With Labor Day behind us, it’s time to assess Jackson Hole’s economy during the summer of 2020.

Or at least take a first crack at it. Data never come in as fast as I prefer, but during the first few days of September I received two pieces of data – daily traffic counts for Yellowstone National Park, and the August report of taxable sales in Teton County – that can serve as the foundation of a bit of analysis, especially as it relates to the effects of COVID-19 on the local economy.

This newsletter consists of three basic parts:

- Yellowstone Summer Traffic Data

- Teton County’s Taxable Sales During the First Four Months of COVID-19

- Analysis

- All the tourists; 60% of the capacity

- The importance of locals

- The importance of construction

- Please Support Our Work

A request

One other note, or more precisely, a request: Will you please make a tax-deductible donation to my Charture Institute to support the work we do, including the analysis I provide in CoThrive?

Jackson Hole is in the middle of Old Bill’s Fun Run season. Thanks to the generosity of community-minded donors, Old Bill’s matches donations received by every local non-profit – last year, every dollar donated up to $30,000 was matched around 50%.

Please CLICK HERE to donate on-line.

Because of COVID-19, this year Charture has been deprived of one of our primary revenue sources: our annual 22 in 21 conferences. This makes donations such as yours all the more important.

The deadline for Old Bill’s giving is Friday September 18 @ 5:00 pm MDT. CLICK HERE to make your donation

Thanks for reading, and I look forward to hearing your thoughts, reactions, and comments.

Jonathan Schechter

Executive Director

I. Yellowstone Summer Traffic Data

Yellowstone National Park has five entry gates. Working clockwise from the park’s northern entrance, these are:

- North (from the gateway city of Gardiner, MT)

- Northeast (Cooke City, MT)

- East (Cody, WY)

- South (Jackson Hole, WY)

- West (West Yellowstone, MT)

Typically, each gate opens for the summer in late April or early May. This year, the two Wyoming gates opened on May 18, while the three Montana gates didn’t open until June 1.

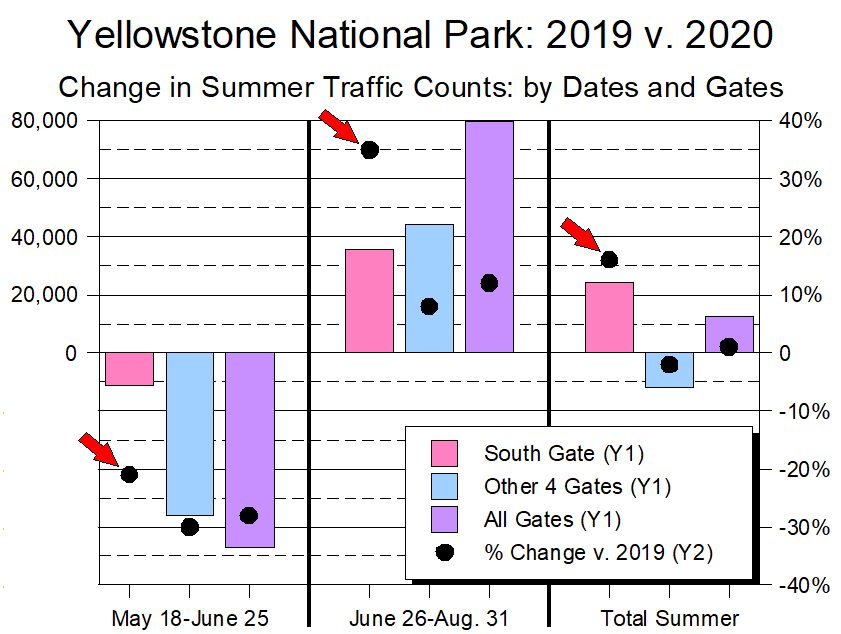

The combination of the delayed opening and the nation’s struggles with the coronavirus resulted in a slow start to Yellowstone’s summer, with visitation during the park’s first several weeks markedly lower than in 2019. Starting in late June, however, things changed rapidly.

For the Jackson Hole gate, the switch seems to have flipped on June 26. From May 18 – June 25, only 8 percent of the days saw 2020 traffic counts higher than those in 2019. From June 26 – August 31, though, 96 percent of 2020’s days had higher traffic counts.

Graph 1 (below) looks at this phenomenon, comparing the number of vehicles entering Yellowstone in 2019 v. 2020 for three periods (for May, just the two Wyoming gates were counted):

- May 18 – June 25

- June 26 – August 31

- the total summer of May 18 – August 31

Graph 1

The big takeaway? During the summer of 2020, the growth in Yellowstone’s traffic was driven by traffic coming through the South Gate; i.e., from Jackson Hole.

In particular:

- during the first half of summer, the Jackson Hole gate had the lowest decline in traffic;

- during the second half of summer, the Jackson Hole gate had the biggest increases in both number of vehicles and percentage growth of traffic;

- for the overall summer, without people coming into Yellowstone from Jackson Hole, overall park traffic would have been down.

Which is why it felt so darned busy here.

(Note: Because the main road through Grand Teton National Park is a US highway, Grand Teton cannot provide the same kind of traffic data.)

II. Teton County’s Taxable Sales During the First Four Months of COVID-19

Data geek preface

Before getting into the data, three data-geek notes.

First, industrial codes. When you get a Wyoming business license, the Department of Revenue categorizes your operation using one of 10,000 North American Industrial Classification Codes (e.g., code 4441 is “Building Material and Supplies Dealers”). These codes are used when reporting taxable sales, and form the basis of this analysis.

Second, the sales taxes you collect in any given month must be sent to the state by the end of the following month. The state then tabulates the taxes it receives and issues its monthly report. For example, taxes you collect in July must be sent to the state by the end of August, so August’s report generally reflects sales in July. By extension, July’s report reflects June’s sales, etc. April was the first complete month that COVID-19 affected the local economy, meaning its effects were first fully captured in the May 2020 report.

Third, taxable sales account for only around 15 percent of Teton County’s economy. However, they are the best proxy we have for local economic activity because they are the only meaningful economic data reported accurately and regularly. Sales taxes also provide around 2/3 of local government general revenue – Jackson Hole is more dependent on sales taxes than the state of Wyoming is on hydrocarbons.

Onto the data.

The data

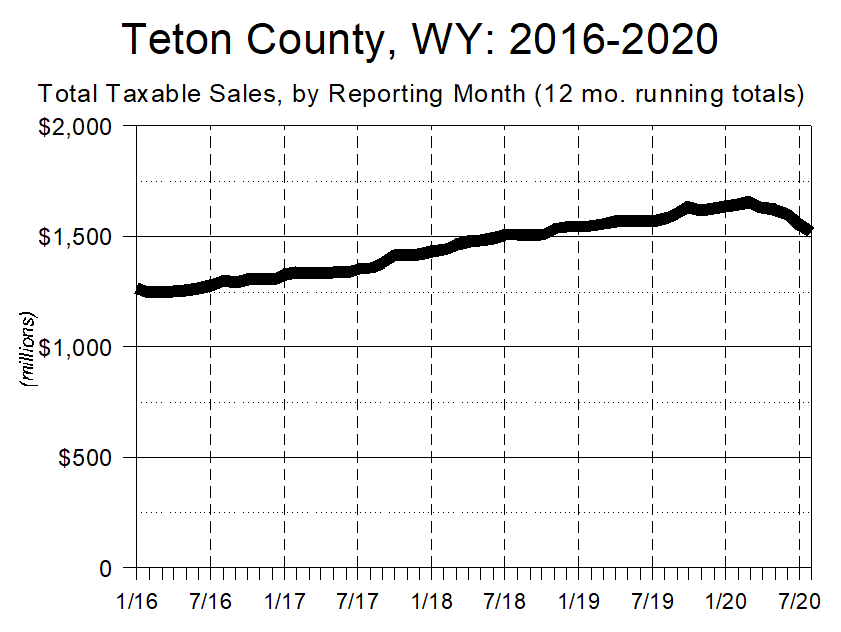

The first thing the data tell us is that, while COVID-19 clearly hammered the local taxable economy, even before COVID Teton County’s taxable sales economy was slowing down. For example, during the reporting months of January-August 2018, taxable sales grew 10 percent from the previous year. For those same months in 2019, the growth rate was 4 percent.

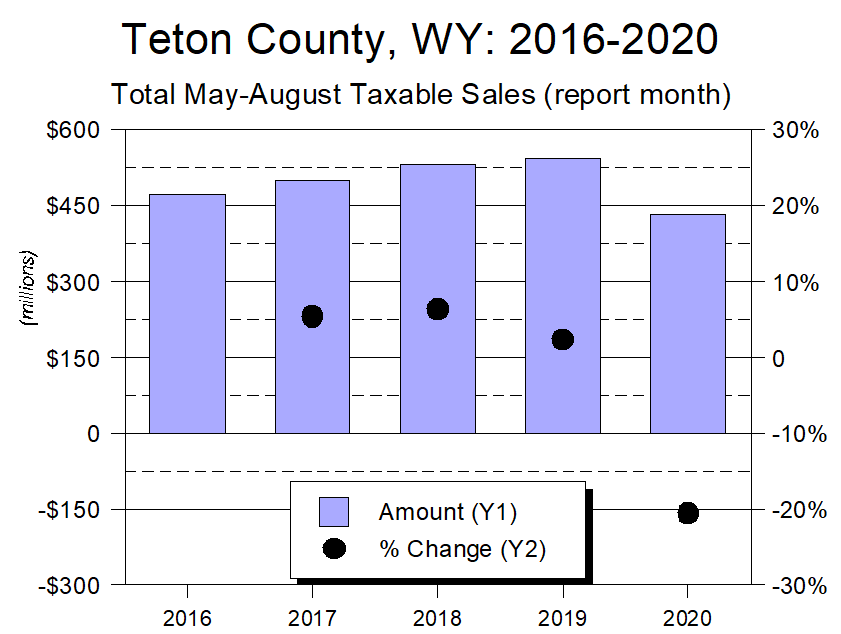

Then COVID-19 hit, and during the same January-August period this year local taxable sales fell 11 percent. As Graph 2 shows, in just four months the local taxable sales economy gave up over 1.5 years’ worth of growth.

Graph 2

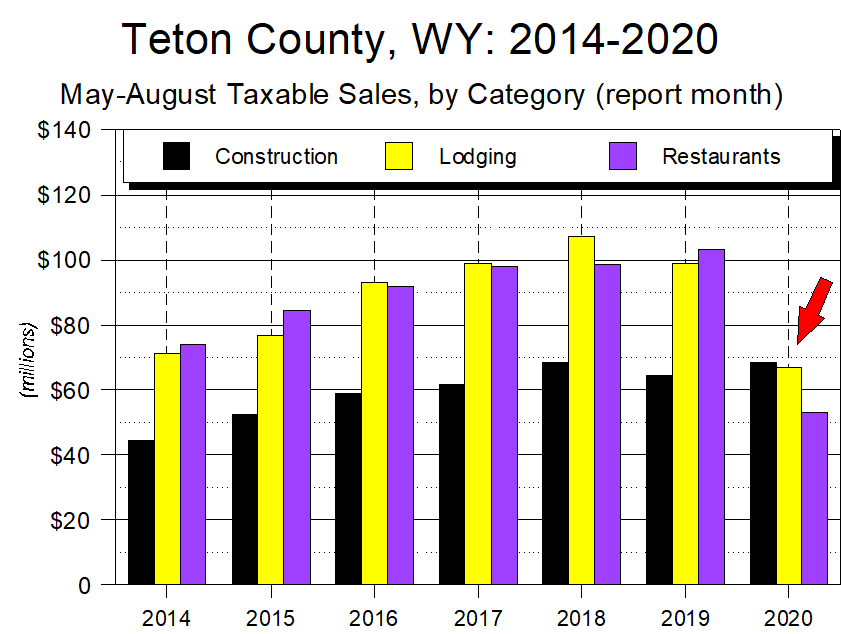

It did so by dropping 20.5 percent during the four reporting months of May-August 2020 versus the same four months in 2019. (Graph 3)

Graph 3

What’s interesting, though is how unevenly the pandemic has affected Teton County’s taxable sales.

At a macro level, Teton County’s taxable sales fall into four basic categories:

- Retail

- Lodging

- Restaurants

- All Other

During the pandemic, sales in all four categories have declined. Get a bit more granular, however, and things are not quite as simple as they appear.

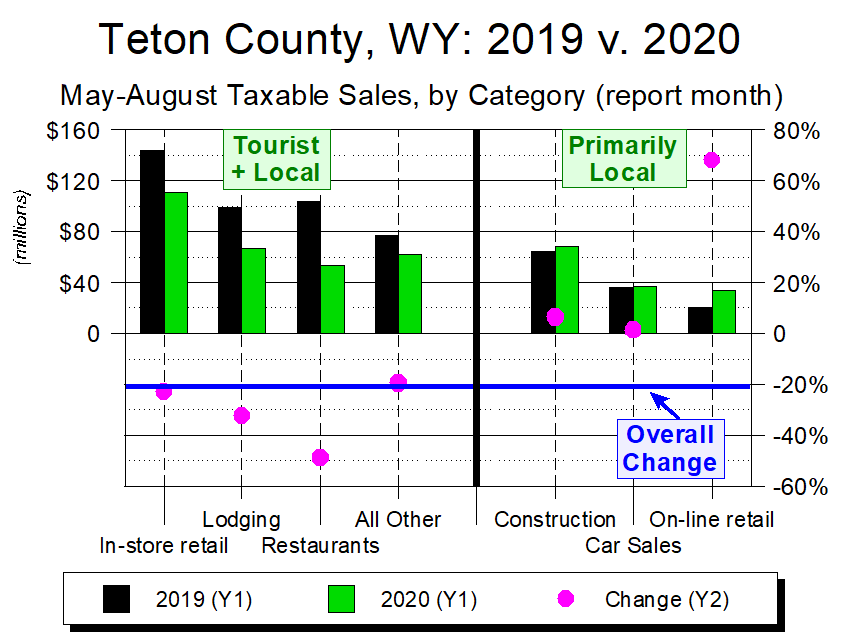

Graph 4 does two things. First, it breaks the four categories of local taxable sales into seven:

- In-store retail (a subset of the larger Retail category)

- Lodging

- Restaurants

- Construction (a combination of sub-categories in both All Other and Retail)

- Car Sales (All Other)

- On-line retail (Retail)

- All Other

It then breaks the seven categories into two customer groupings: businesses patronized by a combination of Tourists and Locals, and those whose clientele is Primarily Local.

Graph 4

Two points jump off this graph.

First, broadly speaking, since COVID-19 hit, businesses associated with tourism have done poorly, while those catering to locals have done well.

Second, on-line sales are booming. Exactly how much of this growth is due to increased sales isn’t clear, for about a year ago Wyoming became more diligent about taxing on-line sales. That noted, it’s clear that a goodly portion of the 68 percent jump in on-line sales-related taxes is due to residents opting to use their devices to shop.

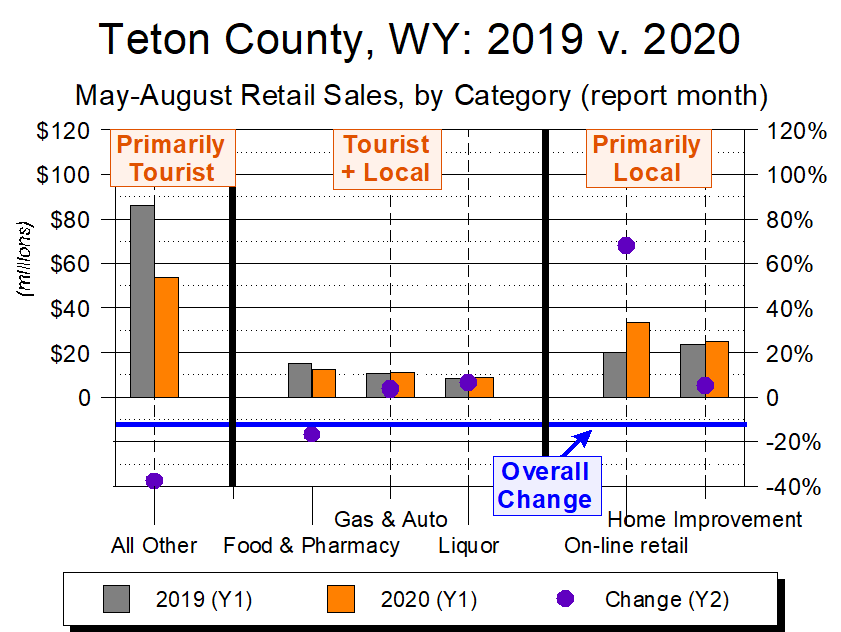

Graph 5 provides more detail about Retail sales, which is Teton County’s largest category in terms of sales.

Graph 5

Here again, COVID-19 wreaked havoc on Retail businesses catering to tourists, while seemingly benefitting those stores locals turned to for shelter-in-place supplies. Hence the growth in Liquor sales and those related to Home Improvement. Ditto Sporting Goods (because it’s too small to warrant its own category, Sporting Goods is lumped under “All Other”).

One other point worth noting about the local Retail scene is that Kmart shut down right before COVID-19 struck. The data suggest it generated around $3.5 million in annual sales, the loss of which is also lumped into “All Other.” Back Kmart out of the equation, and the decline in “All Other” was only 35 percent instead of 38 percent.

III. Analysis

The conclusions I draw from the data fall into three categories:

- All the tourists; 60% of the capacity

- The importance of locals

- The importance of construction

1. All the tourists; 60% of the capacity

Both gut feeling and Yellowstone traffic data tell us July and August produced a bumper crop of tourists to Jackson Hole. Further, while we won’t have actual numbers for another few weeks, it seems likely that August’s sales tax numbers will be decent – not a record, but not nearly as bad as anticipated by most folks, including respondents to my spring surveys.

What the data won’t reveal is that, from a tourism infrastructure perspective, Jackson Hole handled all those visitors with one arm tied behind its back.

Friends object when I use the term “industrial tourism,” but I think it’s a fair description of Jackson Hole’s tourism industry. I don’t mean it as a pejorative, for to me the world’s economy is replete with industries producing highly sophisticated, highly-customized products. Like Jackson Hole’s tourism experience.

As with other world-class industries, tourism in Jackson Hole depends on a finely-tuned infrastructure, with a number of linked parts working closely with and complementing each other. Lodging, restaurants, retail, guides, transportation, cleaning services – all these and more must coordinate with one another to provide a high-quality and, with increasing frequency, high-end experience for the region’s visitors.

In this context, what was striking about this summer was how well this mechanism worked despite COVID-19.

COVID’s biggest blow to the local tourism infrastructure was the capacity reductions it forced upon Lodging and Restaurants. The hotels in Yellowstone and Grand Teton opened 40 percent of their rooms at best, some restaurants around the region converted to take-out only, and even those restaurants that did serve dine-in customers did so at no more than 60 percent capacity. Most other tourism-related industries dealt with their own challenges. Yet somehow it all worked.

Mostly. Talking to merchants and employees, the degree of end-of-summer burn-out seems to be at an all-time high, for workers had to knock themselves out to deal with a summer hallmarked by higher-than-usual tourist numbers and lower-than-usual staffing levels. All that plus the many other stresses of this most unusual summer.

The other thing I wonder about is what lessons employers will draw from this summer’s experience. Of particular interest is the fact that, for most tourism-related businesses, labor is the single biggest expense. Will this summer teach employers that they can save money by using fewer employees in the future? If so, at what price to the employees who are hired? And at what price to the visitor experience?

None of this is knowable right now. But given the extraordinary adaptability local businesses displayed during this extraordinarily challenging summer, I have to believe we’ll look back upon 2020 as a watershed in the internal mechanics of the local tourism industry, with it emerging leaner and, in all likelihood, more profitable.

2. The importance of locals

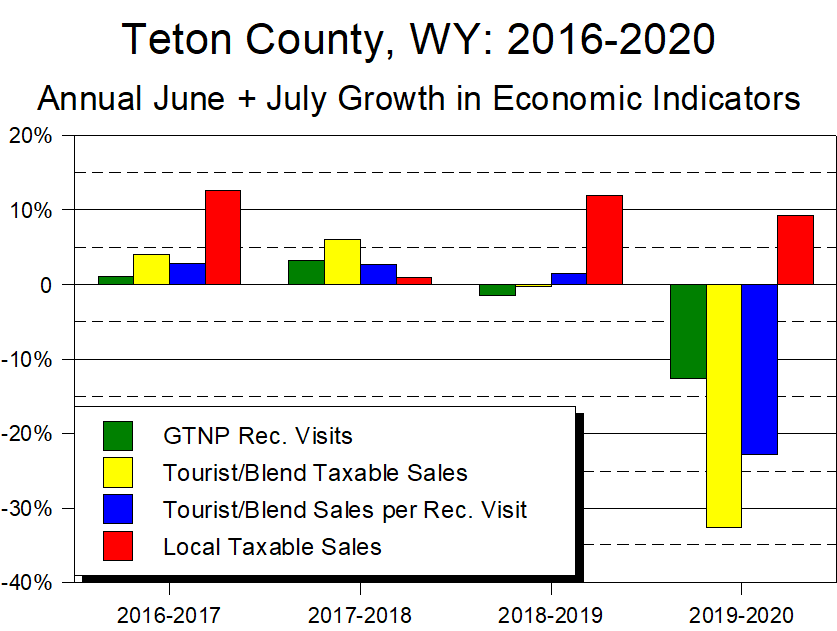

Graph 6 looks at the changes in four local economic indicators during June and July of 2016-2020.

The green bars are the percentage change in recreational visits to Grand Teton National Park. Building on the categories used in Graph 4, the yellow bars are the change in taxable sales by those businesses catering to tourists or a blend of tourists and locals.

The blue bars are a crude proxy for per-tourist spending, and show the result of dividing the yellow bars’ tourist-cum-blend sales into the green bars’ number of Grand Teton visitors. Finally, the red bars – the ones to pay attention to – are the taxable sales by businesses catering to locals.

Graph 6

The graph’s basic point is that sales to locals are becoming an increasingly important part of our summer economy. This was true even before COVID-19 thoroughly disrupted our tourism economy, and coronavirus or not, there’s no reason to think the trend won’t continue in future years.

Will summer sales to locals ever dethrone summer sales to tourists? Of course not. But as our population grows, and as it becomes ever-harder to cram even more tourists in here, sales to locals will likely grow faster than sales to tourists.

That noted, let me flag an utterly predictable exception. Next summer is almost certain to show a big jump in the growth of sales to tourists. Why? Because the ” in that calculation will be this summer’s knocked-down-by-COVID spending number. Reduce any ” enough, and big growth is bound to follow.

This “reduce the denominator” dynamic is the same one we’re currently seeing nationally with the sharp percentage growth in job numbers – the coronavirus knocked employment down so far that high growth rates became inevitable. And to editorialize just a wee bit, it’s at best disingenuous for Mr. Trump to take credit for those job increases if he wasn’t willing to assume responsibility for the decreases preceding them…

3. The importance of construction

The thing that most surprised me about the sales tax data was this.

For the reporting months of May-August 2020, taxable sales in the Lodging and Restaurant categories fell 27 and 48 percent respectively. Those drops were so sharp that, when combined with the 7 percent rise in Construction-related taxable sales, Construction-related sales actually eclipsed those of both Restaurants and Lodging.

As Graph 7 shows, that’s never happened before. Not even close.

Graph 7

This is, no doubt, a one-off occurrence – I expect that when next month’s numbers are reported, both Lodging and Restaurants will be back in their usual places, jockeying to see who plays second fiddle to Retail in terms of biggest category of taxable sales.

I highlight the construction figure, though, because it shines a light on a larger phenomenon, one that’s gotten lost in the chaos of not just COVID-19, but also the incredible growth pressures Jackson Hole has been and is facing.

For the past couple of decades, it’s become increasingly easy and acceptable for people to telecommute. As that’s occurred, Jackson Hole has become increasingly attractive to both primary and second home owners. In turn, that has produced two booms: in our non-tourism economy; and in the pressure for ever-more housing in the entire Tetons region.

In two ways, COVID-19 has thrown gasoline on the growth fire. One is that it has scared people away from crowded urban areas. The other is that it has produced a boom in working remotely. Combined, the result is a new wave of people moving to places like the greater Tetons region.

All this has created even more pressure for new construction, particularly housing.

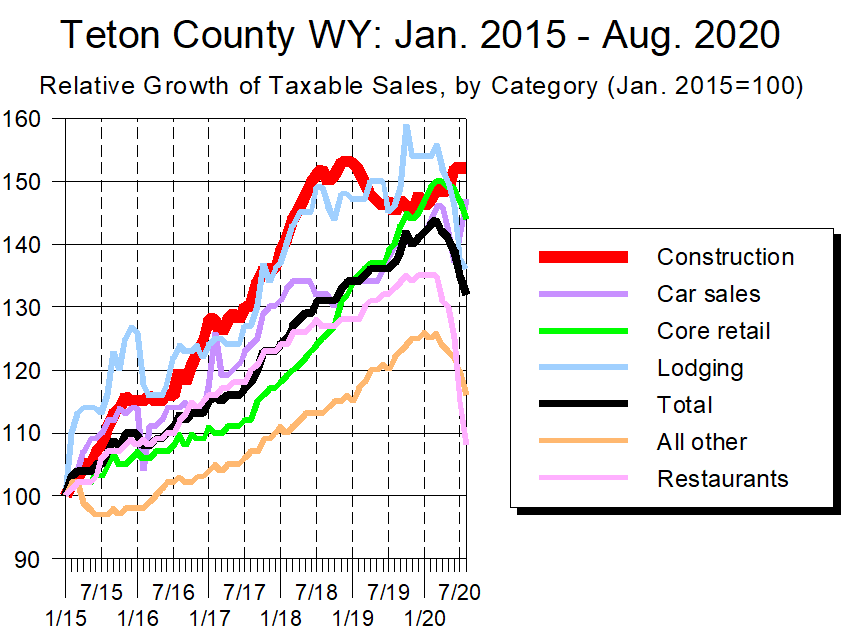

As Graph 8 shows, this is not a new phenomenon. Indeed, since the beginning of 2015, Construction has been Teton County’s fastest-growing category of taxable sales.

Graph 8

Why does this matter? Because of the potential that the development industry will develop a momentum of its own, becoming so powerful that local elected officials will have a hard time saying “no” to its demands, regardless of those demands affect the rest of our community.

The Jackson/Teton County Comprehensive Plan is supposed to prevent this sort of imbalance from occurring. Indeed, the plan’s Vision Statement reads: “Preserve and protect the area’s ecosystem, in order to ensure a healthy environment, community and economy for current and future generations.” To that end, the Comp Plan and its related tools actively attempt to guide the amount and location of commercial and residential development in both the county and town.

That guidance is increasingly being questioned, though, by those who feel the Comp Plan is too restrictive. One particular concern is that it errs on the side of long-term environmental quality at the expense of today’s pressing needs.

Although the soundness of that argument is debatable, what’s undeniable is the importance of the local construction industry:

- There are about as many businesses in Construction as in Retail, Lodging, and Restaurants combined.

- Construction employs nearly as many people as Retail and Restaurants (although only 40 percent of those working in Lodging).

- The typical Construction job pays around twice as much as the typical Retail, Lodging, or Restaurant job.

Perhaps most striking is that, over the past 10 years, Teton County ranks 7th out of 3,112 US counties in per capita construction jobs, eclipsed only by counties recovering from Hurricane Katrina and those experiencing a fracking boom. Those, and Nantucket, where construction workers commute from the mainland on a daily basis.

Long story short, Construction not only plays a significant role in Teton County’s economy, but is growing in importance vis-a-vis tourism. Combine that with the essentially limitless demand for housing in Jackson Hole, and it seems almost inevitable that the pressure for new development will only increase over time. Doubly so should development slow down – given how large the industry is, how many folks it employs, and how much money is at stake, a slowdown in Construction will cause great disruption across the region.

The question then becomes what kind of community we are. Vision Statements such as the Comp Plan’s are developed not for the good times, but for when an organization is stressed: A Vision Statement’s fundamental purpose is to serve as a North Star for guiding decisions in difficult times.

The Comp Plan’s Vision Statement ranks a healthy economy third behind a healthy environment and healthy community. It does so because the plan’s animating belief is that if we preserve and protect our ecosystem, we and future generations will enjoy not just a healthy environment, but a healthy community. If we have those two things, a healthy economy will follow.

That much is clear. Less clear is whether we and subsequent generations will continue to agree with this formulation. The fact that no other place on the planet prioritizes environmental health over economic growth suggests those who embrace the Comp Plan’s current Vision Statement are, over the long run, fighting an uphill battle.

Please Support Our Work

Thank you for supporting our work by donating to the Charture Institute during Old Bill’s Fun Run.

Please CLICK HERE to donate on-line