A Solid 2020 in Store

As we go roaring into 2020, what might the year hold for Jackson Hole’s economy?

I’ve got some ideas, but first it’s important to share a depressing reality: We don’t understand our economy very well, and certainly don’t measure it fully. Not even close.

What we know; what we don’t know

Economics may be the dismal science, but what the heck, let’s start with a joke.

A man walks out of a bar late one night. The block is dark save for one lamppost in the middle of the block. Underneath the lamppost is a guy on all fours – very clearly drunk and very clearly searching the ground for something.

After watching for a while, the guy says to the drunk: “What are you doing?”

“Looking for my keys” replies the drunk.

“Want some help?”

“Sure.”

So now two of them are looking, but after a few futile minutes the guy says to the drunk: “I don’t see your keys anywhere. Where did you drop them?”

The drunk looks up, points to the end of the block, and says “Down by the corner.”

“So why are you looking here?” asks the guy.

“Because the light’s better,” replies the drunk.

And that is the essence of why Teton County does a lousy job understanding and measuring its economy.

What we measure, and why

Wyoming is the most politically conservative of the 50 states, but in a very libertarian way: Generally speaking, Wyoming residents want as little government involvement in their lives as possible.

This libertarian streak plays out in a number of ways, most notably in how Wyoming funds state and local government – basically we rely on taxing stuff we dig out of the ground and buy at the mercantile. Property taxes are relatively light, and it’s a point of pride that the state has no income tax. Also important to this conversation is that one way we keep government out of our lives is by not measuring much of what goes on within our borders.

Critically, one thing Wyoming does measure is taxable sales. Why? Because especially for local government, sales taxes pay a lot of our bills.

Over-simplifying, Wyoming charges sales tax on those items that were important to the state’s economy when our governmental funding mechanism was established in the mid-20th century, most notably consumer goods, hotel rooms, and food and drink sold at restaurants. And because sales taxes are critically important to local government, the state requires them to be remitted monthly, then dutifully records and reports them.

Here in Teton County, no other economic metric is reported as frequently or accurately as sales taxes. Hence, because it’s the measurement we have at hand – the one streetlight on the block, if you will – we equate it with our economic health.

Which, at best, gives us a profoundly incomplete picture of our economy.

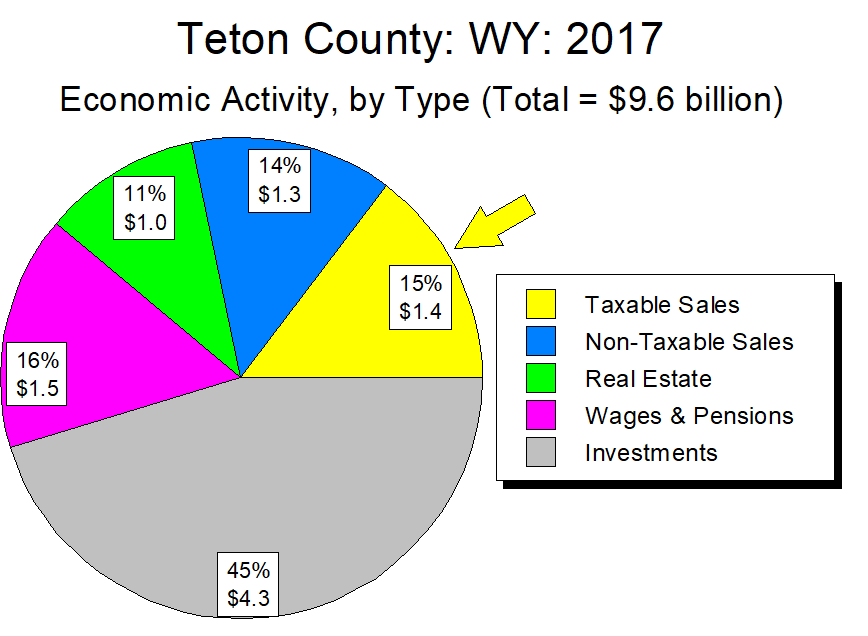

A complete assessment of Teton County’s economic activity would measure not just taxable sales, but all of the community’s other untaxed economic activities. These include non-taxable sales (e.g., professional services and recreational activities) and of course our untaxed income (wages, pensions, and investments). Add these into the mix, and in the most recent data year, taxable sales accounted for around 15 percent of Teton County’s total economic activity.(Figure 1)

Because it’s the only thing we measure on a regular basis, we equate taxable sales with our entire economy. But as with the drunk under the lamppost, in the absence of any other frequent and reliable metrics, we turn to these data even if they illuminate the wrong thing.

Sales taxes in Teton County

Despite this fundamental problem, taxable sales measurements have three things going for them.

First, as noted, they are reported every month.

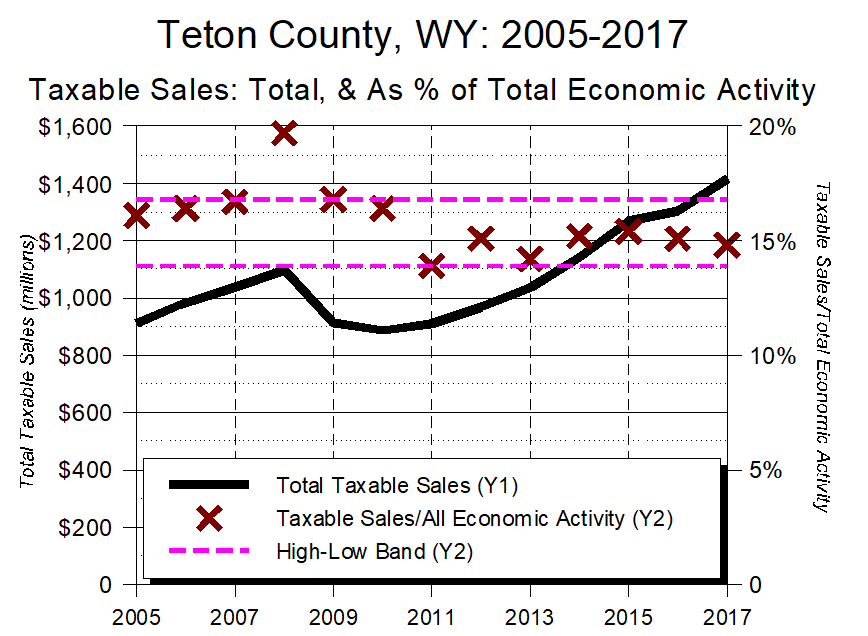

Second, they seem to account for a relatively stable proportion of Jackson Hole’s overall economic activity: As Figure 2 suggests, especially since coming out of the recession, taxable sales have regularly accounted for 14-15 percent of all local economic activity. So while taxable sales data don’t give us a complete sense of what’s going on in our economy, at least they seem to give us a general sense of trends – if taxes are up X percent, the rest of the economy is likely up by a similar amount.

Third, sales taxes generate a lot of money for our state and local governments.

For every $100 of taxable sales made in Jackson Hole, the state of Wyoming gets $2.77 in general sales tax revenue, Teton County gets $1.23, and the Town of Jackson gets $1.00. Multiply that by the $1.63 billion worth of taxable goods sold in Teton County in 2019, and the state received roughly $44.9 million, the county around $20.0 million, and the town around $16.3 million.

Because the Town of Jackson doesn’t levy a property tax, sales-related tax revenues are especially important to the town, accounting for around 75 percent of its FY 2020 general operating funds. For the county, which does levy a property tax, the figure is closer to 50 percent.

Statewide, in FY 2019 Wyoming’s basic four percent sales tax generated around $768 million for the state’s general fund. Which gives us 768 million reasons why the state counts and reports sales taxes every month.

Sales taxes in Jackson Hole: A look back

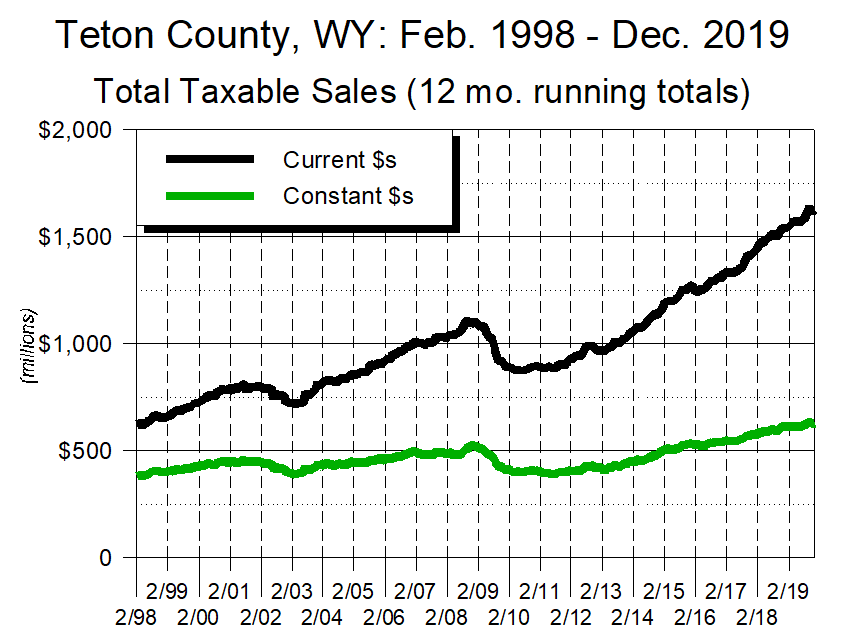

The state’s current system for reporting overall taxable sales dates back to March, 1997. Because any one month’s figures can be wildly misleading, it’s far more instructive to look at 12- month running totals. As Figure 3 shows, during the two-plus decades between February 1998 and December 2019, Teton County’s total taxable sales grew from $621 million to $1.63 billion, a total growth rate of 162 percent and a Compounded Annual Growth Rate (CAGR) of 4.5 percent. (Adjusted for inflation, the growth figures were 65 percent and 2.3 percent respectively.)

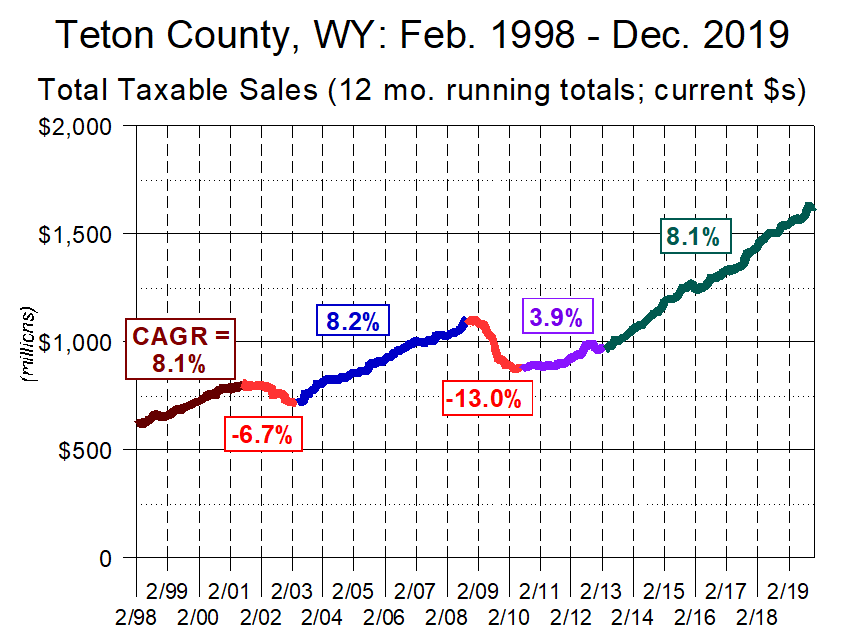

As Figure 4 suggests, from a growth perspective the last 21 years can be divided into six periods: three of strong growth, one of moderate growth, and two of decline.

Three things jump off of Figure 4:

- During the three separate periods of strong growth, taxable sales grew at essentially the same pace – a tad over eight percent.

- The two periods of decline each lasted 21 months. The post-recession decline, though, was twice as sharp as the one around the time of the 9/11 attacks.

- The current period of strong growth has lasted 81 months, or nearly seven years.

The big question, of course, is how much longer the current growth period will continue.

Sales taxes in Jackson Hole: A look ahead

In July 2004, Wyoming began providing reports showing monthly taxable sales by industrial category. As a result, starting in June 2005 12-month running totals of these more granular figures became available. What do data tell us about the economy since then?

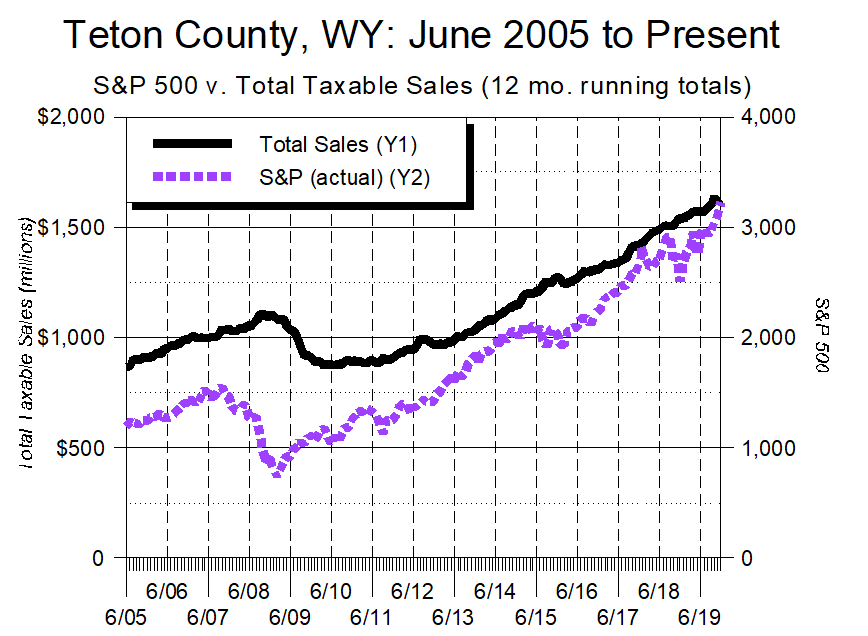

As Figure 5 suggests, if you create a line graph comparing Teton County’s taxable sales to the Standard & Poors 500 average (S&P 500) between June 2005 – December 2019, there’s a striking similarity to the shapes of the two lines.

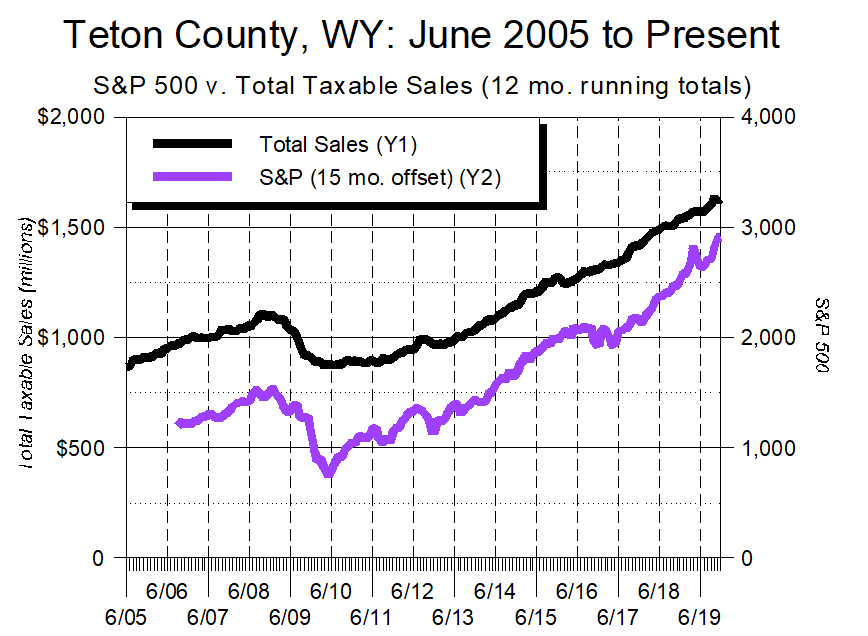

The similarity becomes even more pronounced if you offset the S&P figure by 15 months, so that the S&P’s recession-related zenith and nadir align with those of local taxable sales. (Figure 6)

Happily, this visual similarity also holds up statistically, at a very high level of confidence. As a result, it can serve as the foundation of a model for estimating Teton County’s future taxable sales growth.

The model’s results

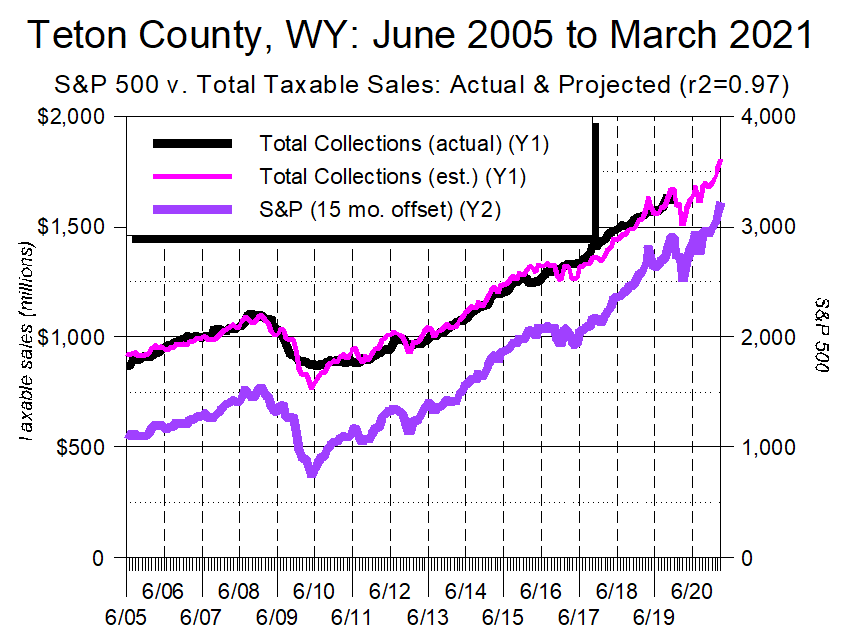

The S&P 500-based model of Teton County’s taxable sales suggests Teton County will continue to see taxable sales growth through at least the first quarter of 2021. Because of the lag between the S&P 500’s performance and local taxable sales, the model indicates this growth will occur even if the stock market slows down or begins to lose value during 2020.

How much growth? The model suggests that during calendar 2020, Teton County’s total taxable sales will grow 6.3 percent from 2019’s $1.63 billion figure, reaching a total of around $1.73 billion. (Figure 7)

Knowing this, the next question to ask is “Which sectors will experience the highest growth?”

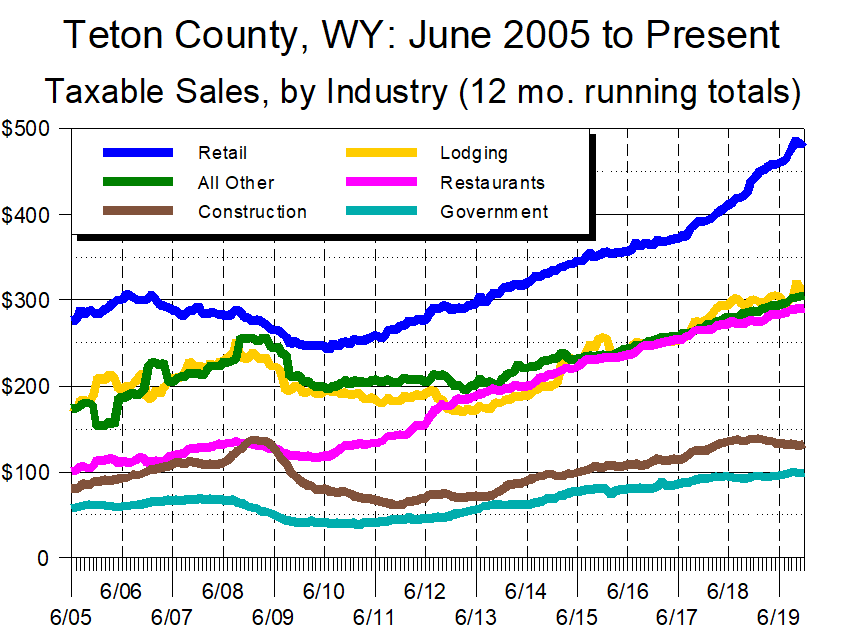

Figure 8 shows, Teton County’s taxable sales can be broken down into six basic categories.

The county’s biggest sales tax-generating industry is Retail, which accounted for around one-third of all sales during 2019.

Second place is shared by two specific industries – Lodging and Restaurants – and the catch-all category of “All Other.” Last year, each accounted for around $300 million in sales.

Of note here is that, over the past 15 years, Restaurants has been by far the fastest growing local industry, with its sales tripling between 2005-2019. Only Retail has come anywhere close to matching that rate of growth.

Construction and Government (which is basically vehicle sales) are the two other major categories, each generating around $100 million in annual sales.

Unfortunately, the statistical correlation between the S&P 500 and most of these categories is not nearly as strong as with overall sales. The one exception is Retail, which the model predicts will enjoy 9.5 percent growth during 2020. The model also suggests Lodging, Government, and All Other will grow at around the same pace as the overall economy. That noted, because the statistical correlation is weaker, these estimates should be taken with a goodly-sized grain of salt.

In short, barring some sort of profound disruption, Teton County’s taxable sales in 2020 should grow at a steady, if not spectacular, pace – below the nearly-seven year average of 8.1 percent, but still a vigorous six-to-seven percent.

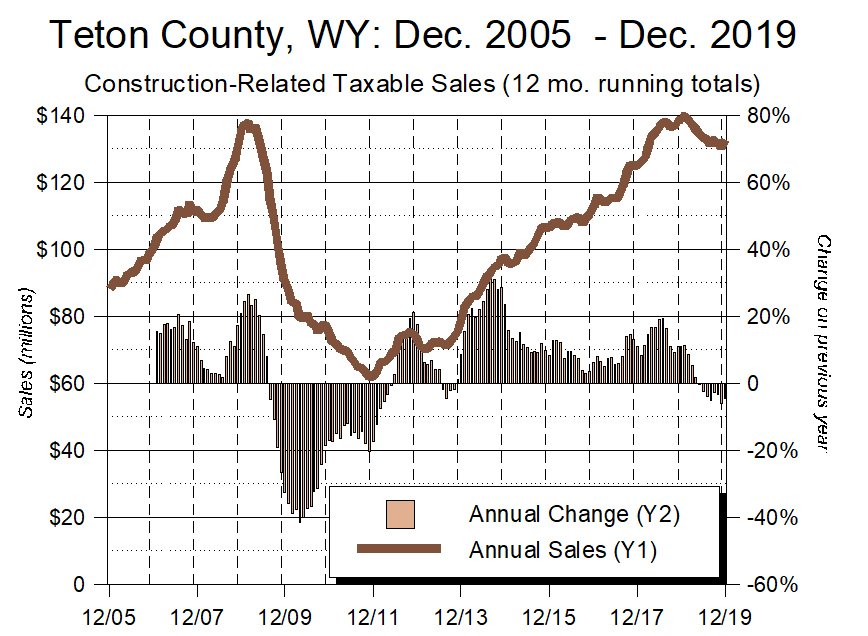

If there is a dark cloud out there, it’s hovering over the Construction sector. As Figure 9 illustrates, since May 2019 Construction-related sales have been declining.

The recession hit the local Construction industry hard, with taxable sales falling in half during its nearly-three year slump. Since starting to rebound in late 2011, though, local Construction-related sales steadily climbed, to a place where, in January 2019, they finally returned to their pre-recession highs.

Not for long, though. Starting last May, every month in 2019 had lower Construction-related taxable sales than in the previous year. The truly odd thing is that no one can explain why, for from their respective perches, people in all facets of the building trades suggest their business continues to be strong. The sales tax data show a softening though, suggesting that, at least when it comes to Jackson Hole’s construction industry, the whole may not be as strong as the sum of its parts.

A note of caution in what looks to be an otherwise solid 2020.