Hello, and happy near-Equinox!

When I write these newsletters, my goal is always to come up with some big “AHA!” moment for both myself and my readers. Something that will cause all of us to see ourselves – whether the Tetons region or, with luck, the broader world – through a new lens. To gain an appreciation for not just some new fact, but a new way of viewing what’s going on around us.

That’s my rationale for publishing sporadically – I want to emphasize quality over quantity.

I’m not sure if I hit my AHA goal with this missive, but I sure gave it a try.

The motivations underlying this particular edition are three-fold. One is esoteric; the other two completely pragmatic.

Starting with the latter, pragmatic reason #1 is that the donation window for Old Bill’s Fun Run closes today – Friday, September 15 – at 5:00 pm MDT. Please click HERE to support this newsletter and the other work Charture does to help make ours a better community.

Pragmatic reason #2: Speaking of work Charture does to make ours a better community, please click HERE to take the public opinion survey we’re running. It’s purpose is to gauge residents’ feelings about our region’s present and future. The survey will remain open for another week – until 11:59 pm on Friday, September 22 – and I hope to get as many responses as possible.

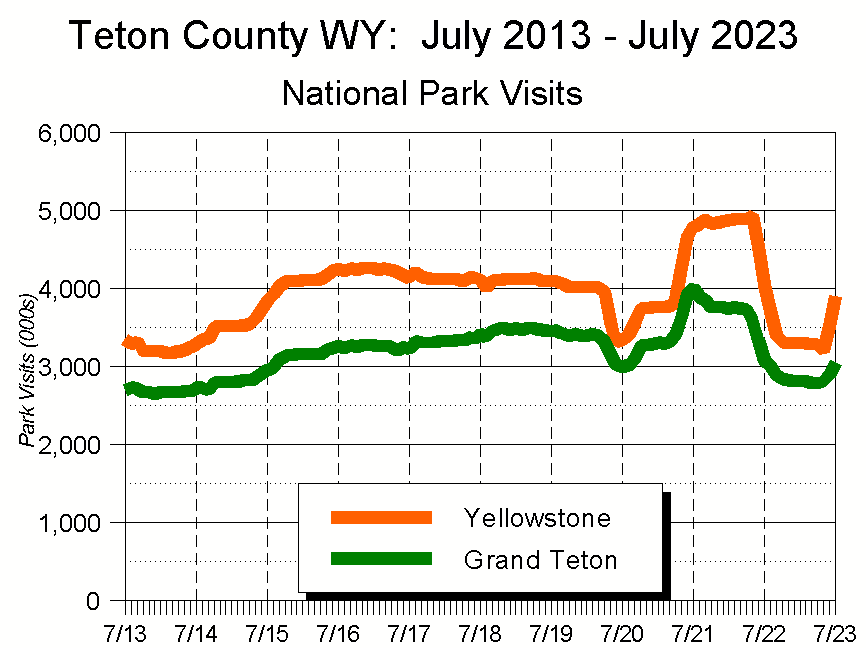

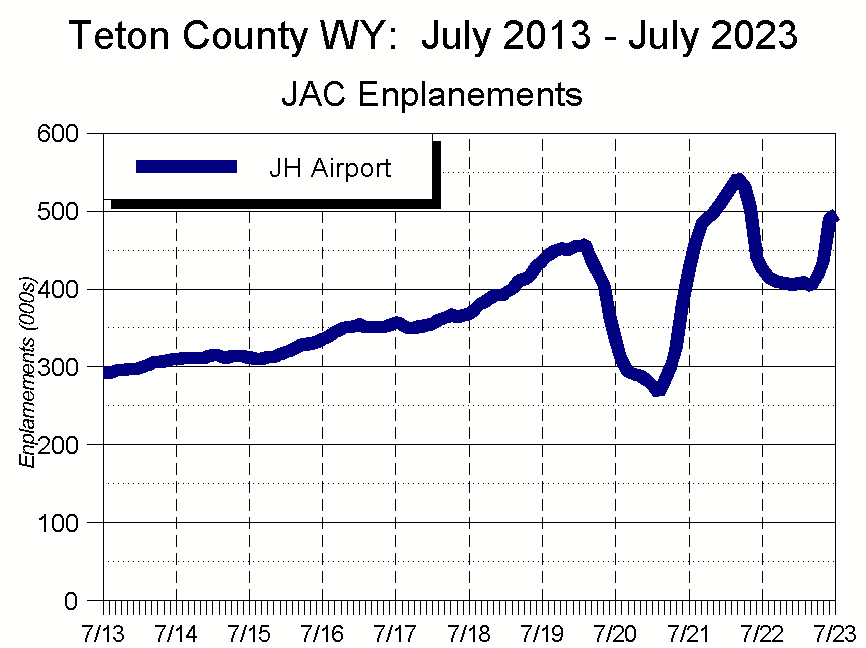

Esoteric reason: For months now, the region’s tourism industry has been super-anxious about having a “soft” summer. In the last few days, visitation and sales tax data have been released suggesting it’s been just the opposite.

I created the public opinion survey because I’ve been wondering a lot about whether there’s a disconnect between residents’ perceptions and the realities of where the community is and where we’re heading. The recently-released data only amplified that curiosity, because the “soft summer” fear v. the “good summer” reality seems to reflect an on-going gap between how we view the world and what is actually going on.

Add the three together, and you get today’s newsletter. My hope is that it provides you with a tangible example of why we’re worthy of your support in both filling out the survey and supporting us through Old Bill’s Fun Run.

As always, deepest thanks for your interest and support.

Cheers!

Jonathan Schechter

Executive Director

PS – Please be sure to take our public opinion survey by clicking HERE or scanning the QR code below. Please also encourage everyone you know to do the same.

PPS – Please donate to Charture through Old Bill’s Fun Run by clicking HERE.

Scan this code to link to our survey. Let us know how you feel about the Greater Tetons Area and its future

The Changing Nature of Our Extraordinary Growth Machine

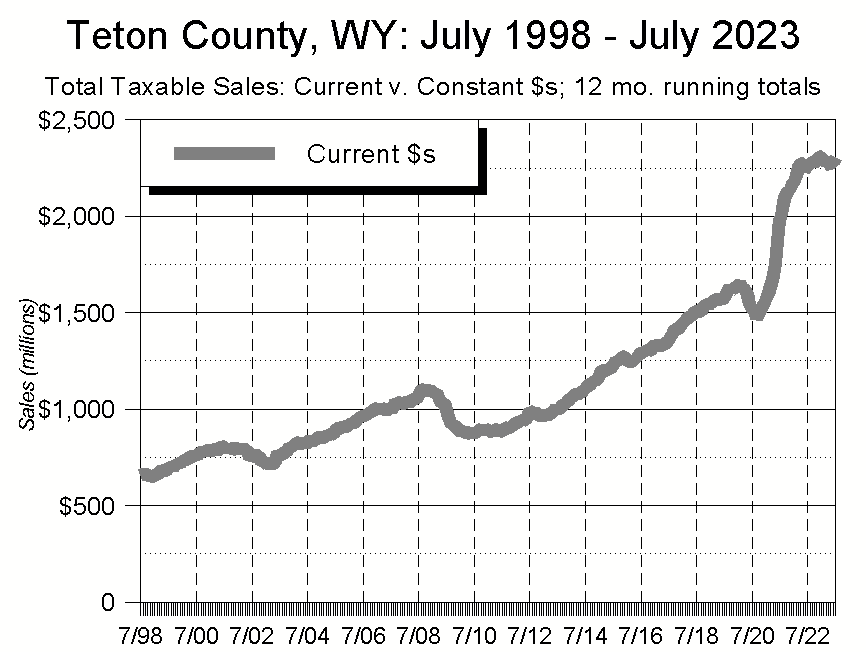

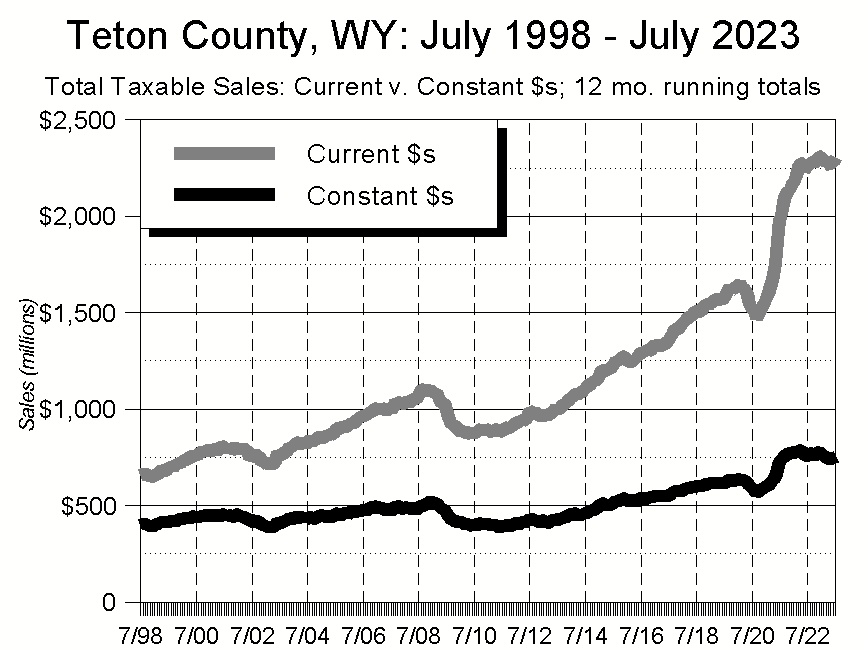

Over the past 25 years, Teton County’s total taxable sales grew 250% – from $659.3 million in the fiscal year ending in July, 1998 to $2.30 billion in the FY ending in July, 2023. Annualized, this is a compounded annual growth rate of 5.1%

During that time, Teton County’s taxable sales have been hallmarked by four periods of steady growth, and three shorter stretches of sharp decline. Over the past year, things have markedly slowed down: between July 2021-July 2022, total taxable sales grew 13.6%; since then, they’ve grown just 2%. In fact, taxable sales have actually declined since their peak in the FY ending December 2022.

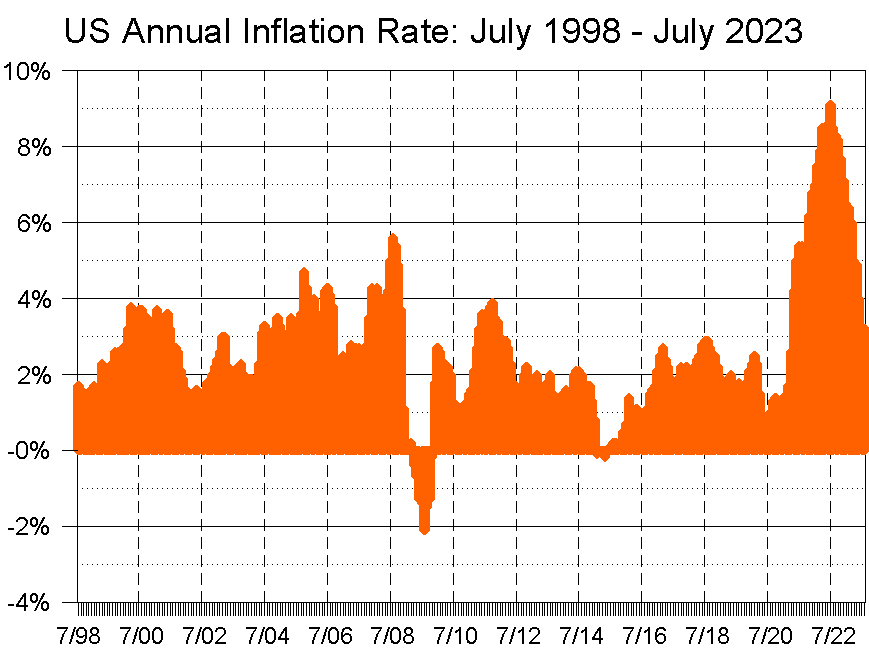

Inflation

Because of inflation, though, these numbers tell an incomplete story. Over the last 25 years, as measured by the Consumer Price Index, the US rate of inflation has ranged from 9% to -2%. Correcting for inflation, Teton County’s total taxable sales have grown from a constant dollar figure of $404.0 million in the FY ending in July 1998 to $753.8 million in the FY ending in July 2023, an increase of 87%. Annualized, inflation takes this down to a 2.5% annual growth rate.

It’s as if COVID never happened

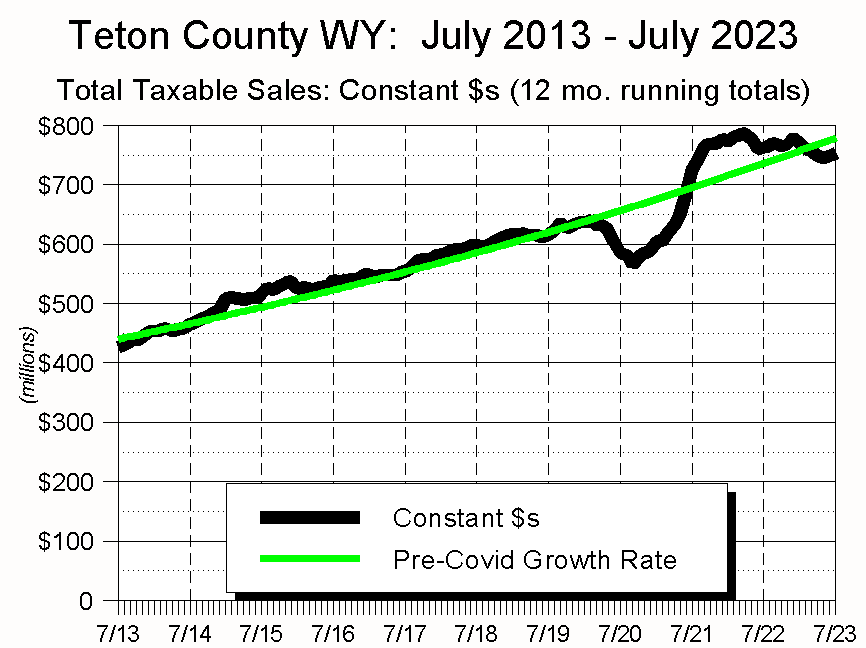

Teton County began its climb back from its Great Recession slump in the summer of 2013. Before COVID struck, Teton County’s total taxable sales peaked in February 2020. Between July 2013 and February 2020, in constant dollars taxable sales grew at a very healthy 6.4% annually – 2.5 times greater than our 25 year average.

What I find interesting is that if you extend the pre-COVID growth rate, today we’re basically at the same place we would have been had COVID not struck. A little lower, actually, but not far off the pre-COVID rate of growth. Which, in turn, was essentially the same inflation-adjusted rate of growth as during the previous growth cycles.

Two conclusions

Add it together, and two conclusions emerge.

First, when it’s growing, Teton County’s inflation-adjusted taxable sales growth rate averages between 5% and 6%. That’s a remarkably high and remarkably consistent pace of growth over the past two-and-one-half decades.

Second, from a taxable sales perspective, it’s almost as though the pandemic never struck.

Almost.

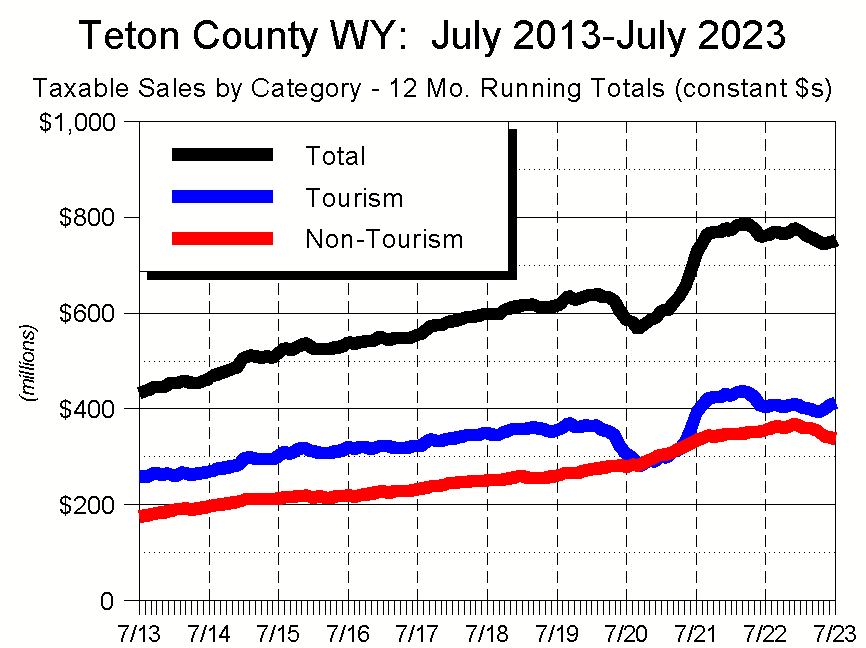

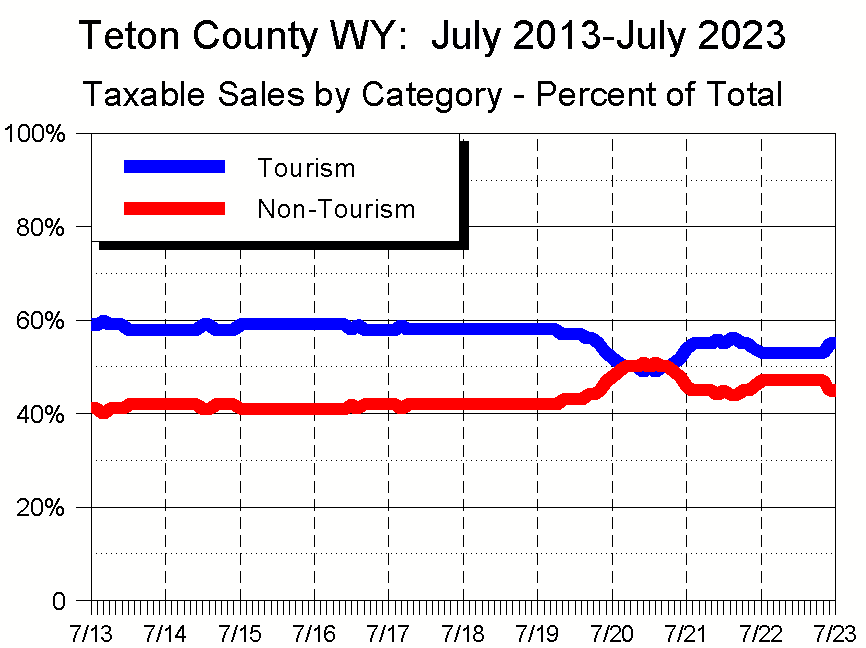

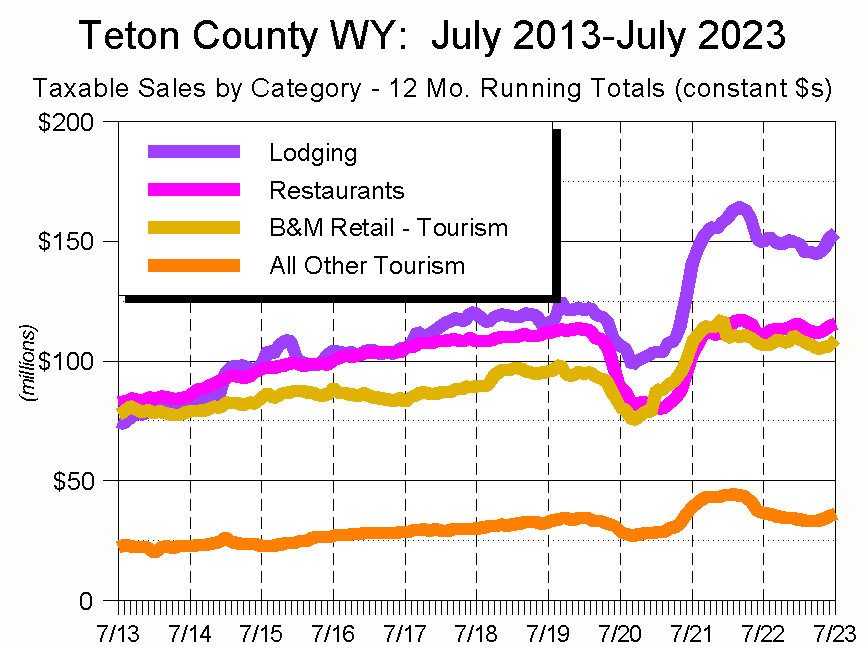

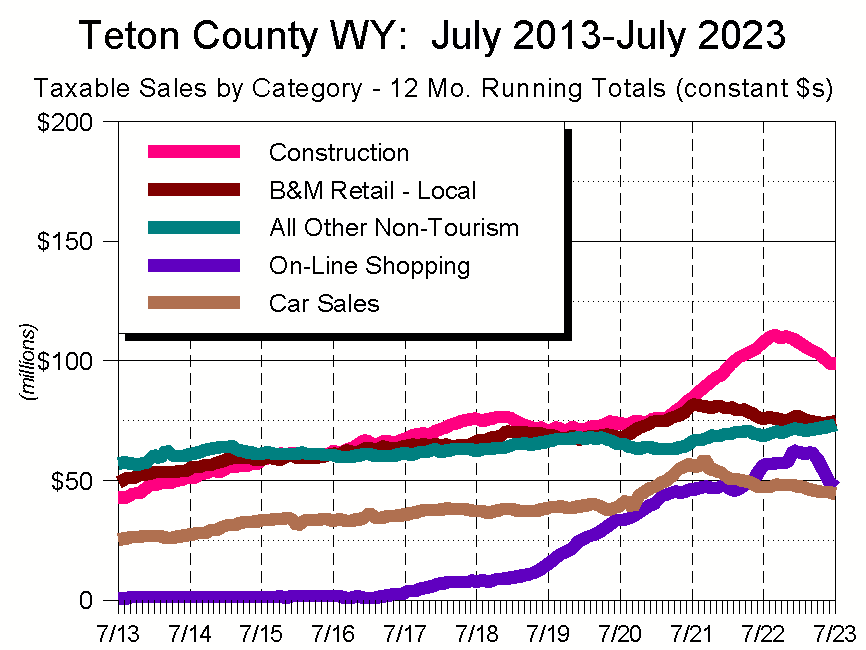

One thing that has changed since the pandemic is the mix of sales. Before COVID, businesses oriented towards tourists – lodging, restaurants, bricks-and-mortar retail (“B&M Retail” on the graphs below), and other tourism-oriented businesses – regularly accounted for around 58% of all taxable sales. During the pandemic, that figure dropped as low as 49%. Today, it is around 54%.

COVID’s toll + the Phoenix arises

As the graphs below suggest, our tourism industry got whacked during the first six-to-eight months of COVID, then rebounded sharply as both tourists came (especially during the summer) and prices shot up (especially during the winter).

Local spending saves the day

What saved our taxable sales bacon during the tourism slump was spending by locals, especially on constructing, remodeling, and equipping homes. That was greatly augmented by the rise of on-line shopping: In the summer of 2017, on-line sales accounted for 1% of Teton County’s total retail sales; today they account for around 20%.

Over the last year or so, there has been a noticeable drop in construction, car sales, and retail – both on-line and in locals-oriented bricks and mortar. While tourism numbers have shot up this summer – and with them tourism-related taxable sales – this growth has not been sufficient to boost overall sales. As a result, the local taxable sales economy is in a period of stagnation (in current dollars), if not decline (in constant dollars).

Particularly striking is the decline in construction-related sales, which in constant dollars are 6.4% lower today than they were a year ago. Unfortunately, the data aren’t available to figure out whether this is due to lower prices, a slowing pace of local construction, or some combination.

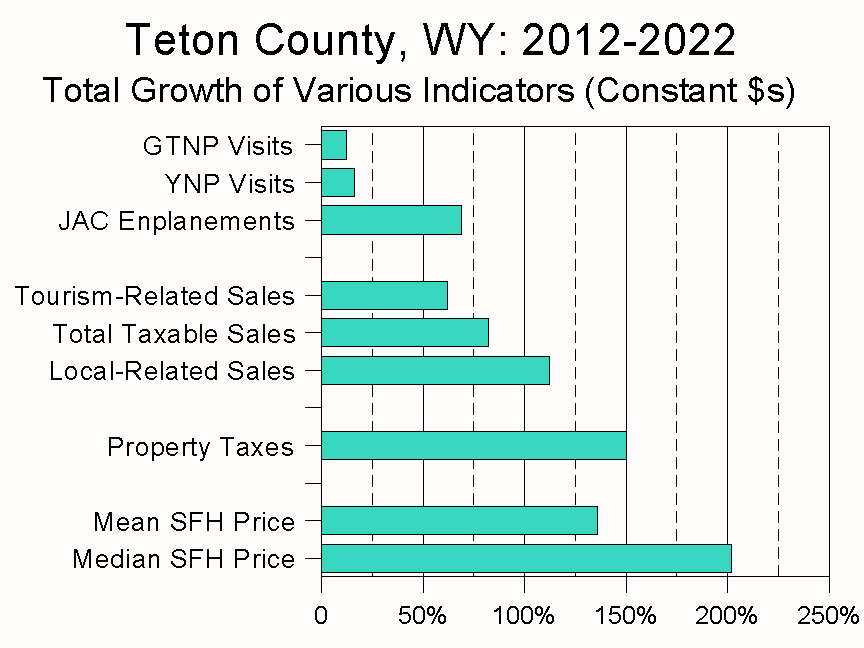

Nothing compares to property values

All of this pales in comparison, though, to the real elephant in the living room: property values. As robust as our various types of growth have been over the past decade, nothing compares to the growth in property values and, with them, property taxes. This is not only causing tremendous anxiety, disruption, and upheaval today, but for a variety of reasons will continue to do so in the future. Prominent among those reasons is that local government funding is tremendously reliant on sales taxes.

21st century community with a 20th century operating system

Why is this a problem? Because folks paying increasingly high prices for real estate are going to expect increasingly higher levels of service from their local government. To provide those services takes staff. To hire that staff takes revenue. And when the primary source of that revenue is growing slower than housing prices, it becomes increasingly difficult to hire the people needed to provide those services.

That fundamental structural imbalance – the dilemma I’ve labeled “a 21st century community with a 20th century operating system” is a topic for another day. For now, the first step in addressing the dilemma is to align our perceptions with reality – thanks for joining me on the journey.