Hello!

Happy 2024! I hope your year is off to a great start.

My most recent CoThrive newsletter focused on an alternative approach to local property taxes. The approach, which I labeled the MOTH, would affect the small share of property tax bills controlled by Jackson Hole’s local governments.

Judging by the emails I received, property taxes are a top-of-mind issue for a lot of folks. Particularly striking was the number of people who asked my opinion about a property tax-related petition currently being circulated. This newsletter is my response.

The petition asks people to support a measure entitled the “People’s Initiative to Limit Property Tax in Wyoming through a Homeowner’s Property Exemption.” If enacted, the “People’s Initiative…” will create a “Homeowner’s Exemption” that will exempt 50% of a home’s value from property taxes. For example, if you owned a home worth $1 million, you’d pay property tax on only $500,000 worth of that value.

The “People’s Initiative…” would apply just to dwellings, not the land on which they sit. It would also apply just to primary homes, not second homes, rental units, or any other type of property.

In my previous newsletter, I focused on the MOTH because it’s something Jackson Hole’s local governments can implement on their own. By extension, I didn’t discuss the “People’s Initiative…” because, like all the other property tax-related proposals currently kicking around, enacting it lies beyond local control.

Today’s newsletter takes the opposite tack. It has two parts: an explanation of the initiative (at least as I understand it), and my reasons for opposing it.

While conceptually I’m okay with the concept of a Homeowner’s Exemption, for two reasons I oppose this particular initiative:

- It’s a one-off temporary fix, addressing the symptoms but leaving the underlying problem unaddressed.

- While the proposed initiative kinda’ sorta’ solves one problem, it creates others. Worse still, it fails to acknowledge that it creates other problems, much less offers solutions to them.

To me, creating a problem without either acknowledging doing so or taking responsibility for addressing it is not just bad policymaking, it’s the antithesis of true leadership. We already have enough of that at all levels of politics and government, so I’m loath to encourage more.

- Introduction

- Taxable Property

- Residential Improvements & Property Taxes

- The 50% Solution: Mechanics

- Winners and Losers

- Comment

- Conclusion

As always, thank you for your interest and support.

Jonathan Schechter

Executive Director

PS – The photos below are of CoThrive’s latest team member. We’re upping our cuteness and fierceness games in 2024.

Introduction

What is the proper role of government? And once we’ve decided that, how do we pay for the services we want?

These are the essential questions of civic life. They also underlie how we might think about a petition aimed at reducing Wyoming’s property taxes.

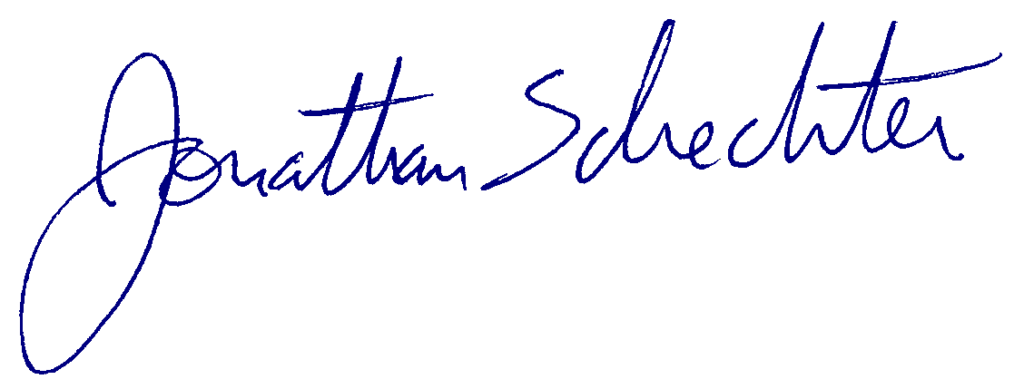

Property taxes are Wyoming’s primary tool for funding public education. They also provide a significant amount of revenue to local governments, among them Teton County (unlike the county, the Town of Jackson collects very little property tax). (Figure 1)

If the petition receives enough signatures, in November voters will be asked whether they want to create a “Homeowner’s Exemption.” If enacted, the Homeowner’s Exemption would exempt from property taxes 50% of a primary residence’s assessed value.

Critically, with some exceptions, the Homeowner’s Exemption would NOT cut property taxes in half. This is because it would apply only to Residential Improvements; i.e., to a dwelling, and not the land on which it sits. It would also apply solely to primary residences, not second homes, non-residential properties, or the like. Finally, it would also be just a one-off remedy – taxes would go down once, but then climb again along with property values.

All that noted, for the 235,000 or so Wyoming residents who own primary residences, the measure would indeed cut their property taxes.

The proposal being circulated has the oh-so-clunky name of “People’s Initiative to Limit Property Tax in Wyoming through a Homeowner’s Property Exemption.” To simplify matters, I’ll refer to it as the “50% Solution.” Also in pursuit of simplicity, in this essay I’ll use the terms “Residential Improvements” and “dwellings” interchangeably (“Residential Improvement” is tax-speak for what mere mortals call a “dwelling” or “home”). Before taking a closer look at the 50% Solution, though, let’s first look at property taxes in Wyoming.

(Note: To do the analysis below, I made several assumptions ranging from home ownership levels to tax rates. As a result, while the numbers below offer reasonably accurate estimates of the 50% Solution’s effects, they aren’t precise.)

Taxable Property

Property taxes are based on assessed value. In Wyoming, the assessed value of most types of property is 9.5% of the market value. The taxes on a property are determined by applying a certain number of mills – the tax rate – to the assessed value. (A mill is one-thousandth of a cent.)

To oversimplify, from a property tax perspective Wyoming has three major categories of property: hydrocarbons, residential, and everything else.

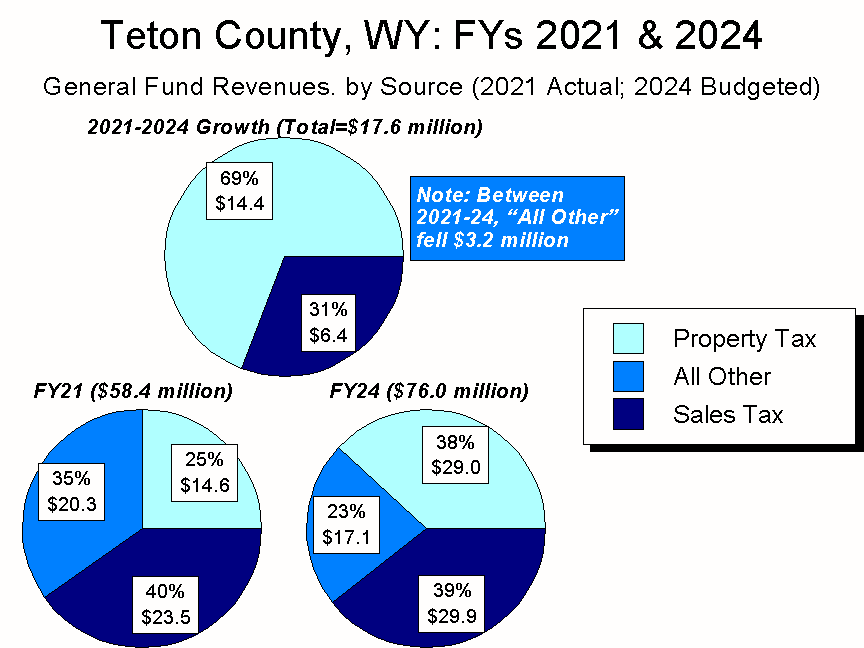

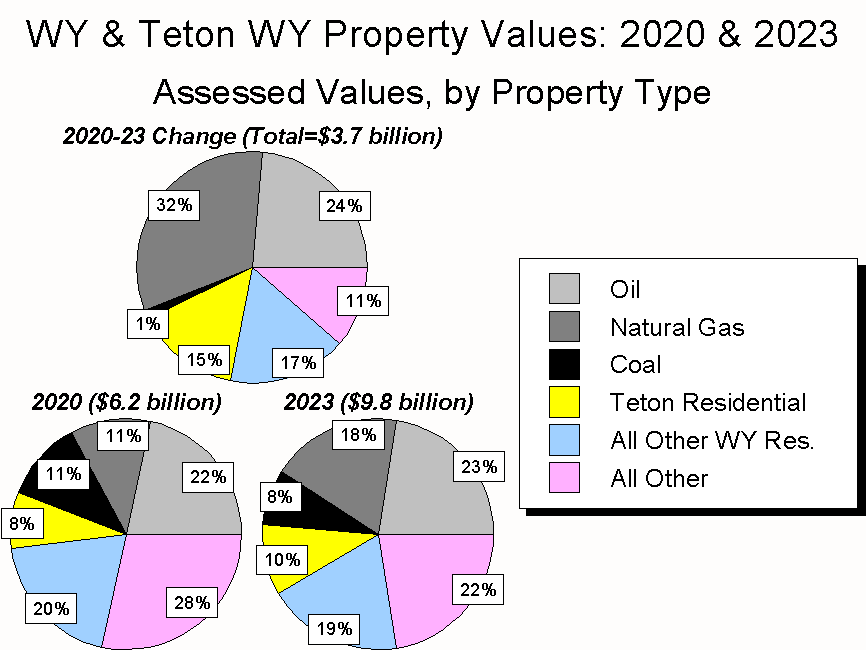

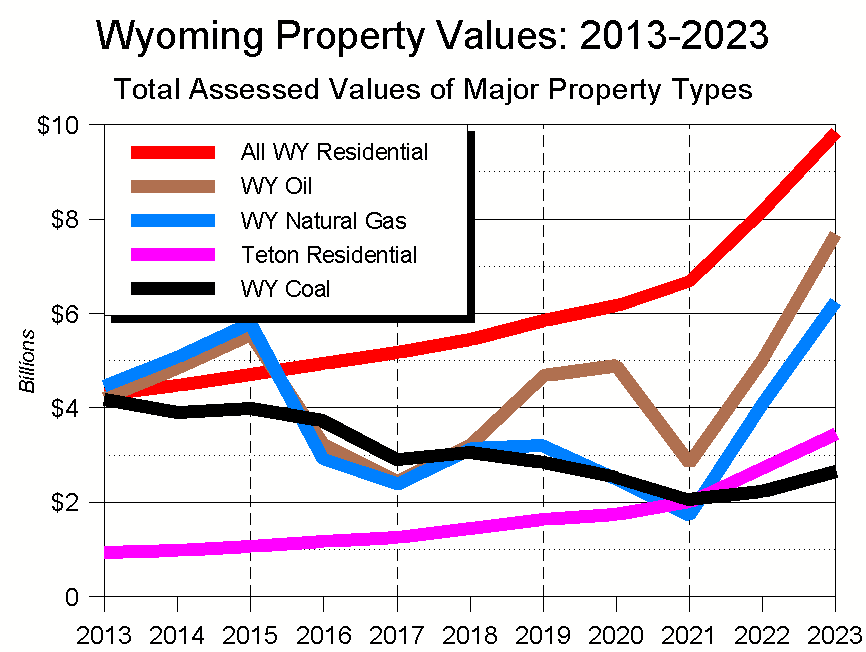

Collectively, the three types of hydrocarbon properties – oil, coal, and natural gas – currently account for 49% of Wyoming’s entire property value; individually, none of the three hydrocarbon types is as big as residential property. Over the past three years, only natural gas-related properties have seen a bigger increase in value than residential properties. In contrast, coal property has seen the slowest growth in value. (Figure 2)

Residential Property

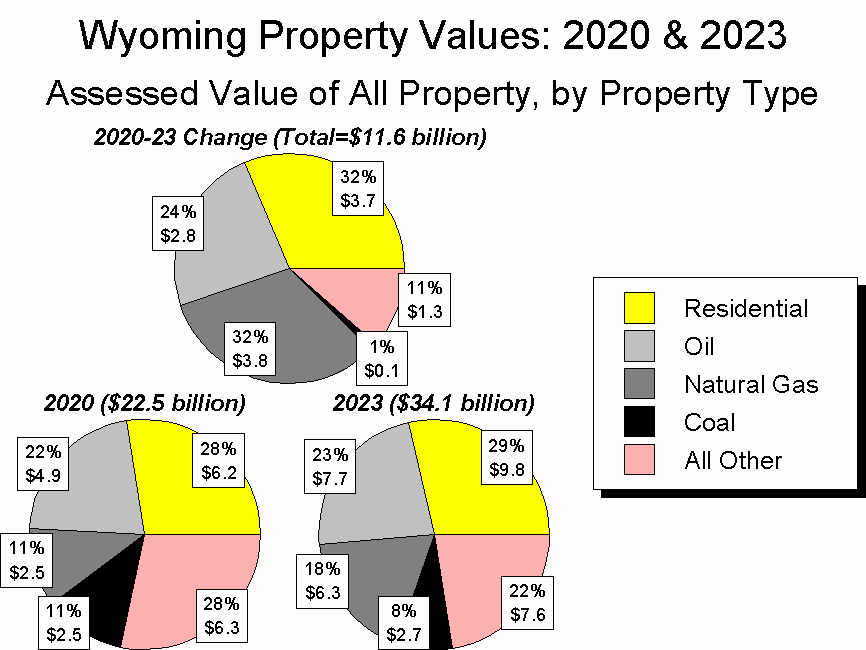

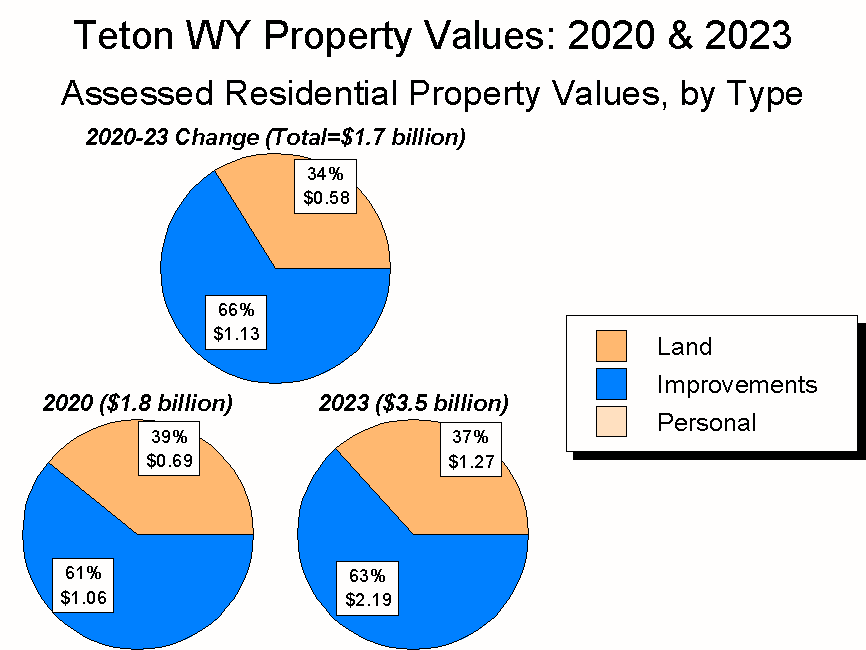

Wyoming breaks residential property into three categories: Improvements, Land, and Personal Property. Roughly 3/4 of the state’s entire residential property value lies in Residential Improvements, and essentially none in Residential Personal Property. (Figure 3)

In Teton County, where private land is so scarce, the figures are somewhat different: roughly 2/3 of the county’s total residential property value lies in Residential Improvements. (Figure 4)

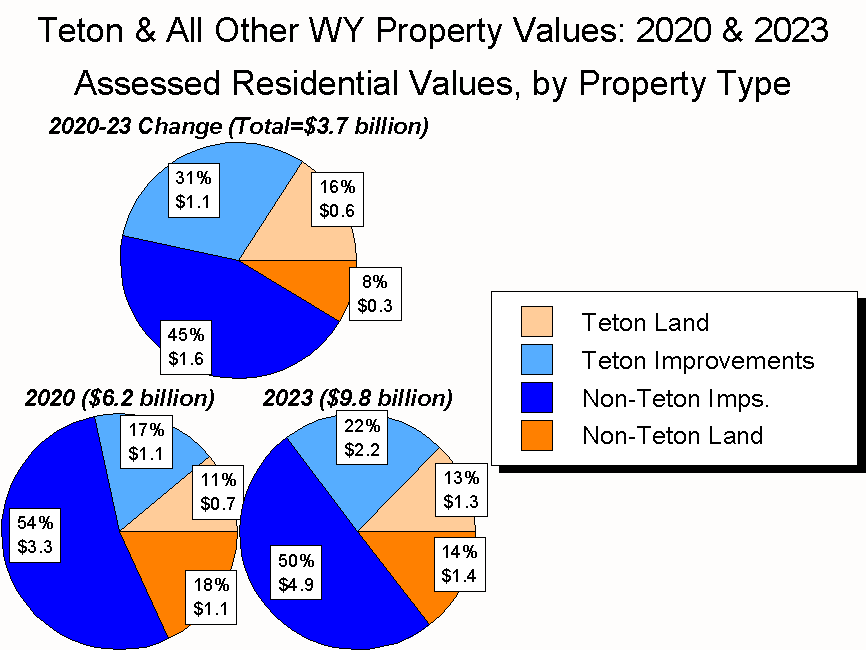

Comparing statewide and Teton-specific data, two interesting facts emerge.

First, despite Teton County having just 4% of Wyoming’s population and 5% of its dwellings, Teton County’s dwellings account for 30% of the value of all of Wyoming’s Residential Improvements. Its Residential Land accounts for 47% of the value of all of the state’s Residential Land.

In addition, between 2020-2023, Teton County also led the state in growth in both categories. (Figure 5)

Second, the combined value of Teton County’s residential properties – its Improvements, Land, and Personal residential property – is worth 30% more than the value of all of Wyoming’s coal properties. (Figure 6)

Residential Improvements & Property Taxes

Currently, the assessed value of all of Wyoming’s Residential Improvements is $7.1 billion, which represents a market value of around $75 billion. The current assessed value of all of Teton County’s Residential Improvements is $2.2 billion, which represents a market value of around $23 billion – nearly one-third of the state’s total.

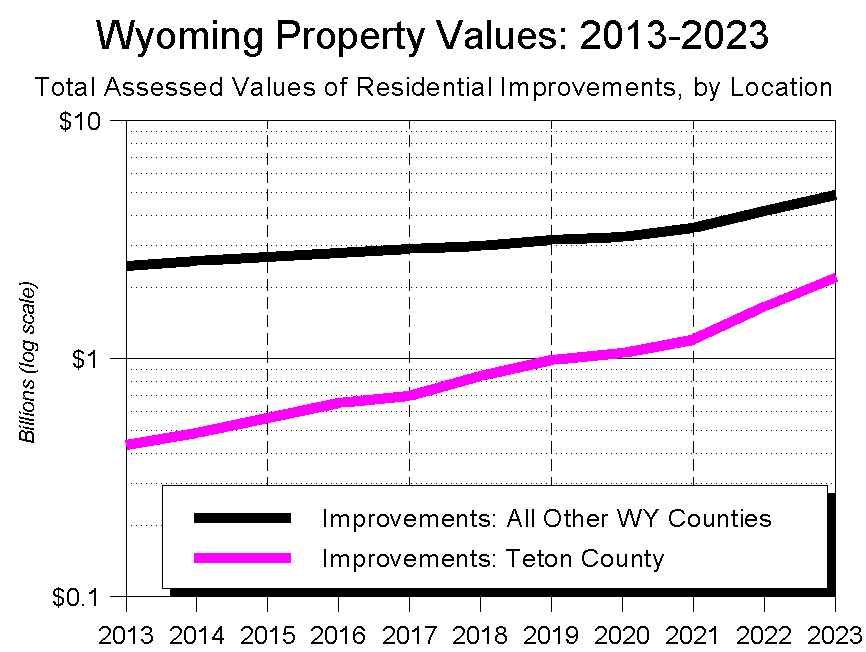

Between 2020 and 2023, the assessed value of all Wyoming’s Residential Improvements grew $2.8 billion, a remarkable 64% overall increase (18% annually). The assessed value of all of Teton County’s Residential Improvements grew $1.1 billion, an even more remarkable 106% increase (27% annually).

Hence the problem. When property taxes are growing 18% or 27% annually, people take notice. As a result, a number of proposals are seeking to do something – anything! – to, as one of my correspondents put it, “STOP THE MADNESS!” (Figure 7, which is graphed on a logarithmic scale to better illustrate rate of growth.)

Most of the property tax-related proposals are focused on steps Wyoming’s legislature might take. In contrast, the 50% Solution is an initiative that would bypass the legislature and go straight to the ballot.

To qualify for the November 2024 ballot, the initiative needs to be signed by around 30,000 registered voters by the time the legislature convenes in mid-February. Teton County will need to provide around 1,500 of those signatures.

The 50% Solution: Mechanics

The 50% Solution will apply only to dwellings used as a primary residence. Owners of such dwellings will receive a “Homeowner’s Exemption,” which will exempt from property tax one-half of the assessed value of their Residential Improvements. Here’s the key sentence from the proposed initiative:

“For property used as a primary residence, fifty percent (50%) of the assessed value of the primary property is exempt from property taxation as a homeowner’s exemption.”

If the 50% Solution becomes law, what will the consequences be for those who qualify?

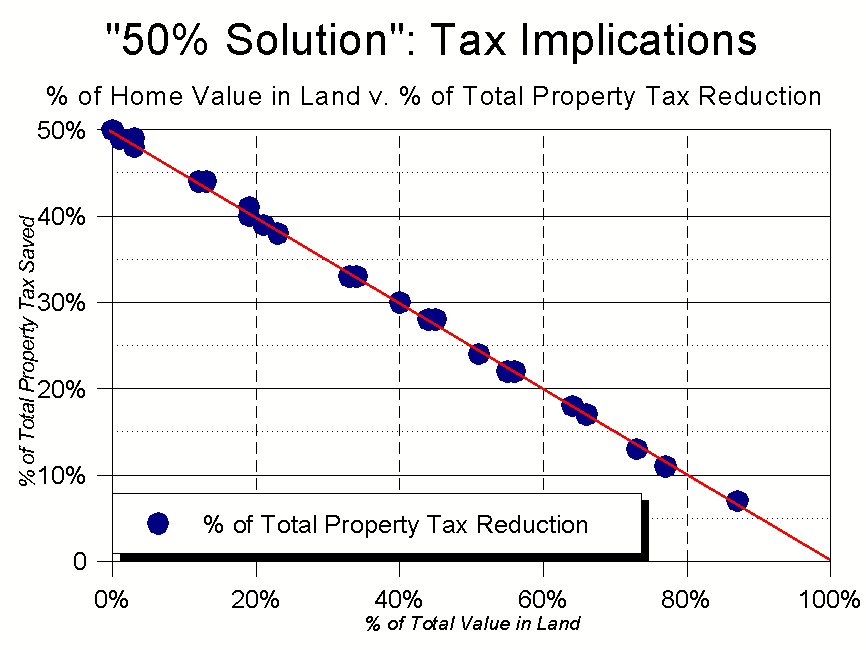

The short answer is that the greater the amount of a property’s value tied up in the dwelling, the greater the overall property tax relief.

Using public records, I created Figure 8 to illustrate what the owners of 30 different Teton County properties would have experienced in 2023 had the 50% Solution been law. As it shows, people who own a dwelling but not the land underneath– e.g., folks who live in trailer homes or condominiums – will see their property tax bills halved. People whose property value is equally split between dwelling and land will see a 25% drop in their taxes, and people who have inexpensive homes on valuable land will see relatively little tax relief.

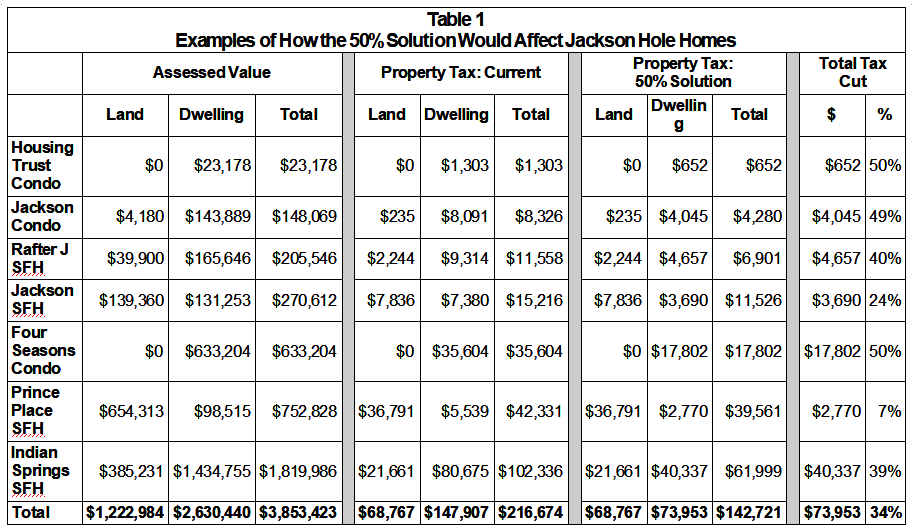

Table 1 gives details for seven of Figure 8’s properties.

Winners and Losers

The Money at Stake

As noted above, the assessed value of all Wyoming property is currently $34.1 billion. Of this, Residential Improvements are worth $7.1 billion (21%).

According to the Census Bureau, 72% of all Wyoming homes are owner-occupied, and therefore would be eligible for the 50% Solution.

Do the math, and the 50% Solution would exempt from taxation around $2.6 billion of Wyoming’s total Residential Improvements. This would lower the amount subject to taxation from the current $14.9 billion to $12.3 billion (17%).

Because Teton County has more second homes, income properties, and the like, fewer of its dwellings are eligible for the Homeowner Exemption. As a result, the decline would be a little less, around 15%.

Winners – Wyoming’s $710 average savings

Across Wyoming there are hundreds of taxing districts, each with the legal authority to levy a few mills of property tax. Most of these districts focus on infrastructure needs such as water, sewer, and roads. In addition, each of the major taxing entities – counties, towns, hospitals and the like – has different limits on how many mills they can levy.

Because of this variety, it’s essentially impossible to calculate exactly how much tax the 50% Solution would cut. It also seems likely that, should the 50% Solution become law, all sorts of current non-residents will figure out ways to claim their Wyoming home as their primary residence.

That noted, we can take a crack at estimating the amount of property tax homeowners would no longer pay/government would no longer receive.

In 2023, Teton County’s basic tax rate was 56.229 mills. Perhaps surprisingly, this is the lowest mill levy in the state. There are two reasons for this: local government enjoys a high amount of tourism-based sales tax revenue; and Teton County’s property values are so high that fewer mills can still produce a lot of revenue.

Doing an unscientific study of the rest of the state, other counties’ basic mill levy ranges between the low 60s and mid-70s. For argument’s sake, let’s say the statewide average is 65 mills:

- 65 mills applied to Wyoming’s current $14.9 billion in assessed property values produces tax revenues of $967 million.

- 65 mills applied to the $12.3 billion that would be subject to tax under the 50% Solution reduces the amount of property tax revenue to $800 million, a 17% decline.

- Divide that $167 million drop over Wyoming’s estimated 235,000 owner-occupied homes, and the 50% Solution will yield a Wyoming-wide average of around $710/dwelling in property tax reduction.

Winners – Jackson Hole’s $4,800 average savings

We can be more precise in Teton County.

As noted, in 2023 Teton County’s basic tax rate was 56.229 mills.

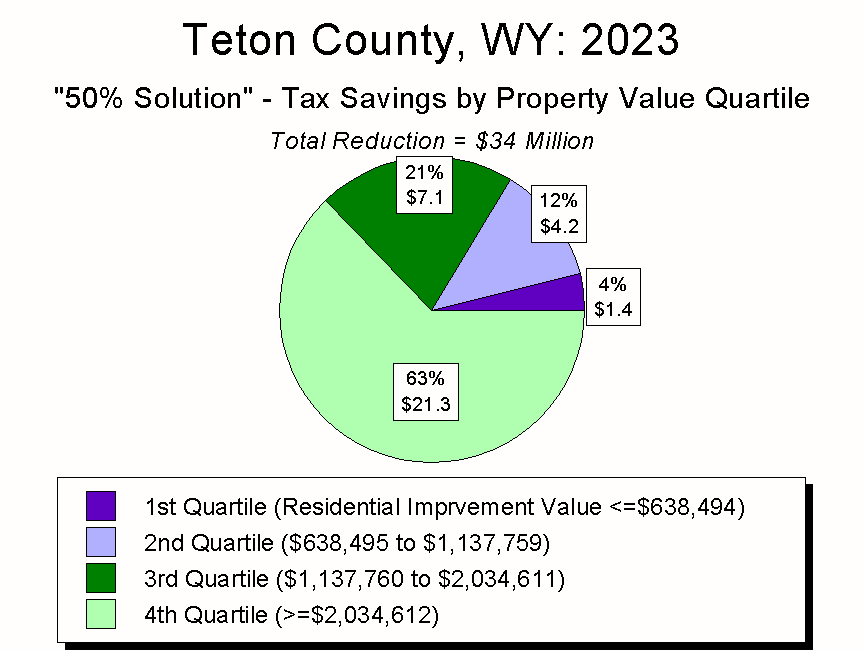

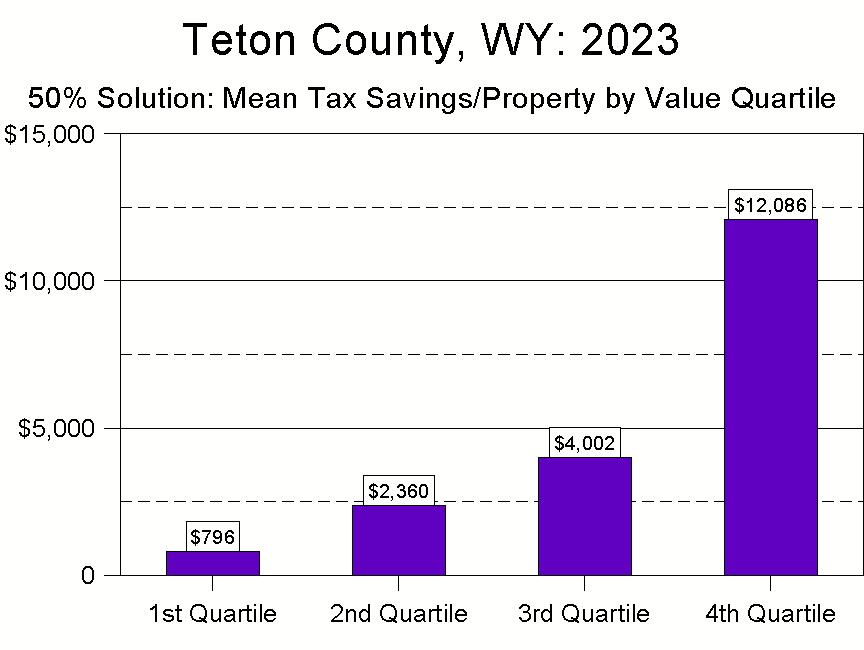

Given Teton County’s property values, this produced $222 million in property tax revenue. Had the 50% Solution been in effect, the property tax proceeds would have been $188 million, a 15% drop. Divide that $34 million drop by the county’s estimated 7,100 primary residences, and the mean reduction/home would have been around $4,800.

This reduction would not be divided equally, though. In particular, because the value of Teton County’s dwellings is concentrated at the high end, the owners of Teton County’s highest-value homes – the 25% of homes worth at least $2 million – would receive 63% of the total property tax reduction (because, of course, they are paying the most tax in the first place). The 1,700 or so homeowners in that group would enjoy a property tax reduction averaging ~$12,000 (Figure 9)

At the other end of the scale, people who own the least-valuable 50% of dwellings – homeowners with a dwelling worth no more than $1.1 million – would see property tax reductions in the $800 – $2,000 range. That’s not nothing, but it’s also not a panacea for those whose property values have left them land-rich and cash-poor. (Figure 10)

Losers – Wyoming

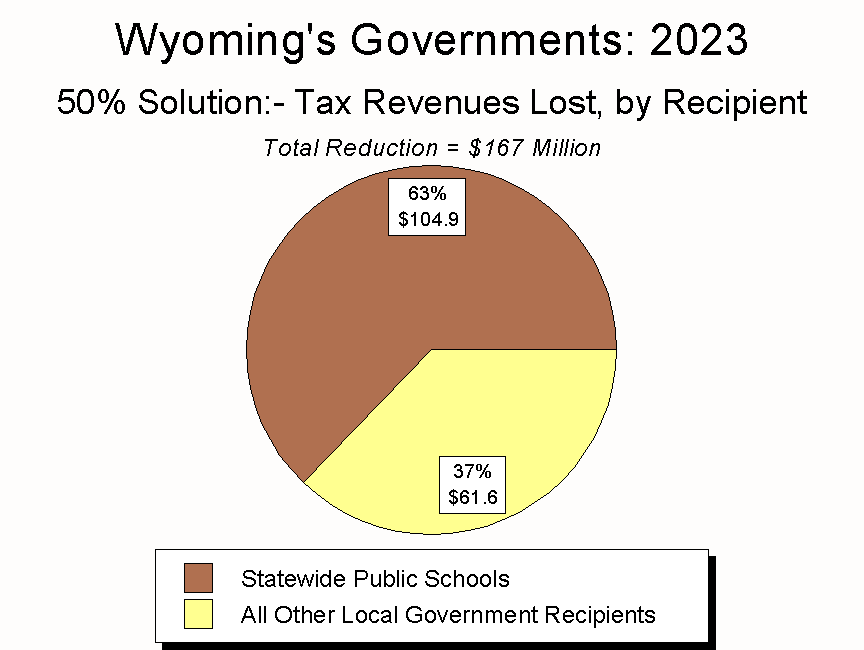

If Wyoming property owners end up paying $167 million fewer property tax dollars, where will that money NOT go?

Wyoming’s K-12 education system gets the lion’s share of the state’s property taxes – around three-quarters of Teton County’s payments, and about two-thirds of most other counties’. Because of this, should the 50% Solution be enacted, Wyoming’s public education system will lose around $105 million – roughly 6% of its annual $1.66 billion operating budget. Having no knowledge of school funding, I don’t know how much such a cut might hurt. Given how heavily Wyoming relies on coal for funding its schools’ capital needs, though, and given how much trouble coal is in, the prospect of such a cut has to be of great concern to public education officials.

Also statewide, many counties and municipalities are quite dependent on property tax revenues to fund core services (how dependent varies with the jurisdiction). If I were a leader in one of those communities, I’d be quite anxious about losing critical revenue. (Figure 11)

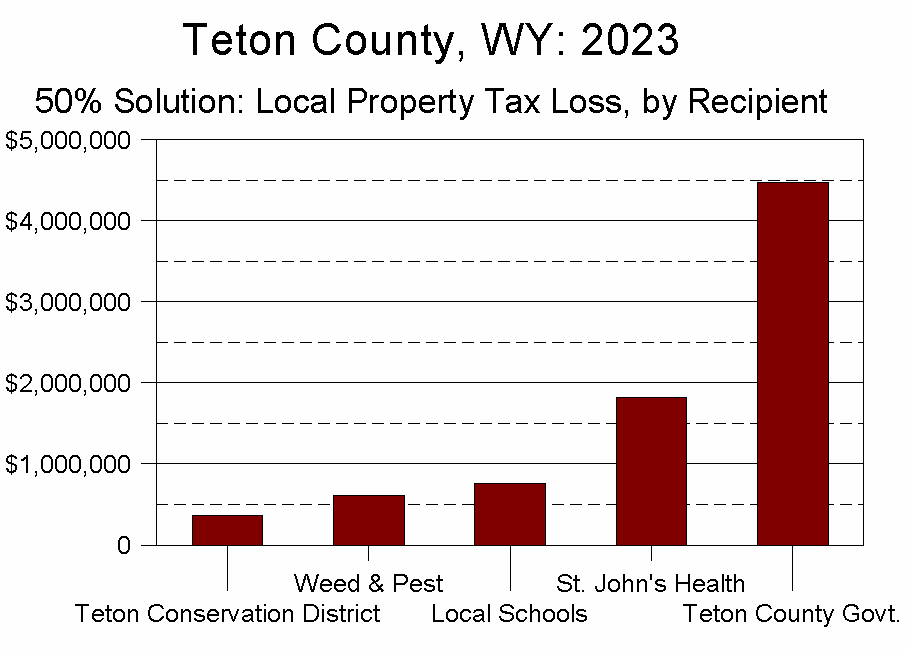

Losers – Jackson Hole

Locally, the 50% Solution’s two biggest losers would be Teton County’s government and St. John’s Health. Could they figure out how to deal with the losses? Almost certainly. Would it make things harder for the two institutions in this period of rapidly rising costs and, for St. John’s, increasing competition/threats to its other revenue sources? Absolutely. (Figure 12)

Comment

Thinking about the 50% Solution, two ideas keep bubbling up for me. I call one “The Individual v. the Collective,” and the other “Eating Broccoli, Not Just Dessert.”

The Individual v. the Collective

Over a decade ago, Smith’s grocery and liquor store opened in Jackson. When they did, their size allowed them to charge lower prices on beer, wine, and spirits than local liquor stores had been charging. Locally-owned stores responded by lowering their prices, so now most of the valley’s liquor stores charge a bit less than they once did.

I mention that because, as a non-profit executive director, I bore witness to an unintended consequence of Smith’s price-cutting: it hurt local non-profits.

This happened because before Smith’s opened, locally owned liquor stores had higher margins, offering them more freedom to donate beverages to non-profit fundraisers. The liquor stores could claim a donation, and the non-profits made a bit of money by not having to buy liquor for their events.

But no more. Now, for example, instead of receiving free beer and wine for my events, I usually have to buy it. At a discount, of course, for which I am always grateful. But in its own small way, the shift from free to discounted has affected the finances of my events.

Reflecting on how the coming of Smith’s changed the dynamics of the valley’s non-profit events, I concluded that the underlying issue boiled down to this: How is the community best served?

Suppose a liquor store has $1,000 of wiggle room in its bottom line. Those arguing for the “Individual” perspective feel the community is best served by, say, 2,000 customers each saving 50¢ on a six-pack of beer. Each of those consumers could then use that 50¢ as they choose, which advocates feel leads to the best possible outcome for the community.

The “Collective” supporter would argue that a bunch of people saving 50¢ each doesn’t add up to much of a community benefit. Instead, they would posit that the community is better served by the store donating $1,000 worth of merchandise to a non-profit, and then letting that organization apply the larger sum towards its mission.

Shifting gears for a moment, in 1978 California was heavily reliant on property tax to fund local government and public education. Like Wyoming today, because property values were shooting up, so too were Californian’s property taxes.

In response, an initiative was passed to limit property taxes. Known as Proposition 13, it saved individual property owners money both initially and going forward. It also, however, wreaked such havoc on public school and local government funding that, arguably, 45 years on the system still hasn’t recovered.

I mention this because it reflects how I’m coming to see the 50% Solution.

If the 50% Solution gets onto November’s ballot, voters’ choice will boil down to this: Is Wyoming best served by the state’s ~235,000 primary homeowners getting a property tax cut on their dwelling, or by continuing to fund public education and local government at its current levels? Put another way, is Wyoming best served by its homeowners benefitting, on average, around $710/year? Or by aggregating that money and keeping schools and counties well-funded?

That is a legitimate policy question, and I’d love for us to have that debate. Unfortunately, though, I doubt it will be framed that way by the proposal’s advocates. Which leads us into eating your broccoli.

Eating Broccoli, Not Just Dessert

Because they are proposing to alter the current system, advocates for the 50% Solution need to make the case why things should change. In particular, they need to clearly explain three things:

- their proposal;

- its consequences; and

- how its negative consequences might be addressed (if at all).

Anything short of directly and comprehensively addressing all three should set off the loudest of warning bells. And I, for one, hear those bells ringing.

I say this because pitching a tax cut is easy – it’s eating your dessert. It’s simple and clear and everyone loves it: who’s against paying lower taxes? But as HL Mencken once observed, “For every complex problem, there is an answer that is clear, simple, and wrong.”

The problem is that someone who advocates for tax cuts but doesn’t tell you both how those cuts will affect government AND how government should respond isn’t eating their broccoli – they’re not doing the hard work of public policy. Instead, they’re telling you what you want to hear – “Here’s more money in your pocket!” – without telling you about the costs associated with their scheme.

And if you cut taxes by over $100 million, there will be costs.

Then the question becomes: “What do you do about those costs?” By not answering the question, does it mean advocates are using the 50% Solution as a stealth way of trying to reduce the size of government? If not, then how do they propose making up for the lost revenue?

To go a step further, it’s imperative that these questions be answered with integrity. By this I mean that it’s completely unacceptable to answer fundamental questions with platitudes like “Eliminate waste, fraud, and abuse” or magical thinking like “Cutting taxes will pay for itself by stimulating growth.” To be generous, anyone making such baseless claims isn’t telling you the whole story; to be less generous, they’re trying to pull something over on you.

Which is arguably what happened 45 years ago in California. After successfully playing on voters’ anger, the folks behind Proposition 13 left it to others to clean up the problems the initiative created. Ducking responsibility isn’t leadership – it’s the most pathetic type of performance art.

Bottom line? If someone is arguing for cutting taxes but won’t tell you both what the consequences will be AND how they propose addressing them, then keep your hand very tightly on your wallet. Nationally, statewide, locally – this is not someone to be trusted.

Like life itself, government is a big messy organism, something easy to poke holes in. It has its purpose though, and voting, public hearings, and other facets of our civic life give us the opportunity to figure out just how big and comprehensive government’s role should be. But if the people involved in that debate don’t conduct it with integrity – if they don’t lay out the pros, the cons, the uncertainties, and the consequences – then all they’re offering is theater, not governance. We all deserve better than that.

Conclusion

For a growing number of Wyoming residents, and especially a growing number of long-time Teton County residents, quickly-rising property taxes are a quickly-rising problem.

In that context, a Homeowner’s Exemption is not a bad idea. It is a bad idea, though, if it’s implemented in the way advocates of the 50% Solution currently propose; i.e., as a standalone “solution,” without consideration of its broader consequences.

There are two reasons for this.

First, the 50% Solution is a one-off reset. It will shield 50% of the assessed value of a primary residence but do nothing to insulate property owners from the fundamental cause of the problem: rapidly rising property values.

Whether or not the 50% Solution is adopted, property taxes will continue to be tied to property values. As those continue to rise, the underlying problem will quickly reemerge. In that way, the 50% Solution won’t cure the underlying problem. Instead, it will simply put a Band-Aid on a symptom.

Second, advocates are not presenting the 50% Solution with integrity. Instead, they’re telling people what they want to hear without mentioning – much less addressing – the costs. Until the advocates prove themselves as willing to eat their broccoli as they are their dessert, their proposals are not to be trusted.

Addressing the problem

So what would I do? Four steps come to mind.

First, I’d pursue the MOTH idea I described in my last newsletter. It wouldn’t help much, but it would help some, particularly for those with lower incomes.

Second, I’d put a lot more money into the state’s property tax refund program. In 2022, 442 Teton County residents – roughly 6% of local homeowners – received an average of around $3,500 in property tax refunds from the state. Statewide, $8.3 million was refunded. As I see it, rather than adopt the 50% Solution or its ilk, Wyoming would be far better off to keep its funding system intact while dramatically boosting the refund program.

Third, I’d help fund the property tax refund program by implementing a real estate transfer tax.

Two simple realities inform this idea:

- Combined, Teton County’s residential properties are worth more than all of Wyoming’s coal properties; and

- Combined, Wyoming’s residential properties are worth more than either its oil or natural gas properties.

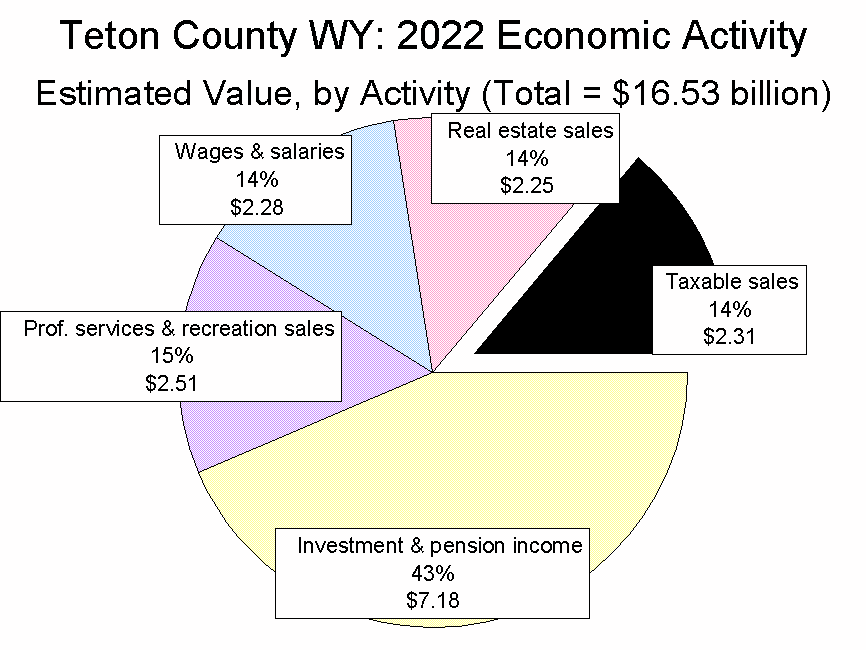

Yet real estate sales go untaxed. Which is weird in a number of ways, especially because taxing a property sale is in some ways far more equitable than levying an annual property tax. (Figure 13)

Steps 1-3 could be implemented fairly quickly. Step 4 is much harder and, if done with integrity, would take a lot of time and effort. With every passing year, though, it’s a step that becomes increasingly important to take: Align Wyoming’s taxing system with the state’s changing economy.

Here’s what I mean.

Sales taxes are the single biggest funding source for Teton County’s local government, accounting for about 50% of general fund revenues. Yet taxable sales account for no more than one-seventh of all local economic activity, and likely less.

Specifically, in 2022, the most recent year for which we have comprehensive data, Teton County’s economic activity broke down like this:

- Taxable sales = $2.31 billion

- Real estate sales = $2.25 billion

- Wages & salaries = $2.28 billion

- Professional services & recreation sales = $2.51 billion

- Investment & other income = $7.18 billion

Of these, only taxable sales helped fund state and local government. (Figure 14)

Because Teton County has no mineral/mining-based economy, its numbers differ from the state as a whole. That noted, the same basic phenomenon holds statewide: Wyoming’s taxation system is well-matched to its economy of 50-100 years ago, but is increasingly out of touch with the economies of today and tomorrow. Until that fundamental disconnect is addressed, the state’s very real property tax problem will become increasingly worse. And that’s a reality the 50% Solution doesn’t address.