $299,811 was 32% higher than Summit UT’s total per capita income.

- Even though it accounted for “only” 24% of Teton County’s total income, Teton County’s 2022 per capita wage income of $97,712 was, on its own, higher than the total per capita income of all but 64 US counties.

- Teton County has 4% of Wyoming’s population and 22% of its total personal income. Teton County also accounts for 49% of Wyoming residents’ total investment income.

- In 2022, Wyoming’s overall per capita income was $73,248, just 18% of Teton County’s figure

- Had Teton County not been part of Wyoming in 2022, the state’s per capita total income would have been $58,361, 19% lower than its actual figure.

- Had Teton County not been part of Wyoming in 2022, the state’s per capita investment income would have been $13,269. 46% lower than Wyoming’s actual figure of $22,450. (Figure 5)

Jobs: The Rise of Finance & Professional Services

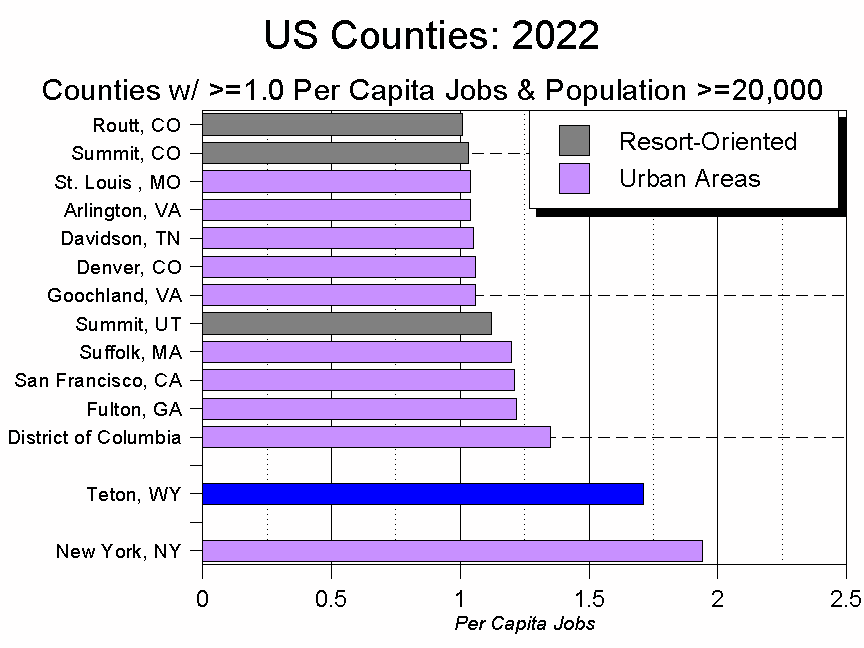

- In 2022, Teton County had 39,800 total jobs – 1.71 jobs per capita. This ranked Teton County 9th in the nation in per capita jobs.

- In 2022, America’s overall per capita job figure was 0.64, roughly 1/3 of Teton County’s figure.

- In 2022, only 39 of America’s 3,114 counties had more than one job per resident. Of these, just 14 had populations of 20,000 or more (smaller population sizes can skew calculations).

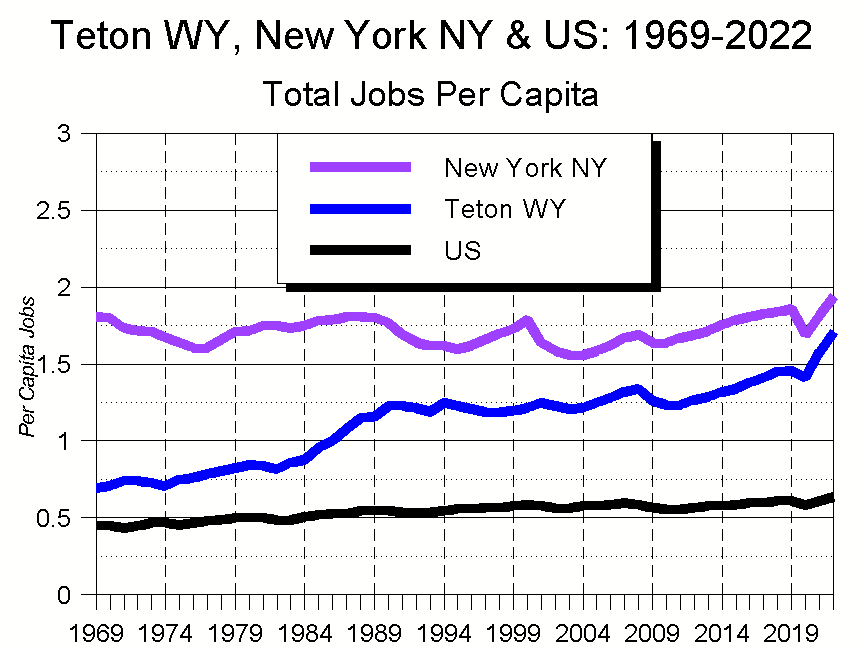

- Among America’s counties with 20,000 or more residents, Teton County’s 1.71 jobs per capita ranked it second, trailing only New York County’s 1.94 (New York County is the island of Manhattan).

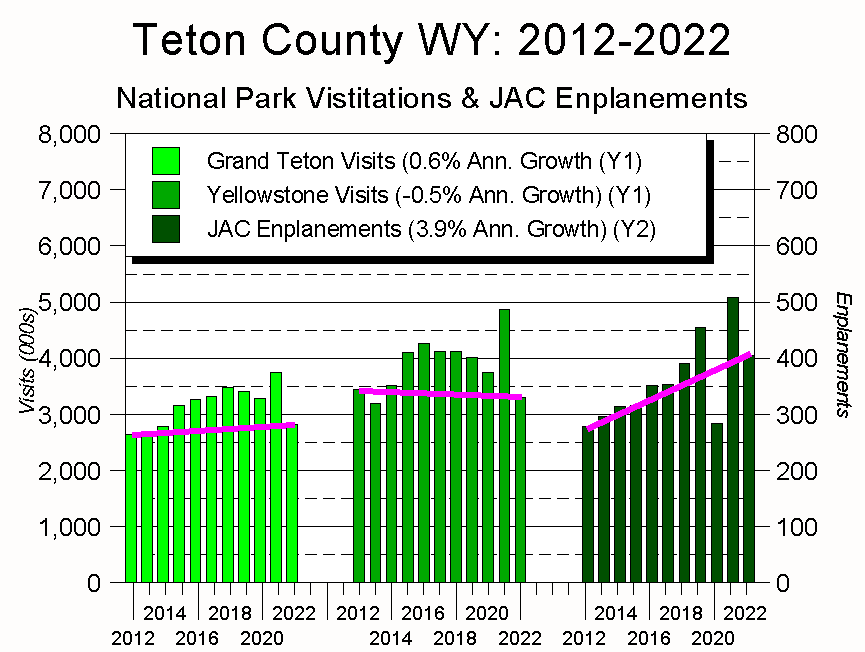

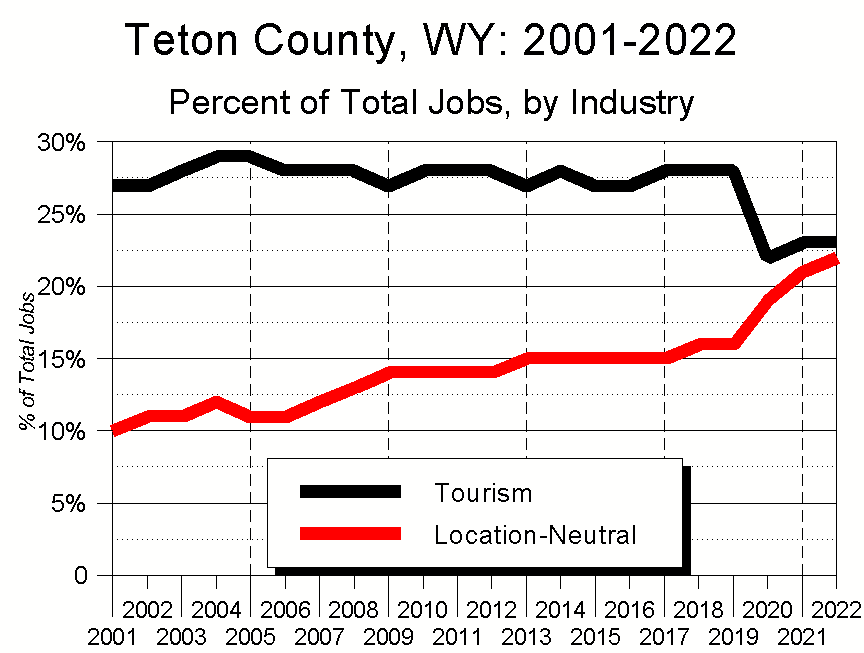

- Over the past decade, among counties with 20,000 or more residents, Teton County’s per capita job figure has consistently been #2 to New York’s #1. During that time, the gap between New York and Teton County has been closing. In 2012, New York City had 33% more jobs per capita than did Teton County. In 2019, the last pre-pandemic year, the figure was 27%. In 2022, it was 13%. (Figure 7)

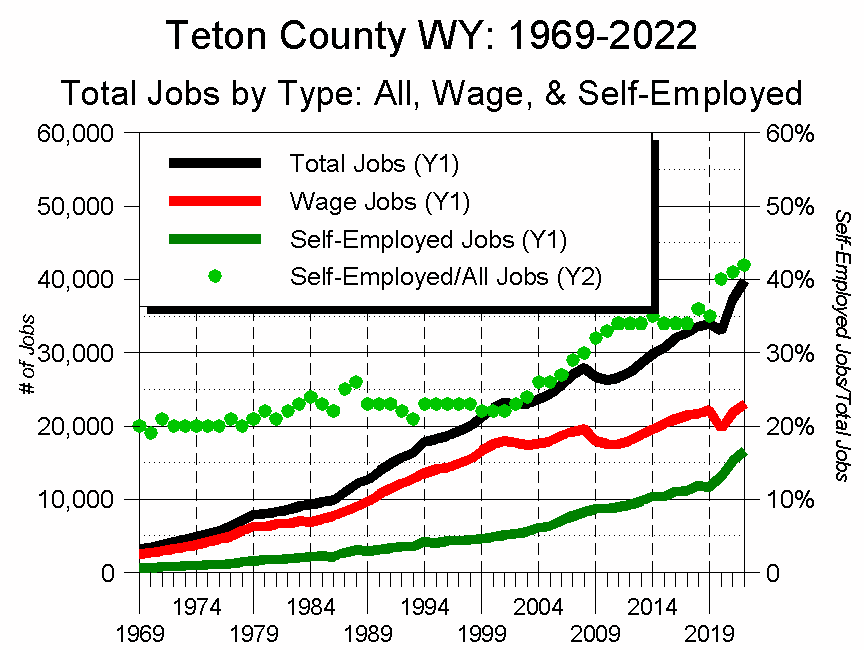

- The BEA classifies all jobs as either wage-based or self-employed jobs (the latter category includes jobs ranging from real estate agents to remote workers). In 2022, 58% of Teton County’s 39,800 jobs were wage-based jobs. The other 42% were self-employed. In the US, the figures were 74% and 26% respectively.

- Over time, as the number of remote workers has risen, Teton County’s mix between wage and self-employed jobs has shifted towards self-employment:

- 2008 was the last year at least 70% of Teton County’s jobs were wage-based

- 2019 was the last year at least 65% of Teton County’s jobs were wage-based

- In 2022, 58% of Teton County’s jobs were wage-based. (Figure 8)

- Over time, as the number of remote workers has risen, Teton County’s mix between wage and self-employed jobs has shifted towards self-employment:

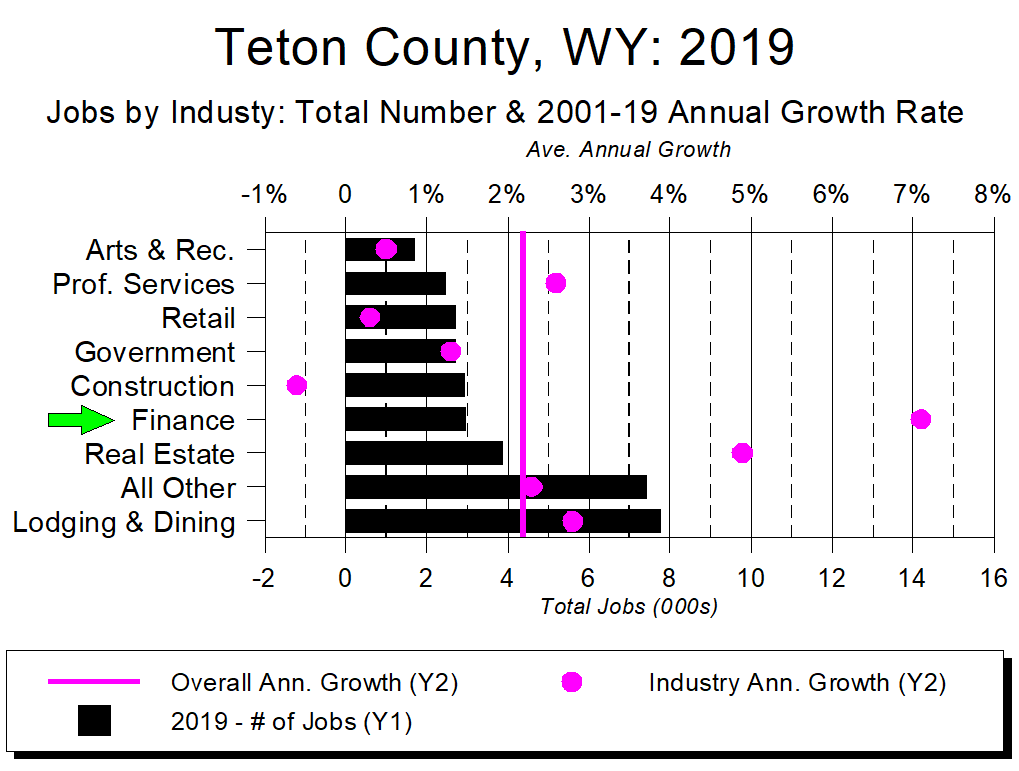

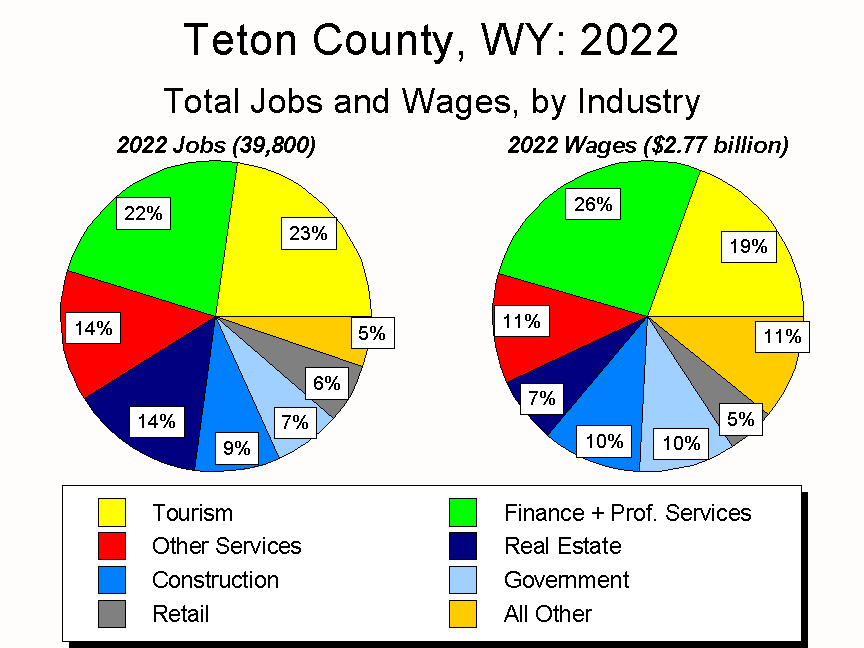

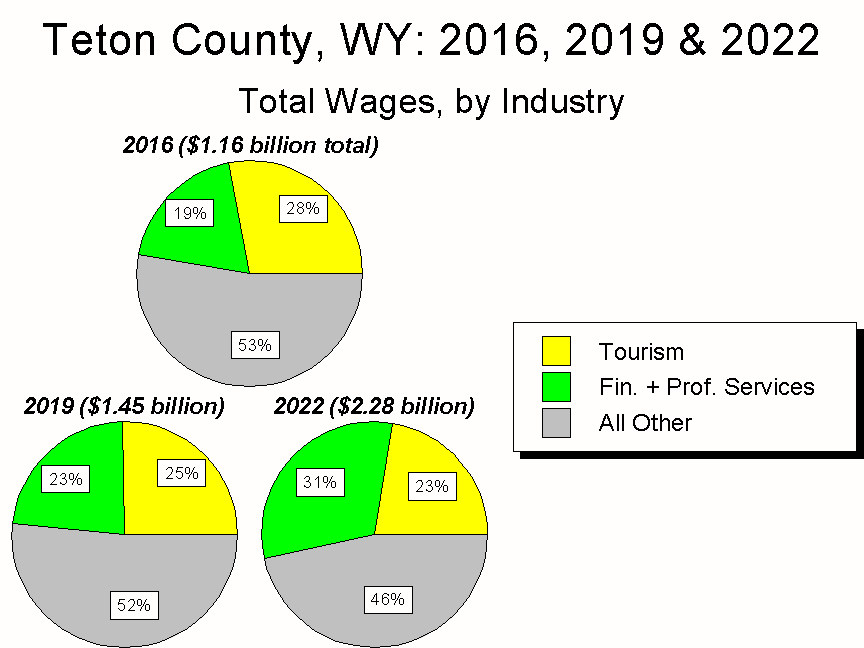

- In 2022, Tourism-related jobs (Recreation and Lodging & Restaurants) accounted for 23% of Teton County’s total jobs and 19% of residents’ total wages.

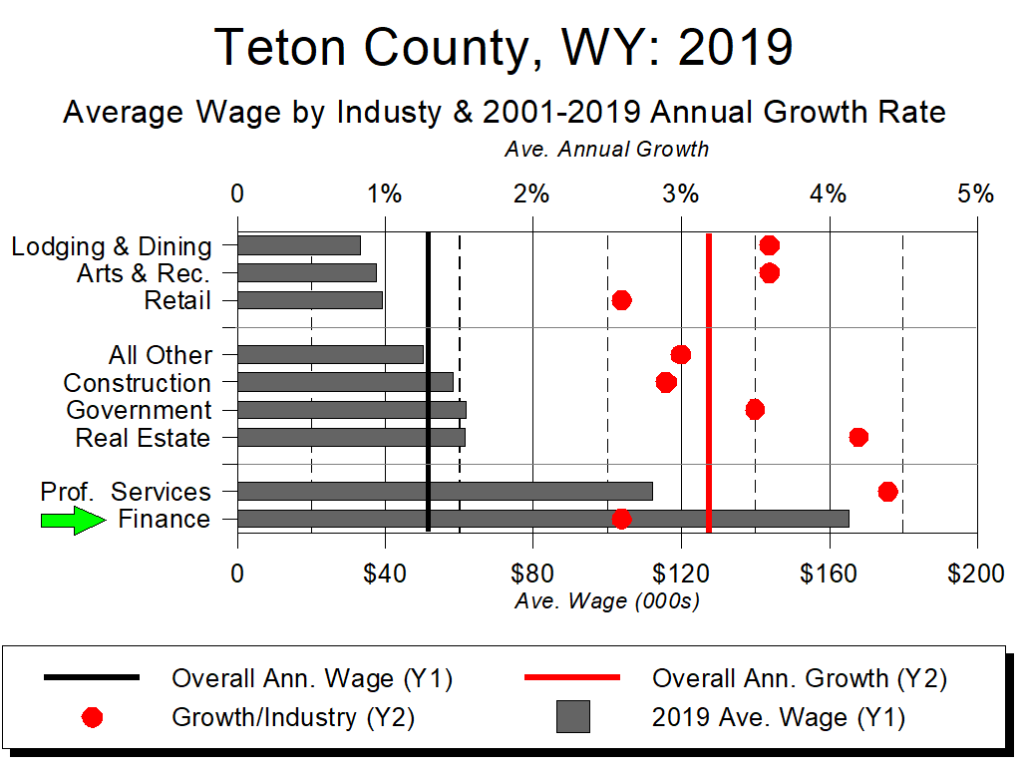

- Also in 2022, Location-Neutral jobs (Finance & Professional Services) were the other largest employment area, accounting for a virtually-identical 22% of the county’s total jobs. In contrast, these better-paying jobs accounted for 26% of residents’ total wages.

- In 2022, Lodging & Restaurants were the biggest employer in the Tourism sector, accounting for 19% of all of Teton County’s jobs.

- This proportion ranked Teton WY 23rd in the nation, ahead of such well-known tourism destinations as Clark County, Nevada (the location of Las Vegas) and Orange County, Florida (the location of Orlando). It also ranked Teton WY higher than every other major ski county in the US except Summit Colorado (Breckenridge).

- In 2022, Finance was the biggest employer in the Finance/Professional Services sector, accounting for 14% of all of Teton County’s job.

- This proportion ranked Teton WY 7th in the nation, ahead of such well-known financial centers as Fairfield County, Connecticut (the location of Greenwich) and Suffolk County, Massachusetts (the location of Boston).

Growth and Change

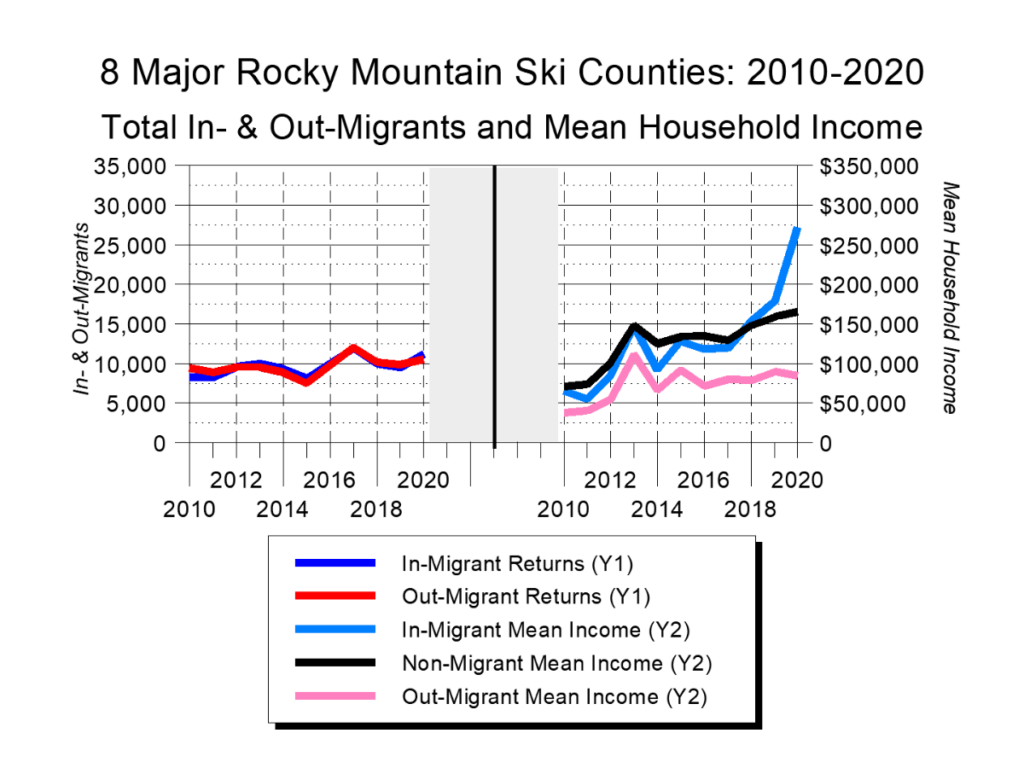

The COVID pandemic didn’t fundamentally change Jackson Hole or other desirable places to live. What it did do, however, was pour gasoline on an already-burning fire of growth and change.

COVID and Remote Working

Arguably COVID’s greatest long-term effect will be that it legitimized remote working. For huge numbers of people, the already stretched-and-frayed umbilical cord connecting work and home was suddenly completely severed, freeing them to live where they wanted to, rather than where work forced them to be. For better or worse, the “beneficiaries” of that liberation were places like Jackson Hole and other Greater Tetons area communities.

The folks best able to take advantage of this fundamental shift are those with Location-Neutral incomes. The most Location-Neutral income of all is, of course, investment income, which continues to pay regardless of where someone lives. For those reliant on wage and salary incomes, jobs in Professional Services and Finance are often Location-Neutral.

From that perspective, Teton County, Wyoming leads the nation in its percentage of Location-Neutral income, as well as its per capita Location-Neutral income amount.

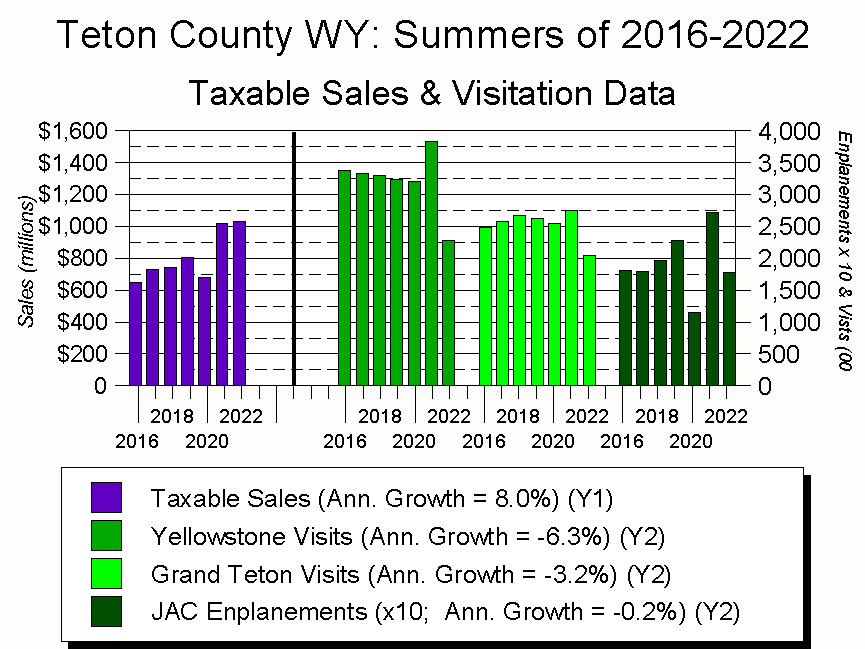

At the other end of the jobs spectrum – i.e., jobs which are Location-Dependent – are those in Tourism, for no one has yet figured out how to remotely load lifts, clean hotel rooms, or serve and cook restaurant meals. This makes it illuminating to compare Jackson Hole’s Location-Neutral and Location-Dependent economic indicators before and after the pandemic hit in 2020.

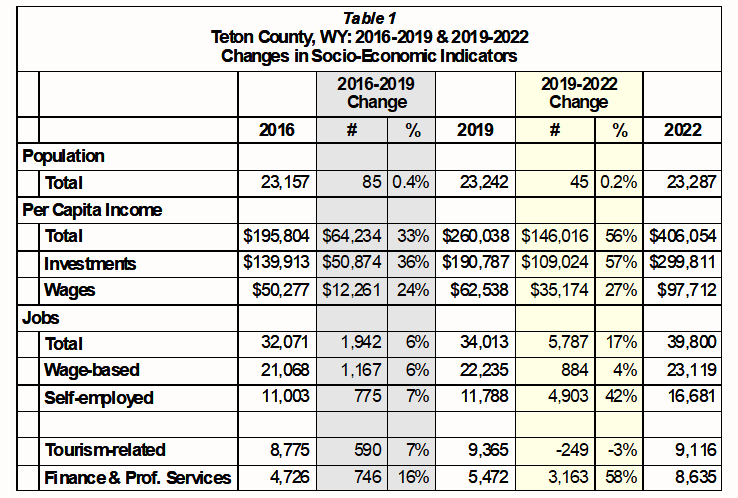

The table below summarizes how big a pivot the pandemic proved for Teton County. In the three years before the pandemic, Teton County enjoyed good economic growth; in the three years from 2020-2022, it experienced extraordinary growth.

The COVID Pivot

Between 2020-2022, Teton County also experienced an extraordinary – and extraordinarily rapid – shift in the composition of its economy.

Not in its population – Teton County’s population has remained essentially flat since 2016. What has changed, however, is the composition of that population.

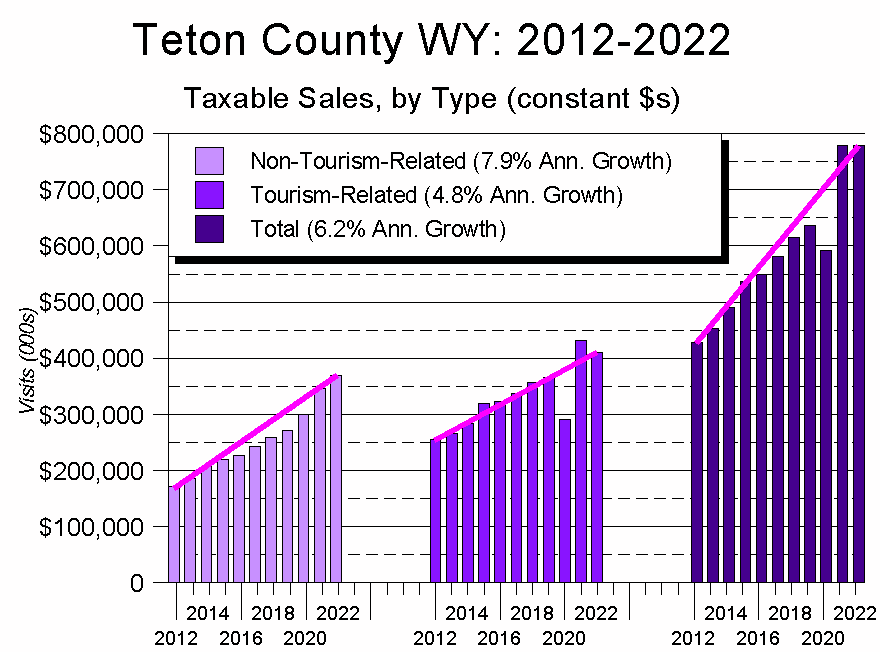

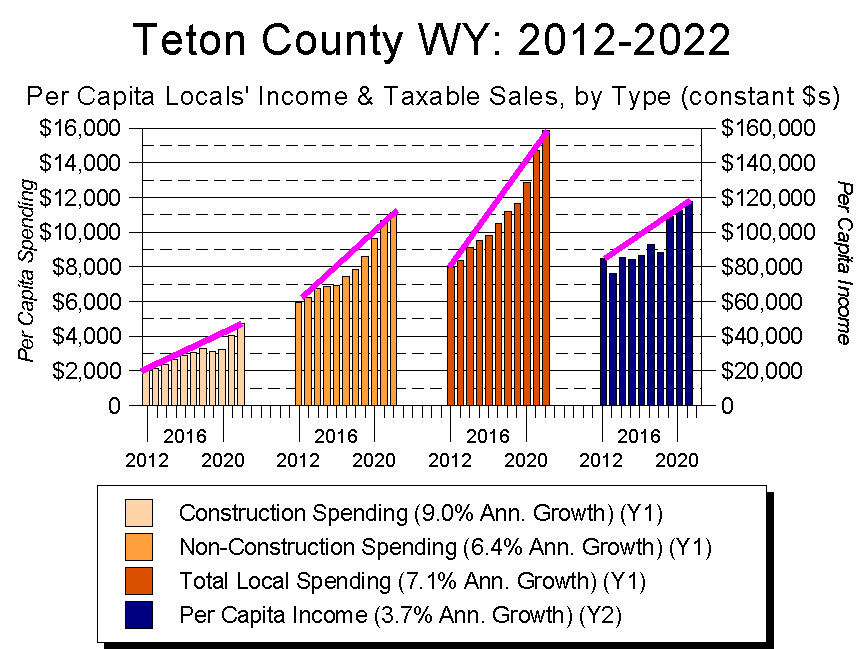

Specifically, in the three years between 2016-2019, Teton County’s overall income grew 33%; in the three years between 2019-2022, it grew 56%.

More strikingly, in the three years between 2019-2022, while the mix of residents’ total income didn’t change much – 73% came from investments in 2019, while the figure was 74% in 2022 – what changed dramatically was the composition of its jobs.

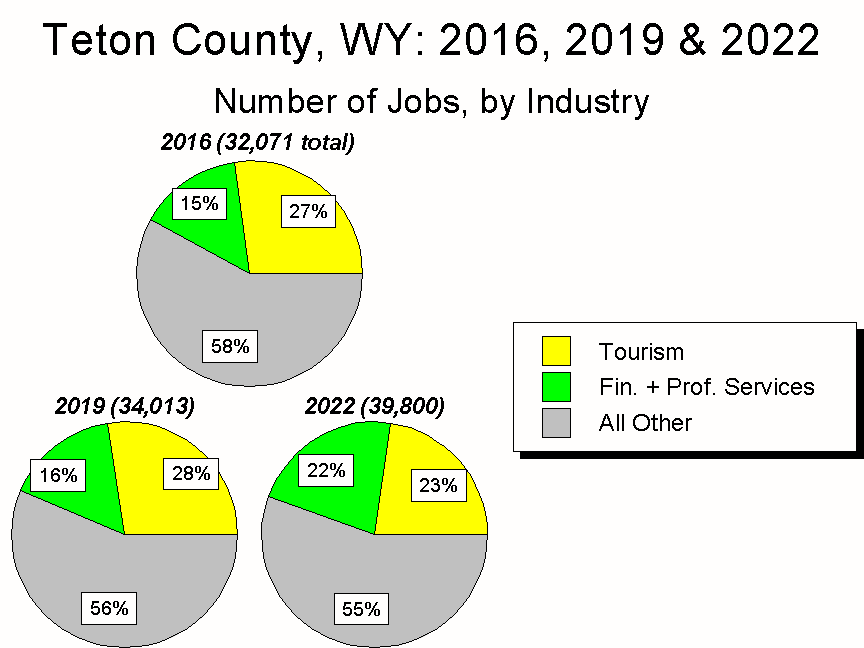

- In 2019, 28% of Teton County’s jobs were in Tourism (Recreation, Lodging, and Restaurants). In 2022, only 23% were.

- In 2019, 16% of Teton County’s jobs were Location-Neutral (Finance or Professional Services). In 2022, 22% were.

This was after essentially no change in the job mix between 2016-2019.

Wages Followed Jobs

- In 2019, 25% of Teton County’s wages were in earned in Tourism. In 2022, only 23% were.

- In 2019, 23% of Teton County’s wages were earned in Finance or Professional Services. In 2022, 31% were.

The Biggest Shift in History

What does it all mean? Just this.

Big picture, between 2019-2022, Jackson Hole’s economy changed more than at any other time since 2001, and arguably in its history. As a result, from a socio-economic perspective, today’s Jackson Hole is in an awkward adolescent phase, evolving from taking care of visitors to providing financial and professional services to a worldwide clientele.

Put another way, to see the future of Jackson Hole’s workforce and culture, look more to New York City or San Francisco than other national park gateway communities or tourist Meccas such as Orlando.

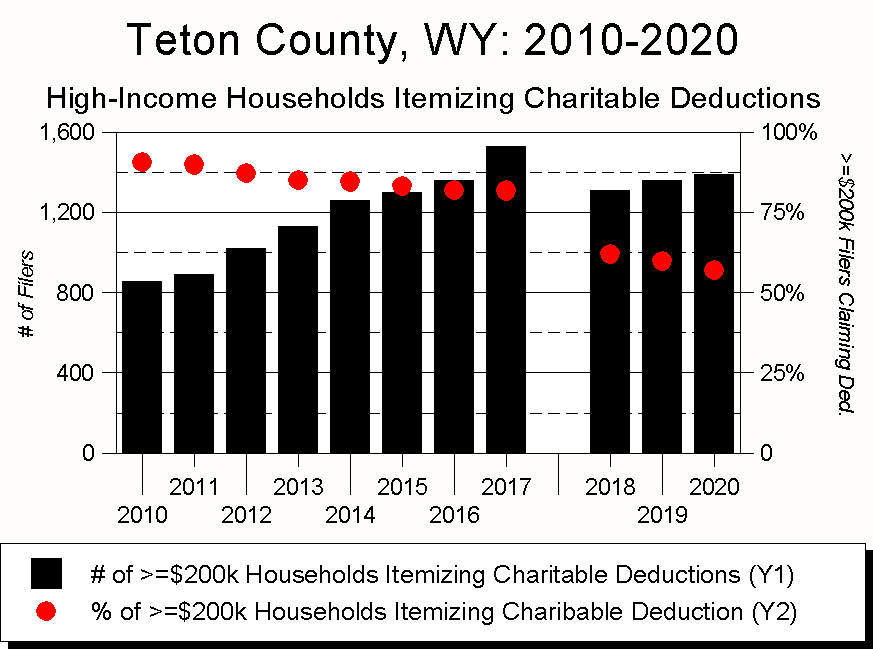

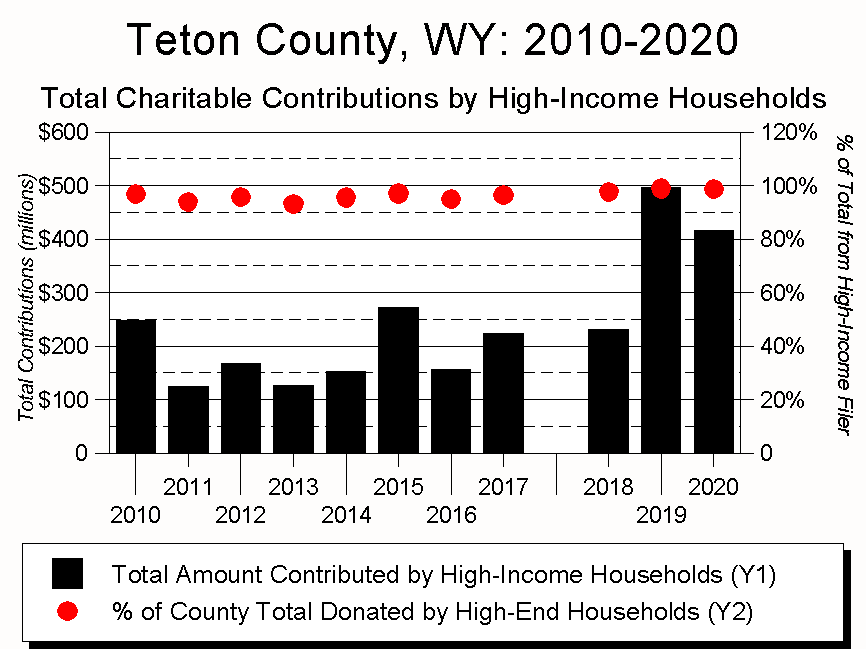

Part of this has to do with Wyoming’s wealth-friendly tax and trust laws. But as noted above, while Teton County is home to just 4% of Wyoming’s population, it accounts for 22% of the state’s total personal income and 49% of its investment income. If the well-to-do aren’t living in other parts of Wyoming, other factors must be at work.

What might those other factors be? One is clearly the region’s ecosystem. Respondents to my recently-completed public opinion survey ranked the area’s ecosystem as the thing they most valued about the region – more so than the community and far more so than the economy. But here again, the ecosystem has always been an attractor, so what’s changed?

Geographic Isolation Matters Less

As I’m coming to see things, the biggest drivers of change in Jackson Hole are the technologic and market forces combining to obliterate the importance of Jackson Hole’s geographic isolation.

Throughout history, the Tetons region’s rugged, remote qualities have served to shape not just its culture but its economy. No more. The same global forces that are upending the Earth’s climate, economy, and institutions may not be affecting Jackson Hole’s geologic features, but they are rapidly and profoundly changing pretty much everything else about the region: ecologically, economically, and from a community perspective.

For example, global warming is clearly affecting Jackson Hole’s flora and fauna, terrestrially and aquatically. Similarly, outside forces are affecting the valley’s cultural make-up, as COVID migrants and other newcomers replace others who choose to leave (or perhaps are getting priced out…).

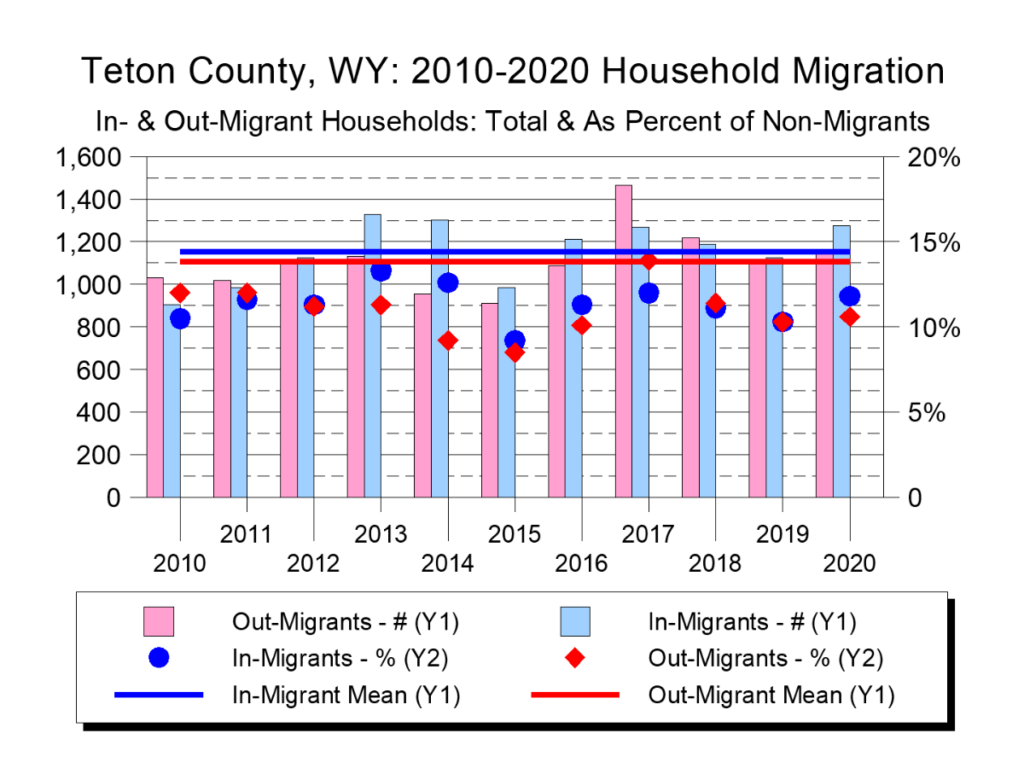

Turnover is nothing new in Jackson Hole, of course – historically, there’s a 10%-15% turnover as one year’s residents are replaced by a similar number of newcomers. What makes the past few years different is the amount of wealth recent newcomers have brought to the community.

Who Are We?

And then there is a really interesting question, one almost existential in capturing just how profound our upheaval is proving to be: Who are we?

More precisely, here’s the question suggested by the BEA data: Are we a Tourism community, or are we a Location-Neutral community? In a Zen Koan-esque fashion, for Jackson Hole the answer is “yes.” In fact, it’s more “yes” than for any other county in America.

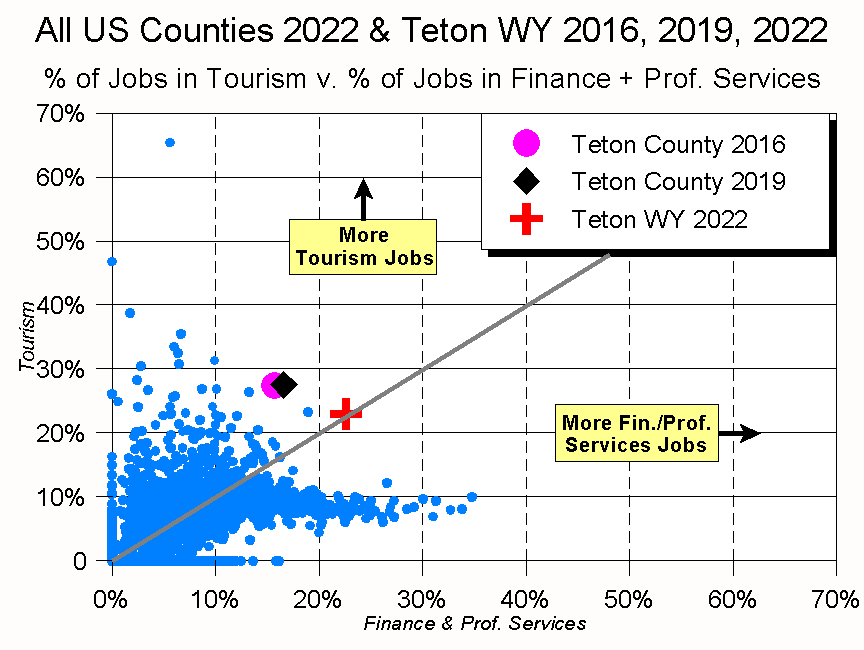

The graph below looks at every county in America. The X axis measures the percentage of a county’s Location-Neutral jobs; the Y axis measures the same thing for Tourism jobs (Figure 10)

In 2022, Teton County had an essentially identical percentage of both Tourism jobs (23%) and Location-Neutral jobs (22%). Just three years earlier, the percentages were 28% and 16% respectively.

A Balance Like No Other

That is a wild and rapid swing in the community’s jobs base. Even more striking, though, is that in 2022, Teton County reached a point of equipoise, balanced like no other American county in its large percentage of Location-Neutral jobs and its large percentage of Tourism jobs. As a result, we were in the top 1% of all counties in both categories, a claim no other county could make.

Which is crazy. Why? Because Tourism and Location-Neutral industries have fundamentally different business models.

Different Business Models

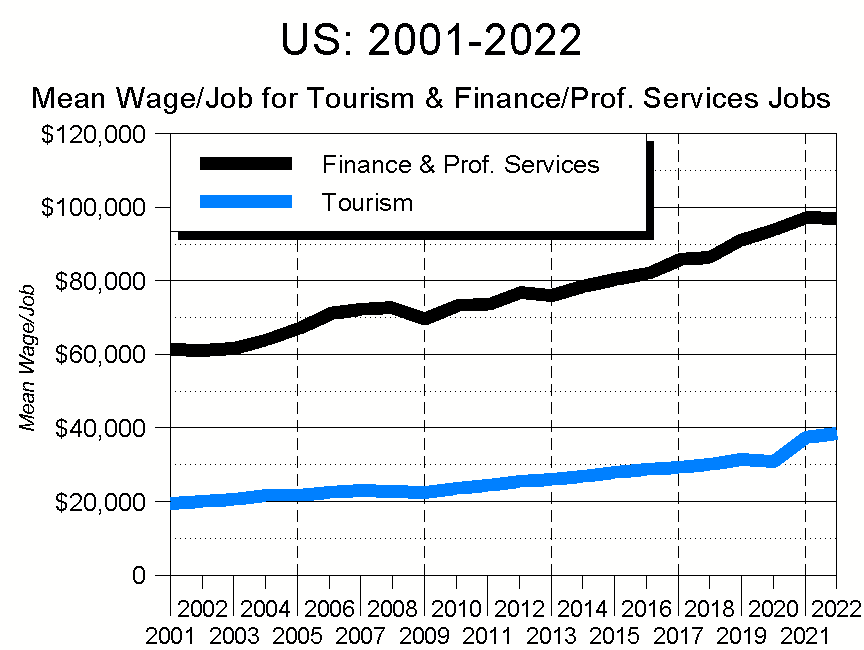

As a rule of thumb, Tourism businesses hire a lot of people and pay them relatively low wages. Location-Neutral businesses can also be big employers (think about how many people you see in a bank lobby), but their business model allows them to pay a lot more.

The result is a huge pay gap between the two industries. And even if the pay gap continues to narrow as it has in the last few years, over time Tourism will find it increasingly difficult to compete for employees, making things increasingly difficult for an industry which has long-defined Jackson Hole.

So who are we?

Ultimately, the only way lower-wage industries like Tourism can succeed is to have access to low-cost housing, which in turn requires low-cost land. Arguably, that once was possible in Jackson Hole, for our geographic isolation allowed for housing prices to be more closely tied to the local economy. No longer though – the technology-driven demand to live in our increasingly-connected region has fundamentally shifted the region’s supply/demand balance. And as demand increases, it’s not just Tourism being affected, but any location-dependent industry (e.g., health care, education, and government).

In short, barring fundamental changes to the nation’s economy, any person or industry without a direct link to investment income and other sources of wealth is going to find it increasingly hard to live in Jackson Hole and, ultimately, the greater Tetons region. What we should do about that – if anything – is the fundamental policy question facing not just local government, but the community as a whole.

Conclusion

There is no particular significance to Teton County exceeding $400,000 in per capita income. Any more than there was in us hitting the $300,00 mark two years earlier. Or $200,000 three years before that.

Each level has huge symbolic meaning, though, for each represents – in increasingly stark terms – the forces of growth and change washing over Jackson Hole. Each also represents the kind of community those forces are creating.

America relies on market forces to allocate resources. And while government policy tweaks things a bit here or there, our underlying belief is that the combination of market forces and economic self-maximization produces the best possible outcome for society as a whole.

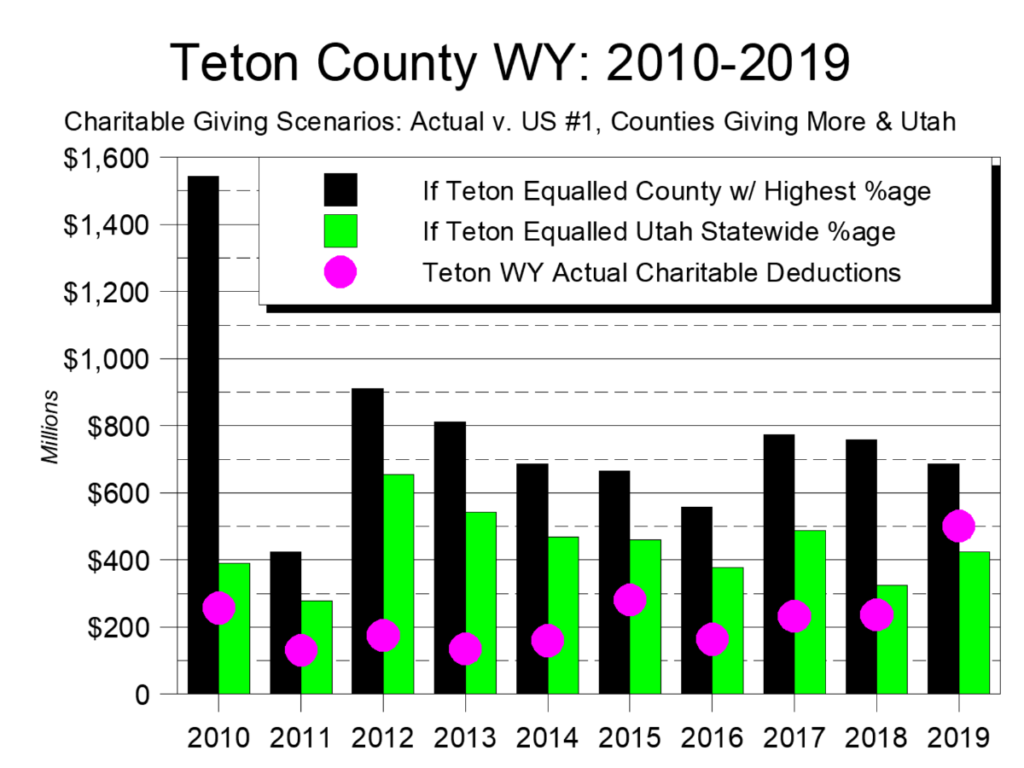

No state embraces this philosophy as actively as Wyoming, where we consciously limit government powers and have created the nation’s most wealth-friendly tax and trust laws. All this has reached its apotheosis in Teton County where, as noted above, we have 4% of the state’s population and 49% of its investment income.

Does Wealth = Happiness?

So why is there a sense of despair?

My recent survey of the region’s residents not only showed we prioritize the environment over community, and community over the economy, but that we were pessimistic about where things are heading. We’re also not happy about how things are today versus how they were before.

Again, why? We have become rich beyond the dreams of avarice, yet something seems amiss.

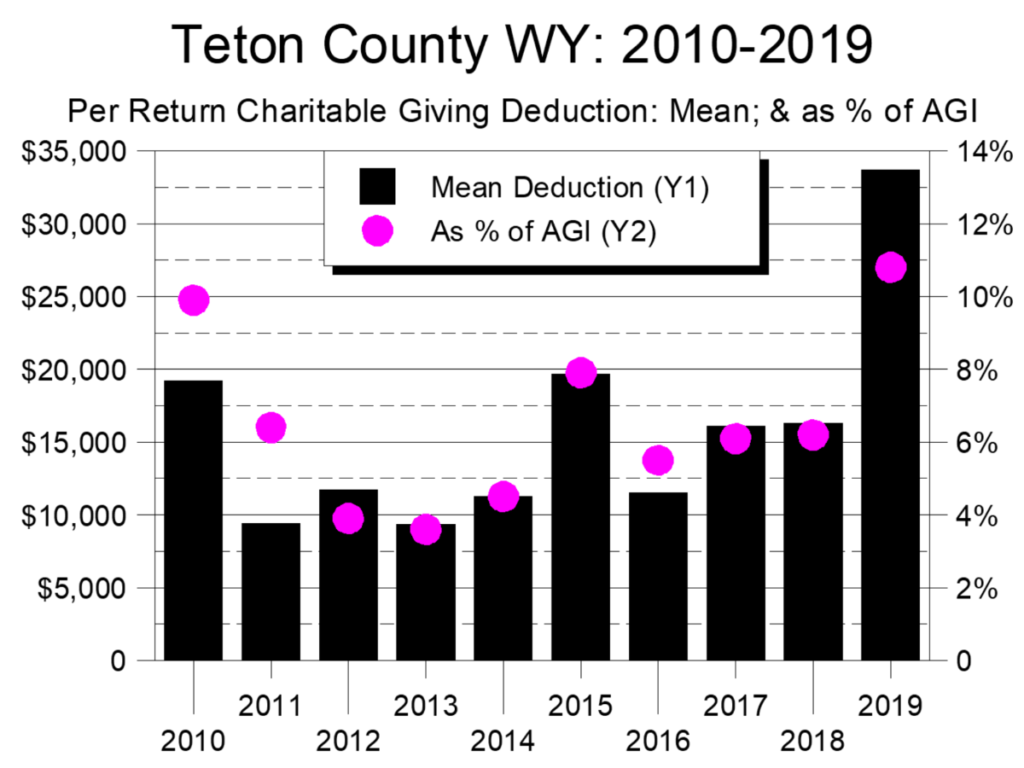

Perhaps a clue lies in the obituary of my late friend, the beloved author and Kelly School teacher Ken Thomasma. Mr. Ken loved telling the story of how, in the 1980s, he camped out for several days on the roof of Fred’s Market. He did so to help raise around $150,000 in community donations for supplies the school district simply couldn’t afford.

When Ken climbed onto Fred’s roof, Teton County’s per capita income was around $17,000. As a result, during his “camp-a-thon” Ken was trying raise 10 times what the “average” Jackson Hole resident earned. In today’s dollars, his $150,000 target would be around $450,000. Which is, of course, just a little more than what one “average” Jackson Hole resident earns today.

The idea of someone doing today what Ken did 40 years ago is almost inconceivable. In part that’s because we have so much more money, which of course is a great thing. In part, though, it’s because the equation for how we give back to the community seems to have switched from giving time to giving money.

For me, this reality calls to mind a quote which seems as relevant today as when it was first uttered in 1909, in a speech at UC Berkeley by Lord James Bryce, a British diplomat and historian:

“What will happen when California is filled by fifty millions of people, and its valuation is five times what it is now, and the wealth will be so great that you will find it difficult to know what to do with it? The day will, after all, have only twenty-four hours. Each man will have only one mouth, one pair of ears, and one pair of eyes. There will be more people – as many perhaps as the country can support – and the real question will not be about making more wealth or having more people, but whether the people will then be happier.”

Two Points

From Lord Bryce’s vantage point, the survey results and BEA data seem to make two points.

First, the BEA data affirm what we know in our guts: Jackson Hole is changing, both rapidly and profoundly. The forces washing over the Tetons are the same ones that, across the planet, are producing massive upheaval in not just the world’s economies, but also how we interact and coexist with each other.

Second, despite being the wealthiest county in the wealthiest country in the history of the world, we’re still beset by a number of challenges. Some are inherent to the human condition; others the result of how we allocate our resources and what we choose to prioritize. Collectively, those challenges seem to be creating a community that many folks feel isn’t working well; a once-special place slipping away at an increasingly rapid rate.

Three Questions

Given this, I think we’ve reached a point where we need to ask ourselves three simple questions. Simple to ask; hard to answer.

The first is the one noted above: “Who are we?” What do we care about? What do we want for ourselves?

Historically, we’ve taken who we are for granted. We haven’t had to ask because we haven’t had to think about it. Combined, economic forces and our geographic isolation not only answered the question for us, but gave us an answer we very much liked. As we have become both more connected and more similar to the outside world, however, it’s fair to wonder whether this approach will continue to work.

Second: “Do we like where we’re going? ” The BEA data paint a picture of a rapidly-changing community, one hallmarked not just by increasing wealth, but an increasing concentration of wealth. Perhaps even more important, our economy is becoming increasingly disconnected from the natural world around us.

Throw in a set of governmental tools perfectly suited for the mid-20th century but increasingly feeble today, and it’s pretty clear where, barring significant change, the community and region will be in 10, 20, 50 years. Is that what we want?

Finally, if we don’t like where we’re going, we need to ask ourselves a third, equally important question: “Do we care enough to make meaningful changes?” For absent that passion, any effort will likely be for naught.

Why? Because the forces at play are extremely powerful, and there’s no clear blueprint for addressing them. Part of the answer lies in aligning incentives, in somehow developing a jujitsu-like approach to guide those forces towards where we want to go. But because we’ve never done anything like that, the process will likely be a hard slog.

Many hard slogs end up with a great result. Because there are no guarantees, though, to have a chance of success will require vision, grit, and a profound sense that the community’s future is worth it.

Which, of course, it is. The opportunity is at hand – together, let’s seize it.