Income, Income Inequality, and Charitable Giving

The November edition of CoThrive focused on an astonishing fact: According to recently-released Bureau of Economic Analysis data, in 2017 Teton County, Wyoming had the nation’s highest per capita income: $251,728.

One quarter-million dollars, plus $1,728. An all-time record – not only for Teton County, but the nation as a whole.

Today, I’d like to examine the 2017 income data in more detail, focusing on three topics:

• Teton County’s income inequality;

• Teton County’s actual charitable giving; and

• Teton County’s potential charitable giving.

Before diving into these topics, though, let me offer one more tidbit regarding Teton County’s quarter-million dollar per capita income.

OMG

In second place behind Teton County was New York County, New York, the island of Manhattan. In 2017, New York’s per capita income was $193,940, 77 percent of Teton County’s.

That same year, America’s per capita income was $54,446. Add the two together – New York’s $193,940 and America’s $54,446 – and the total is $248,386. Or $3,342 less than Teton County’s figure.

In other words, in 2017 Teton County’s per capita income exceeded that of second-place New York City and the nation combined.

Regardless of whether you view things statistically, from an OMG perspective, or in some other fashion, Teton County’s 2017 per capita income figures are beyond extraordinary.

Why?

These astonishing figures raise the question of “Why?” As in “Why is Teton County’s per capita income so incredibly high?”

For answers, let’s turn to 2017 Internal Revenue Service (IRS) data.

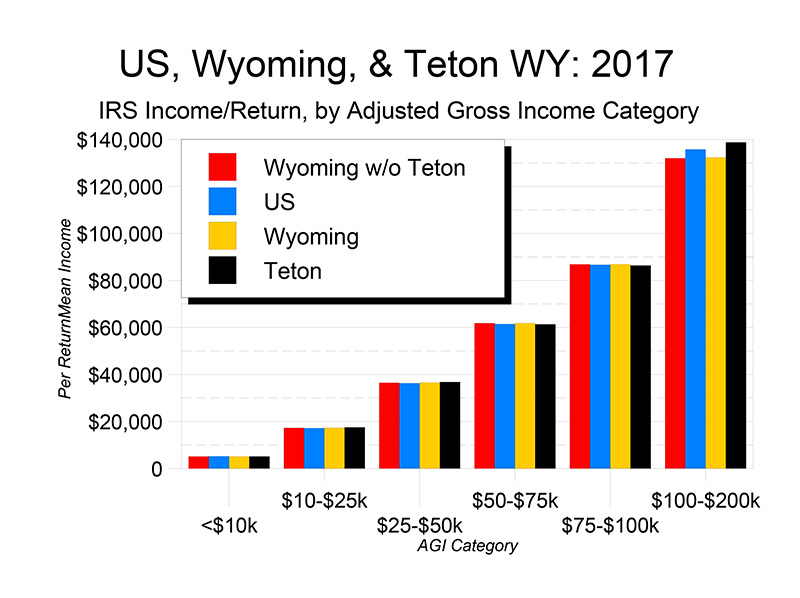

Each year, the IRS breaks down income tax returns by Adjusted Gross Income categories (AGI). The lowest of the seven categories covers tax returns with an AGI of under $10,000; the highest covers returns of $200,000 or more. As Graph 1 shows, for the first six income categories, there’s little per-return difference between Teton County and the rest of America.

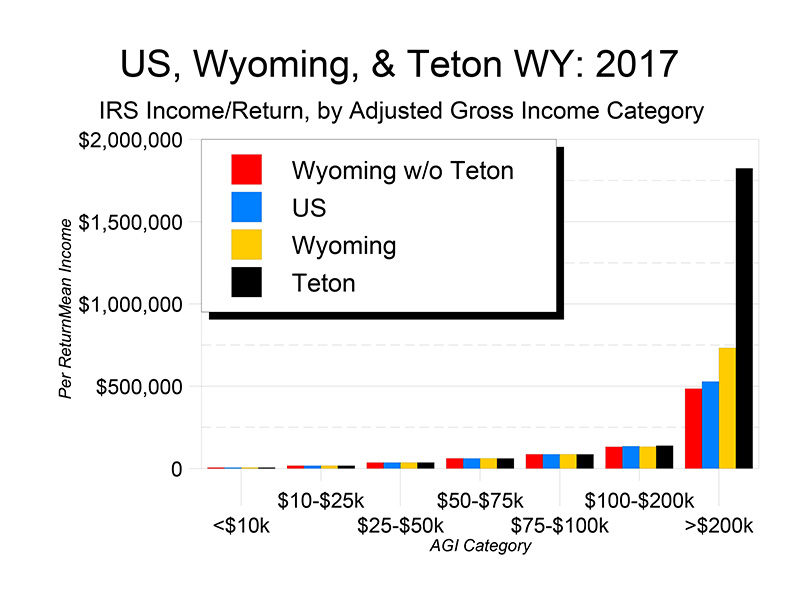

Once we get to AGIs of at least $200,000, though, Katy bar the door.

Graph 2 is the same as Graph 1, but adds the final IRS income category: returns with an AGI of $200,000 or more. In this category, Teton County’s per-return income figure is 2.5 times higher than Wyoming’s, and 3.5 times higher than the nation’s. What’s really astonishing is that without Teton County, Wyoming’s per-return mean falls by around $250,000, a full third.

Hence the short answer to the “Why?” question: Teton County’s per capita income figure is so high because of the income generated by households earning over $200,000/year.

Who are those people? While the IRS doesn’t identify individuals, we do know this.

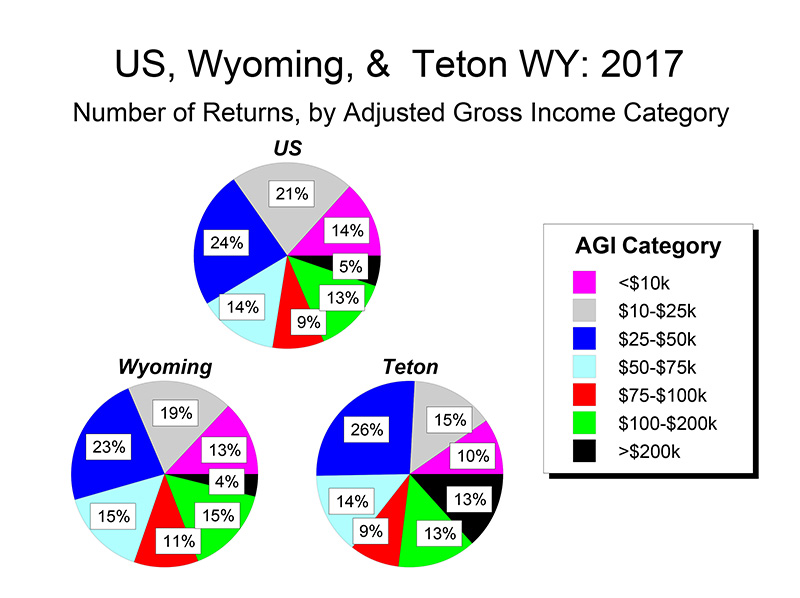

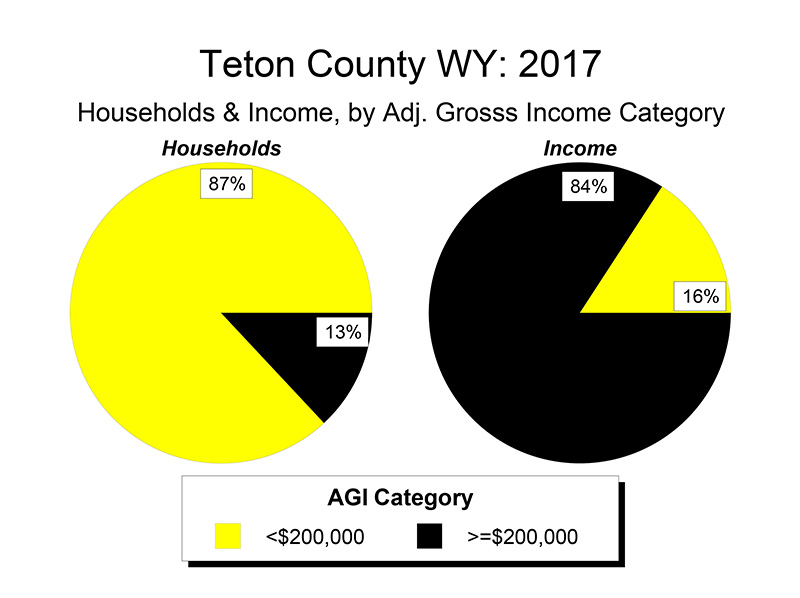

In 2017, 14,410 households claimed Teton County as their residence. Of these, 1,870 – 13 percent, or roughly one-eighth – reported an AGI of $200,000 or more. This is high by national standards, but not dramatically so. (Graph 3)

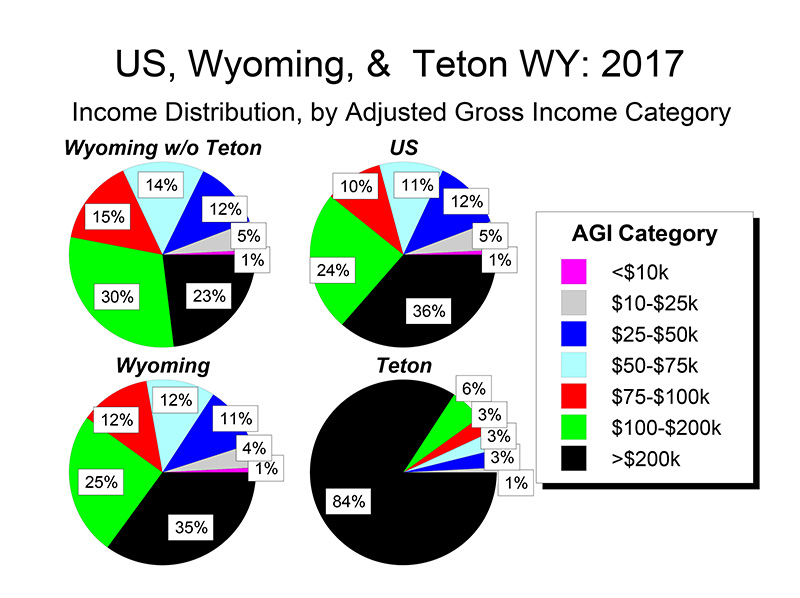

What is dramatic is captured in Graph 4. In America as a whole, the 5 percent of households reporting a AGI of at least $200,000 accounted for 36 percent of the nation’s overall income. In Wyoming as a whole, the figures were essentially the same. In Teton County, however, the 13 percent of households reporting $200,000 or more in AGI accounted for an astonishing 84 percent of income. Meaning the remaining 87 percent of us earned just 16 percent of the county’s total income. (Graph 5)

America’s Greatest Income Inequality

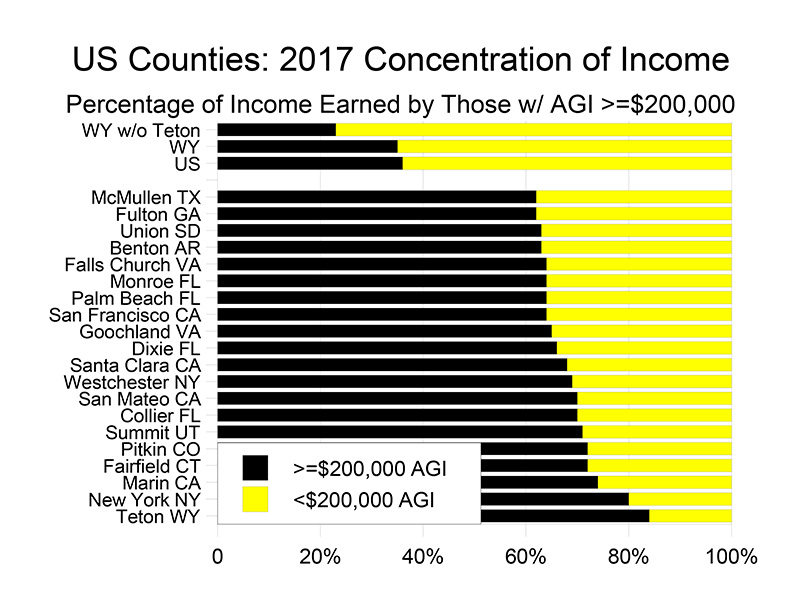

Do the math, and in 2017 the 87 percent of Teton County households making under $200,000 had a mean AGI of $32,212. For the 13 percent of households making at least $200,000, the figure was $1.82 million, 57 times greater.

Simply put, Teton County has not only America’s highest per capita income, but also its greatest income inequality. And as with per capita income, the “contest” isn’t even close. (Graph 6)

Charitable Giving – Actual

Which raises another interesting question: “What are we doing with all that income?”

One thing is giving it away. Thanks to our well-to-do residents, Teton County led the nation in overall per-return deductions for charitable giving, averaging $16,516. And to sound like a broken record, no one else was even close: The per-return figure for second place Benton County, Arkansas, where Walmart’s world headquarters is located, was $11,864, 30 percent below Teton County’s figure.

Dig a little deeper, though, and a more complicated picture emerges.

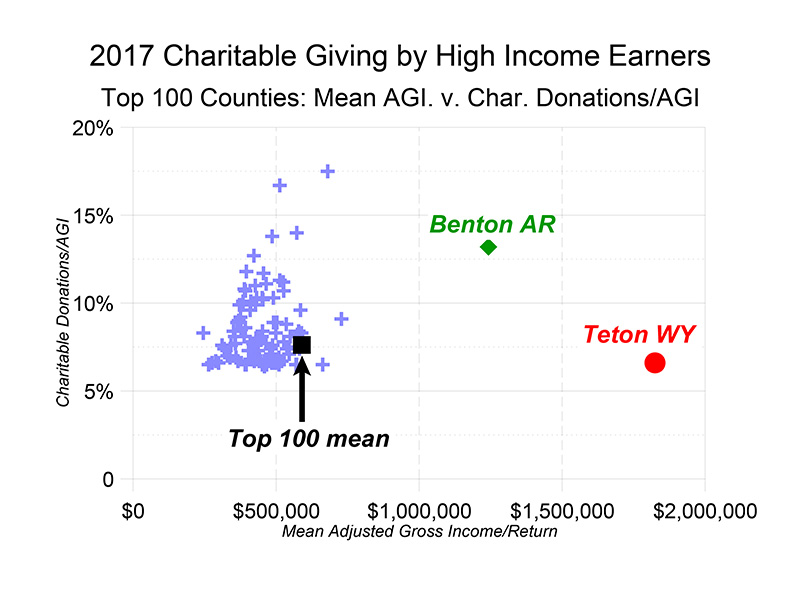

In particular, among households earning $200,000 or more, Teton County did not lead the nation in charitable giving per return. While our mean charitable deduction figure was huge – $119,567 – it was 30 percent below Benton County’s figure of $164,464. As a result, our well-to-do households ranked only second in per-return charitable deductions.

Even more striking is that on a percentage basis, the 6.6 percent of AGI donated by our well-to-do residents ranked us only 90th in the nation – barely in the top three percent. The leader? Tattnall County, Georgia, whose well-to-do residents donated an astonishing 17.5 percent of their 2017 AGI to charitable causes.

Arguably, because Tattenall County has only 110 well-to-do households, it may not be fair to compare us to them. But Benton County has four times as many well-to-do households as Teton County, and their charitable deductions totaled 13.2 percent of their AGI, twice our percentage.

In fact, looking at the 100 US counties with the highest percentage of charitable giving among their well-to-do residents, Teton County’s mean AGI was 309 percent greater than the Top 100’s mean figure, but our percentage of AGI donated was 14 percent lower. (Graph 7)

Charitable Giving – Potential

Which leads to the next question: “What if Teton County led the nation in not just mean Adjusted Gross Income, but also in percentage of charitable giving?” Or perhaps more fairly, what if our giving rate equaled that of Benton County, Arkansas?

Running the numbers for 2017, if Teton County overall had donated at Benton AR’s overall rates, we would have collectively donated an additional $136 million to charitable causes. If Teton County’s well-to-do had donated at the same rate as their Benton County counterparts, the figure would have been an additional $228 million.

The bottom line is that, had Teton County residents given at the same rate as Benton AR residents, we would have roughly doubled the amount of money we gave to charitable causes. How much of that would have gone to local non-profits isn’t clear, but the IRS data suggest Teton County has a lot of additional charitable giving capacity.

Why Does It Matter?

One final question to ponder: “So what?” More precisely: “What difference does it make if Teton County has the nation’s highest per capita income?”

At a certain level, not a lot. Why? Because a community’s level of wealth doesn’t really affect its day-to-day life.

By this I mean that, regardless of income, we all have to eat, shop, get around town, and the like. And most of the costs associated with these basics – e.g., groceries, gas, and clothing – don’t vary much with a community’s wealth.

Where our wealth does matter, however, is in the price of Teton County’s scarcest commodity: land.

Specifically, of America’s 3,100 counties, only one has less private land than Teton County: Esmeralda County, Nevada: Population 826 (4 percent of Teton County’s) ; per capita income $40,113 (16 percent).

That Teton County has a limited amount of private land isn’t new, of course, but until 30 years or so ago, that scarcity wasn’t much of a problem. Why? Because our geographic isolation also isolated us from regional, national, and global economic forces, resulting in land prices being reasonably well-connected to the the local wage base.

No more. Instead, as changes in technology and the economy have increasingly stretched, frayed, and severed the umbilical cord that connects where we work to where we live, the demand for Jackson Hole’s incredibly scarce land has become essentially unlimited.

As it has, land prices have followed the basic law of supply and demand and gone up, up, up. As they have, those most able to buy that increasingly-dear land have been those with the highest incomes; i.e., those whose incomes are based either on investments or location-neutral jobs. And as that’s occurred, those whose incomes are based on “traditional” Jackson Hole industries such as tourism and construction have found themselves increasingly out-competed.

The resulting asymmetry has produced a host of consequences, affecting who can live here, commuting and traffic patterns, and community character. And while the consequences are clear, far less clear is what, if anything, we can do about them, especially given that the root causes of these issues – our wealth and income disparity – are unmatched in the nation.

Making our situation even more complex is the fact that we need to address all these issues while simultaneously ensuring the health of our ecosystem, for it is the foundation of everything vital to Jackson Hole. Added together, all of this presents a challenge as magnificent as our ecosystem; as extraordinary as our wealth.

Note: If you would like to make a tax-deductible donation to support CoThrive, please click here to donate to its parent organization – the Charture Institute/1% for the Tetons – through Patagonia’s match program. Through December 31, 2019, Patagonia will generously match donations up to $10,000.

Thank you so much, and happy holidays.