Hello, and happy September!

Wyoming’s governor was recently in town. After his speech, an acquaintance greeted me by saying: “What are YOU doing about hotels? What are YOU doing about traffic?”

I thought: “Why hello! So nice to see you too!”

The encounter stuck with me because, while at one level the comments were about Jackson Hole’s growth-related problems, they also reflected two additional qualities shared by so many people: a deep passion for our community; and the deep-seated angst hallmarking our times.

Regardless of where I go or with whom I speak, people are anxious about both our world and the seemingly intractable nature of the issues we face. Whether local or global, whether dog parks or COVID or climate change, we live in an era chockablock with great passion and great fears.

Reflecting on this, I began to wonder about the root causes of our manifold concerns. One hypothesis I thought worth exploring was how quickly Jackson Hole is changing, and whether that might be contributing to locals’ angst.

In particular, my focus was on how our community’s economy is evolving from location-dependent – i.e., dominated by tourism and informed by its values – to location-neutral; i.e., an economy hallmarked by income derived from investments, finance, and professional services. The result is the essay below.

Teaser

To lure you in, here’s the most interesting fact I uncovered in my research.

Out of America’s 3,143 counties, in 2019 Teton County ranked 4th in per capita jobs in the Finance & Insurance sector (the two are lumped together by the US Bureau of Economic Analysis, and 2019 is the most recent year for which data are available).

In first place was New York County, New York; i.e., the island of Manhattan. In 2019, the world’s financial capital had 0.28 Finance & Insurance jobs per resident, most of them in finance.

In second and third places were two midwest counties housing major insurance companies. Their 0.17 and 0.14 per capita Finance & Insurance jobs were mostly in insurance.

And then was Jackson Hole, with 0.13. What’s crazy about this is that there’s no obvious explanation for our extreme concentration of finance jobs. Yes we have a handful of insurance brokers. And yes we have several commercial banks and trust companies. But so, too, do hundreds of other places.

Yet somehow, per capita, we had more Finance & Insurance jobs than 3,139 other counties, including major financial centers such as Boston, Charlotte, San Francisco, and Minneapolis (5th, 12th, 13th, and 14th respectively).

And as an added bonus, between 2001-2019 Teton County ranked 13th nationally in our growth in Finance & Insurance jobs.

Why do we rank so high? My theory is that Teton County’s extraordinary wealth has become both a magnet and incubator for jobs in finance. And as finance grows in importance, that industry’s location-neutral ethos is increasingly clashing with our community’s historic location-centric character. Hence one major contributor to local angst.

One Final Note

At 5:00 pm MDT this Friday, September 17, the donation period closes for this year’s Old Bill’s Fun Run. Rather than send out a generic appeal, my hope is that this newsletter will convey the message “If you appreciate this kind of analysis, please donate to my Charture Institute through Old Bill’s.” PLEASE CLICK HERE TO DONATE.

The beauty of Old Bill’s is that donations are matched, historically at a rate of around 50%.

Remember, the deadline for donating match-eligible funds is Friday, September 17 at 5:00 pm MDT. PLEASE CLICK HERE TO DONATE

As always, thank you for your interest and support.

Cheers!

Jonathan Schechter

Executive Director

Elephants: In the Room and In the Grass

Let’s talk about elephants. The metaphorical ones. Not the pink ones associated with the DTs, but the ones that occupy living rooms. The ones which, according to the Swahili proverb, trample the grass around them when they fight.

Before we do, though, consider some background data.

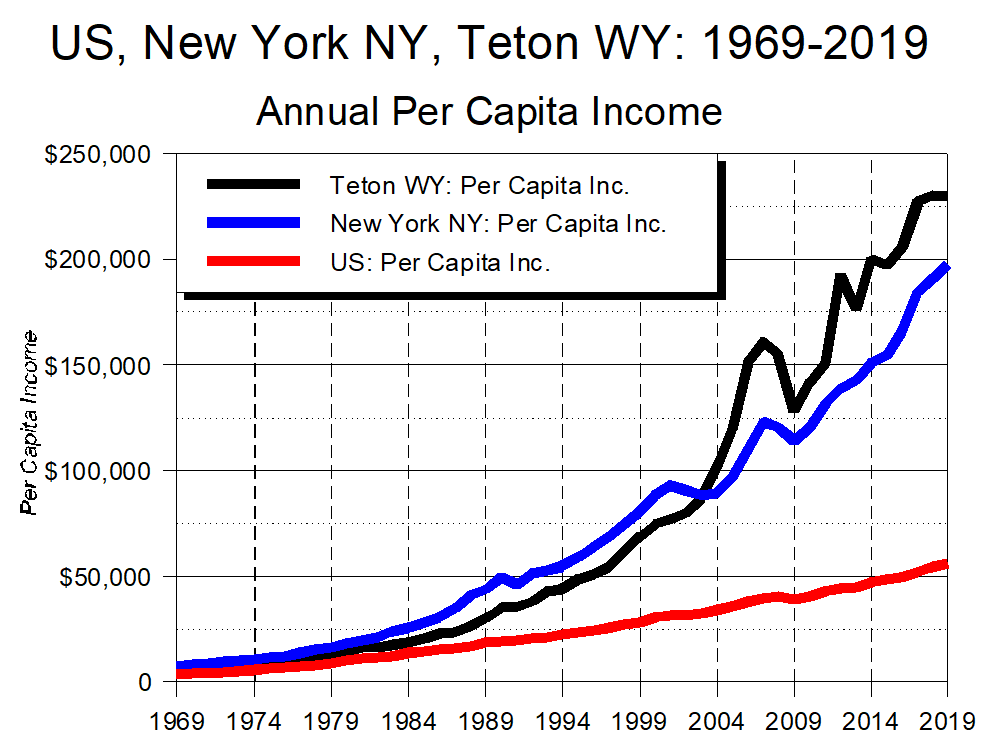

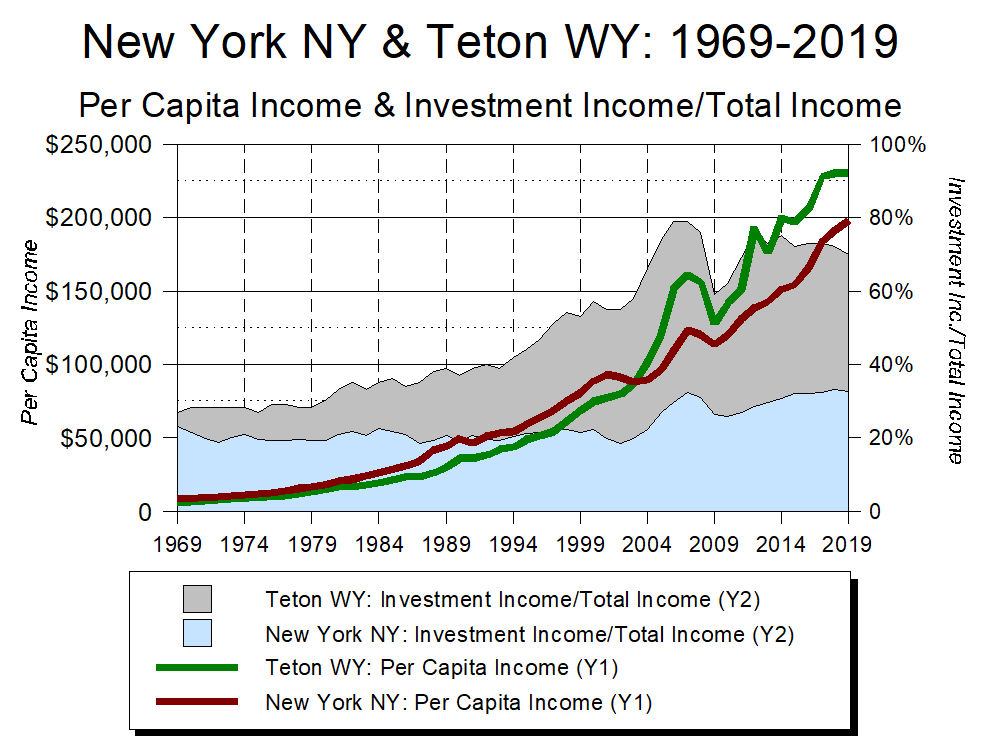

Among America’s 3,143 counties, Teton County has the highest per capita income. It’s not even close: in 2019, our per capita income was $229,825, or 16% higher than second-place New York, NY’s. It was also over four times greater than America’s overall per capita income of $56,490. (Graph 1)

Graph 1

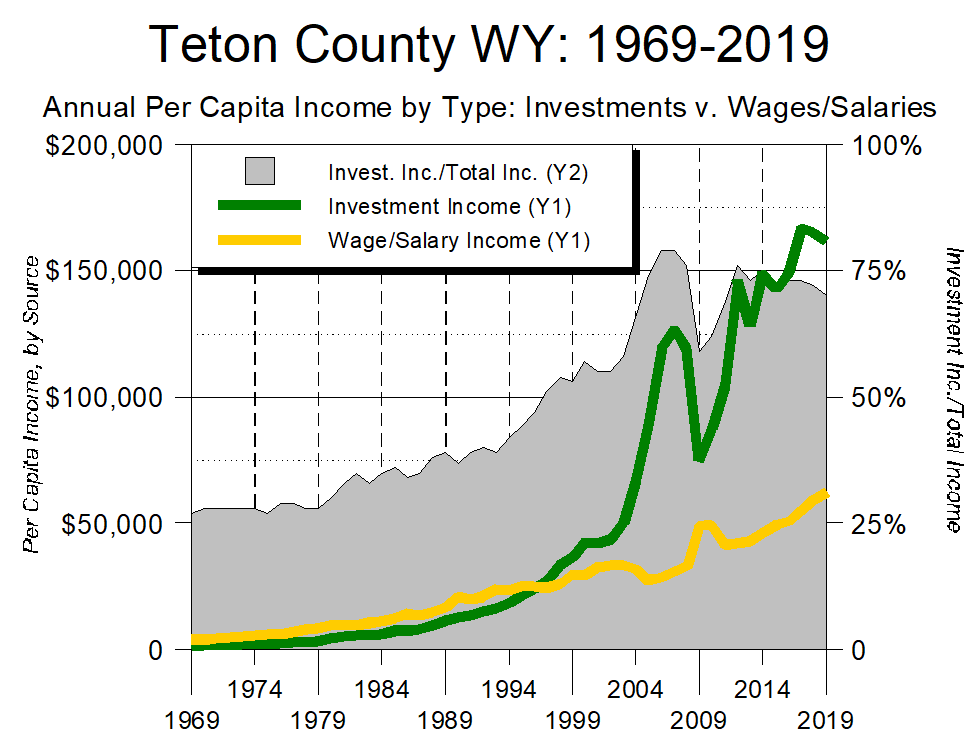

Teton County ranked first because we also led the nation in per capita investment income: $161,411 in 2019. In fact, our per capita investment income figure was so big that it alone would have ranked us second in the nation in per capita total income. (Graph 2)

Graph 2

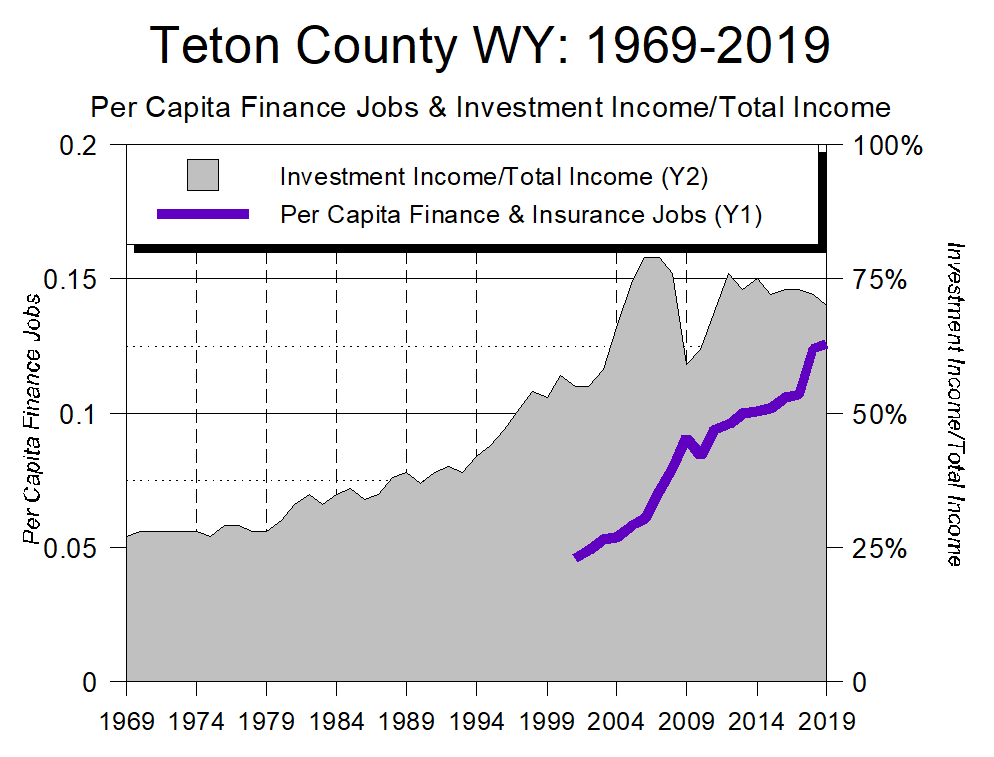

Teton County has led the nation in per capita investment income every year since 1998. We have also led the nation in per capita total income every year since 2004, when a huge jump in the community’s investment income overcame New York City’s big advantage in wage income. (Graph 3)

Graph 3

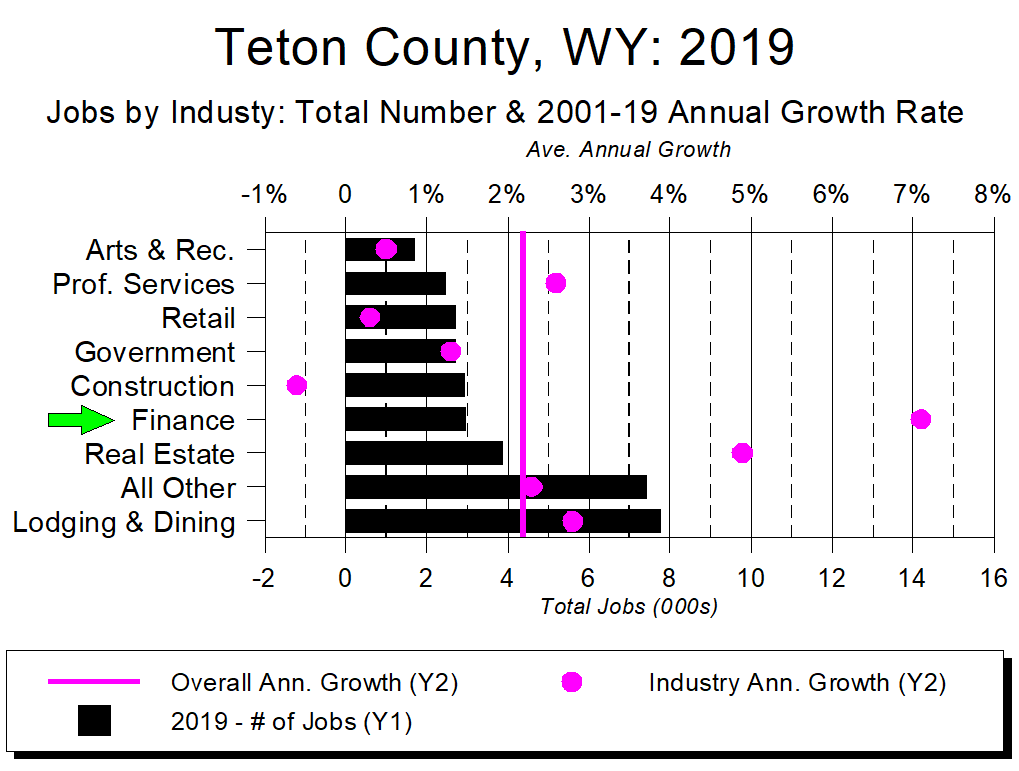

Inevitably, all this investment income attracted finance-related businesses. As a result, between 2001 and 2019 Teton County’s fastest-growing employment sector was Finance. (Finance-specific employment data were not available until 2001 – Graph 4)

Graph 4

As a further result, in Teton County today more people are employed in Finance than in Construction, Government, Retail, Professional Services, and all other sectors except Real Estate and Lodging & Dining. (Graph 5)

Graph 5

Graph 6 helps explain why.

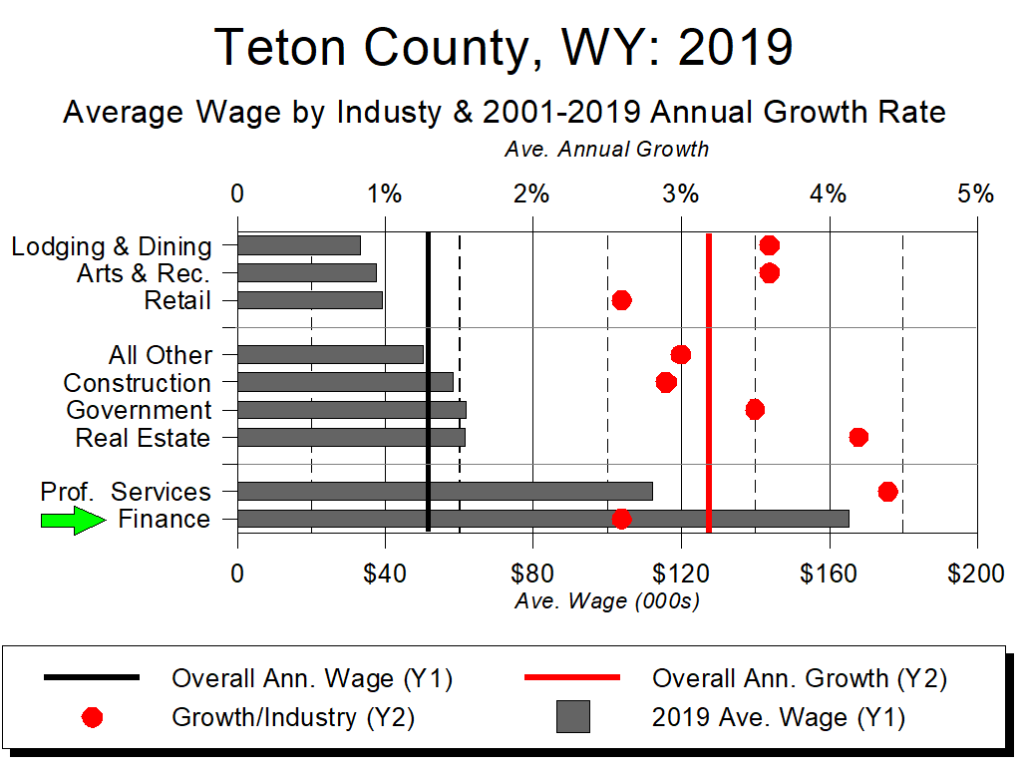

The math is stark: In Teton County in 2019, the average Finance job paid more than four average tourism-related jobs combined. It also paid more than 2.5 average construction jobs.

And while location-neutral Professional Services jobs don’t pay as well as those in Finance, they still pay gobs more than those in the “traditional” Jackson Hole job categories of Tourism, Construction, and Government.

Put another way, Jackson Hole’s location-neutral sources of income – investments, and jobs in Finance and Professional Services – are far, far, far more lucrative than our traditional location-dependent jobs in Tourism, Construction, and Government.

Also worth noting is that these data are from 2019, so don’t capture COVID’s effects. When the data for 2020 and beyond come out, they will show that COVID accelerated these trends, greatly increasing the disparity between Jackson Hole’s location-neutral economy and its traditional, location-dependent economy.

Graph 6

Two Critical Implications

From this perspective, consider two critical implications of the rise of Jackson Hole’s location-neutral economy.

Constraints

First, changes in the economy and advances in technology and transportation have made Jackson Hole’s geographic isolation less forbidding. This has led to increasing numbers of people moving to the region. As they have, Jackson Hole’s physical, political, and land ownership-related constraints have loomed ever-larger – simply put, there is increasingly less space in which to put everyone and everything that wants to be here.

In a constrained world, those with more resources tend to win. And in the constrained world that is Jackson Hole, the location-neutral economy has all sorts of resource advantages over the location-dependent one.

Why? The most important reason is that location-dependent and location-neutral industries have wildly different business models. As traditionally practiced, tourism – that supremely location-dependent industry – needs to employ a ton of people at low wages. Who, in turn, require abundant cheap housing. But when it takes four Tourism jobs to equal the pay of one Finance job, Tourism employees simply can’t compete. Nor can they compete with those making lots and lots of investment income.

The result? The kind of help wanted problems we’ve been experiencing. In turn, these are occurring because people with location-dependent jobs are being displaced by those with location-neutral incomes, who are buying up record amounts of housing at record high prices.

Billionaire gentrification

Second, like attracts like. Over time, more and more well-to-do people have been attracted to Jackson Hole because the well-to-do people who originally moved here started a process of what we might call “billionaire gentrification” – a few people of means coming here made it safer for the next wave, who in turn made it safer for the next wave, and so on.

The gentrifiers’ wealth inevitably attracted people working in finance, leading to Teton County’s aforementioned #13 ranking in Finance & Insurance job growth. (Our 5.7% annual growth rate in Finance & Insurance jobs was over six times faster than that of 1,412th-place New York’s rate.)

We also saw significant growth in Professional Services jobs, further accelerating the shift away from our traditional location-dependent economy toward our new, increasingly location-neutral one.

COVID Hasn’t Helped

COVID has only accelerated Jackson Hole’s billionaire gentrification process, which in turn has put additional strains on our tourism businesses – be it in finding employees, housing employees, or maintaining their financial growth targets.

To address these challenges, many of our location-dependent businesses and industries – including the Jackson Hole Mountain Resort, St. John’s Health, restaurant groups, hotel groups, and construction firms – are vertically integrating or otherwise consolidating. Another tactic COVID has forced upon many businesses is to see just how lean their operations can become.

Such strategies can only be pushed so far, though. As a result, local location-dependent businesses are going to increasingly struggle as their traditional approaches to growth and profitability face myriad challenges and constraints, including:

- competition with location-neutral businesses (hello Chase and First Republic banks);

- competition with growth-oriented national chains (hello Black Diamond, REI, Target, and Whole Foods);;

- community backlash against more visitors (especially as our location-neutral economy grows, and residents become less dependent on tourism for their livelihoods); and

- the viability of the ecosystem on whose health tourism depends.

Back to the Elephants

Which brings us back to elephants.

In this metaphor, there are two elephants in the room: Jackson Hole’s location-dependent economy and its location-neutral economy. We know they’re there, and of course tourism gets a lot of attention. Receiving less attention, however, is our location-neutral economy; receiving even less is how the two are increasingly competing for the same limited resources of people, housing, and land.

Which, in turn, leads to the Swahili proverb: “When elephants fight, it is the grass that suffers.”

While businesses in both the location-dependent and location-neutral economies share a focus on profitably and Return on Investment (ROI), their very different business models are increasingly incompatible. This is especially true when it comes to how Jackson Hole uses its land, whether for housing, bricks-and-mortar businesses, or hosting visitors. As a rule of thumb, location-dependent businesses need to have more employees on site, and more people coming here as customers. In contrast, location-neutral businesses’ employees and customers can be anywhere. Throw in much greater profit margins for location-neutral businesses, and you have the recipe for a resource-driven clash which increasingly favors location-neutral industries.

As that battle escalates, things will become increasingly difficult for our location-dependent industries, which in turn will make it harder for all of us – particularly those who came to Jackson Hole for reasons other than maximizing ROI – to maintain a shared sense of community and comity.

Put another way, by definition location-neutral industries are agnostic towards their communities, while the fate of location-dependent industries is deeply entwined with that of their locales. As these differences play out, one result can be trampled grass.

Extending the metaphor, in our local version of two elephants fighting, the grass is both the region’s ecosystem and its residents of modest means.

Regarding the former, how will our already-under-pressure ecosystem respond to our rapid growth in visitation? This summer, Yellowstone, Grand Teton, and the Jackson Hole Airport all set new activity records, and the trend shows no signs of abating. Why? Among other reasons, shrinking revenues from other sources is driving airlines, tour operators, and state and local governments to ramp up their marketing of our region, leaving it up to us to figure out how to deal with the growing number of visitors. This may help the tourism industry, but at what cost to the community at large?

Regarding the latter, right now it seems that the only folks who can afford to buy in Jackson Hole – and increasingly in our region – are people with location-neutral incomes. If this continues, things do not bode well – not just for our location-dependent industries, but for those people who don’t make a ton of money yet form the warp and woof our community and its character.

These clashes between location-neutral and location-dependent industries are already occurring, and will only get worse as the two elephants compete for the region’s increasingly constrained resources. And not just locally. Nationally and globally, this same location-dependent v. location-neutral clash is occurring, producing similar dynamics and similar stresses for both the elephants and the “grass people” affected by the battles.

Looking to the future, are we “grass people” and our “grass communities” destined to be little more than collateral damage, the victims of a titanic struggle for economic dominance? Possibly. But because we can see it coming, we can also try to set up guardrails to protect the things we value from forces that can too often be indifferent to the locations in which they operate.

That is our challenge. It’s also our opportunity. Game on.

Thank You for Your Support

Please support CoThrive, 22 in 21, and Charture’s many other efforts by making a donation through Old Bill’s Fun Run?

Click here to go to the Charture-specific donation page.