Hello, and happy summer!

How did it become the end of July? It’s beyond me. As are a large and growing number of things. And that is about as succinct a summary as I can offer of how this newsletter came to be.

In particular, two recent occurrences left me not just baffled but angry. One harmed my brother; the other is harming my community. Both are on-the-ground consequences of the willful insanity currently enveloping Washington DC.

My brother heads California’s vaccination programs, and is one of America’s foremost public health professionals. In recognition of that fact, last year he was appointed to the National Institute of Health’s National Vaccine Advisory Committee (NVAC), the group responsible for assessing the safety and efficacy of vaccines and how they are administered.

NVAC is – or I should say was – comprised of 17 of the nation’s leading authorities on the incredibly complex and vital work that is immunizations. In fact, these people are all so smart and talented and conscientious that they pose a threat to the quacks, charlatans, and grifters currently running the federal government. As a result, last month my brother and the other 16 HVAC members were ignominiously fired from their posts by the US Department of Health and Human Services’s quack-in-chief: Robert F. Kennedy Jr.

Whether short or long term, little good is going to come from the Big Beautiful Bill (BBB), DOGE, and all the other “burn it down” efforts currently upending America’s governance, education, and research institutions. Nor will anything good come from the accompanying explosion in the federal debt we’ll soon be seeing. All this makes me furious.

Hence today’s newsletter. It was born not just out of my anger at what the Trump administration and its abetters in Congress are doing to my brother, community, and nation, but my frustration over feeling there’s nothing I can do.

I’m not wired to simply wallow, though. Instead, I’ve chosen to take two steps: Develop an understanding of what’s happening locally, then use that understanding to act. What you’ll read below is my first step in that process – trying to understand how the BBB might affect Jackson Hole, and what resources the community has for responding.

I started crafting this essay in early July, and since then it’s been the albatross around my neck. Despite cranking out draft after draft, what you’ll find below is wicked-long. For those who don’t want to bother wading through it, here are the three main takeaways:

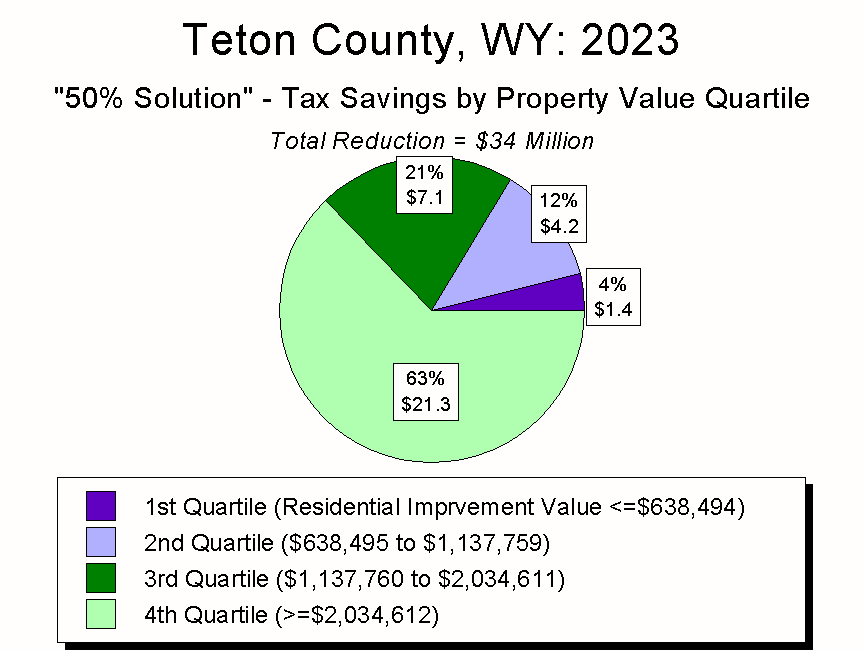

- Because Teton County, Wyoming is the wealthiest county in the wealthiest country in the history of the world, and because the BBB will disproportionately help the wealthy, Teton County will disproportionately benefit from the BBB.

- In particular, 6% of Teton County households make at least $1 million/year. For them, the BBB’s mean tax benefit will be around $151,000. For the remaining 94% of Teton County households, the mean benefit will be around 2.5% of that: $3,600.

- Because Teton County, Wyoming also has the nation’s greatest income inequality, it’s likely that the BBB and related efforts will disproportionately harm Jackson Hole’s most vulnerable residents. My constituents. My friends. My God.

- Between 2018-2022 (the most recent years of data), Teton County, Wyoming’s well-to-do residents led the nation in charitable deductions per household, claiming per-return donations averaging $191,233/year. As large as this number is, though, it represents a smaller share of Teton residents’ collective income than in many other counties.

- Had Teton County’s wealthiest residents matched each year’s leader in percentage of income donated, their mean annual deduction would have risen 83%: from $191,233 to $350,791. This would have raised Teton County’s total giving from an annual average of $492 million to $902 million.

- Given that Teton County’s wealth has only increased since 2022, Teton County’s current philanthropic capacity is north of $1 billion. This is likely twice what it is actually giving, if not more.

I found all this interesting. It also gave me hope and, if only a bit, helped quell my anger. May it do the same for you.

Preface

Introduction

Income

BBB’s Tax Benefits

Charitable Giving

Summary and Comment

Four Figures

Three Questions

As always, thank you for your interest and support.

Jonathan Schechter

Executive Director

“What will happen when California is filled by fifty millions of people, and its valuation is five times what it is now, and the wealth will be so great that you will find it difficult to know what to do with it? The day will, after all, have only twenty-four hours. Each man will have only one mouth, one pair of ears, and one pair of eyes. There will be more people – as many perhaps as the country can support – and the real question will not be about making more wealth or having more people, but whether the people will then be happier.”

– Lord James Bryce, from a speech at U.C. Berkeley, 1909

“Taxes are the price we pay for a civilized society.”

– Supreme Court Justice Oliver Wendell Holmes, Jr., 1927

“For unto whomsoever much is given, of him shall be much required.”

– Luke 12:48 (King James Bible)

Preface

It’s striking how little society asks of the private sector.

By this I mean that, across the globe, most societies have just one request of the private sector: do only those things that make money.

The reason? Deeply embedded in our collective psyche is a shared-yet-unstated understanding that, unless an activity can potentially turn a profit, we won’t ask the private sector to do it.

But what about the many human wants and needs that don’t lend themselves to making money? To address those, societies turn to the public sector.

In some places – think Scandinavia – the public sector does a lot of can’t-make-a-profit stuff. In other places – think Wyoming, the most libertarian of states – the public sector does far less. Even where government does a lot, though, many needs and wants go unmet. To address these, we look to the third economic sector: Non-profits. In particular, if non-profits don’t address society’s remaining needs and wants, they fall between the cracks.

Through their work, non-profits bind communities together. In Jackson Hole, the Community Foundation’s non-profit directory lists 328 organizations operating in Teton County. Hundreds more serve the greater Tetons area. Recognizing this vital role, for 28 years the Jackson Hole community has celebrated its non-profits through Old Bill’s Fun Run – a remarkable fundraising event, and so much more.

(Note: The donation period for this year’s Old Bill’s runs from August 15-September 12. You can help support this newsletter and my related efforts by donating to the Charture Institute through Old Bill’s – https://www.oldbills.org/give . Thank you in advance for your support.)

I mention all this because, over the past six months, the “move fast and break things” mantra of Silicon Valley has been applied to the private/public/non-profit continuum. And it’s worked: Across all three economic sectors, lots of things have been broken.

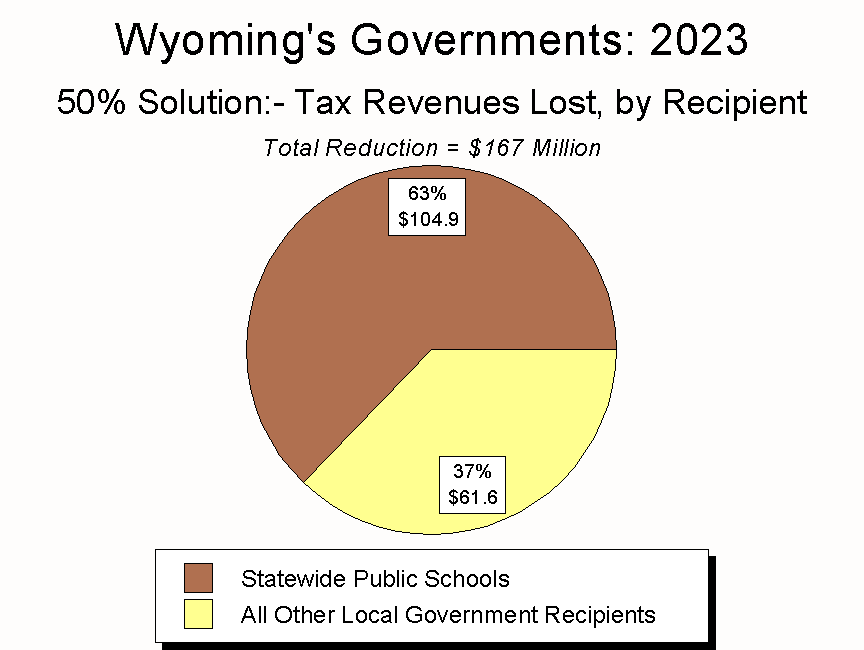

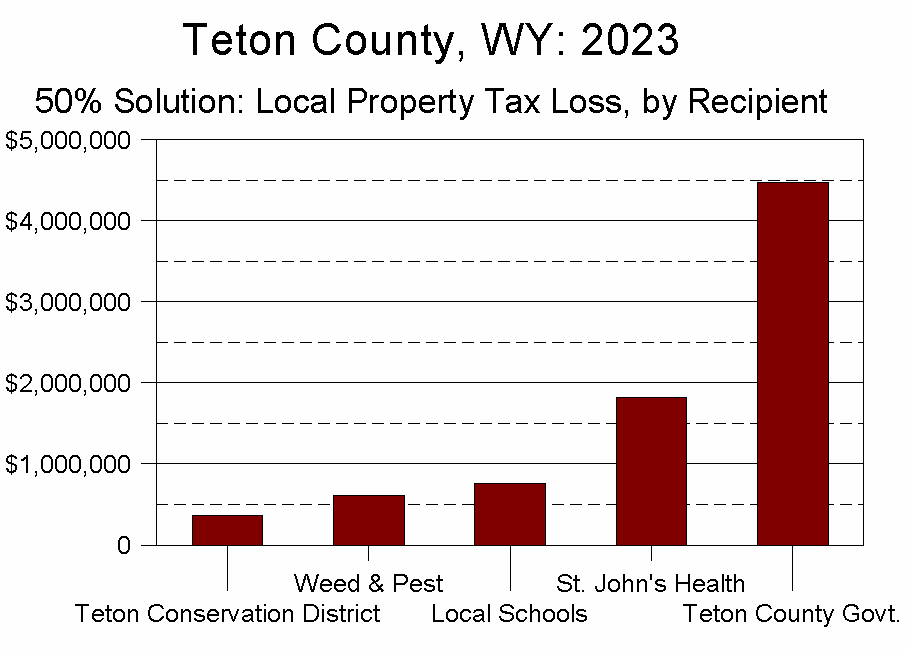

Less clear are the effects of that breakage, which are only now starting to manifest themselves. What we do know, though, is that communities around the country will soon be experiencing sharp cutbacks in funding for social services, education, healthcare, environmental protection, scientific research, and a host of other efforts important, if not vital, to large swathes of people, the economy and, more broadly, quality of life.

Just because government stops funding a program, though, the underlying issues don’t magically vanish. So who will sweep up the mess? Since businesses won’t step in and governments are choosing not to, the load will fall on non-profits.

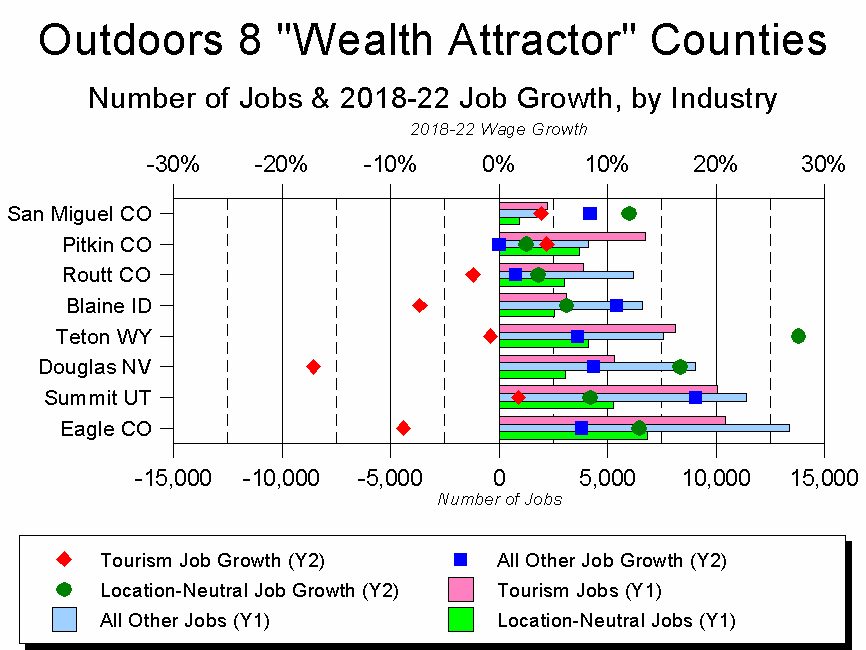

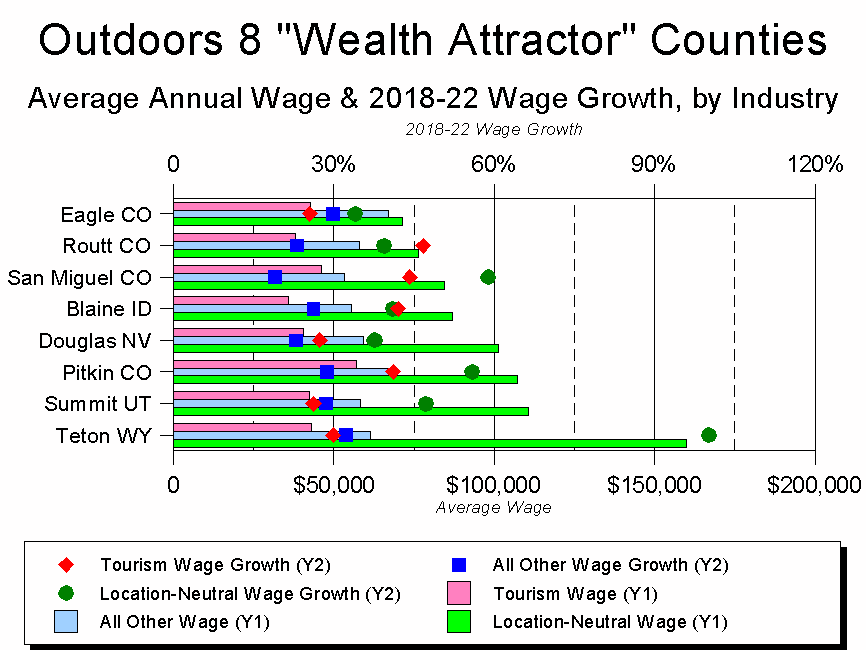

How will Jackson Hole’s non-profits meet this challenge? To answer that question, we must first understand Jackson Hole’s economic realities.

Introduction

This essay builds on two foundational facts:

- On a per capita basis, Teton County, Wyoming is the wealthiest county in the wealthiest country in the history of the world.

- The tax benefits and other elements of the recently-enacted Big Beautiful Bill (BBB) disproportionately favor the well-to-do.

Combined, this suggests Teton County’s well-to-do residents will disproportionately benefit from the BBB. To understand how well they will do, let’s take a look at income.

Income

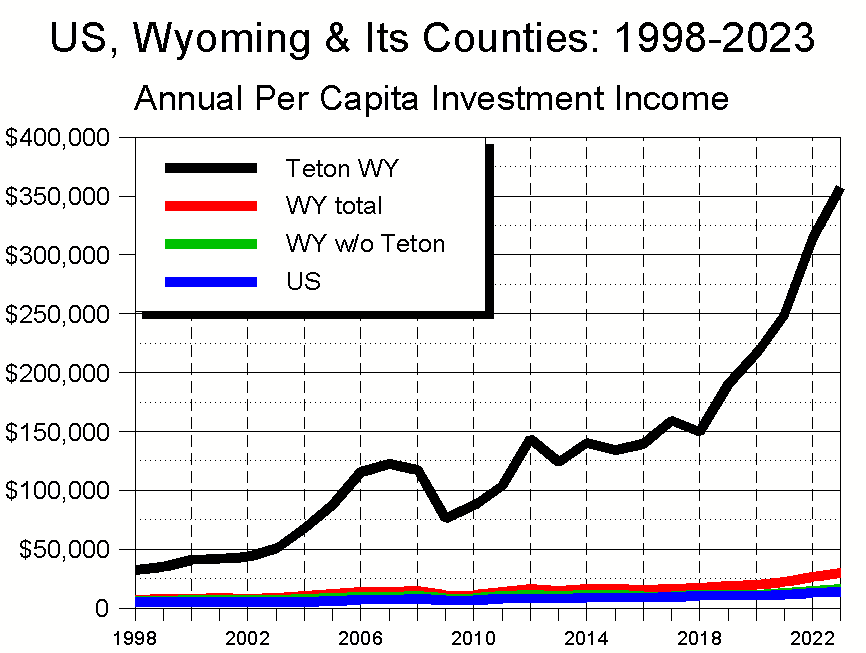

As noted, on a per capita basis, Teton County, Wyoming is the wealthiest county in the wealthiest country in the history of the world.

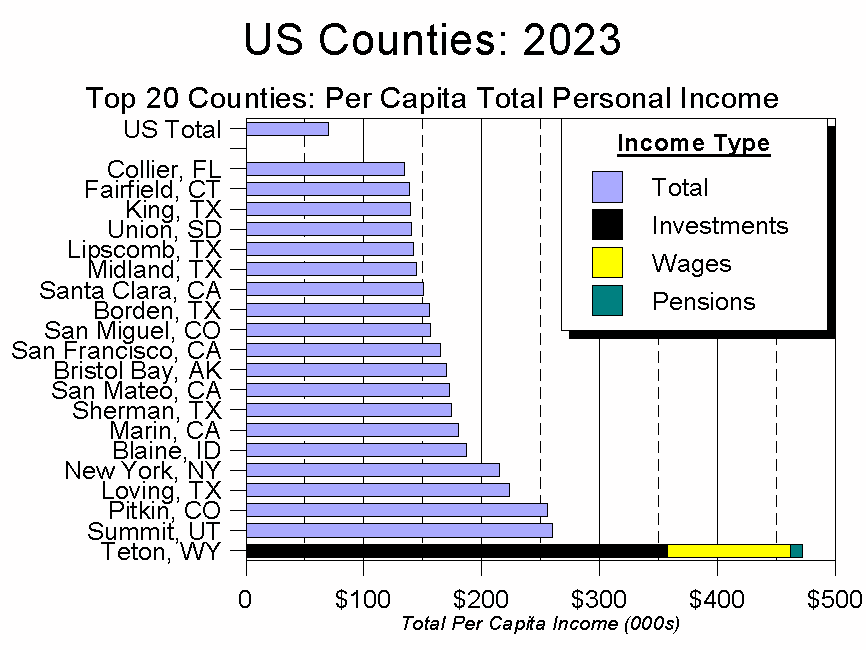

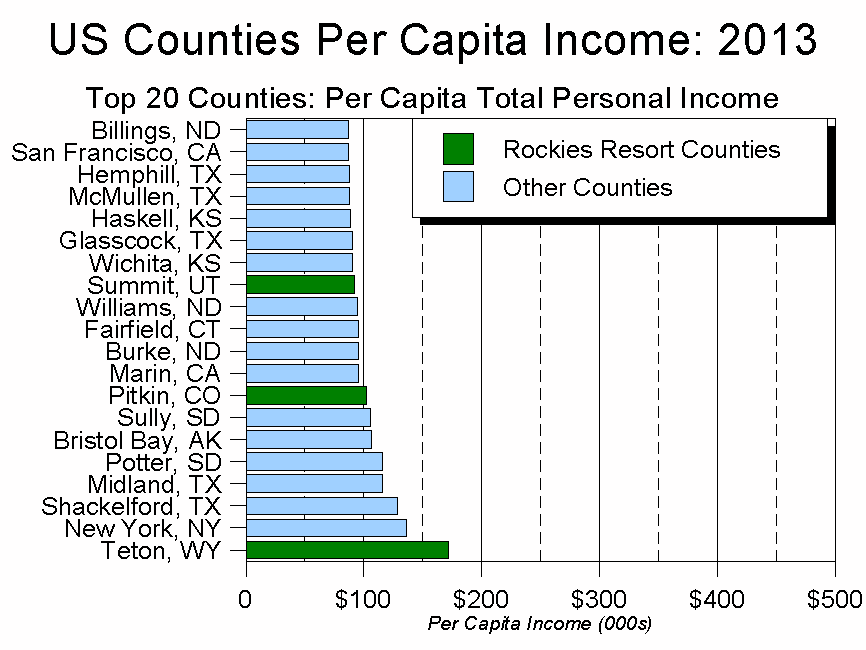

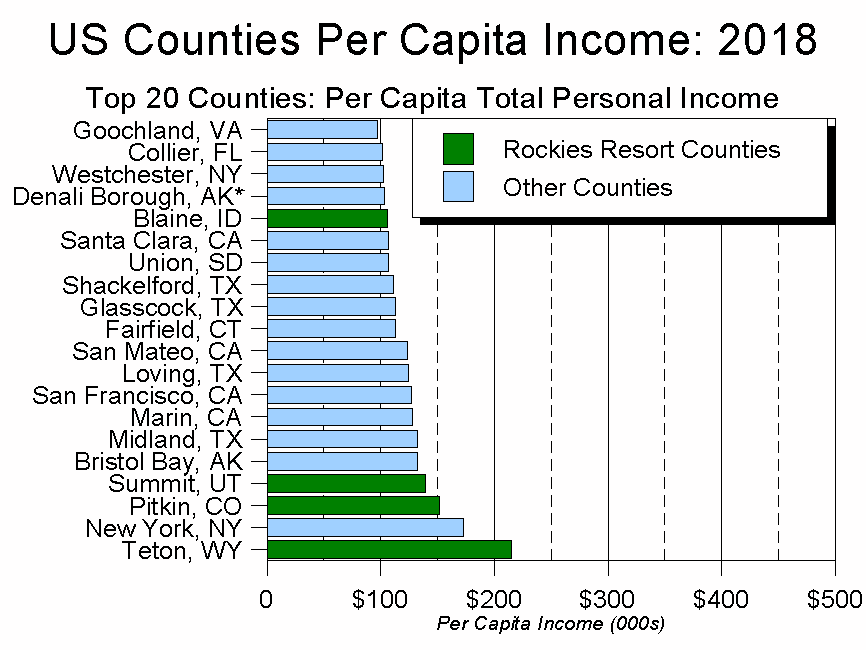

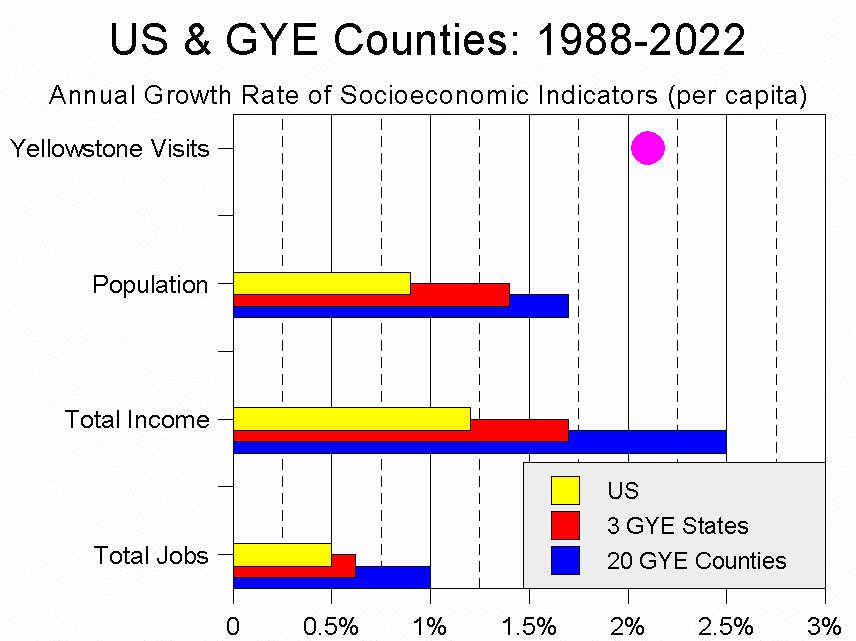

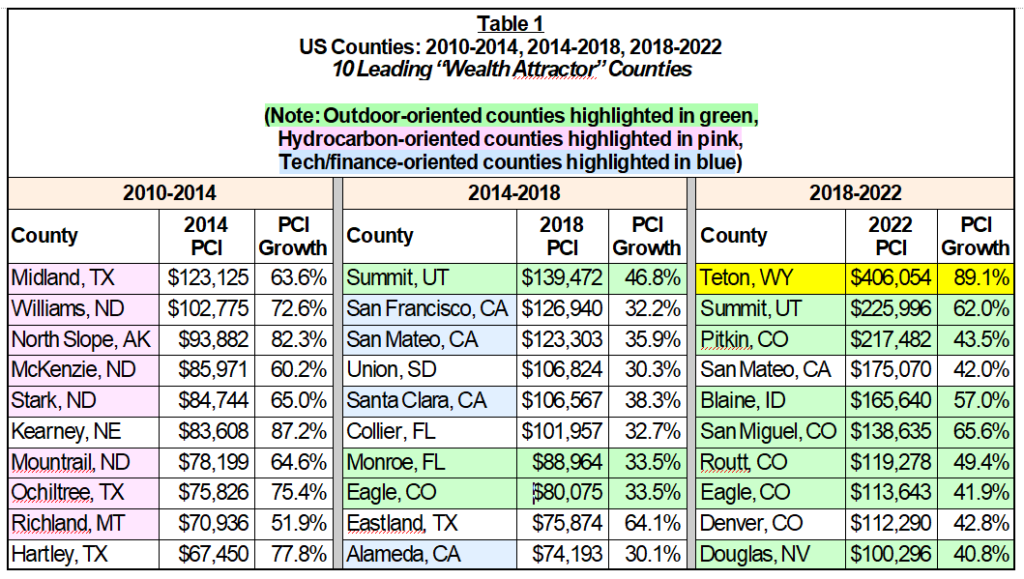

Specifically, according to the US Bureau of Economic Analysis, Teton County has had America’s highest per capita income for 20 consecutive years.

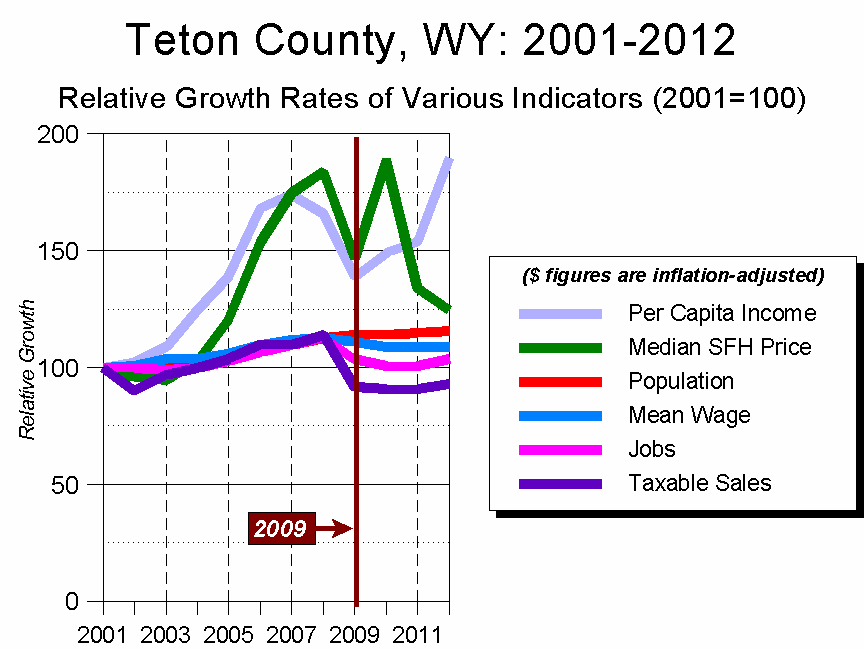

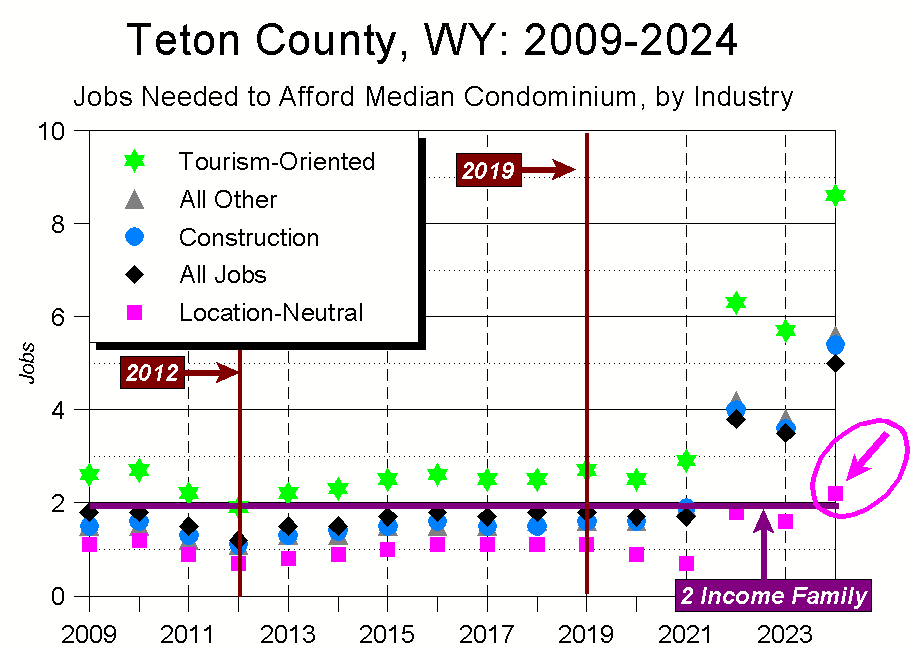

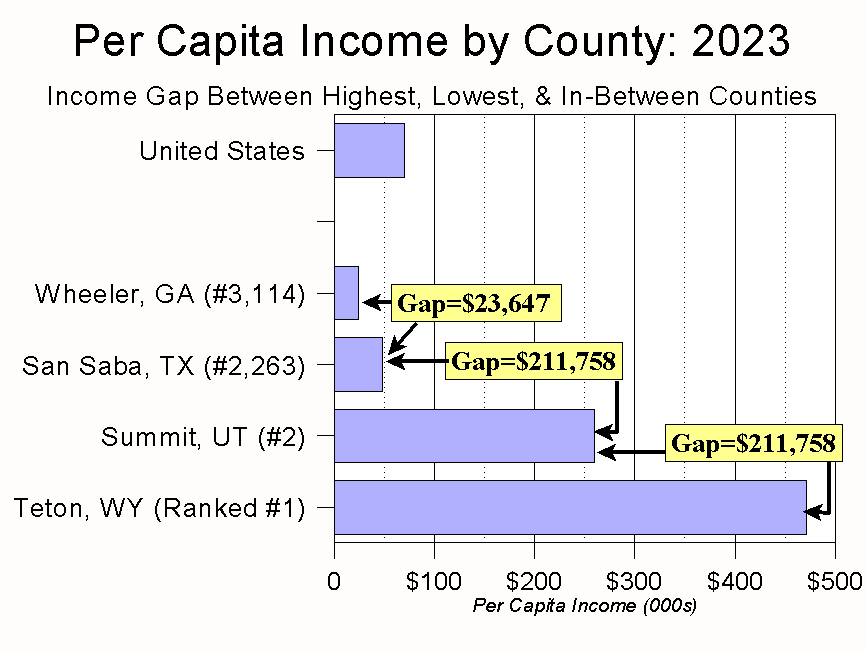

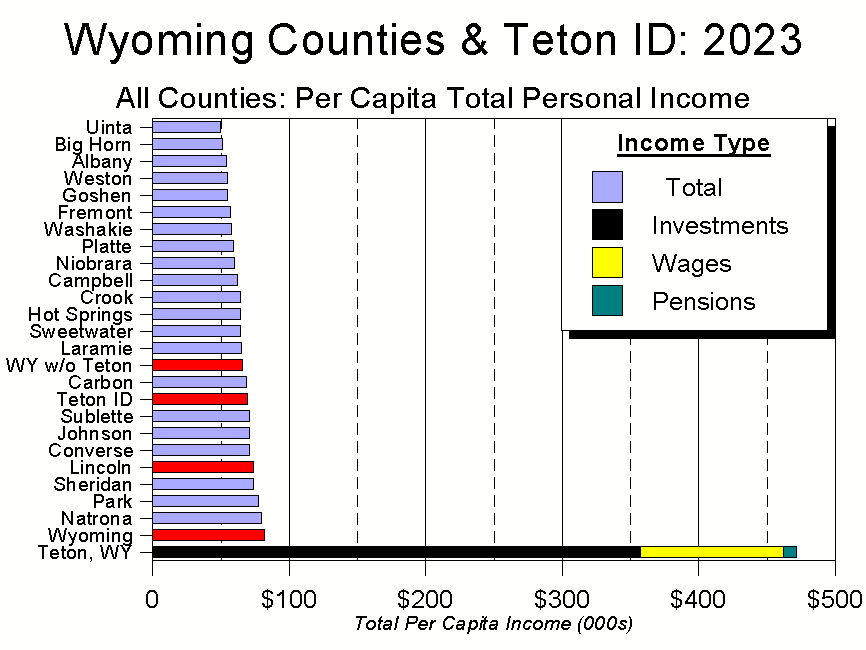

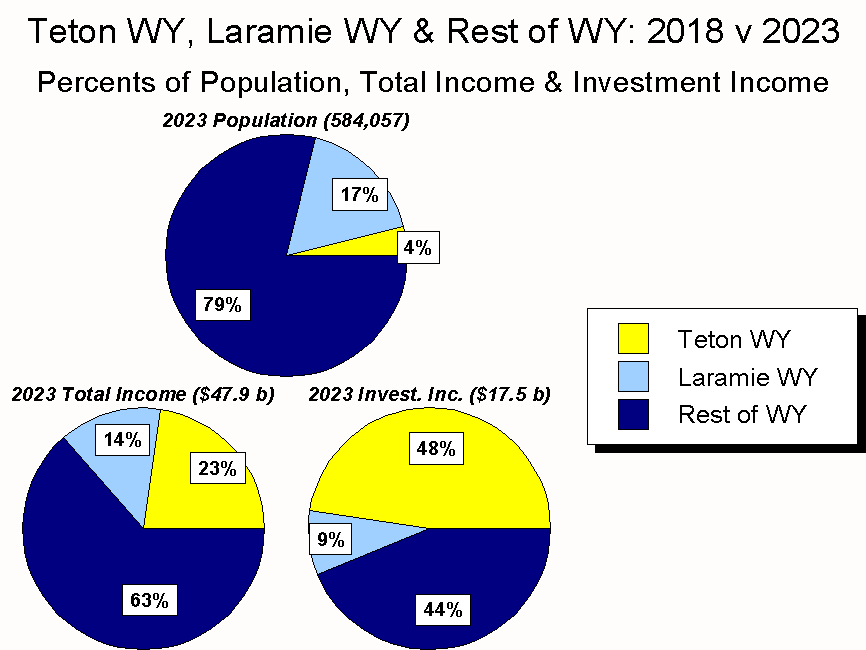

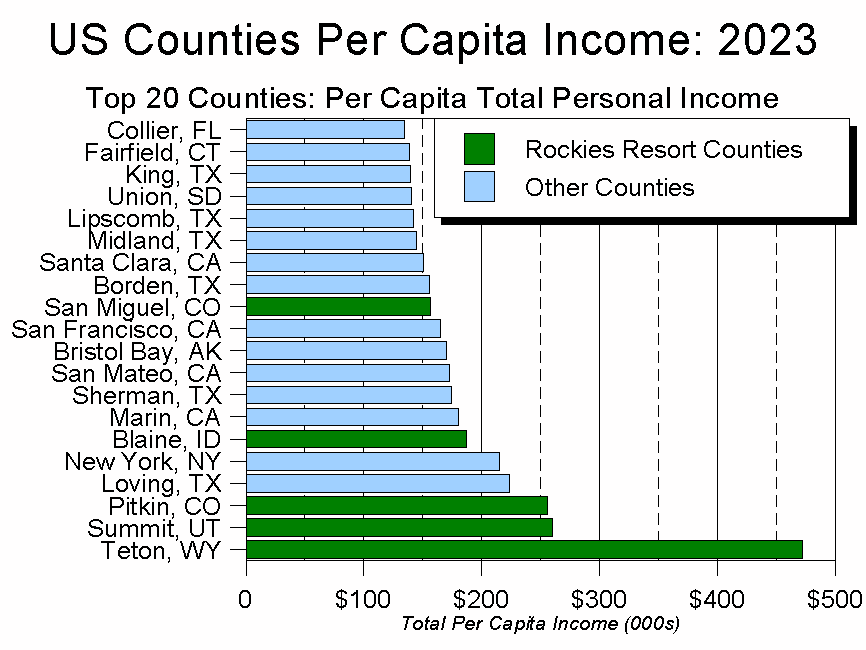

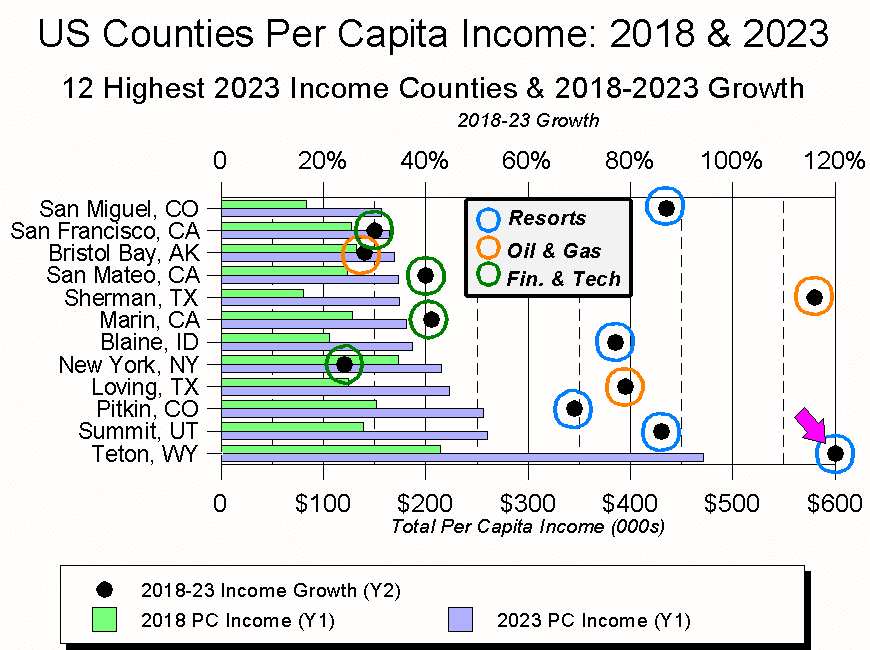

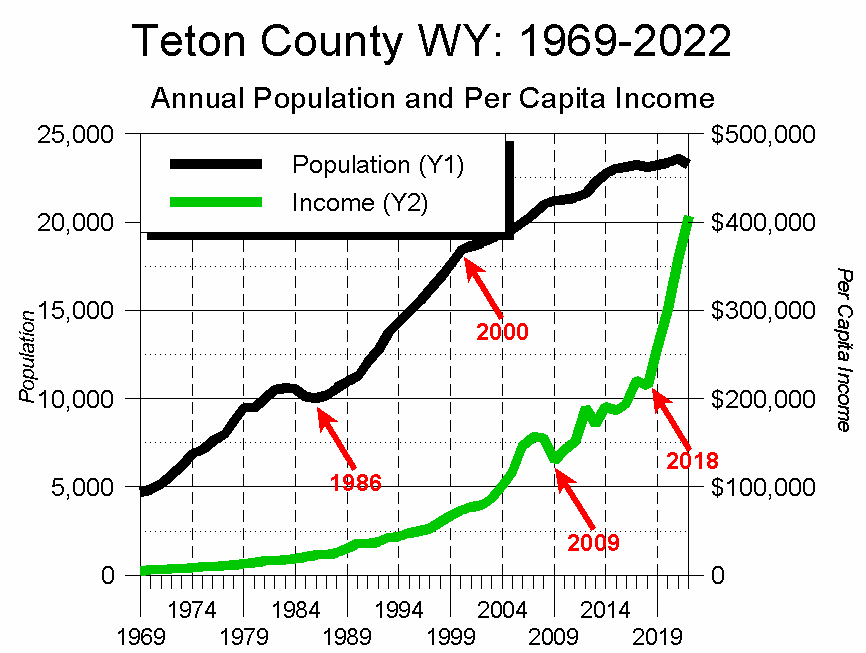

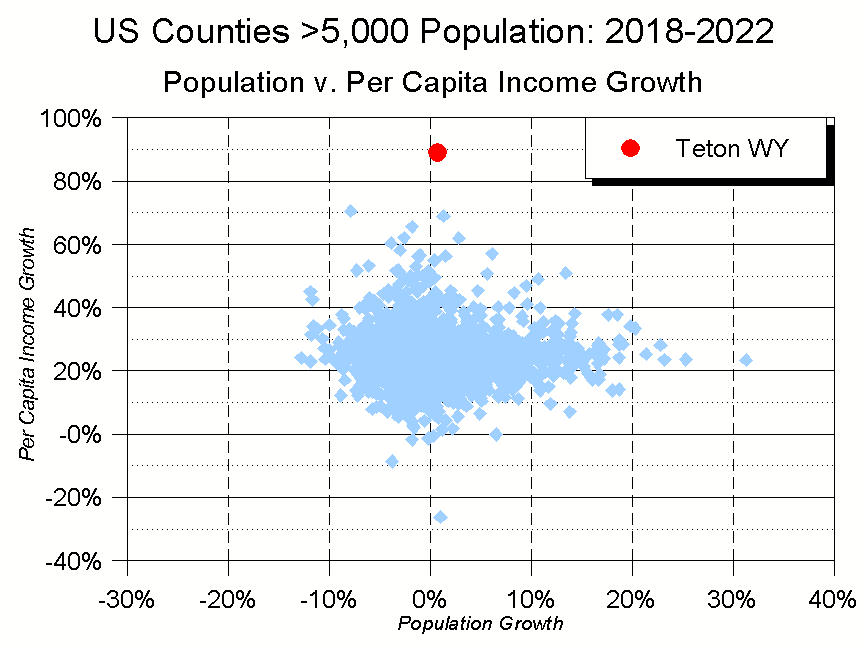

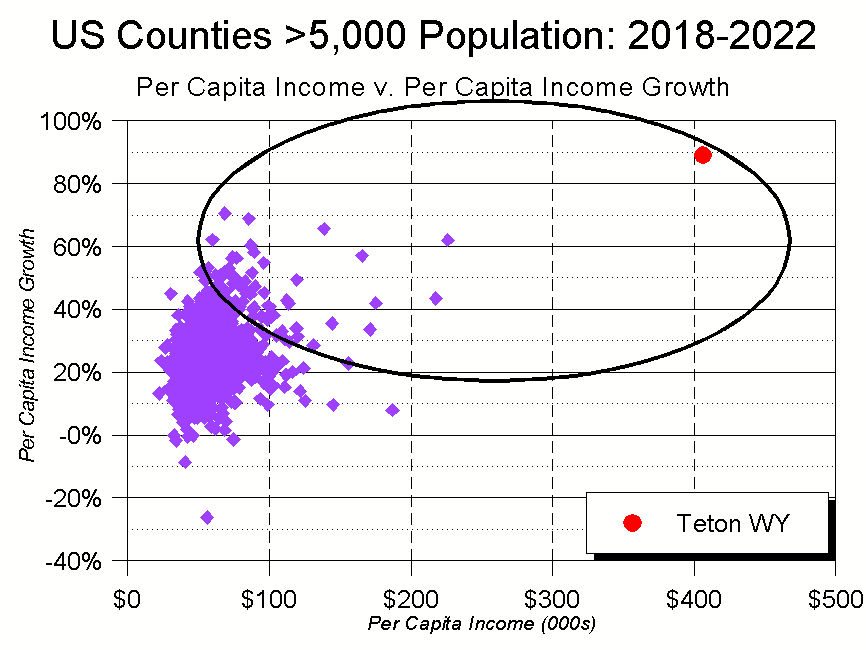

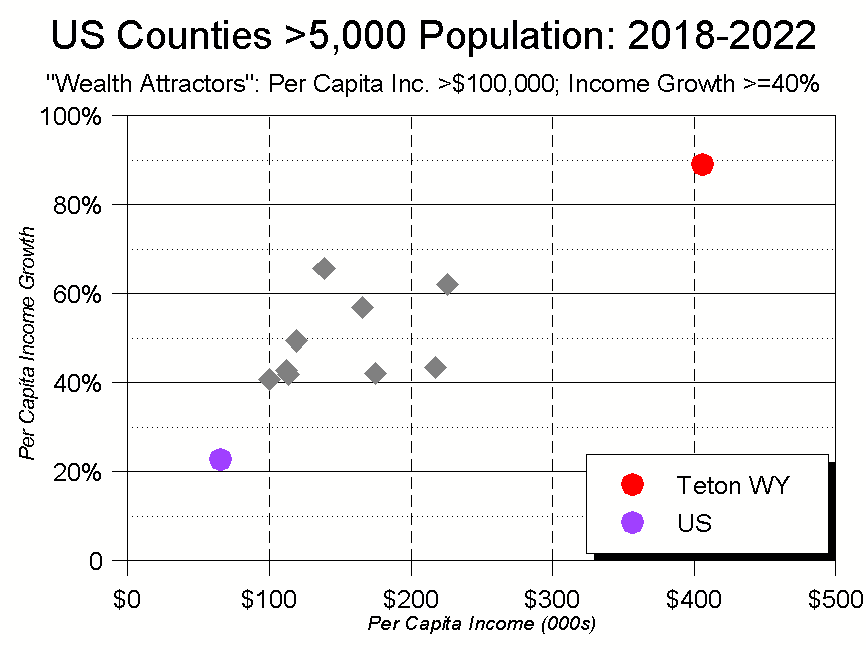

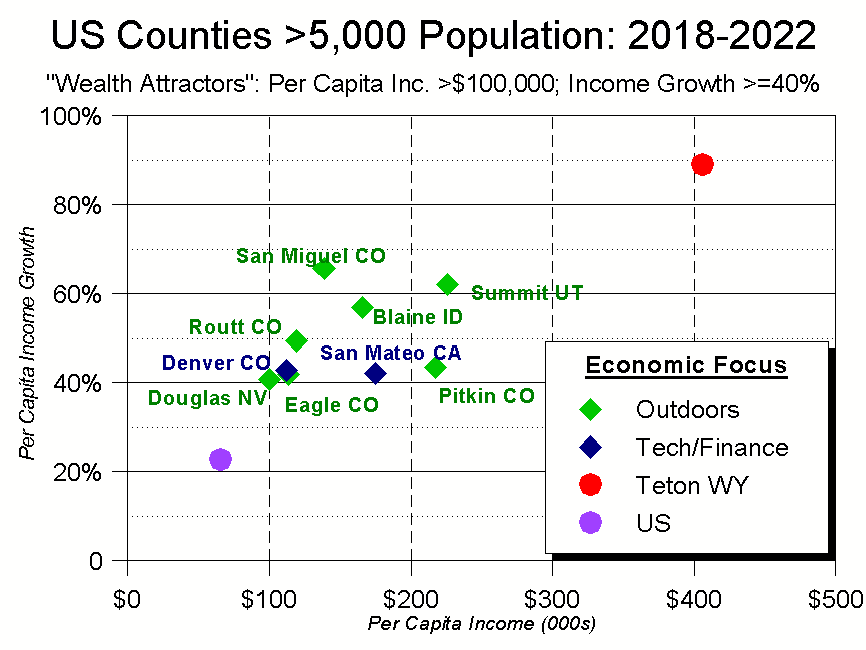

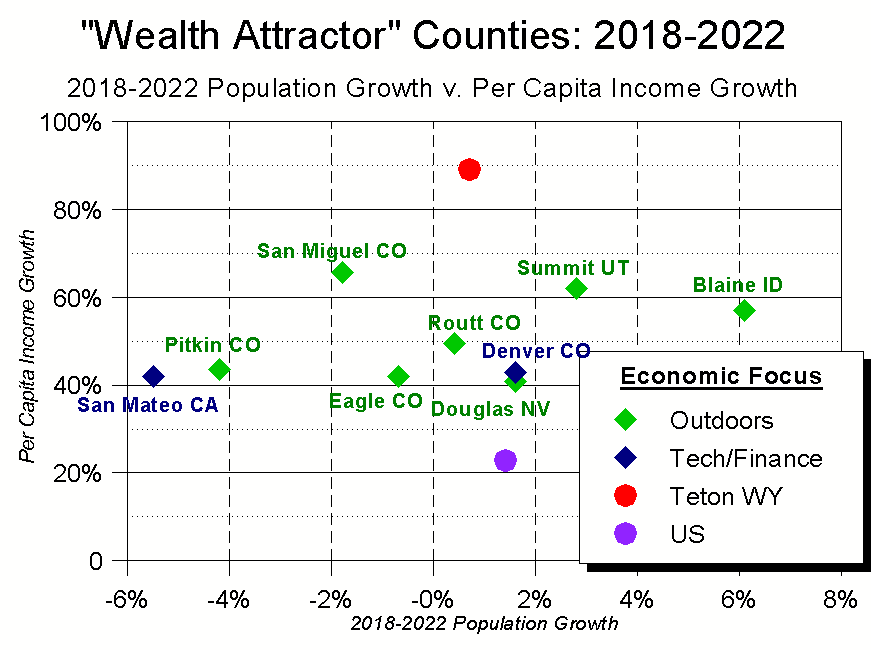

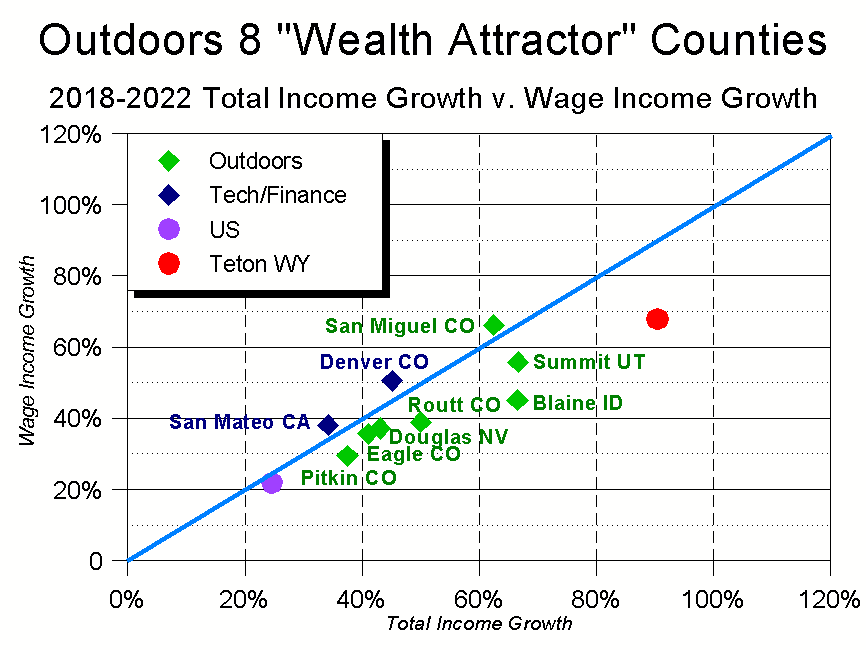

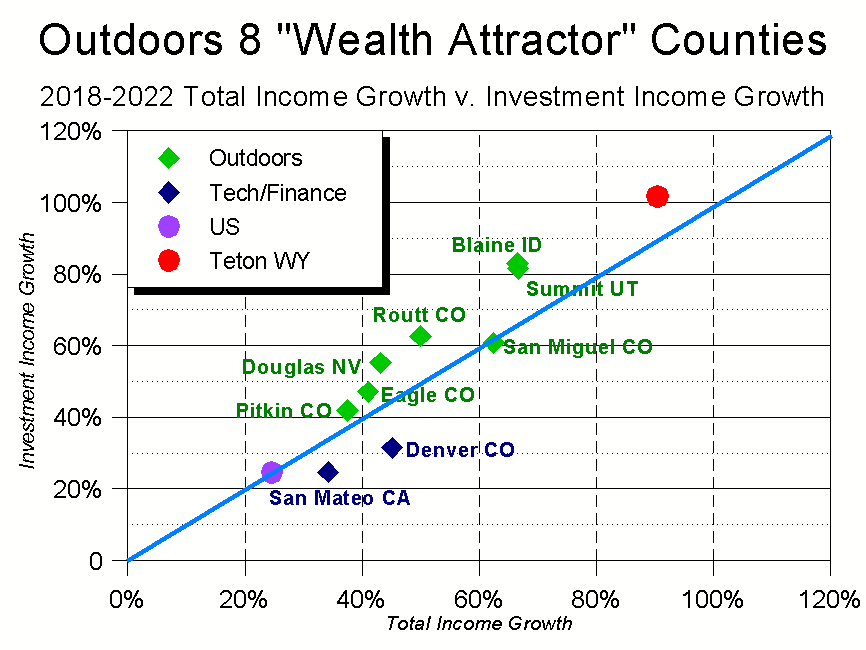

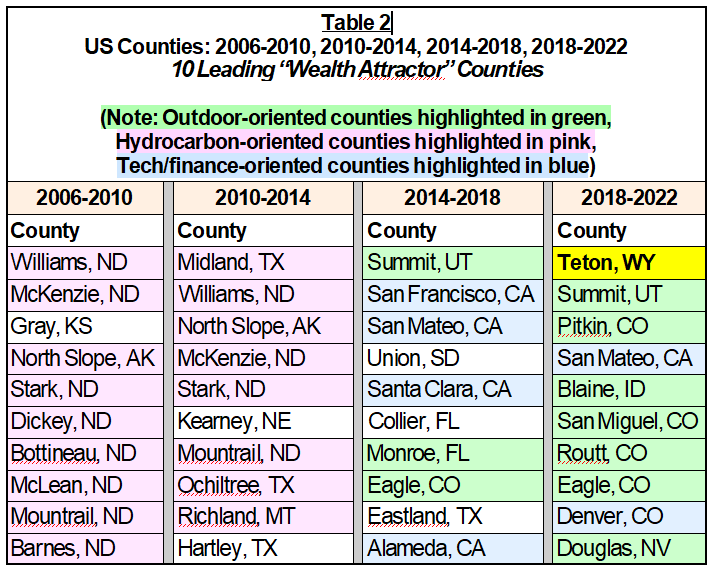

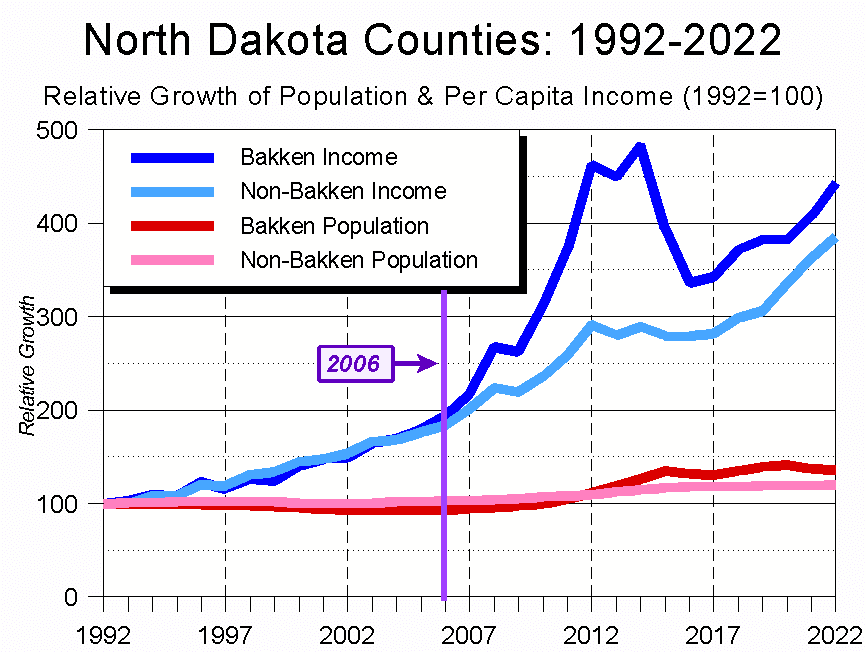

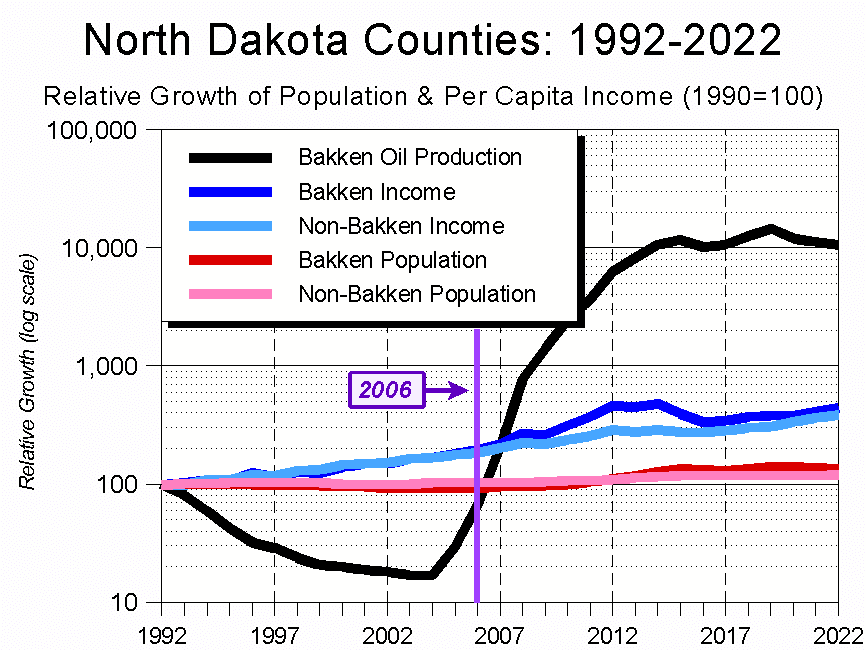

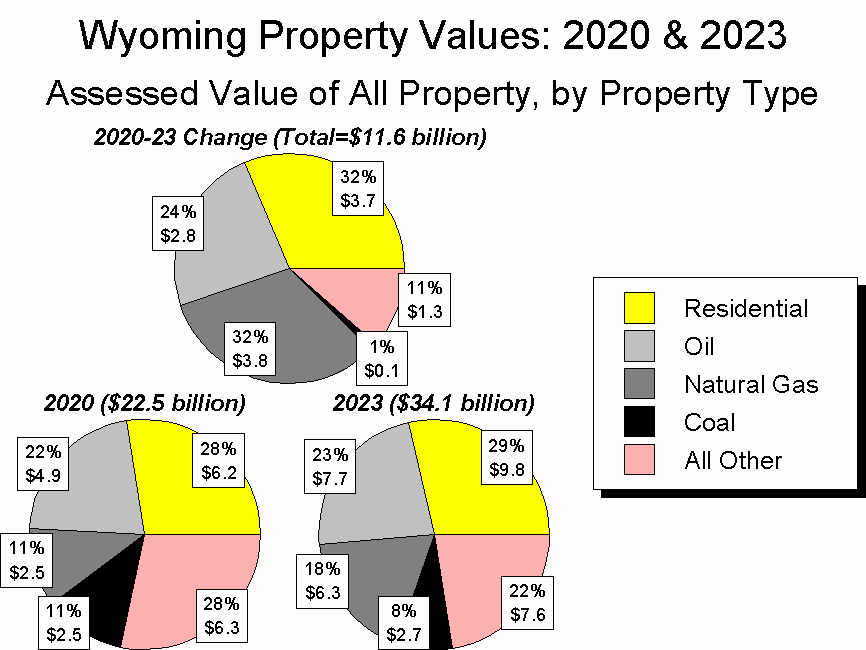

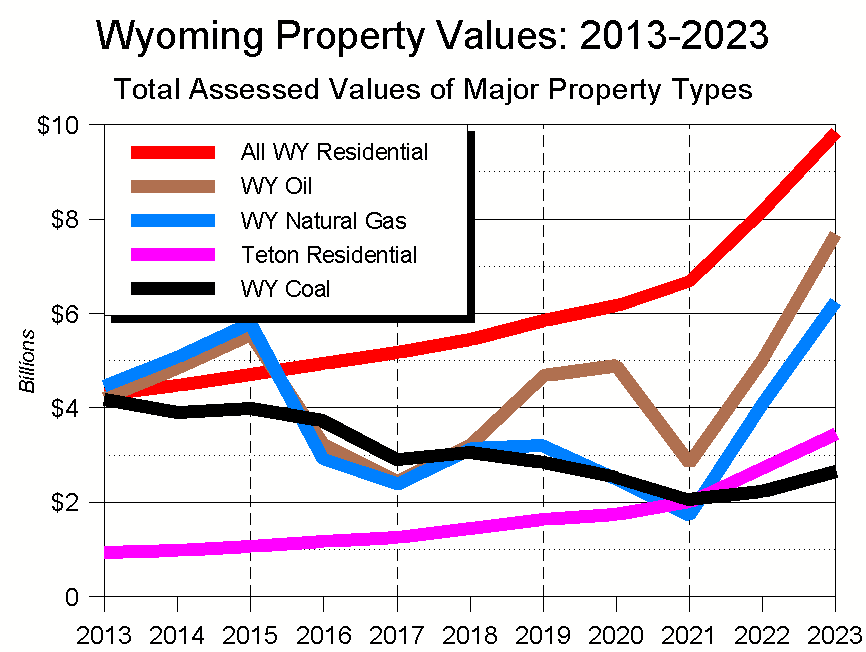

Over those two decades, Teton County’s lead over the rest of the country has markedly grown. In 2004, Teton County’s per capita income was 16% higher than the second-place county’s, and three times higher than the national average. In 2023, the most recent year available, Teton County’s per capita income was 81% higher than the second-place county’s, and nearly seven times higher than the national average. (Figure 1)

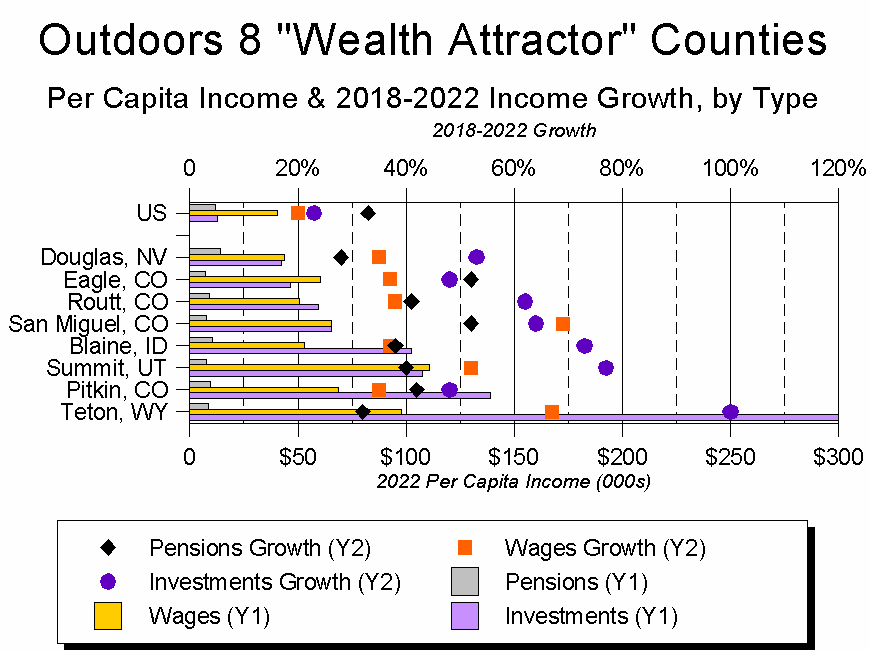

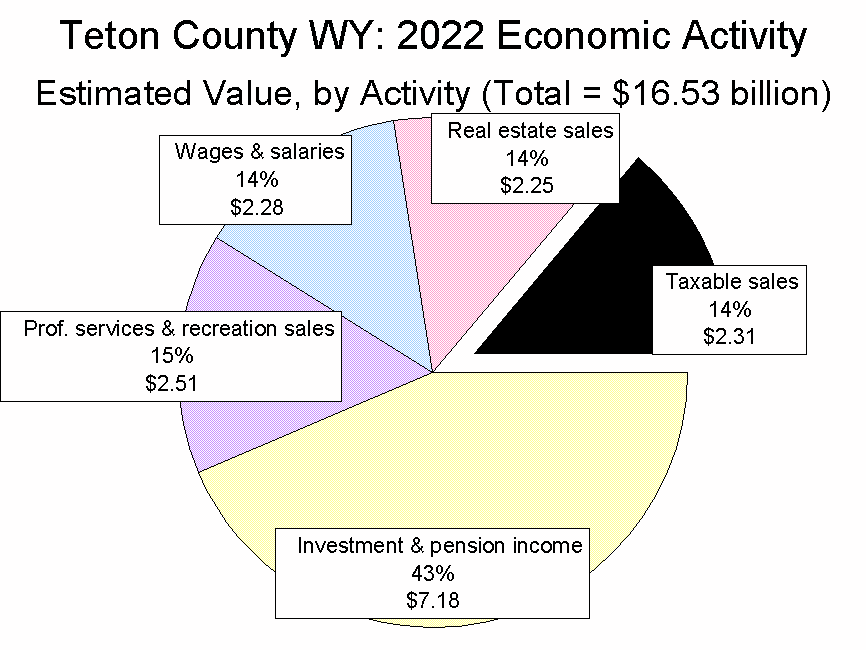

At its core, the BBB is a tax bill. Accordingly, to understand its effects we need to look at tax data, the most recent of which are from 2022. That year, Teton County’s mean per-return income was just north of $500,000 – 53% higher than second-place Pitkin CO (the location of Aspen), and over five times higher than the national average. (Figure 2)

Teton County’s income leads the nation for two reasons: We have a lot of well-to-do residents, and they make a lot of money.

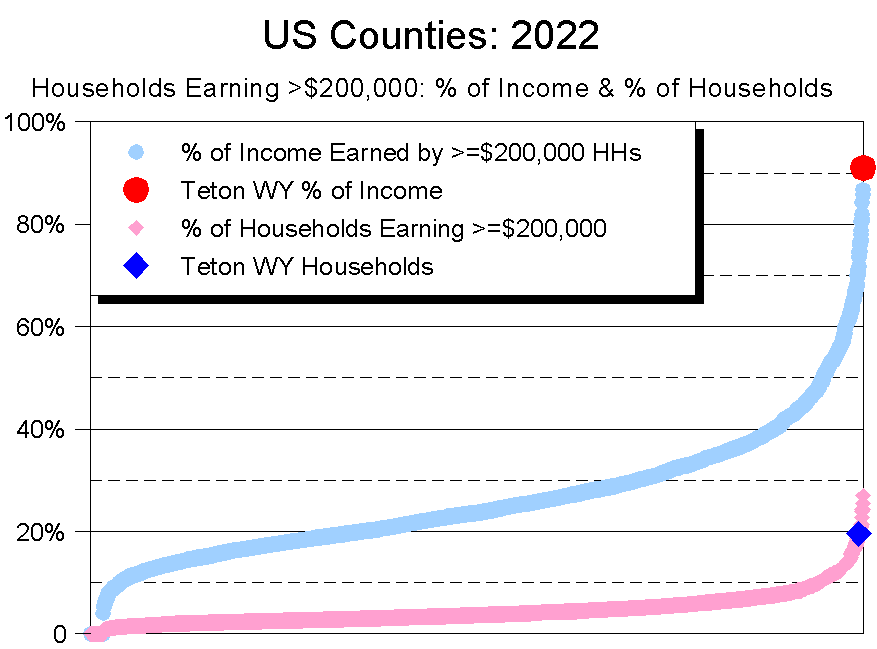

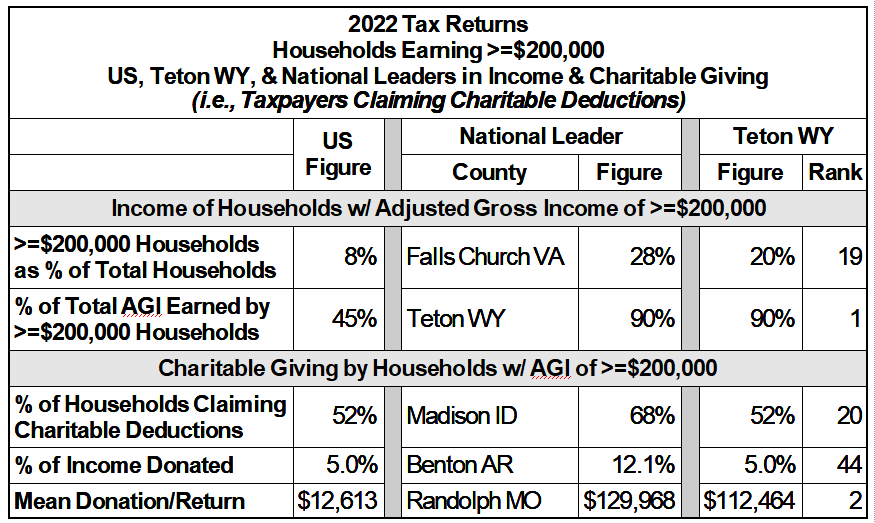

In its data, the IRS reports several categories of Adjusted Gross Income (AGI). At a county level, the highest AGI category is >=$200,000. In 2022, 20% of Teton County’s taxpayers earned >=$200,000, ranking Teton County 19th among the nation’s 3,143 counties. That same year, this same group of residents accounted for 90% of Teton County’s total income. This ranked us first. (Figure 3)

Because of this concentration of income at the highest end, among the households earning >=$200,000/year in 2022, Teton County had the nation’s highest per-return income: $2.27 million. This was 45% higher than second-place Pitkin County, and over four times higher than the national average. (Figure 4).’

For confidentiality reasons, at the county level the IRS combines all tax returns of >=$200,000. At the state and national level, they add three higher categories:

- $200,000-$500,000/year;

- $500,000-$1 million; and

- =$1 million.

Using these categories, I was able to estimate how much of a county’s wealth was earned by people in the highest three income brackets.

Not surprisingly, Teton County’s wealth is concentrated at the highest level. (Figure 5)

Also not surprisingly, the mean income earned by Teton County’s highest-end earners was substantially higher than that earned in any other county. (Figure 6)

Using these figures, I then went on to estimate how the BBB will affect Teton and other counties.

BBB’s Tax Benefits

The BBB’s tax benefits come from a combination of new tax breaks and making permanent 2017’s “temporary” tax cuts. For simplicity’s sake, I’ll refer to all the BBB’s tax-related components as “tax benefits.”

Every credible evaluation of the BBB concludes that, despite the Trump administration’s budget cuts, the BBB’s tax benefits will explode the federal deficit. These same evaluations show the tax benefits disproportionately favor the well-to-do. In my analysis, I use benefit figures provided by one of these evaluators, the Tax Policy Center (TPC).

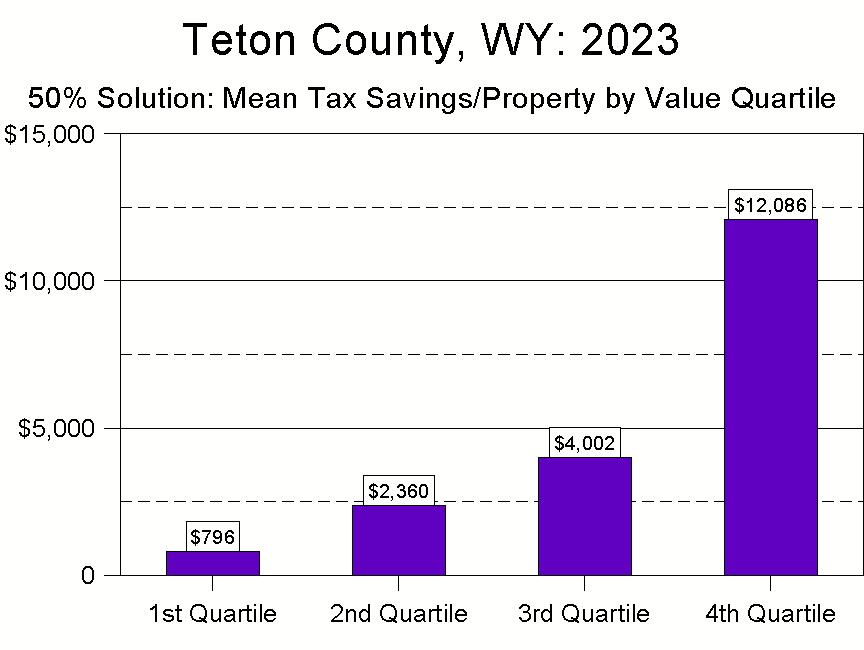

The BBB’s tax benefits will increase taxpayers’ after-tax income between 0.8%-4.4%. Matching the TPC’s figures to IRS income categories, Table 1 shows how much, on average, Teton County’s taxpayers in each category can expect to benefit. (Table 1)

Using 2022 income figures, Teton County’s overall average tax benefit will be $12,831 (Table 1’s light blue box). Among specific income groups, the 8% of Teton County taxpayers with the lowest incomes will see their after-tax income increase $39 (light green box). At other end of the spectrum, the 6% of Teton County taxpayers with incomes of >=$1 million will see their after-tax incomes increase average of $151,624 (light yellow box).

In percentage terms, in 2022 the 6% of Teton County households with incomes of >=$1 million earned 75% of the county’s total income, and will receive 74% of the BBB’s tax benefits.

As noted, for Teton County households earning >=$1 million, the mean per-return tax benefit will be $151,624. To put that figure in local context, $151,624 is more money than ~75% of Teton County’s households earned in 2022.

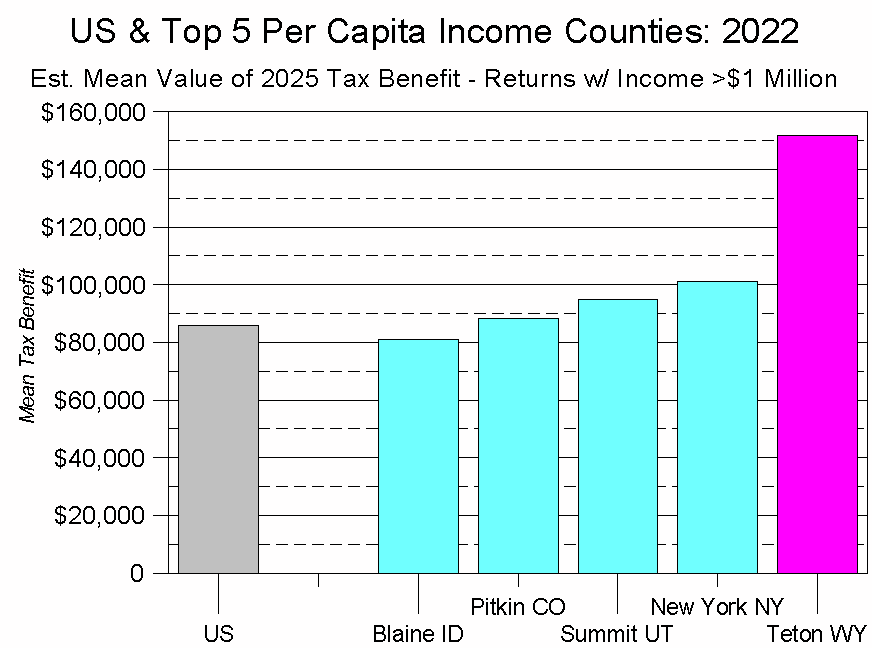

Nationally, $151,624 is 50% higher than the mean tax benefit the highest-end taxpayers in second-place New York City enjoyed, and 77% higher than the national figure. (Figure 7)

Charitable Giving

Along with the nation’s highest per capita income, Teton County also has the nation’s greatest income inequality. As a result, the BBB will both disproportionately benefit some residents of Teton County and disproportionately harm others. In part, this harm will be a result of cutbacks to programs such as Medicaid and Supplemental Nutrition Assistance Program (aka food stamps). Equally concerning are the effects of major cutbacks to the National Park Service, US Forest Service, and other stewards of our public lands. Throw in reductions in the grant money and other federal assistance – direct and indirect – that comes into the region and, for all its wealth, the greater Jackson Hole community will face an increasingly difficult time over the next few years.

Which leads us to non-profits and charitable giving. If government will be cutting back on its services, and if the private sector wasn’t providing those services in the first place, then either the non-profit sector will pick up the slack, or the work won’t get done.

To fund that additional work, non-profits must look to charitable donations.

Unfortunately, IRS data don’t allow me to estimate how much the three higher-end income brackets deduct in charitable giving. As a result, all of the charitable giving analysis is based on the larger, less-precise grouping of those making >=$200,000.

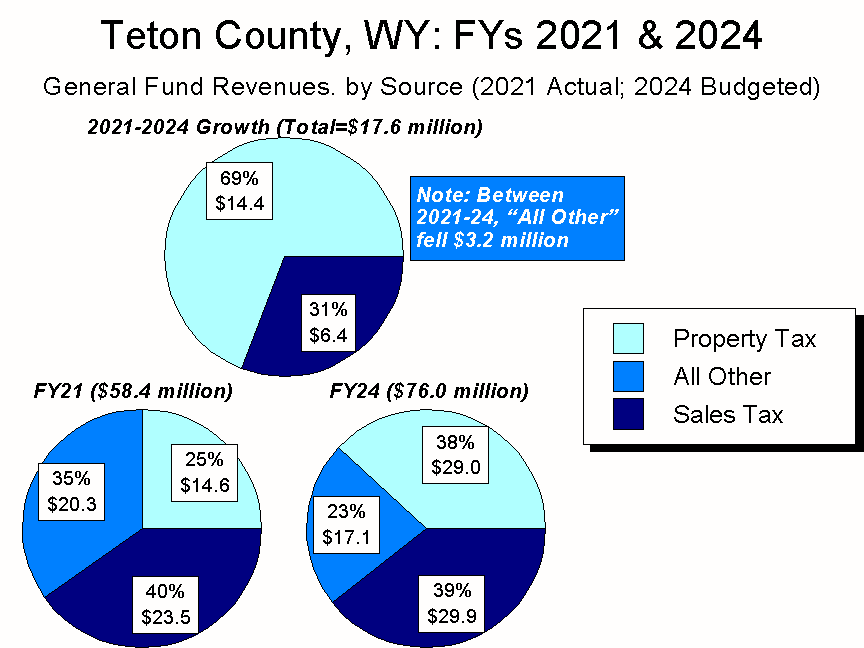

In Teton County, taxpayers earning >=$200,000 annually account for 90% of residents’ total income. They also account for 99% of the charitable deductions claimed for tax purposes.

Between 2010-2022, the total annual charitable deductions claimed by Teton County residents on their income tax returns varied between $124 million and $983 million. In any given year, this represented between 4.2% and 11.6% of wealthier residents’ total AGI.

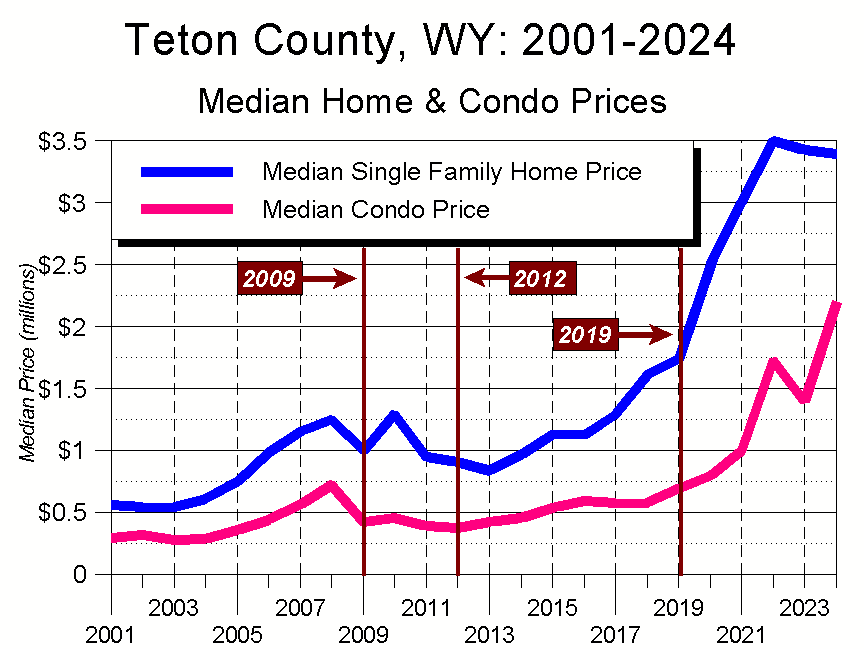

On a per-return basis, during this same stretch these same Teton County residents enjoyed mean annual incomes ranging between $1.6-$3.4 million. Their mean annual charitable giving ranged from $94,000-$319,000. (Figure 8)

Because any one year’s figures can vary, it’s helpful to look at income and giving patterns over time. Between 2018-2022, the charitable deductions claimed by Teton County’s high earners averaged $191,233/year. This led the nation, and was 19% higher than the second-place county’s figure. It was also 13 times higher than the national average.

Which raises an interesting question: How do you define generosity?

Year in and year out, Teton County’s highest earners tend to lead the nation in the amount they donate each year. However, they have never led the nation in the percentage of their income they donate. For example, in 2022 Teton County ranked second nationally in the amount donated per-return ($112,464), but only 44th in percentage of total income donated (5.0%). (Figure 9)

Taking a longer-term look, between 2018-2023, Teton County’s high-end residents’ charitable deductions claims averaged 8.3% of their income. Over that same time, the county with the highest average deduction – Benton AR – donated an average of 14.5%.

Which raises another interesting question: What if Teton County were to donate the same percentage each year as the national leader? In particular, what if, in 2022, instead of donating 5.0% of their total income, Teton County’s highest earners had matched Benton AR and donated 12.1% of their AGI?

To state the obvious, they would have given more. A lot more. $483 million more. Had that occurred, it would have raised Teton County’s total charitable giving deductions from the actual $344 million to $827 million.

Let’s create a name for what Teton County could give were it donating a nation-leading percentage of its income: the county’s “philanthropic capacity.” And let’s create another for the gap between what Teton County actually gives and its philanthropic capacity: “additional philanthropic potential.” In 2022, Teton County’s philanthropic capacity was $827 million, and its additional philanthropic potential was $482 million. Given that Jackson Hole is a lot wealthier today than it was three years ago, Teton County’s current philanthropic capacity is likely north of $1 billion, and its additional philanthropic potential well north of $500 million.

Summary and Comment

Reflecting on this analysis, four sets of figures seem worth summarizing, leading to three questions.

Four Figures

Figure Set 1: Local income

In 2022, 6% of Teton County’s taxpayers earned $1 million or more. Collectively, they earned 74% of the county’s total income.

Another 7% of Teton County’s taxpayers earned between $500,000-$1 million. Collectively, this group earned 13% of residents’ total income.

The remaining 87% of the county’s residents earned under $500,000. Collectively, they earned 13% of residents’ total income.

Since 2022, these figures have probably become more extreme. Even if they haven’t, Teton County still has both the nation’s highest per capita income and its greatest income inequality.

Figure Set 2: The BBB’s Tax Benefits

Had the BBB been in effect in 2022, the 6% of Teton County households earning at least $1 million would have enjoyed tax benefits averaging around $150,000. That $150,000 would have been more than the total income earned by around 75% of Teton County households.

The 75% of Teton County households earning <$150,000 would have, on average, received a tax benefit of around $1,000, or 0.7% that received by the county’s wealthier residents.

Of course the tax benefits gap doesn’t tell the whole story. That’s because the folks living in households making <$150,000/year are more likely to need the services being cut back.

Figure Set 3: Actual Charitable Giving

Table 2 summarizes Teton County’s key charitable giving data. While figures vary annually, in most years Teton County leads the nation in its per-return charitable giving. In those years it doesn’t lead, it’s among the top handful.

Teton County does not rank as high, though, in either the proportion of income it donates, nor the proportion of households claiming charitable deductions.

Nationwide, only one other county comes close to matching Teton County’s largesse: Benton County, Arkansas, the home of WalMart. Benton County is much more populous than Teton County, and its residents donate a much higher percentage of their AGI: Between 2018-2022, Benton County’s nation-leading average donation each year was 14.5% of total income, while Teton County’s was 8.3%.

Figure Set 4: Potential Charitable Giving

Between 2018-2022, Teton County’s highest-end taxpayers claimed a total of $2.47 billion in charitable deductions, an average of $492 million/year. This represented 8.3% of the high-end taxpayers’ total AGI.

If Teton County’s highest-end taxpayers had donated the same percentage of their income each year as the nation’s leading county (in most years Benton AR) they would have donated an average of $925 million/year, 88% more. (Figure 10)

Over the five year period, this would have produced an additional $432 million/year in average charitable deductions.

This $432 million/year was Jackson Hole’s additional philanthropic potential for 2018-2022. Because Teton County’s collective income has risen since 2022, Teton County’s current additional philanthropic potential is likely higher – at least another $500 million each year.

Should Teton County residents donate more to charitable causes, much of it would no doubt go to organizations outside of Teton County. Even a portion of that extra spending, though, would be a godsend for those local non-profits whose funding models have been turned inside out by the chaos of the last six months.

Three Questions

Question 1: What Is Fair?

Under the BBB, Teton County’s well-to-households will receive tax benefits averaging more than the entire income of 75% of Teton County households. Is this fair?

Those who argue “yes” can point to two pieces of data.

One is that, on a percentage basis, those paying the most are getting back about the same amount they earned. (Figure 11)

The other, similar piece of data is that, again on a percentage basis, all income brackets will enjoy tax benefits roughly proportional to the amount they earned. (Figure 12, which is presented logarithmically because that scale more clearly shows percentages.)

Others have a different, more visceral take on fairness. To them, the BBB’s tax benefits are anything but fair.

These folks would point to Figure 13, which presents the same data as Figure 12 but uses a linear scale. On this graph, the fact that the tax benefit figures for most income brackets don’t even register on the graph is all the evidence they need of the measure’s imbalance.

Beyond the tax benefits, critics also point to how people at the lower end of the income scale are those most vulnerable to the cuts being made. That, too, would factor into their definition of “fair.”

Question 2: What Is The Proper Role Of Government?

While Teton County clearly has the capacity to help offset a lot of the local effects of the BBB, DOGE, and other whacks at federal and state budgets, it’s not clear whether it should.

Why? For two reasons.

The first flows from a philosophical concern: What should government fund?

In particular, suppose you’re someone who feels government should fund healthcare, nutrition, public lands, scientific research, and a host of other programs. And then suppose large donors step in to fill the gap left by the BBB, DOGE, and the like. Given this, how will you respond to those who favor less government when they say something like: “I told you so! Government doesn’t need to fund that park/forest/health clinic/education program/you name it, because others will step up to do it”?

It’s a compelling argument, and will likely affect government spending decisions far into the future – especially when Washington is finally forced to address the national debt.

The other consideration is that while local fundraising might work for a year or three, there’s no guarantee it will last. If donors’ interests wander or donor fatigue sets in, the results might not be pretty.

Question 3: What Is Community, And Who Is Responsible For It?

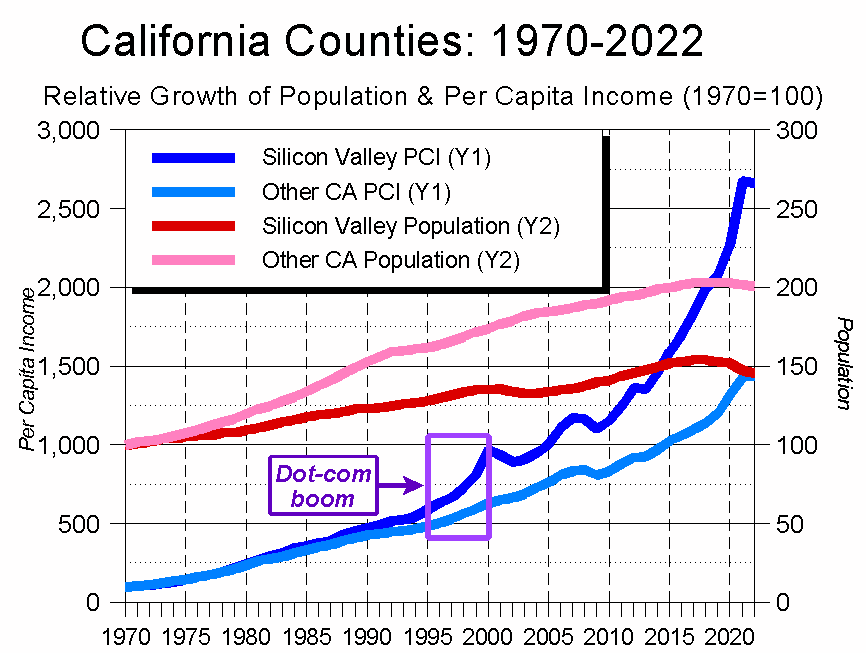

When Lord Bryce gave his talk 116 years ago, California’s population was around 2 million people. Today, it’s over 15 times that. Within a decade or two of his speech, California’s valuation had grown five-fold, and today its wealth is greater than that of most countries.

Whether its people are any happier is an open question.

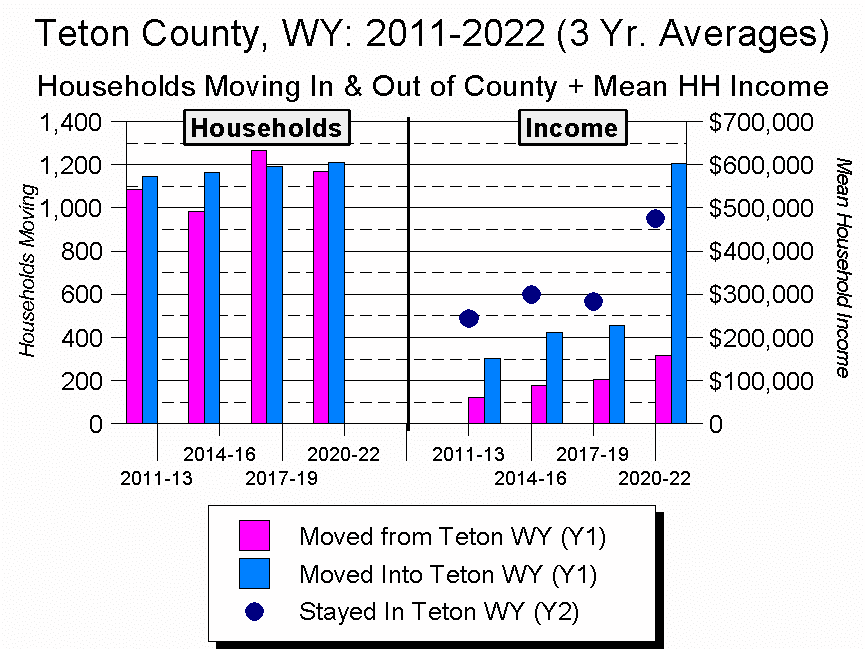

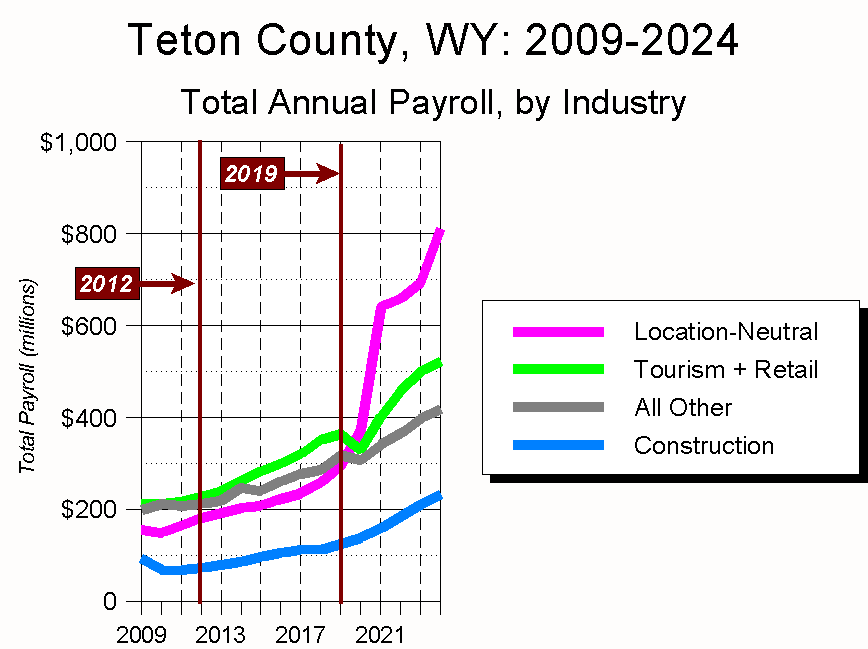

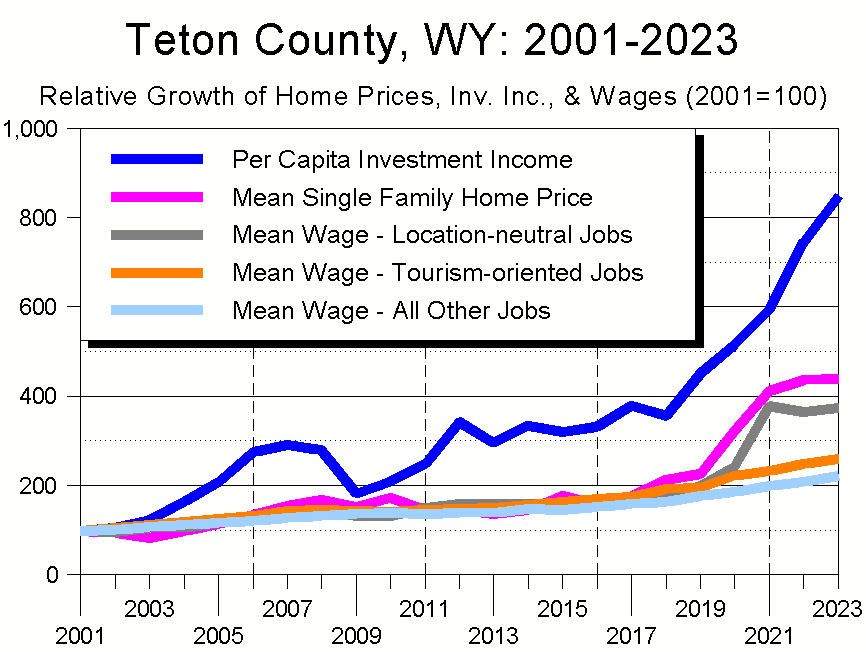

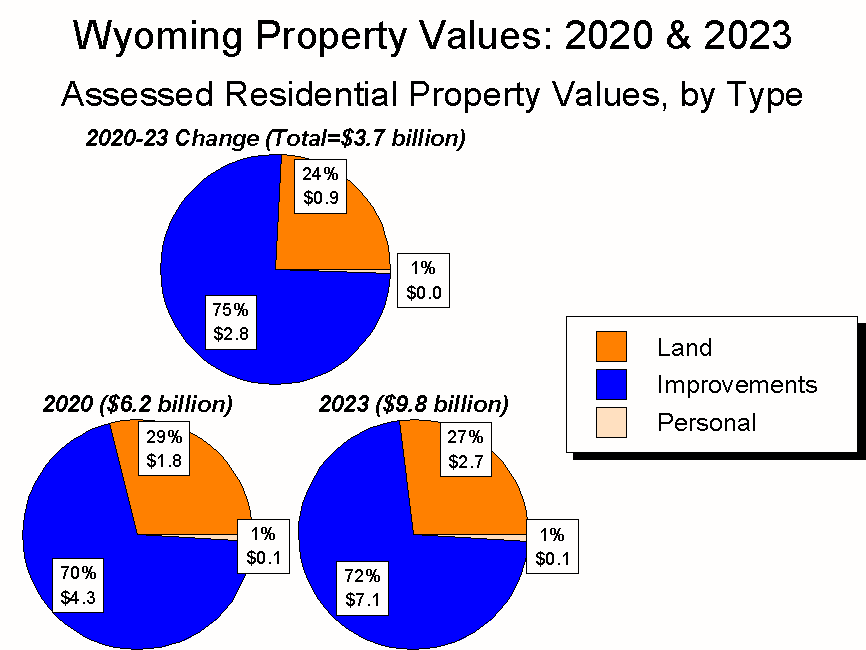

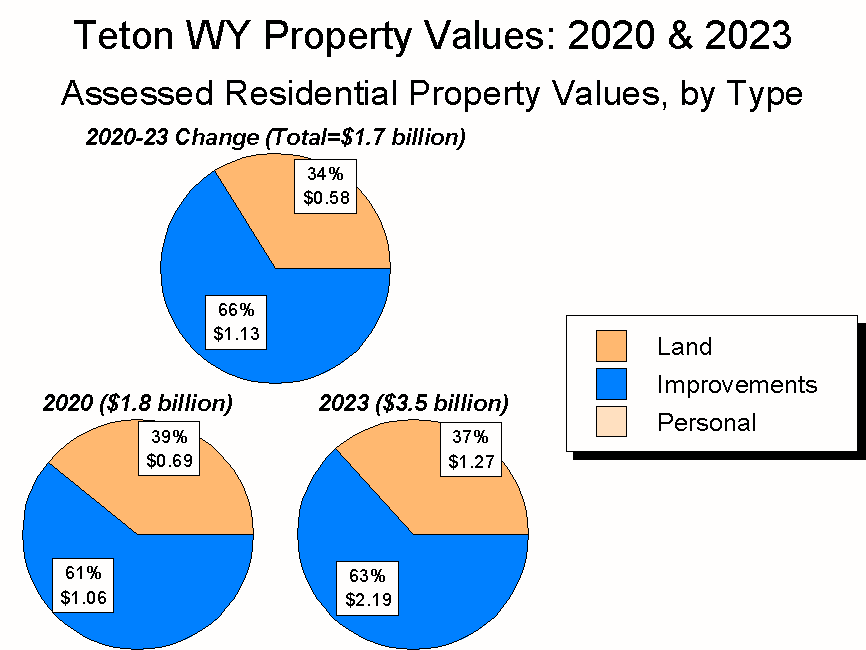

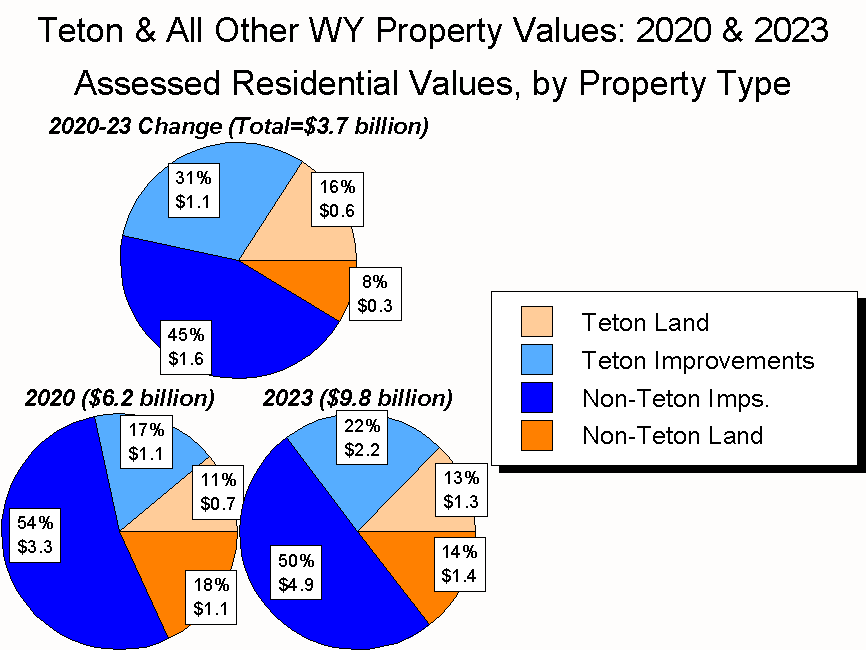

Jackson Hole, too, has boomed, albeit far more recently. In the last five years, while our population has stayed flat, residents’ combined income has more-than-doubled. Ditto property values. Yet as with California, whether our people are any happier is an open question.

As Lord Bryce’s remarks suggest, for well over a century we’ve equated material wealth with both happiness and quality of life. Yet as a public opinion survey I conducted in 2023 made clear, even as the Tetons region becomes wealthier, few residents think things are getting better. And they’re certainly not happier.

All of this informs conversations I’ve been having around a simple yet vexing question: “What are Jackson Hole’s values? What does it mean to be part of this community, and how do newcomers learn what that is?”

There is, of course, no clear answer. One thing is clear, though: The methods we’ve had for transmitting our values are getting overwhelmed by the region’s growth and change.

This reality is shaping how I view the BBB’s benefits and our charitable giving. As the wealthiest county in the wealthiest country in the history of the world, our more well-to-do residents are going to disproportionately benefit from the BBB. So we’re about to become wealthier still.

Yet as Lord Bryce observed: “The day will, after all, have only twenty-four hours. Each man will have only one mouth, one pair of ears, and one pair of eyes…and the real question will not be about making more wealth or having more people, but whether the people will then be happier.”

It’s also likely that, because of our nation-leading income inequality, our less well-to-do residents will disproportionately suffer from the BBB and related budget-slashing efforts. Which, of course, takes us into the realm of philanthropy and philanthropic potential.

In Teton County, 20% of households provide 99% of the charitable donations. At least if you define “charitable donations” narrowly.

As evidenced by Old Bill’s, though, each year thousands of Jackson Hole residents give what they can. For many of these folks, the tax implications are irrelevant – they give because it’s the right thing to do.

You know what’s really cool, though? The thousands of people who donate their time, and the hundreds of thousands of volunteer hours they put it. Thanks to those efforts, events go on, lives are saved, and institutions are able to function.

To me, this give-what-you-can ethos has long been a core Jackson Hole value. Yet arguably that core value is under grave threat: Charitable giving is growing more slowly than incomes, and volunteerism seems to be lagging.

So what to do? Unfortunately I don’t have a clear answer. What I am certain of, though, is this.

Life in Jackson Hole is an embarrassment of riches. In return for enjoying the region’s bounty, though, those of us lucky enough to live here have a stewardship obligation – an obligation to both past and future generations – to leave this place better than we found it.

For much of Jackson Hole’s history, being a good steward has been relatively easy. The valley’s isolation was so great and the land so bountiful that people could use the region’s resources without giving them much mind. Over the past couple of decades, though, changes in technology, the economy, transportation, values, and mores have rapidly increased the pressure on both the land and the community.

As a result, we no longer have the luxury of taking a leisurely approach to either stewardship or transmitting our culture and values. Instead, we need to develop “active stewardship.” We need to create plans and actions for assessing how well our region is faring, what stewardship steps need to be taken, and how we can ensure that future generations understand that if you really want to be part of Jackson Hole, you need to give more than you take.

Without active stewardship, it’s likely – if not inevitable – that the qualities we so cherish will be overwhelmed by the extraordinary socio-economic forces sweeping over the region, nation, and planet. That’s not a future I want, so my next great effort will be to figure out just what it means to be an active steward. If you’d like to join me, I’d welcome the company.