Hello, and happy mid-summer!

Over the past couple of months, I’ve enjoyed a lot of off-the-grid outdoors time. Re-entry’s been a slog, though, especially digging out from the seemingly bottomless pile of daily life stuff.

One of the many emails that fell between the cracks was from a long-time friend who raised an interesting question: Is there any way to track the effects of all the new money flooding into Jackson Hole over the past few years? Today’s newsletter is both an effort to answer that question and, more personally, to atone for not responding more promptly to my friend.

The essay below focuses on Jackson Hole’s charitable giving patterns. I chose the topic for four reasons:

- It’s the only readily-available metric I know for gauging wealthy residents’ actions and priorities.

- There is a deep and on-going debate whether the wealthy folks coming into Jackson Hole “get” the community. Are they as philanthropically minded as earlier generations of well-to-do Teton County residents? If so, are their donations a way of supporting Jackson Hole’s ethos and character? Or is their giving more akin to a modern-day papal indulgence?

- There is a large and growing chasm between Jackson Hole’s economy and how we fund government. As a result, there is a large and growing chasm between what local government can afford to do and what the community wants it to do. Unless and until Wyoming alters how local government is funded, the level of services enjoyed by the community will increasingly be a function of philanthropic giving.

- Locally, ‘tis the charitable giving season: Teton Valley’s annual Tin Cup race was two weeks ago, and Jackson Hole’s annual Old Bill’s Fun Run is coming up in six weeks (click HERE for more information; click HERE to go to the Donations page – donations can be made from August 11 – September 15).

The essay below is structured around my three major findings:

- Teton County’s income and giving patterns are completely dominated by the well-to-do, particularly their non-wage income.

- Over the past few years, as Teton County’s wealth has increased, so have its charitable giving metrics. Less clear is whether the growing metrics reflect an actual increase in giving or are simply statistical anomalies.

- While Teton County leads the nation in some key charitable giving metrics, others suggest residents have the capacity to donate several hundred million additional dollars each year.

- Teton County’s income and giving patterns are completely dominated by the well-to-do

- Coincident with Teton County’s influx of wealth has been an increase in charitable giving

- Teton County appears to have the capacity for far greater charitable giving than current levels

One final thought

One final note. Although my research focuses on Teton County, WY, my strong hunch is that the same basic trends are playing out in every other desirable place to live. For readers living outside Jackson Hole, are you seeing similar patterns in your communities?

As always, deepest thanks for your interest and support.

Cheers!

Jonathan Schechter

Executive Director

Teton County’s income and giving patterns are completely dominated by the well-to-do

Since 2010, for every county in America, the IRS has reported a wide variety of income tax data (the most recent year is 2020). Not just the number of returns filed and total income, but other tidbits such as how that income is earned, charitable deductions, and total tax liability.

The IRS also breaks tax returns into income categories, the highest of which is households reporting an Adjusted Gross Income (AGI) of $200,000 or more. To make the nomenclature easier, I’ll refer to these as “high-income households,” and those earning under $200,000/year as “lower-income households.”

Before getting into the analysis, two caveats:

- While the IRS data show total itemized deductions claimed for charitable giving, they do not show where that money went; i.e., how much was donated to Teton County non-profits, and how much was donated outside Teton County. (The data also exclude donations not claimed as a deduction, which history suggests is a small percentage of the overall total).

- Federal tax reform legislation passed in 2017 significantly lowered the tax benefits of charitable donations for everyone except the ultra-wealthy. The consequences became evident in 2018’s tax return data, and have remained that way since.

2010

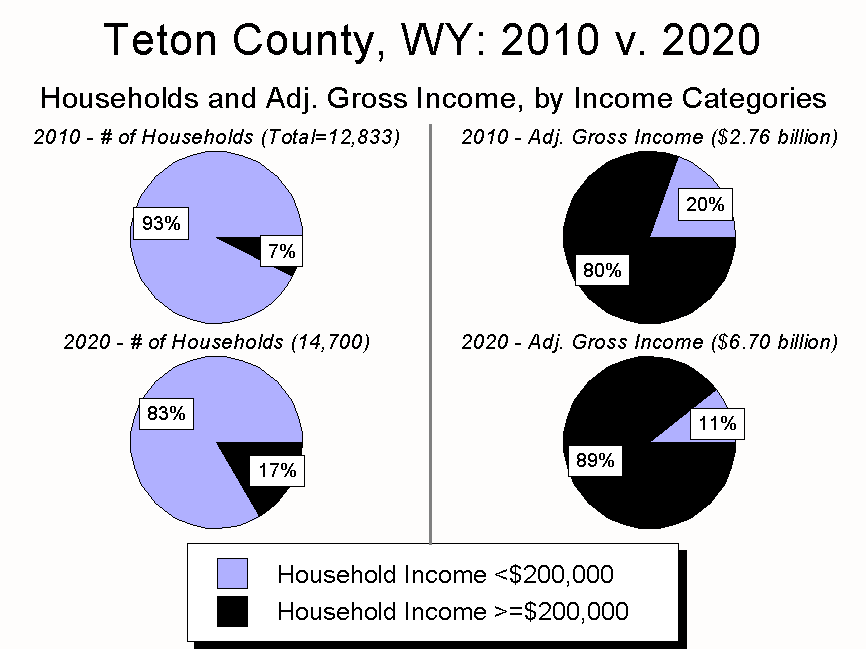

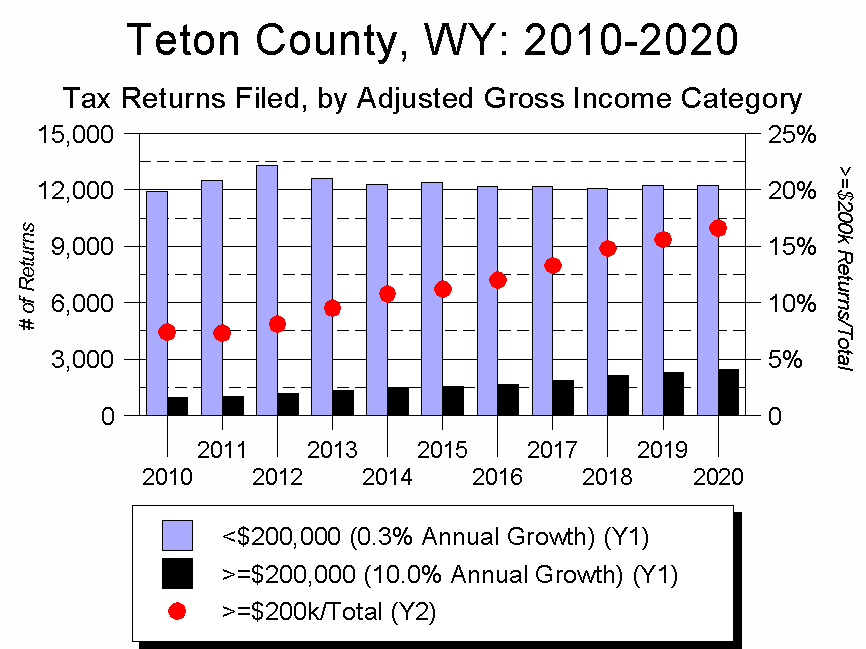

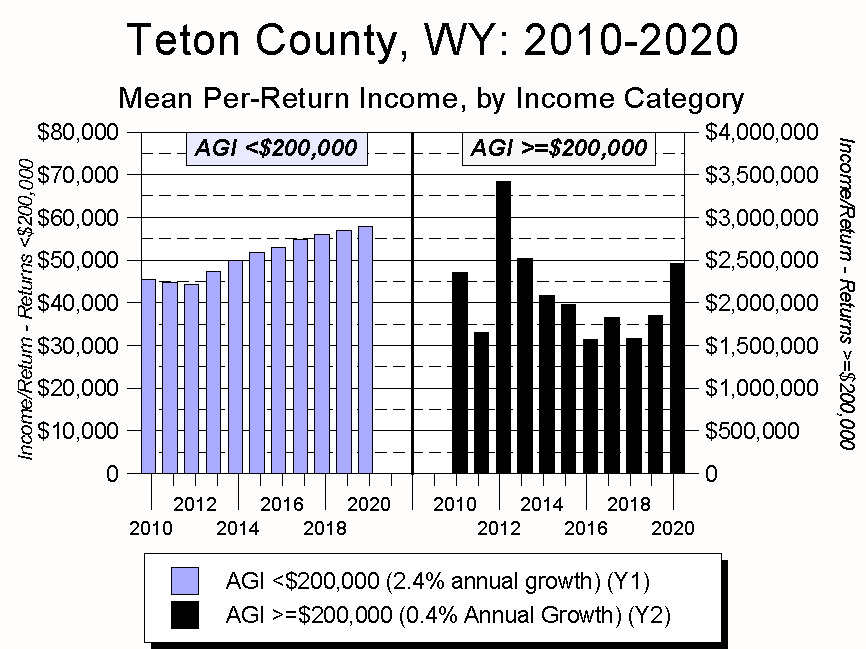

In 2010, 12,833 Teton County, Wyoming households filed an income tax return. Their total AGI was $2.76 billion, yielding a mean per-household income of $215,305. This was the nation’s second-highest per-household income, trailing only Billings County, North Dakota (which enjoyed a one year income spike thanks to being located at the heart of the Bakken fracking boom).

That same year, 944 of Teton County’s households – 7% of the county’s total – were high-income households. Collectively, those households earned $2.22 billion, which accounted for 80% of residents’ total AGI. Their mean household AGI was $2.35 million.

Also in 2010, Teton County had 11,889 lower-income households, 93% of the total. Collectively, they earned $541 million, or 20% of the county’s total. Their mean household AGI was $45,521.

2020

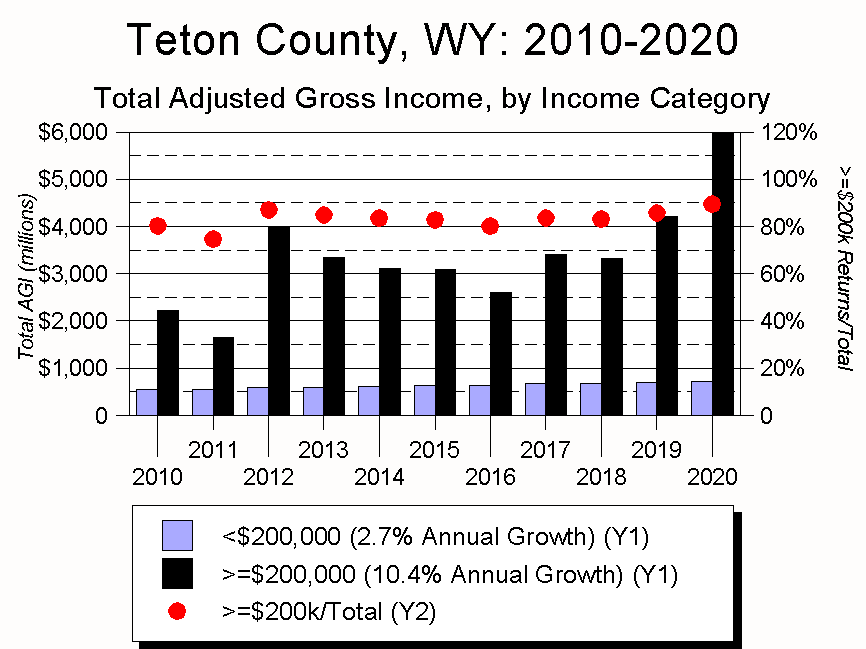

In 2020, 14,700 Teton County households filed an income tax return, a 15% increase from 2010. The county’s total AGI was $6.70 billion, 142% more than ten years earlier. Teton County’s mean per-return income was a nation-leading $455,855, 112% higher than in 2010.

That same year, 2,440 Teton County’s households – 17% of the county’s total, or one out of every six households – were high-income. Those households earned a combined $5.99 billion, 89% of residents’ total AGI. Their mean AGI was $2.46 million, 4% higher than in 2010.

Also in 2020, Teton County had 12,260 lower-income households: 83% of the total, or five out of every six households. Collectively, these households earned $708 million. Although this was 31% more than in 2010, the lower-income households’ share of the county’s total income fell from 20% to 11%. In 2020, the mean AGI of lower-income households was $57,746, 27% more than in 2010.

2010-2020

Between 2010 and 2020, essentially all the growth in Teton County’s households and income occurred among the well-to-do – high-income households accounted for 80% of the county’s household growth and 96% of its income growth.

In both 2010 and 2020, the mean income of Teton County’s high-income households was about 50 times greater than the mean income of its lower-income households. In both years, that disparity led the nation.

To put Teton County’s wealth disparity into context, in 2020 Teton County had 2,440 high-income households. Collectively, they earned $5.99 billion.

In contrast, between 2012 and 2020 a total of 111,570 Teton County households earned under $200,000. Collectively, those lower-income households reported a total AGI of $5.83 billion.

Compare the two, and in 2020 – in just one year – Teton County’s 2,440 high-income households made more money than over 111,000 Teton County lower-income households combined made during the nine years spanning 2012-2020. To grossly understate the case, that is an impressive amount of wealth concentration.

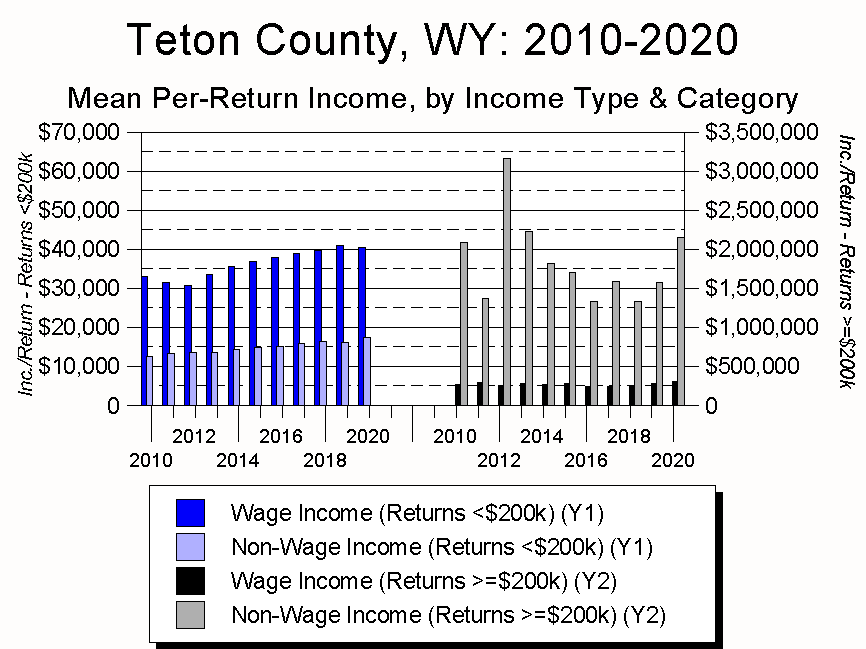

Why the great disparity? In part it’s because Teton County’s high-income households not only earned much more income than the rest of the community, but a different kind of income.

In particular, as the graph below shows, the bulk of all the income earned by Teton County lower-income households comes from wages and salaries. Further, for those households “non-wage income” is primarily pensions.

It’s just the opposite for high-income households, who make the vast majority of their income from non-wage investments.

Coincident with Teton County’s influx of wealth has been an increase in charitable giving

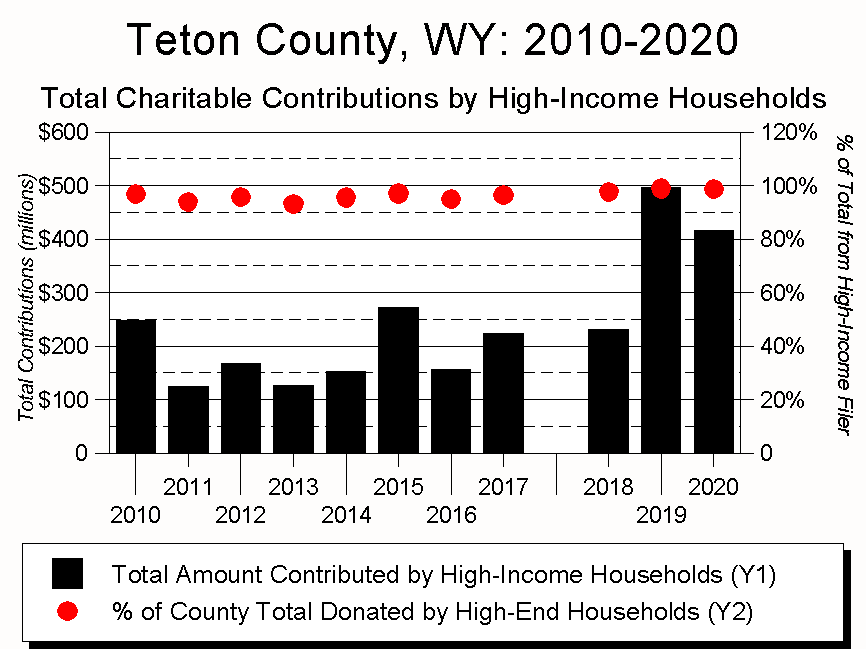

Because tax law incentivizes the well-to-do to make charitable contributions, tax return data on charitable donations is dominated by high-income households. For example, for the US as a whole in 2020, high-income households were responsible for $136 billion of the $193 billion Americans claimed in charitable donations: 71%. In Teton County, the figures were $416 million of the $422 million total: 99%.

Ten years earlier, the situation was much different. In 2010, high-income homes accounted for just 40% Americans’ total itemized charitable deductions: $68 billion out of $169 billion. In Teton County the figure was 97%: $248 million out of $257 million.

The cause of the change was 2017’s “Tax Cuts and Jobs Act” which, in the words of the Tax Policy Center, discouraged charitable giving by reducing “the value and incentive effect of all tax deductions… raising the after-tax cost of donating by about 7 percent. Unless taxpayers increase their net sacrifice – that is, charitable gifts less tax subsidies – charities and those who benefit from their charitable works, not the taxpayers, will bear the brunt of these changes.”

The law certainly had an effect on Teton County.

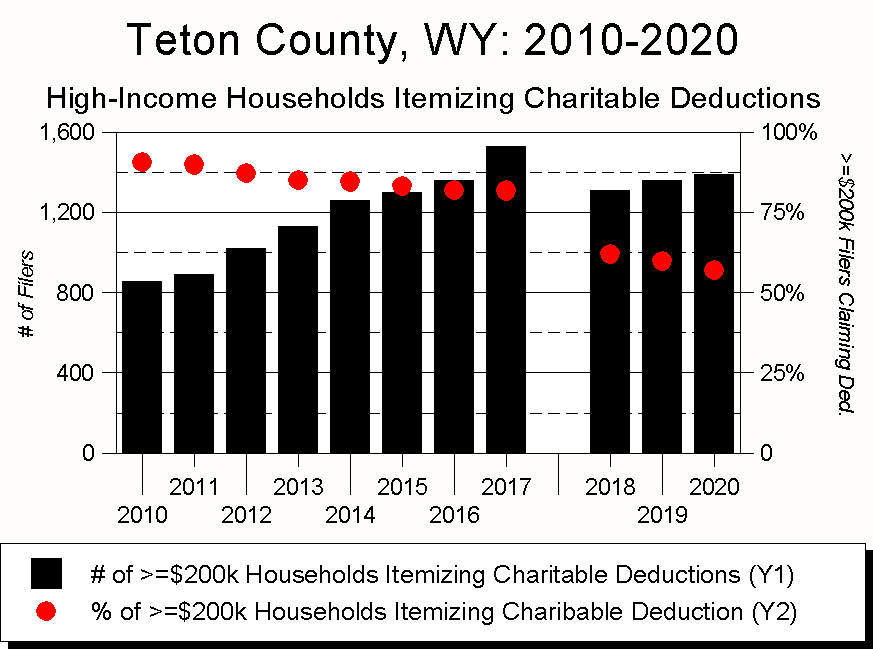

As the graph below shows, from 2010-2017, each year an average of 86% of Teton County’s high-income households claimed deductions for charitable giving. From 2018-2020, the average dropped to 60%.

Interestingly, the law did not seem to affect total itemized donations, which were flat between 2017 and 2018, then spiked in 2019.

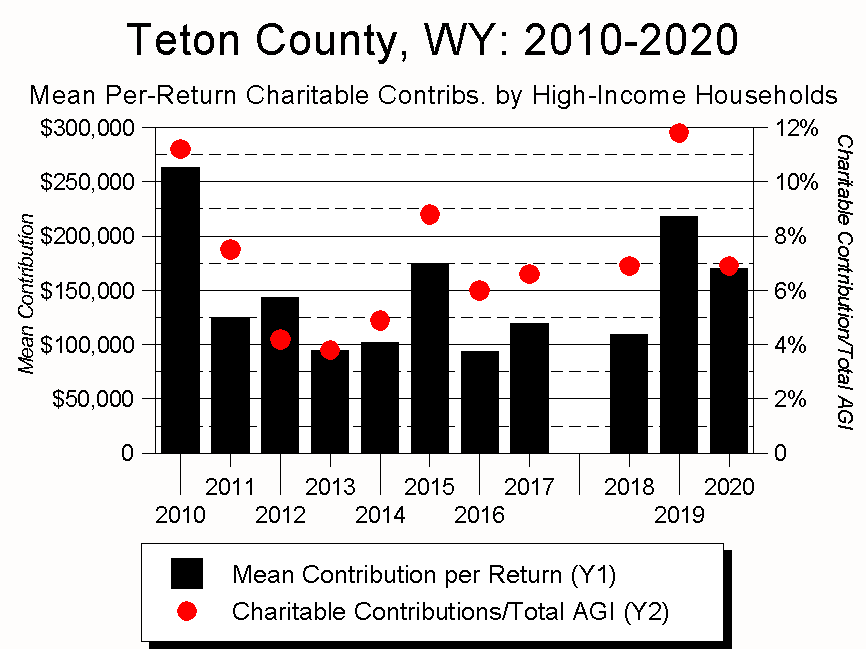

Put the two together, and for the past 11 years, annual mean donation figures have bounced all over the place. This is because any one year’s charitable deduction claims can be wildly influenced by the actions of just a few tremendously wealthy households.

Sadly, this variability makes it hard to draw any firm conclusions about how either the 2017 tax law or the 2020 COVID in-migration affected Teton County’s giving patterns. To try to work around this problem, I combined the data into two larger time periods: the three years before the act took effect (2015-2017) and the three years following (2018-2020).

2015-2017

Between 2015-2017, Teton County’s high-income households had the nation’s second-highest mean per-return household AGI: $1,788,883. (We would have been first had a few residents of the lightly-populated Dixie County, FL not enjoyed a one-time, one-year income surge.)

During that same period, our $128,040 mean per-return donation figure was also second in the nation, trailing only Benton County, Arkansas’s $135,989. (Benton County is the location of Walmart’s headquarters.)

Where we lagged was in donations as a percent of total AGI. During those three years, our high-income mean donation rate 7.2% of AGI ranked us 54th in the nation. In contrast, Benton County’s well-to-do citizens gave 13.2% of their income to charitable causes, ranking them 3rd nationally.

2018-2020

Things were different for the period 2018-2020.

During those three years, Teton County led the nation in high-end income, with a mean AGI of $1,983,033. This was 11% more than in 2015-2017

What’s striking is that during the three years following the “Tax Cut and Jobs Act,” Teton County’s high-income households actually claimed a higher level of charitable deductions than they had in the three previous years.

In particular, during 2018-2020, Teton County’s mean charitable deduction rose to a nation-leading $167,659, 31% more than in 2015-2017. Further, those donations represented 8.5% of Teton County’s total high-end income, 10th highest nationally and an 18% increase over the earlier period’s 7.2%.

As a result, while we can’t say anything specifically about COVID’s effects on charitable giving, at first blush it seems that over the past few years, local charitable giving has surged. While I hope that’s the case, the underlying explanation may be far more prosaic – a function of basic math rather than a more charitable mindset.

A huge mathematical caveat

Between 2015-2017, an average of 86% of America’s high-end households claimed a deduction for charitable donations. Between 2018-2020, that figure fell to 46%.

For Teton County, the figures were 82% and 60% respectively.

The basic reason for these declines was that, for all but the very wealthiest Americans, the “Tax Cut and Jobs Act” reduced the incentive to take charitable deductions. As a result, the people who continued to claim charitable deductions tended to be those making the most money. Which was, of course, a large and growing element of Teton County’s population.

This change in incentives discouraged a lot of lower-income folks from making – or at least itemizing – charitable donations: In 2017, 18% of Teton County’s lower-income households itemized their charitable donations; in 2020 that figure was 6%. Even among the well-to-do, the changes hit hard: in 2017, 82% of Teton County’s high-income households itemized their charitable donations; in 2020 that figure was 57%.

As a result, starting in 2018 the pool of people claiming charitable donation tax deductions became much more concentrated at the higher end than it had been before. Do the math, and the inevitable result is a higher overall average.

Here’s an example. Imagine that, in 2017, five households each itemized their charitable donations. The biggest donation was $34; the rest were $26, $18, $12, and $10. The total amount donated was $100, an average of $20/donation.

Now skip ahead a year. Keeping everything else the same except the tax law changes, there was no longer any incentive for 2017’s smaller donors to itemize their donations (and perhaps not donate at all). Eliminate those bottom two donations, and the total amount given falls to $78. The mean donation, however, rises to $26.

It seems likely something similar happened in response to the “Tax Cut and Jobs Act”: those well-to-do Teton County residents who continue to claim charitable donation deductions were those who made more money and larger donations. It also helps explain why the number of high-income households rose more sharply from 2018-2020 – 16% – than did the number of high-income households claiming charitable deductions: 6%

What this argument doesn’t explain why overall donations rose, but there again annual donation figures are subject to pretty big swings.

Teton County appears to have the capacity for far greater charitable giving than current levels

As noted above, in the years 2018-2020, Teton County’s high-income households led the nation in mean annual giving, with a per-return figure of $167,659. In a distant second place was Benton County, Arkansas, at $127,584.

Where Benton County’s high-income households had a leg up on Teton County was in the proportion of total income they donated to charities: a nation-leading 13.5%, versus Teton County’s 10th place 8.5%.

Benton County’s high-income households also led the nation in their proportion of non-wage income donated to charities: 19.4%, essentially double Teton County’s 60th-place 9.8%.

Viewed through this lens, it suggests that while Teton County has a strong culture of charitable giving, it also has the capacity to give more. A lot more.

Specifically, if in the three years between 2018-2020, Teton County’s high-income households had donated the same percentage of their total AGI as did Benton County’s, Teton County residents would have donated an average of an additional $226 million each year to charitable causes – 59% more than they actually gave.

Similarly, had Teton County high-income residents matched Benton County’s percentage of non-wage AGI, they would have donated an average of an additional $369 million per year, an increase of 97%.

Before going any further, two observations.

First, it’s easy for me to say “they could have donated a lot more” because it’s not my money.

Second, as noted earlier, even if Teton County’s well-to-do donated more, there’s no guarantee the money would be donated to Teton County non-profits.

Still, while it’s clear that Teton County has historically cultivated a culture of giving, due to the annual vagaries of giving patterns and the timing of the “Tax Cuts and Jobs Act,” it’s not clear whether that giving culture has been embraced by the influx of residents who’ve arrived in the past few years. We can hope it has, but unfortunately the data won’t settle the debate.

Donations as a percentage of income

So what might give clarity? What might be a clear indicator that new arrivals have embraced Teton County’s culture of giving?

Again, it ain’t my money, but I can think of no better measurement of our charitable giving culture than “Donations as a Percentage of Income.” In particular, the goal would be for Teton County to lead the nation in the proportion of income its high-income households donate to charitable causes.

Is this possible? Arguing for it is the fact that between 2010-2020, Teton County’s high-income households led the nation in mean per-return giving five times, ranked 2nd three times, and ranked either 3rd or 4th the other three years.

When it comes to “Donations as a Percentage of Income,” though, we’ve not done nearly as well. Specifically, between 2010-2020, the best we ever did is rank 3rd one year. In three other years we placed in the Top 25; in the remaining seven we didn’t even crack the Top 50.

Which is baffling, especially when you consider that Wyoming is America’s most wealth-friendly state. Given that, how is it that counties in less wealth-friendly states can donate so much more than we do? Especially when Teton County is the wealthiest county in the wealthiest country in the history of the world?

So which counties rank highest in average giving percentage? As a rule of thumb, they fall into one of two camps. One is lightly-populated counties in southern states, where large numbers of residents belong to evangelical churches. The other is counties in Utah and Idaho with high concentrations of members of the LDS church.

Teton County falls into neither category. Nor does Benton County, which makes it such a good place to compare ourselves to.

One final thought

Looking at the list of counties which rank highest in “Donations as a Percentage of Income,” it’s striking how living in an intensely religious environment can correlate with great generosity.

Without meaning to blaspheme the sacred, I’m also struck by how many people wax spiritual when they speak of the Tetons region. In that light, I can’t help but wonder whether the non-religious spirituality Jackson Hole evokes might lead Jackson Hole’s well-to-do residents to donate even more of their wealth to causes of their choosing – even in this community of abundance, the need is certainly there.

Many of our well-to-do residents have already made a mark on the world. How wonderful would it be if this extraordinary place can inspire people – especially those new to the region – to use their wealth to have an even greater effect on their community, region, nation, and world.